Today’s Animal Spirits is brought to you by YCharts:

Enter your information here to get 20% off YCharts (new clients only)

On today’s show, we discuss:

- The narrative vortex

- December 2022 retail sales

- Auto market weekly summary: January 13

- Tesla’s price cuts are roiling the car market

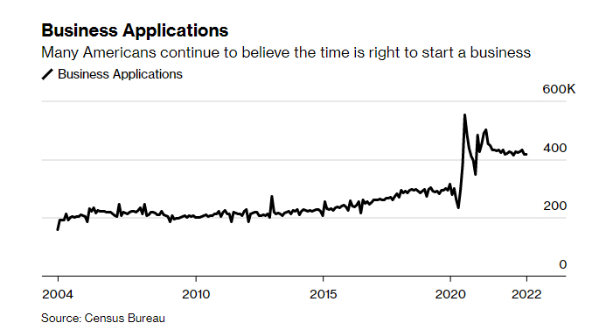

- Over 5M new US startups show Covid-era boom has legs

- Google laid off high performers and earners while largely sparing ‘Brain’ AI lab

- How Apple has so far avoided layoffs: lean hiring, no free lunches

- What the Genesis bankruptcy means for GBTC

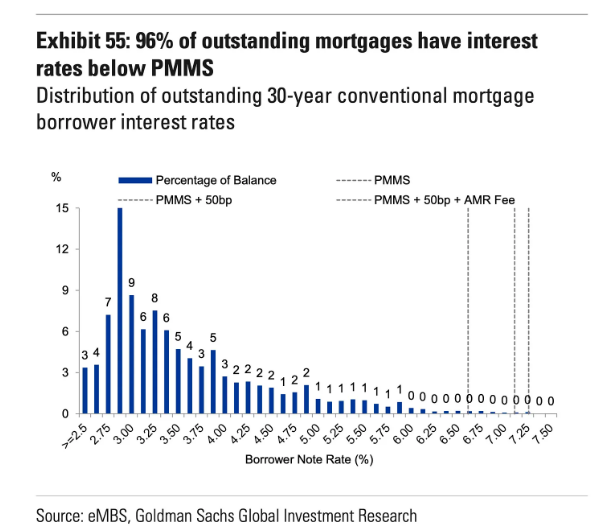

- Some home builders are offering mortgage rates as low as 3%, here’s why they’re doing it

- Inside the controversial sales practices of the nation’s biggest title lender

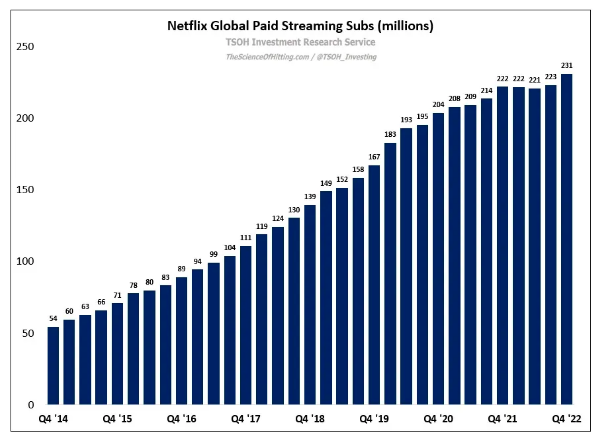

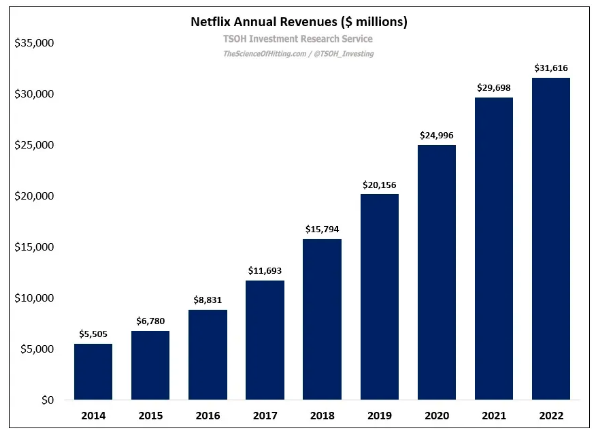

- TSOH on Netflix

- See Quartr’s earnings season recap here

- SCHW earnings

- ALLY earnings

- Rich customers pull money from banks offering paltry interest rates

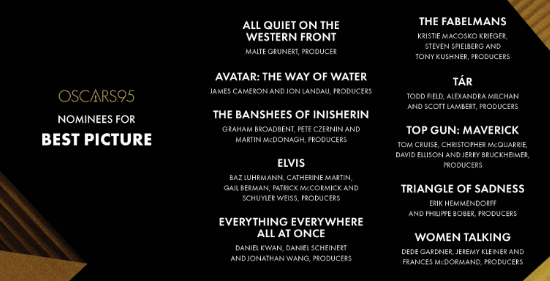

- Avatar: The Way of Water becomes sixth film in history to surpass $2B globally

Future Proof Festival 2023:

Listen Here:

Recommendations:

Charts:

Tweets:

Best start to the year for the Euro Stoxx 600 return (+7.8%) since Bloomberg data began in 1987.

(via Deutsche) pic.twitter.com/9oybLsWw4N

— Carl Quintanilla (@carlquintanilla) January 19, 2023

Individual investors have been doubling down on Tesla stock

They have spent more money on TSLA in the past six months than in the 5 years prior—in Jan, net purchases hit a one-day record@WSJmarkets @vandaresearch @hannahmiao_ pic.twitter.com/B1J9D3EYUW

— Gunjan Banerji (@GunjanJS) January 22, 2023

Vanguard's US funds and ETFs continue to gather prodigious sums from investors–~$83B in net inflows in 2022 alone. But growth does appear to be slowing–the funds' 1.1% organic growth rate in 2022 is the slowest since 1999. This is likely a law of large numbers thing but fwiw. pic.twitter.com/8pHHCCKkSH

— Jeffrey Ptak (@syouth1) January 18, 2023

The China reopening appears to be real this time.

China flights RAMPING…now higher than at any point in 2022.

Data provided by @fernavid @3F_Research pic.twitter.com/rF1V3RQrnu

— Warren Pies (@WarrenPies) January 20, 2023

“.. According to the firm’s trading model, seven of nine asset classes .. now show less than a 50% chance of a recession ..”@business @denitsa_tsekova https://t.co/7Vq8PFHwkQ pic.twitter.com/0U5sDIcoNM

— Carl Quintanilla (@carlquintanilla) January 22, 2023

Even though retail sales lost momentum heading into end of 2022, they increased by 7.2% throughout entire year, which was strongest (nominal) annual gain since 2004 (if excluding huge post-lockdown jump in 2021) pic.twitter.com/9wFm6QW9un

— Liz Ann Sonders (@LizAnnSonders) January 19, 2023

Subprime consumers are not paying their car loans more than *ever* before.

7.11% of subprime loans were "severely" delinquent in December — The highest in the data series back to 2006.

[via Cox Automotive]

— Car Dealership Guy (@GuyDealership) January 17, 2023

Average monthly payment on a new car hit $777 in December.

An ALL-TIME record.

Is this what it feels like to hit the Jackpot? 🥴

— Car Dealership Guy (@GuyDealership) January 19, 2023

People are really underwater on their car loans. pic.twitter.com/yeefK9MhXy

— Car Dealership Guy (@GuyDealership) January 20, 2023

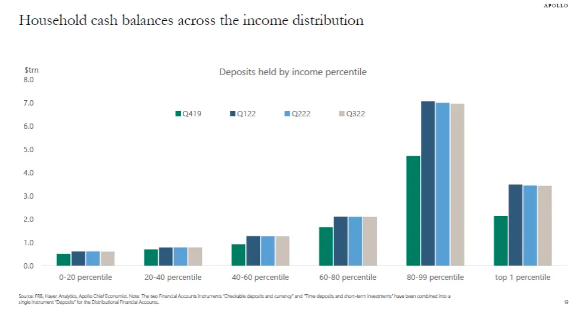

Average deposits held by the bottom half of American households more than tripled from 2019 to 2022, as pandemic aid & rapid wage growth have created unprecedented breathing room on household balance sheets (even amid high inflation). @Morning_Joe pic.twitter.com/S65yGFphyH

— Steven Rattner (@SteveRattner) January 19, 2023

https://twitter.com/pkedrosky/status/1617228986014392321

The meme that Elon cut 75% of Twitter and the service works just fine is a bit off. Many of those cuts were in the sales org and revenue is down 40%. That's not working fine.

— Alex Kantrowitz (@Kantrowitz) January 23, 2023

Amazon, Google, Microsoft, and Meta:

2016 cumulative headcount = ~545,000

2021 cumulative headcount = ~2,020,000 pic.twitter.com/RgPgV7N6gN

— Alex Morris (TSOH Investment Research) (@TSOH_Investing) January 23, 2023

Google NYC employees who arrived at the office early this morning stood in a line to test their badges– if light turned red, it meant you had been laid off. if green, you were safe. 👎

— Daniel Roberts (@readDanwrite) January 20, 2023

MICROSOFT TO AXE THOUSANDS OF JOBS IN LATEST CULL BY TECH GIANT- SKY NEWS

MICROSOFT IS SAID TO BE CONTEMPLATING CUTTING ROUGHLY 5% OF ITS WORKFORCE- SKY NEWS$MSFT

— *Walter Bloomberg (@DeItaone) January 17, 2023

$MSFT employees: pic.twitter.com/ugBRT1hlcJ

— The Transcript (@TheTranscript_) January 20, 2023

scoop with @Kamaron: spotify is planning to lay employees off as soon as this week, following earlier cuts at its podcast networks gimlet and parcast + layoffs at other tech and media companies https://t.co/N9Z8x14ktD

— Ashley Carman (@ashleyrcarman) January 23, 2023

Spotify plans to cut its workforce by about 6% as part of broader cost-saving measures, the latest in a wave of tech layoffs https://t.co/u0pIofRZL4

— The Wall Street Journal (@WSJ) January 23, 2023

Tech layoffs are getting a lot of press, but these layoffs are small, being quickly absorbed into a tight labor market for college+ educated talent, and are a poor reflection of broader labor market dynamics.

Today's Google layoffs brings Jan on par with Nov. Thread. pic.twitter.com/WodLiIVMge

— Bob Elliott (@BobEUnlimited) January 20, 2023

https://twitter.com/TrackInflation/status/1615708179312025600?s=20&t=C69F27iuopQXzyzRPwmKdA

The layoffs of 1,750 people are in addition to a cut of 870 positions the online furniture retailer disclosed in August. https://t.co/Rp86Xi1a0f

— Barron's (@barronsonline) January 20, 2023

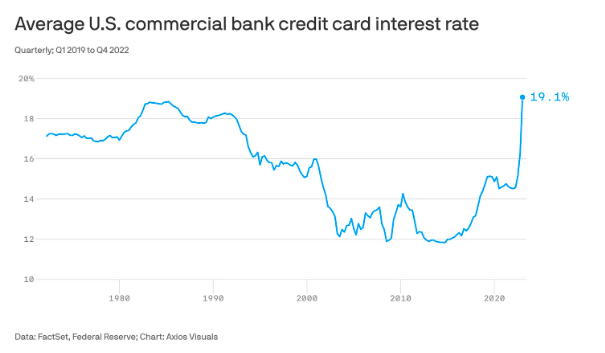

Seems bad pic.twitter.com/dWNjcibPq2

— Ramp Capital (@RampCapitalLLC) January 21, 2023

https://twitter.com/NorthRockLP/status/1617193294928433153

UPDATE: Initial conversations/bids for @CoinDesk range from $15M-$25M

**source: “interest is coming from media properties outside of crypto, multiples are much, much lower than expected.”

— Andrew (@AP_Abacus) January 21, 2023

UPDATE: Per @GenesisTrading bankruptcy filing @Gemini has $600M+ available/pledged via $GBTC shares value to return to Gemini Earn customers.

**31M $GBTC shares have already been delivered, and another 31M have been pledged. @Gemini Earn customers are owed $900M.

— Andrew (@AP_Abacus) January 22, 2023

Goldman calling a housing bottom already:

“We believe that the aggregate drag on GDP growth from the housing sector peaked in 2022Q4”

“The negative impulse of home sales is diminishing and leading indicators of home sales have already turned higher”

cc @conorsen https://t.co/XhcimmaEM8

— Neal (@termloanb) January 24, 2023

https://t.co/fNUspmGbWx pic.twitter.com/XOCeAHr6kQ

— Bill McBride (@calculatedrisk) January 19, 2023

I heard that DR Horton is offering 4.8% mortgages and money towards down payments if you buy their existing inventory. Know several first time home buyers taking them up on the offer.

— Kyle Cerminara (@kcerminara) January 21, 2023

U.S. mortgage applications spiked by 28% last week, largest % change since March 2020 pic.twitter.com/0H7FWIHZeM

— Liz Ann Sonders (@LizAnnSonders) January 18, 2023

12-week change in 30y U.S. mortgage rate has dipped to most negative since February 2020 pic.twitter.com/kV8B1B5euy

— Liz Ann Sonders (@LizAnnSonders) January 19, 2023

"With 11% of S&P 500 companies having reported, 57% are beating 4Q earnings (vs. 70% avg. last 4Qs, Figure 1) and 61% are beating revenue estimates (vs. 69%)." – JPM

— Sam Ro 📈 (@SamRo) January 24, 2023

We have read all the earnings call transcripts from the major U.S. banks so you don't have to.

Let's take a look at what $JPM, $MS, $GS, $BAC, $WFC, and $C had to say about inflation, credit levels, FED, and the general health of the economy.

Thread 🧵 pic.twitter.com/XF7ep6Zalb

— Quartr (@Quartr_App) January 18, 2023

"We haven't seen any elevation on consumer debt," says $VZ CEO Hans Vestberg. "Customers are paying. Delinquencies are low. Consumers waited longer during the holiday season but they came just days before Christmas and did a deal." pic.twitter.com/L7QG1vBEqH

— Squawk Box (@SquawkCNBC) January 24, 2023

Twitter says revenue fall 35% in Q4 – The Information

— *Walter Bloomberg (@DeItaone) January 18, 2023

SCOOP: Twitter’s ad revenue fell around 35% in the fourth quarter of last year to $1.025 billion, 72% of Twitter’s own projections. Twitter hopes to make $732 million in revenue in Q1.

way more details here, including Q4 revenue broken out by region: https://t.co/EeYqlsFcCg

— Erin Woo (@erinkwoo) January 18, 2023

🚨BREAKING — Moderna CEO Admits On Live Air At Davos They Were Making A COVID-19 Vaccine In January Of 2020 Before SARS-CoV-2 Even Had A Name pic.twitter.com/SMKH74NgGi

— James Cintolo, RN FN CPT (@healthbyjames) January 19, 2023

New report: US cancer mortality rate fell by ONE THIRD in the past three decades!https://t.co/XXSPnrWAgO

Key findings: Mortality declines are

– accelerating for lung cancer

– slowing for breast cancer

– stabilizing for prostate cancerKey charts—> pic.twitter.com/Xbfm37xoKM

— Derek Thompson (@DKThomp) January 12, 2023

wow: that 2016 tesla self-driving demo that essentially kicked off the entire industry-wide spending spree…it was fake https://t.co/F5uXGvzfiU

— Max Chafkin (@chafkin) January 17, 2023

Streaming took ~1,000 basis points of share over the past year pic.twitter.com/6K6IL504oe

— Alex Morris (TSOH Investment Research) (@TSOH_Investing) January 19, 2023

Peacock now accounts for 1% of all TV viewing in the US. pic.twitter.com/hmmc2Zf2tp

— Lucas Shaw (@Lucas_Shaw) January 19, 2023

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees.