Some charts I came across this week along with some thoughts on each:

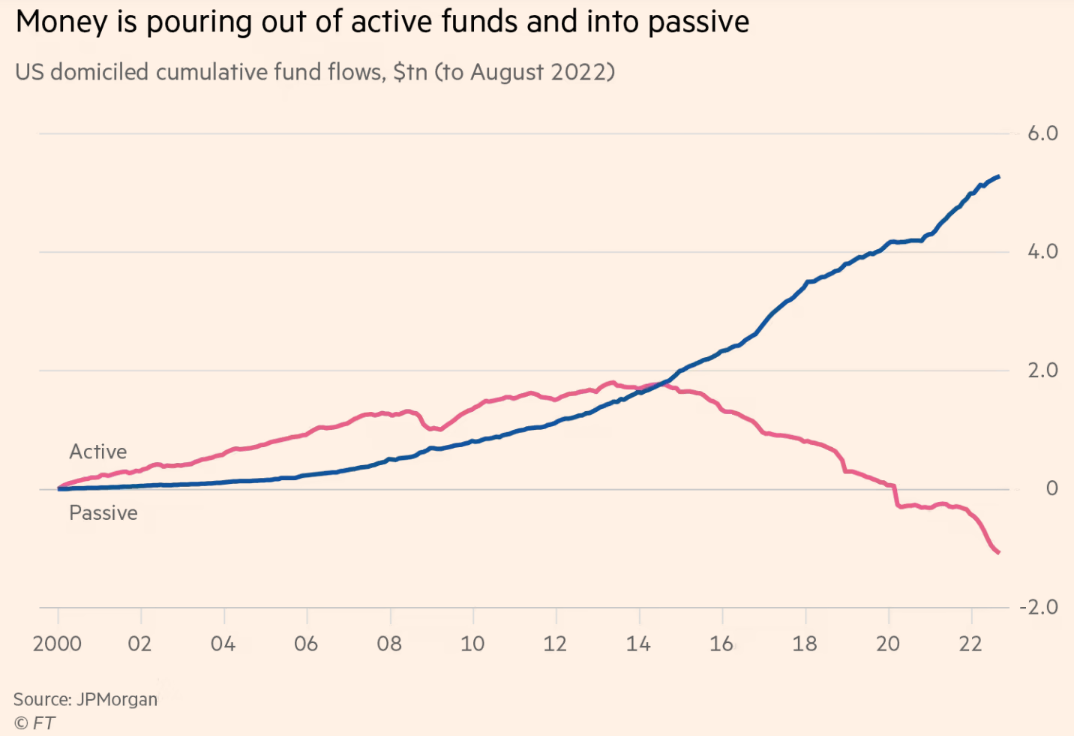

The bear market is speeding up the move from active to passive:

This trend has been in place for a while now but the bear market is accelerating things. It makes sense if you think about it in terms of a down year in the stock market where people with long-term gains are more willing to get out of a position to make a portfolio change.

Plus this is the first time in maybe forever that bonds are in a double-digit downturn. This year was the perfect time to hit the reset button.

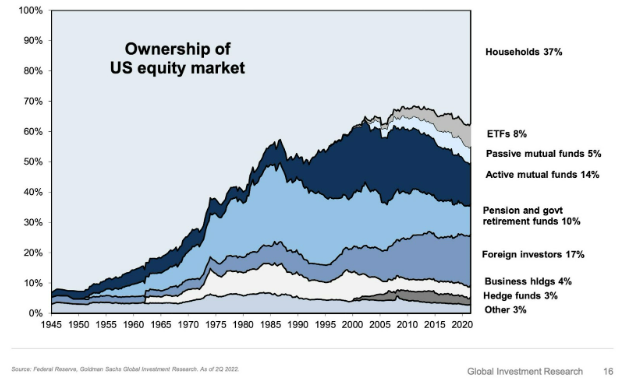

I don’t know how much longer we can keep up this pace but passive funds still have some room to run if you look at the ownership of the U.S. stock market:

Passive funds are still relatively small in the grand scheme of things.

I know a lot of people believe all of this index investing is hurting price discovery but look at how things were in the 1940s, 50s and 60s. Individual investors held 80-90% of stocks.

There were no high-frequency trading firms back then. We didn’t need hedge funds to control the markets to set prices. People were mostly buy-and-hold investors.

And guess what? Price discovery was just fine. You didn’t need everyone day trading their faces off to make a market.

The good thing about a buy-and-hold approach using low-cost index funds is you know what you’re going to get — the market return minus a minuscule fee.

The problem for some investors is sitting on their hands and holding on when market downturns occur.

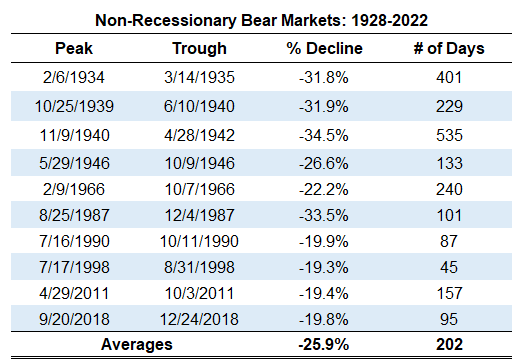

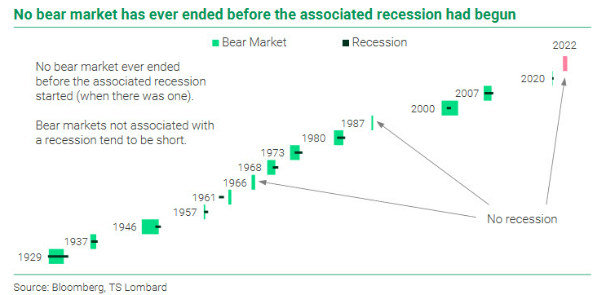

Bear markets outside of recessions are relatively rare but not out of the question:

What makes the current iteration so difficult to handicap is we’ve already experienced a decent-sized bear market and yet the recession everyone is predicting hasn’t even happened yet.

What happens if the Fed does throw us into a recession in 2023 or 2024 but the stock market has already recovered all or most of the losses? Do we go through this all over again? Has the stock market already priced that in?

That’s the trillion-dollar question. I honestly don’t know. It likely depends on the severity of the recession should one take place.

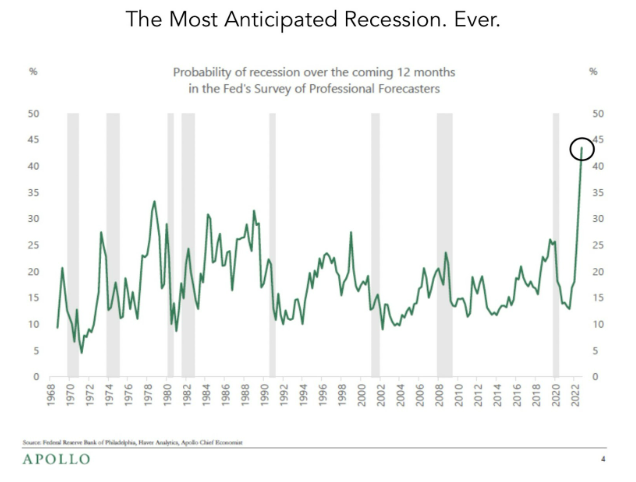

Research from TS Lombard shows no bear market cause by an economic slowdown has ended before a recession has started:

‘Never’ and ‘always’ can be dangerous words in the world of finance.

Things that have never happened before seem to be happening with regularity these days. And relationships from the past seem to fall apart right when you expect them to pay off.

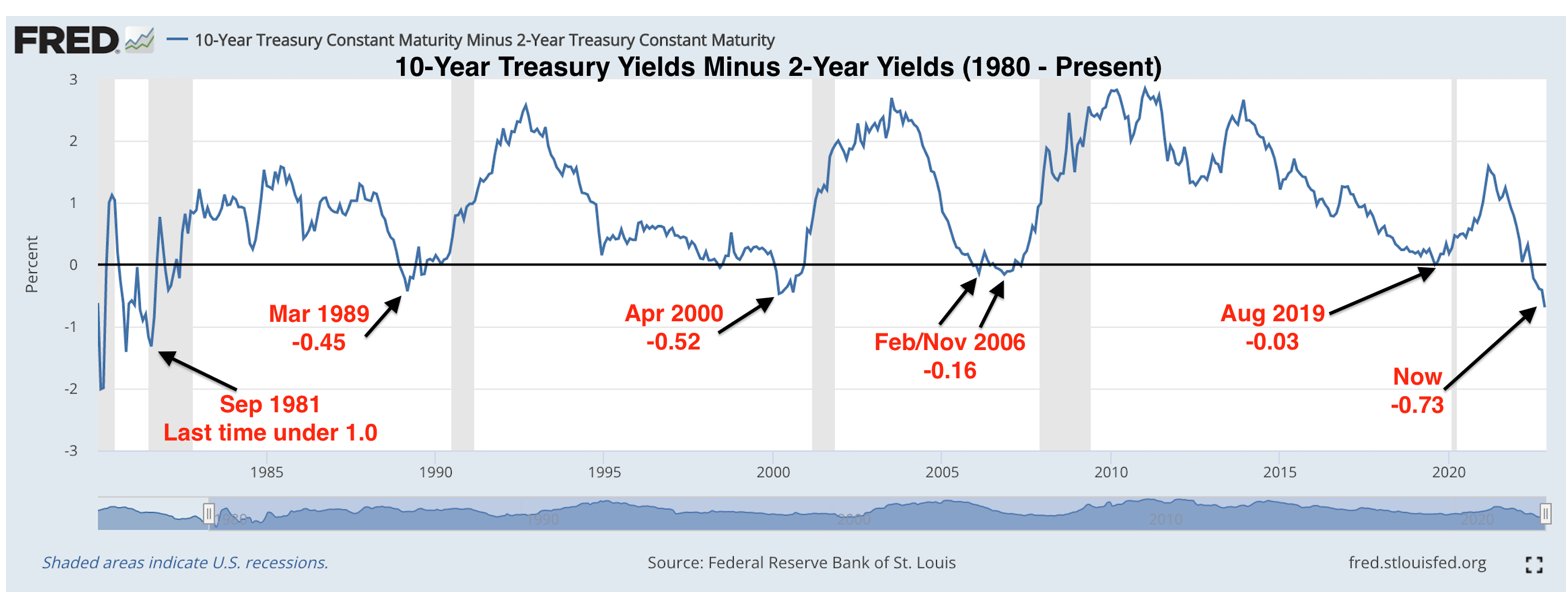

One of those relationships many market observers are paying attention to is the spread between long and short bonds. DataTrek Research shows 2 year treasuries now yield more than 10 year treasuries by 0.7%:

That’s the biggest spread for short-term bonds over long-term bonds since the early-1980s (incidentally the last time the Fed went on a rate-hiking binge).

You can see from the gray bars on that chart that an inverted yield curve has been a reliable indicator of an oncoming recession in the past.

If we don’t get a recession in the next 12 months or so it’s going to surprise a lot of people.

We shall see.

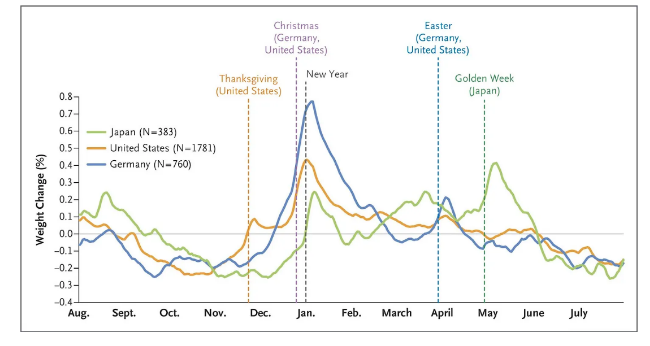

Something that should not come as a surprise is the fact that most people who gain weight do so during the holidays.

My pal Phil Pearlman made a great analogy between the stock market and weight gain in his latest piece on Prime Cuts:

There’s a famous line of financial markets research that goes something like this.

If you miss the single best day of the year in stocks, your performance suffers badly over the long run.

Really badly.

Here’s one variation of this with data from Bank of America describing how you would go from a 17,000% return to a 28% return over 90 years if you missed the ten best days of the decade.

I was thinking about how the average adult in the US gains around 1-2 pounds per year.

Maybe that doesn’t seem like much but over the course of 20 or 30 years, we’re talking 30 to 45 pounds.

Of the 1-2 pounds American adults gain over the course of the year, all of it (and then some) comes during the winter months.

Here’s the chart to prove it:

I was jealous of this take because it’s so obvious, but I’d never thought about it this way before.

Avoiding weight gain over the holidays might be even harder than timing the market but this was a good reminder from Phil that seasonality plays a large role in the growth of our waistlines.

Michael and I discussed all of these charts and many more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

4 Concerning Personal Finance Charts

Now here’s what I’ve been reading lately:

- Past performance (Reformed Broker)

- The incredible shrinking future of college (Vox)

- How much growth should you expect in your portfolio? (Dollars & Data)

- 8 studies on human imagination (Experimental History)

- An oral history of Planes, Trains & Automobiles (Vanity Fair)