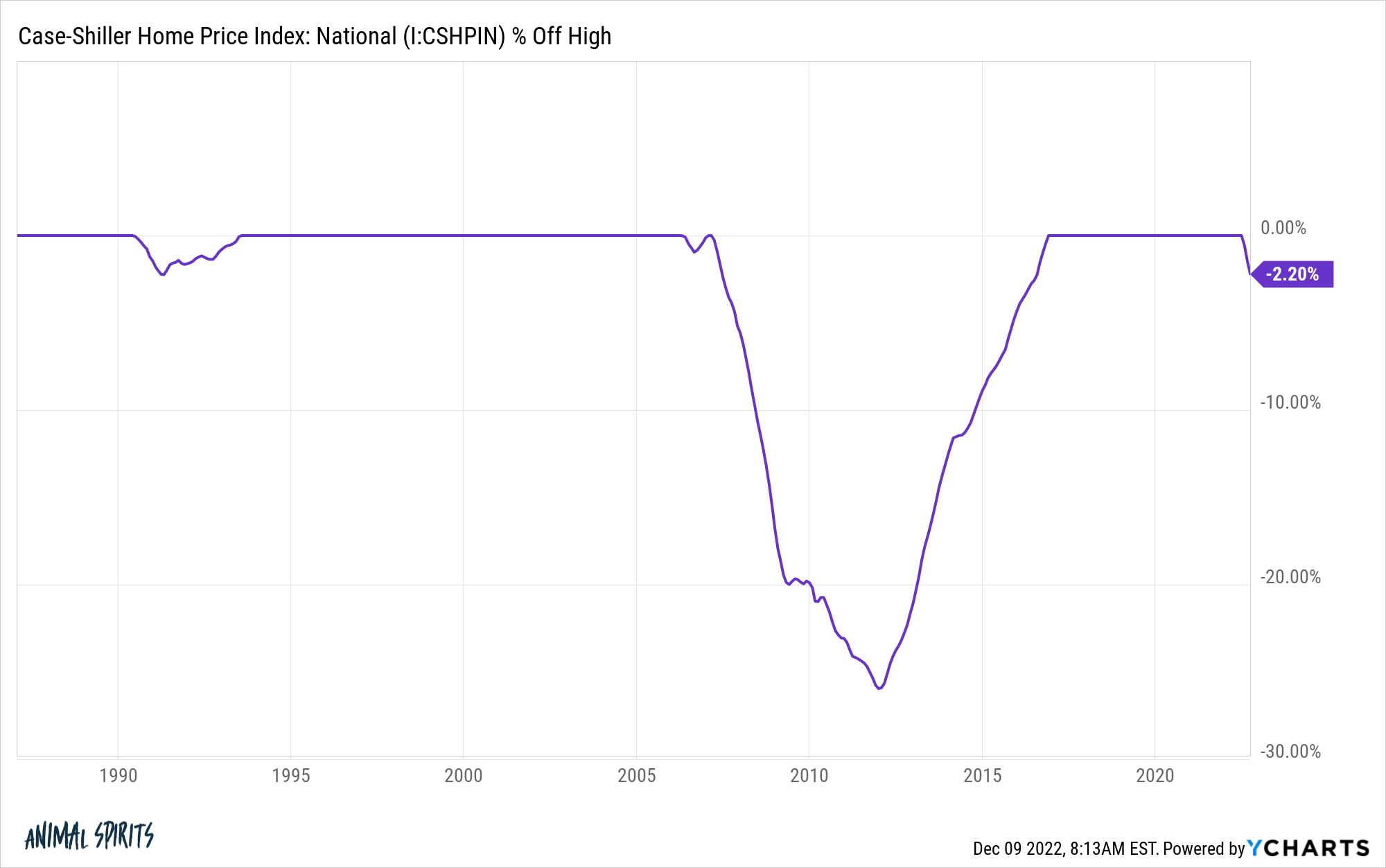

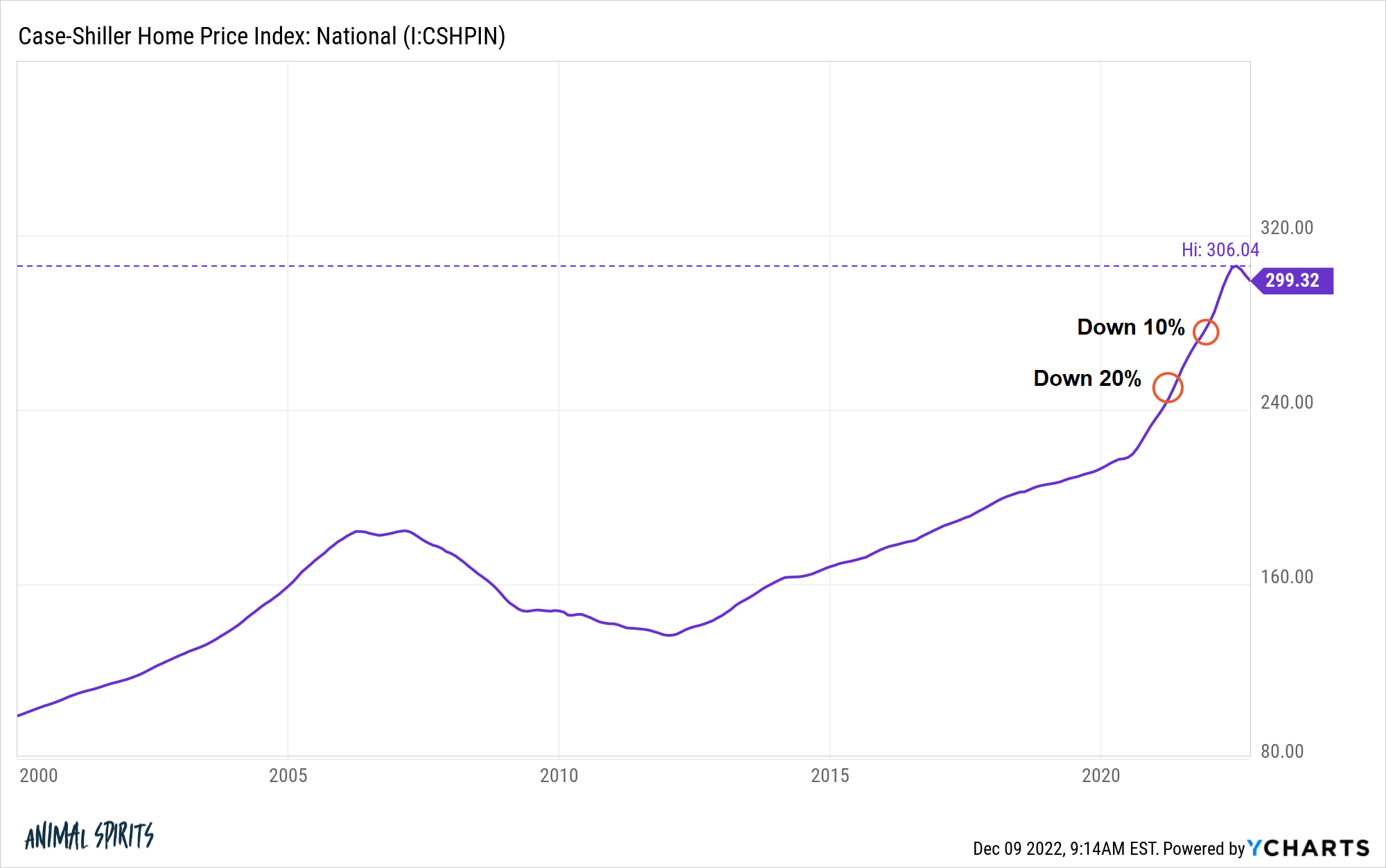

Nationwide price declines in the housing market are relatively rare.

Since 1987, there have been just three times when the Case-Shiller National Home Price Index has been in a state of drawdown:

The first was in the early-1990s when housing prices fell a little more than 2% nationally. Then you have the housing crash at the end of the 2000s when prices fell nearly 27%.

Now prices are dipping again.

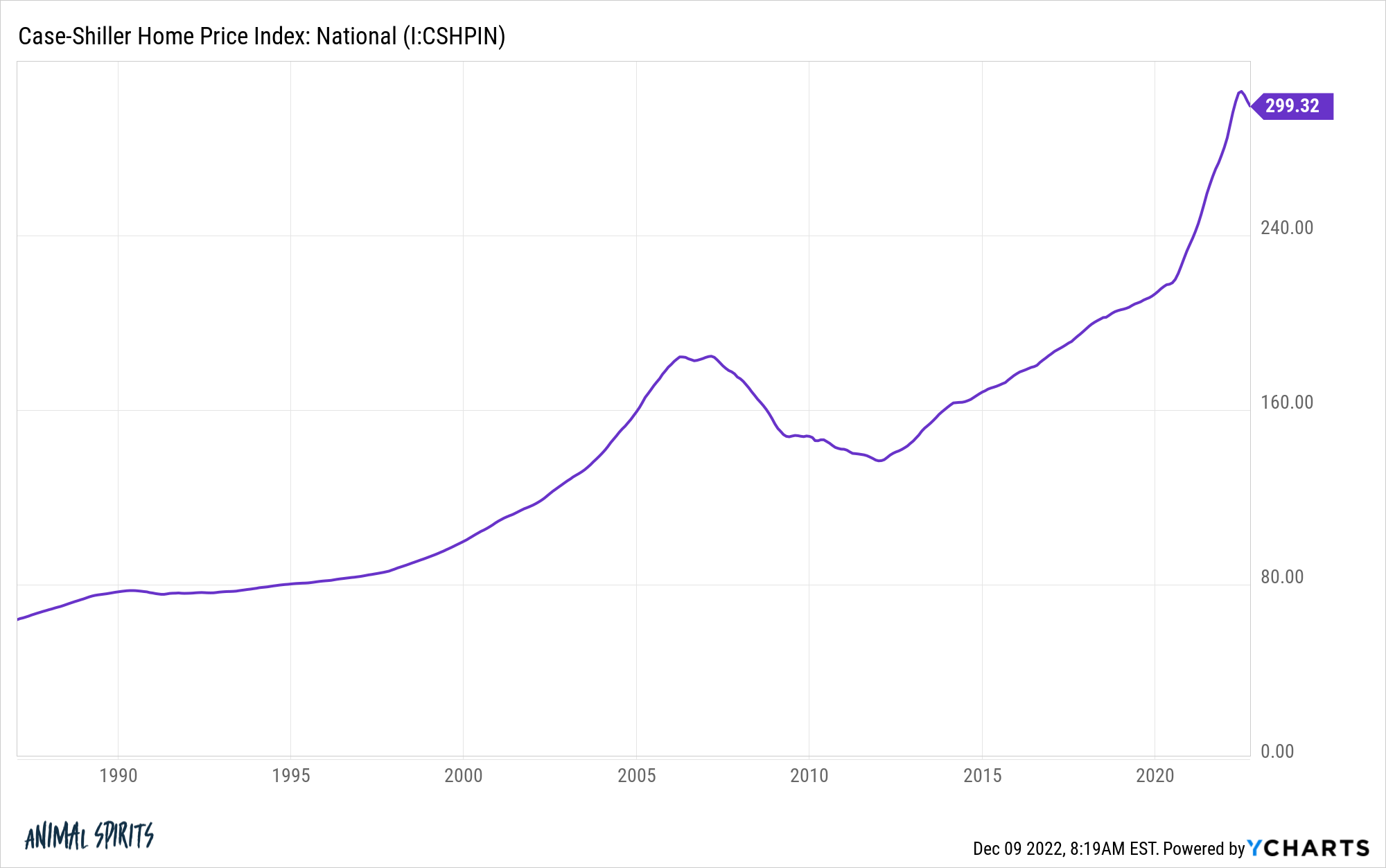

And while housing prices rarely go down, they’ve never gone up as much as they did during the pandemic either:

From April 2020 through June 2022, housing prices in the United States rose more than 41%.

That was basically a decade’s worth of price gains in a little over two years. You simply cannot have that happen for the most important financial asset for the majority of U.S. households.

There is a possibility that home prices simply stagnate for a while to work off these gains.

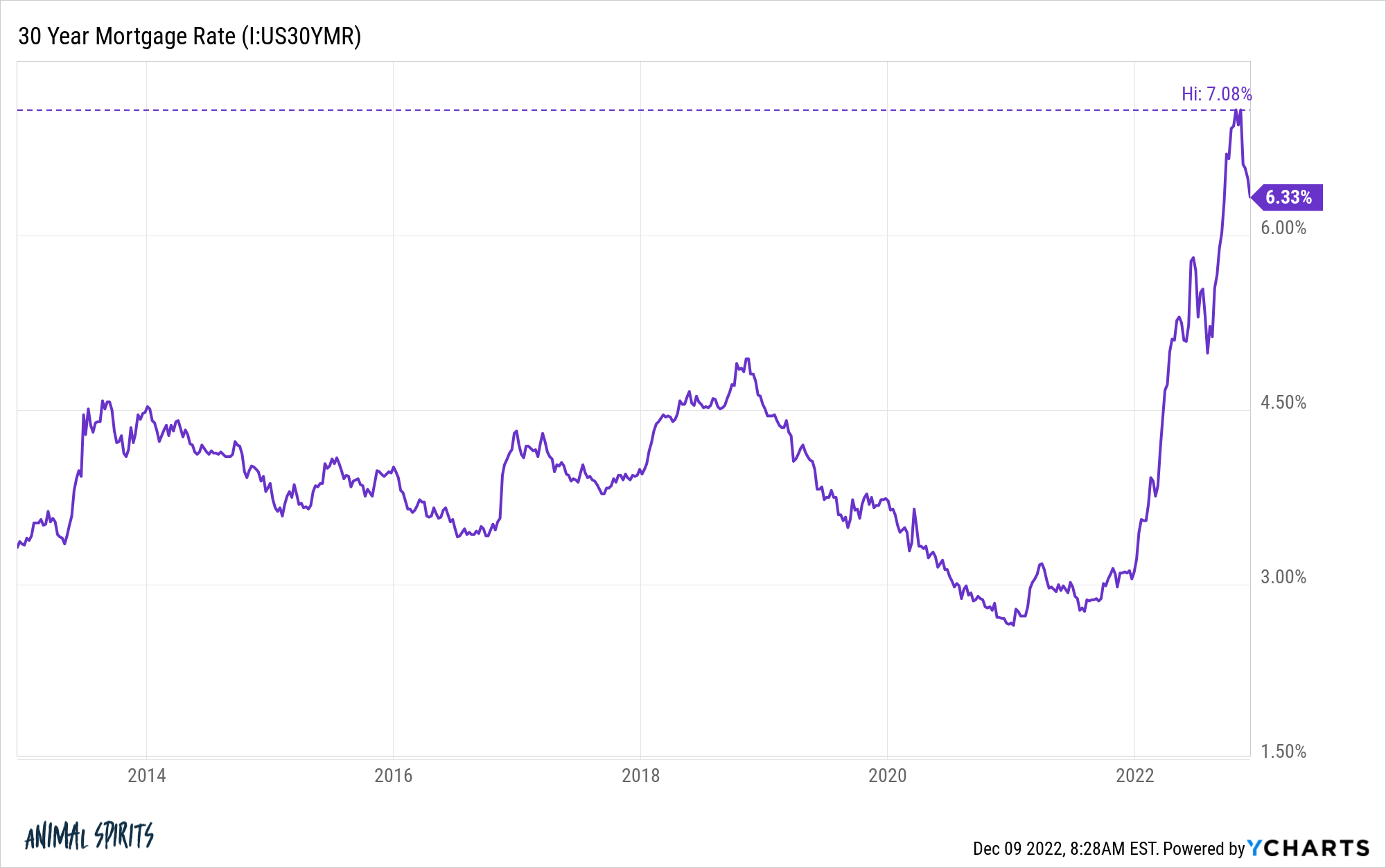

However, the rapid rise in mortgage rates also increases the probability of a more substantial fall in prices.

If mortgage rates stay in the 6-7% range for an extended period of time, many housing experts are now forecasting a drawdown of 10-20% in housing prices.

One of those housing experts is Rick Palacios from John Burns Real Estate Consulting. He joined Mike Simonsen on the Top of Mind podcast to give his price forecast for the coming years:

And so when we roll it all up, we think, again, our view is and this is now a 7% mortgage rates and core assumption in here is that mortgage rates stay relatively, relatively close to about 6% through next year. So that’s a foundational assumption, we think that home prices nationally, will correct to late 2020 levels, by the time we get to 2024.

He thinks a 20% decrease in prices is on the table.

The biggest assumption here is that mortgage rates stay at 6% or higher. Obviously, if rates move back down to 5% or lower, this would change the baseline here.

But the rest of his reasoning makes sense.

I’ve been writing all year about how homeowners who have a 3% mortgage are more or less going to be locked into their houses for a while with higher rates.

Not only is there a financial component involved but people who own a home are reluctant to sell at a loss or a lower value than they assume it’s worth.

Homebuilders, on the other hand, don’t have that same psychological baggage. They typically make up something like 10-15% of the housing supply. Today it’s more like 30%.

If it gets as high as 40-50%, those homebuilders are going to be the marginal seller making a market and setting prices. They have the ability to cut costs, eat into margins and negotiate with suppliers. Plus, they have carrying costs for the land they own and need to get the homes off their books.

You can see how a market with much lower inventory could potentially lead to a double-digit drop in housing prices.

I don’t know if this will happen but it’s worth considering what the ramifications could be if we do get a reset in the housing market.

It’s probably not all that helpful to people looking to buy an existing home but it could mean those looking to build will have the ability to find lower prices and negotiate for the first time in years.

That’s a good thing.

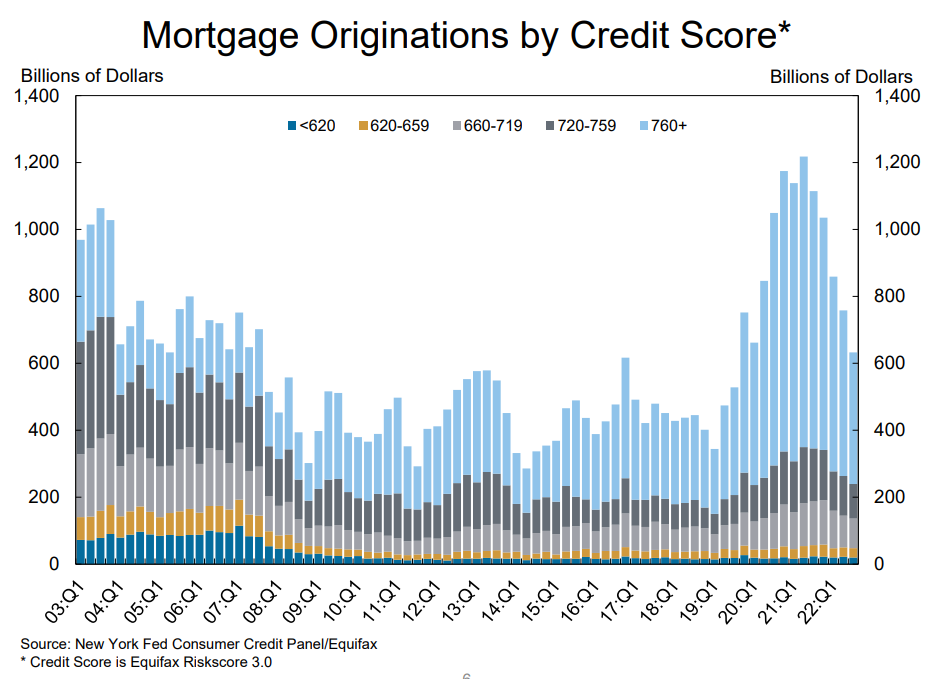

Even if we do get a 20% woosh lower in housing prices, it’s not likely going to have the same impact as the housing crash in 2008.

The credit profile of borrowers is far better now than it was back then:

The majority of homeowners have locked-in rates at 4% or less. Even if prices fall, most people will still be able to pay their mortgages.

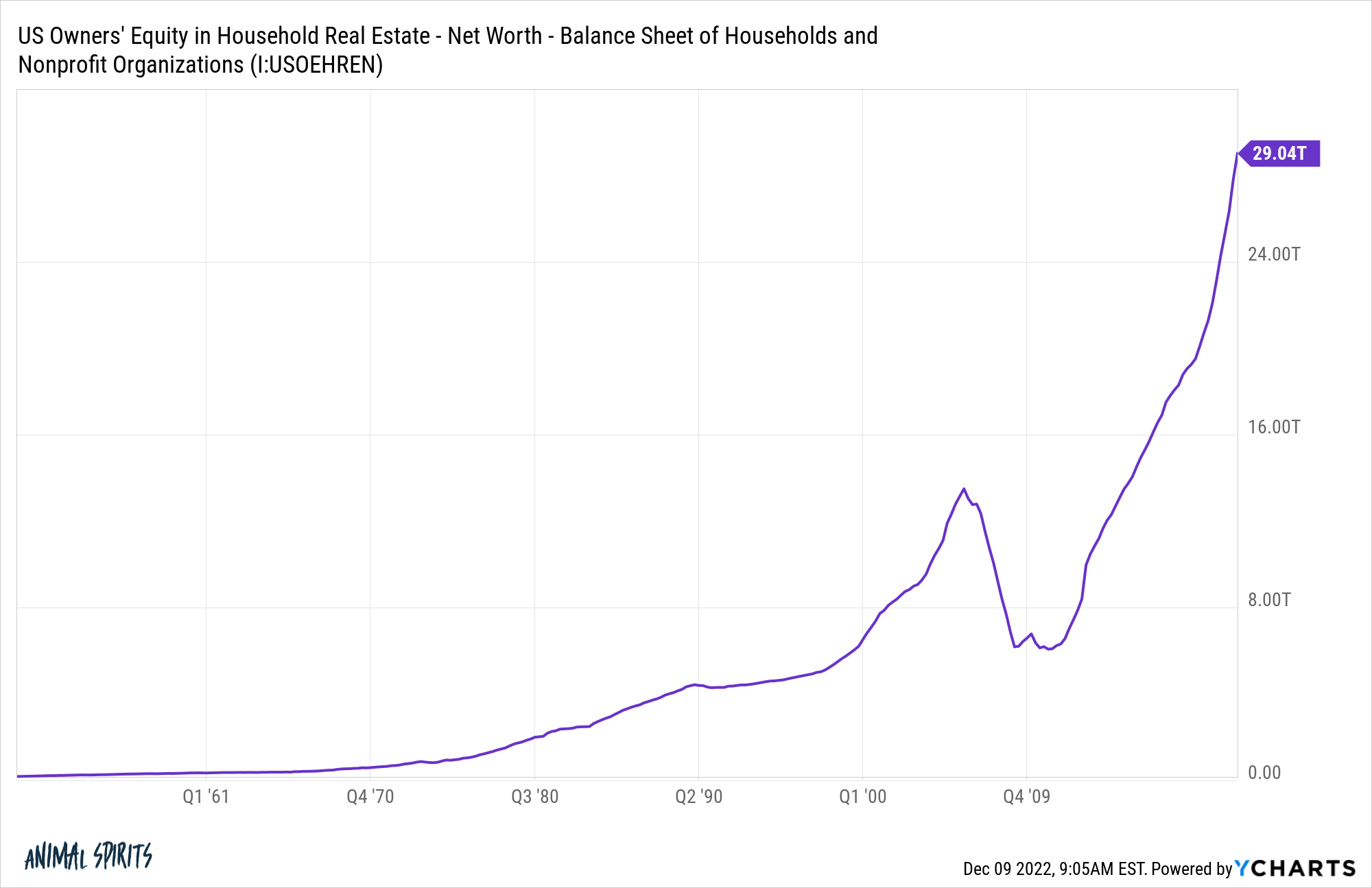

Plus there is an enormous margin of safety built-in with all of the home equity that’s been accrued from the housing bull market:

That $29 trillion in home equity dwarfs the $11 trillion in mortgage debt.

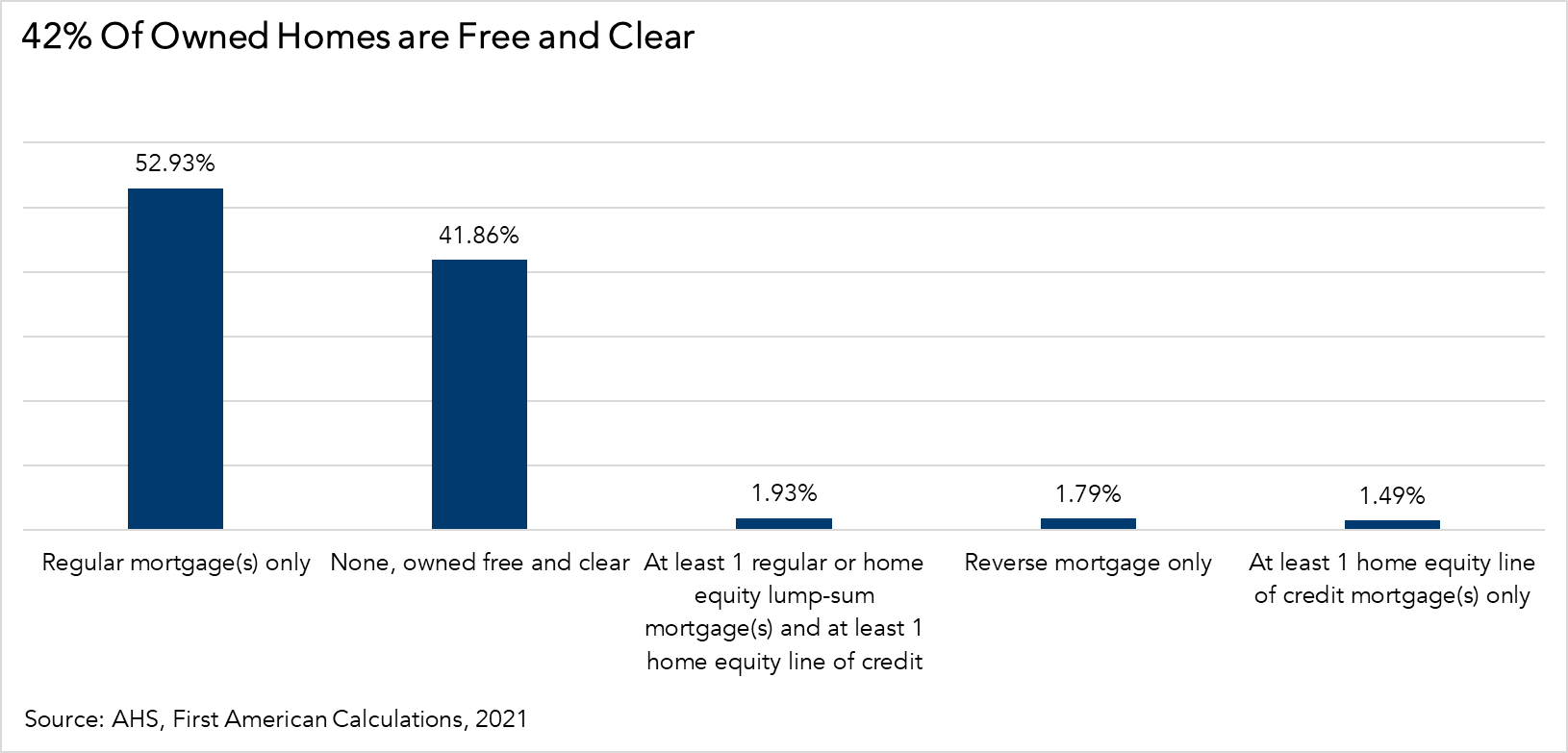

More than 42% of homes are owned free and clear with no mortgage:

Plus, a decline in prices of 10% or 20% doesn’t even come close to wiping out the pandemic-induced housing gains.

A 10% loss from the peak takes us back to October 2021 values. Even a 20% bear market in housing would only bring prices back to March 2021 levels.

It’s not the end of the world.

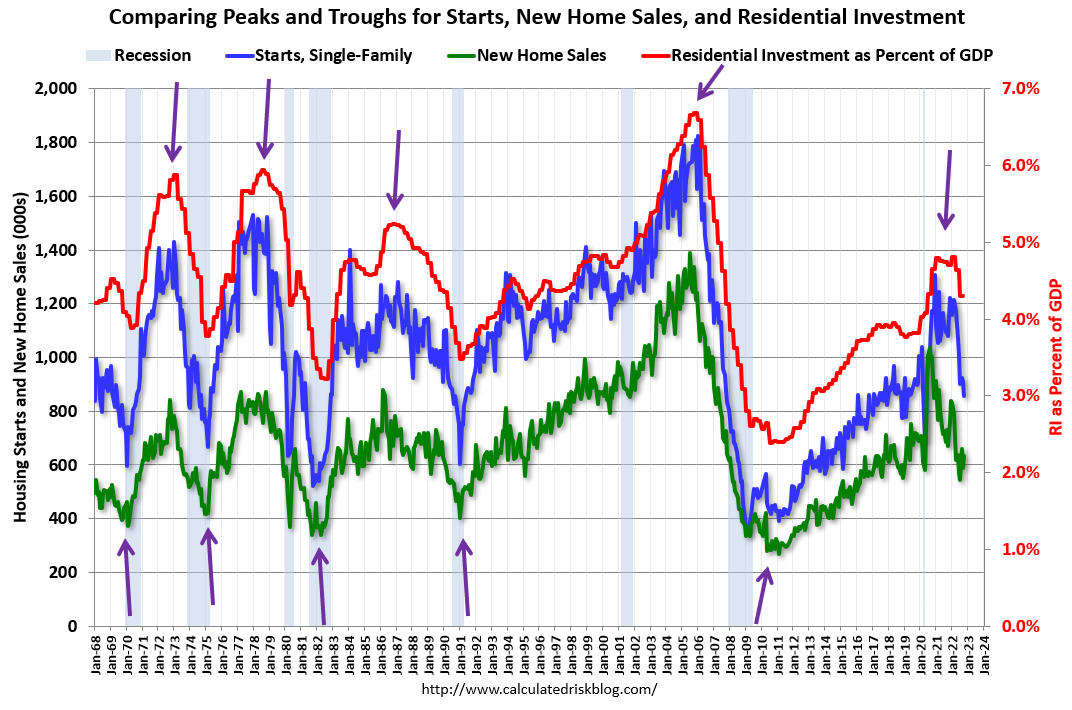

The biggest problem with a severe slowdown in housing is its effect on the economy.

Bill McBride at Calculated Risk shows that a downturn in housing activity is a decent precursor to a downturn in the economy:

McBride notes:

If the Fed tightening cycle will lead to a recession, we should see housing turn down first (new home sales, single family starts, residential investment). This has happened, but this usually leads the economy by a year or more. So, we might be looking at a recession in 2023.

We’re already in a housing recession. That could lead to an actual recession next year if things don’t turn around.

Michael and I talked about the prospects for a bear market in housing and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Luck & Timing in the Housing Market

I was traveling this week and didn’t read much so check out Nick’s favorite investing writing of 2022 at Of Dollars and Data.