A reader asks:

Collective wisdom is that over the long-term markets go up. While this may have been the case in the past, it’s the baby boomers who control the vast majority of the equity market on a generational basis, and they are in the process of selling out in mass due to financing retirement over the next decade. Is this a real cause for concern that this will trigger endless selling pressure and keep returns down for decades to come? I’m coming at this question as a 30-something, thanks.

Fair question.

I was at a Christmas party last week where a gen Z family member was asking a baby boomer family member if he thought Social Security would still be around when he retired.1

There is this sense that the boomers are going to leave the cupboards bare for the next generations. It’s possible but I’m dubious about using demographics to predict the path of the stock market.

For one thing, demographic trends are fairly easy to map out. The markets know what’s coming.

In the 2000s a lot of people assumed baby boomers would be able to prop up the stock market coming into the new century. Robert Shiller talked about why it didn’t happen in the second edition of Irrational Exuberance:

If life-cycle savings patterns alone were to be the dominant force in the markets for savings vehicles, there would tend to be strong correlations in price behavior across alternative asset classes, and strong correlations over time between asset prices and demographics. When the most numerous generation feels they need to save, they would tend to bid up all savings vehicles: stocks, bonds and real estate. When the most numerous generation feels they need to draw down their savings, their selling would tend to force down the prices of all these vehicles. But when one looks at the long-term data on stocks, bonds and real estate, one finds that there has in fact been relatively little relation between their real values.

He did admit that perceptions of strong demographic tailwinds could help the markets but there is no proof in the data.

Look no further than Harry Dent’s predictions to see why using demographics to forecast the market is a losing proposition.

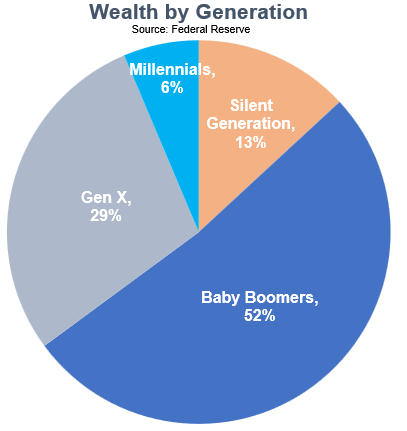

It is true that boomers hold the bulk of the wealth in this country:

If all of the boomers decide to sell at once it would make sense that financial markets would come under pressure but I don’t think that’s going to happen.

For one thing, people are living longer these days.

It’s not like you have a 10 year window for retirement like people did in the past. A 65-year-old male in the United States has a life expectancy of 85 years. For females, it’s 87. If you’re a married couple at retirement age, there is a 50% chance one of you will live until you’re 95.

We have never seen a demographic as large as the baby boomers live as long as they are going to live.

So it’s not like all of the selling is going to happen at once.

And a lot of boomers aren’t going to sell down much of their wealth at all. They are simply going to pass down some or most of their money to the next generation.

Think about it — the top 10% by wealth in this country owns 90% of the stocks. People in the wealthy class aren’t going to need to spend all of their money. Eventually the next generations are going to get some of that wealth.

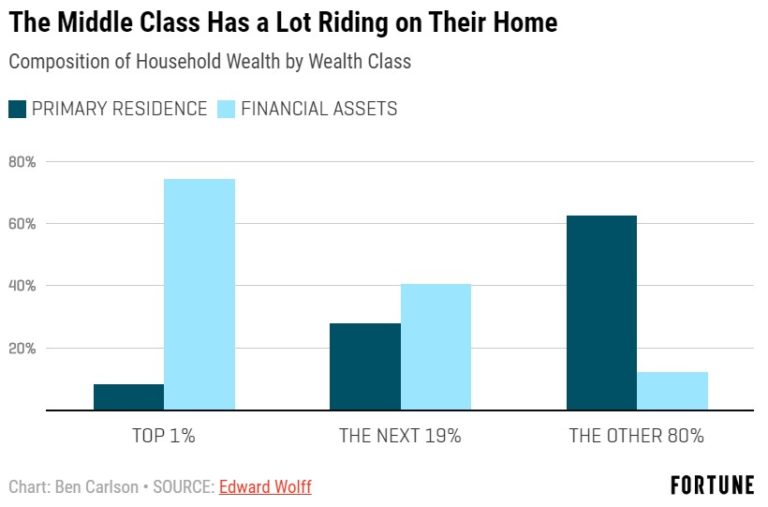

Boomers also don’t have their entire nest egg in the stock market. The middle class has the majority of their wealth tied up in their primary residence:

You could make the case that housing will be more heavily impacted by boomers selling than the stock market.

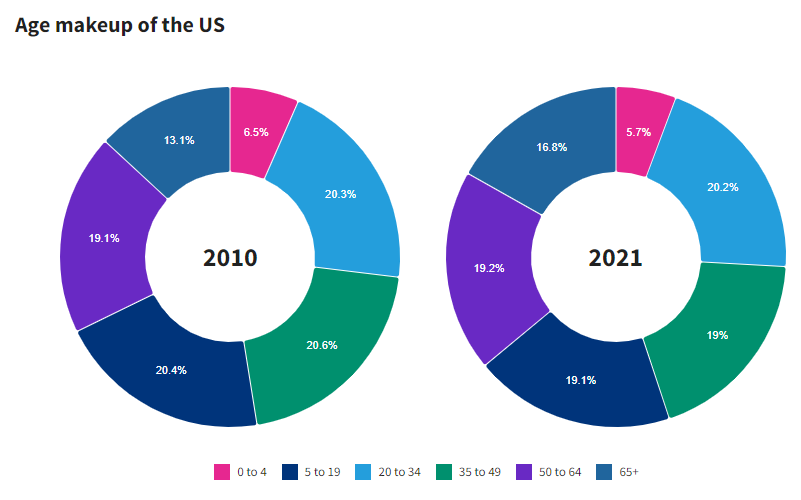

But even there, we have plenty of young people moving up the ranks to pick up the slack if boomers do sell their stocks or houses. Millennials are a larger demographic than the boomers. Gen X will probably catch them by the end of this decade as older people begin dying off.

The biggest age demographic right now is 20-34. The 35-49 cohort is just as large as the 50-64 group. There are more people in the 5-19 age range than those over 65 years old.

That 65+ bucket is going to continue getting larger but millennials are about to reach their peak earning years and they are the most highly educated demographic in history. That should translate into higher wages and thus an ability to invest their money in the stock market.

There are also structural reasons the baby boomers will have a more muted impact than you would assume.

Markets are more global than ever and investors have never had easier access to investing in them.

We now have automatic investments via 401ks, IRAs, roboadvisors, targetdate funds and online brokerage accounts that you can fund in minutes on the supercomputer in your pocket. Educating yourself about finance has never been easier.

The act of investing itself is still challenging, but the barriers to entry into the stock market have never been lower.

There are always plenty of risks involved when investing in the financial markets. I’m not all that worried about baby boomers as a potential catalyst for poor returns going forward.

We discussed this question on the latest edition of Portfolio Rescue:

Josh Brown joined me again to discuss this question and the Fed vs. inflation, lump sum vs. dollar cost averaging, investing in real estate, and figuring out what to invest in following a crisis.

1Read here for why I’m not all that worried about Social Security.