Today’s Animal Spirits is brought to you by YCharts:

Enter your information here to get 20% off YCharts (new clients only)

On today’s show we discuss:

- Individual investors hang on in wild year for stocks while pros sell

- Powell’s press conference transcript

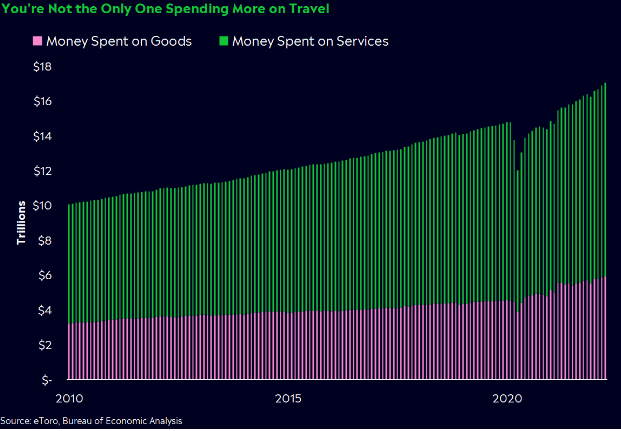

- Why your portfolios future may hinge on your travel plans

- Highest interest rates in 15 years are derailing the American Dream

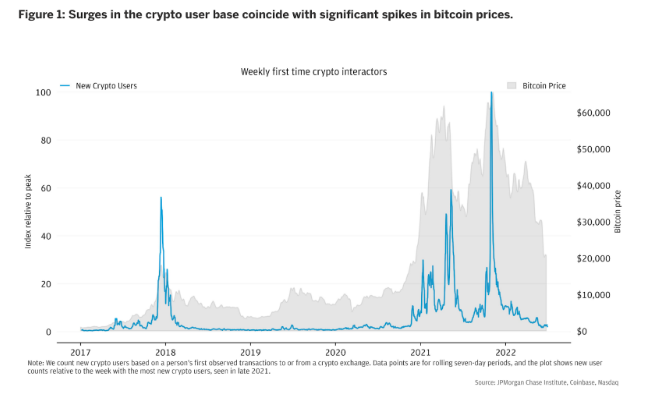

- The dynamics and demographics of US household crypto-asset use

- Why this housing downturn isn’t like the last one

- Musks Twitter layoffs inspire founders to cut deep

Listen Here:

Recommendations:

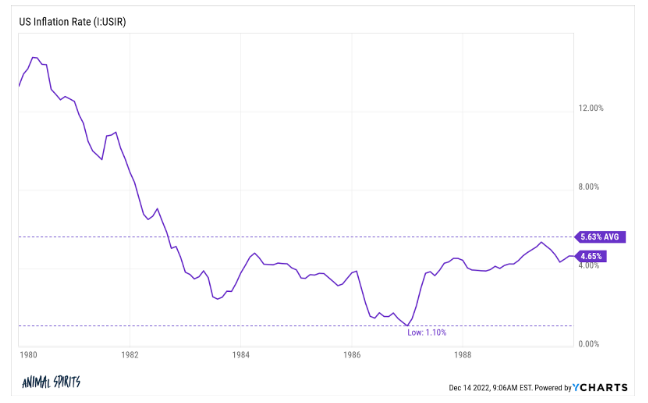

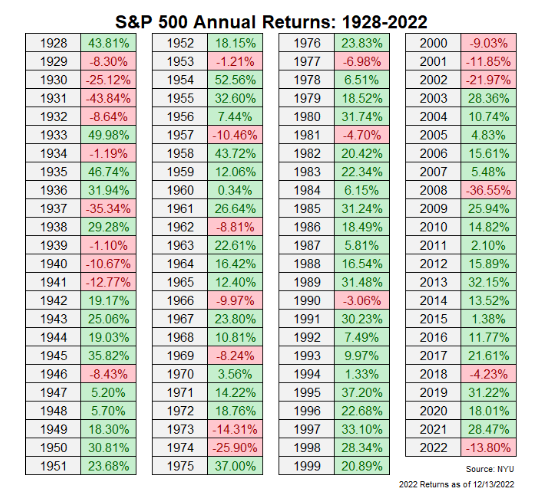

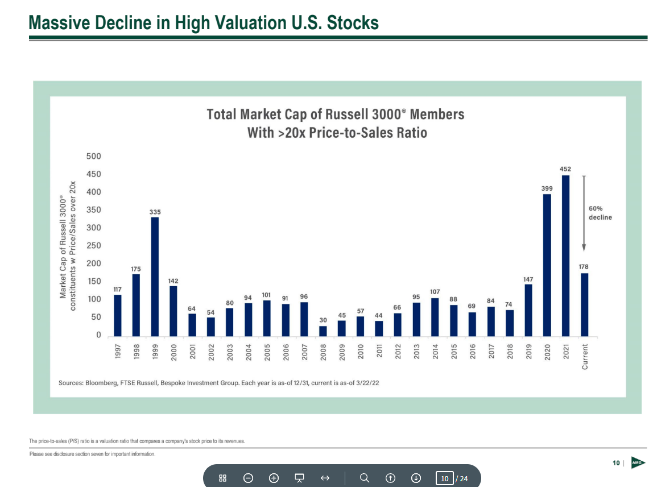

Charts:

Tweets:

“The depth of recessions are not massively correlated to the scale of the S&P 500 declines. The 1970 and 2001 (the mildest) recessions were very bad for stocks.” – DB pic.twitter.com/RUbgqTqIqz

— Sam Ro 📈 (@SamRo) December 15, 2022

With yesterday's decline in the S&P 500, we've now had 16 down days of 1% or more.

This is the most 1%+ declines in a calendar year going back to 1952. (Source: @bespokeinvest)

Not the kind of record we were hoping to set going into 2022! pic.twitter.com/bE75ae1p9I

— Adam Zuercher (@adamzuercher) December 16, 2022

It’s a bit wonky, but this chart of $SPX performance following a #FOMC pause is worth noting.

(via Apollo/Slok) pic.twitter.com/UJnuqSMvSO

— Carl Quintanilla (@carlquintanilla) December 15, 2022

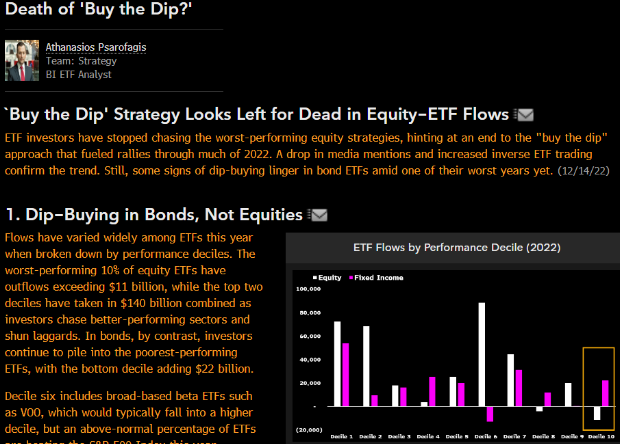

BTFD is finally dead. If you looking for signs of capitulation, here's one: retail ETF traders have as a whole stopped buying beaten up ETFs. Fed hikes has finally beaten them into surrendering and/or selling the rip as evidenced by inverse ETF volume spiking via @psarofagis pic.twitter.com/gCftFFAL1e

— Eric Balchunas (@EricBalchunas) December 14, 2022

Record $1.5tril gap b/w $$$ flowing into ETFs & out of mutual funds this yr…

ETF inflows = $588bil

MF outflows = $950bil

via @isabelletanlee pic.twitter.com/U4eGta3Ur2

— Nate Geraci (@NateGeraci) December 16, 2022

"Yesterday retail investors were buying mainly tech – as usual, the most bought stock was TSLA" – @vandaresearch pic.twitter.com/tn2b86sRL0

— Gunjan Banerji (@GunjanJS) December 14, 2022

Highest SI % Float wit hShort Interest over $50 million pic.twitter.com/cVmn56Yzrp

— Ihor Dusaniwsky🇺🇦 (@ihors3) December 15, 2022

If we focus on US stock funds that existed at the time of ARK Innovation's 2014 inception…what you find is that, even after all of this, ARKK's lifetime return still beats ~2/3 of those funds. Of those 2,984 funds, 714 no longer exist and another 927 lag ARKK's return. Anyway. pic.twitter.com/gFjjaPT2wU

— Jeffrey Ptak (@syouth1) December 16, 2022

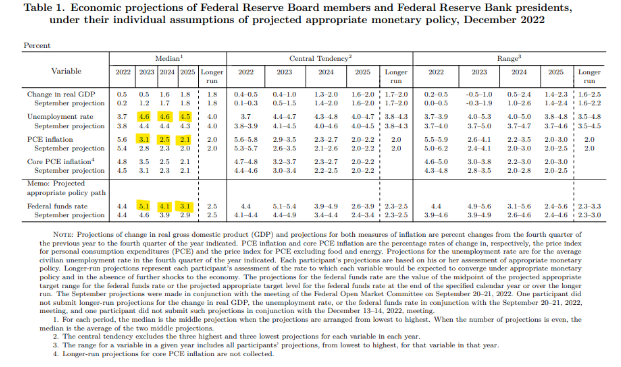

Powell on changing the Fed's 2% inflation target: "We're not going to consider that under any circumstances."

— Nick Timiraos (@NickTimiraos) December 14, 2022

This is a US phenomenon. Chronically low inventory levels keep a firmer base under prices than we have seen in other downturns. https://t.co/IgBglZeiv9

— Jonathan Miller (@jonathanmiller) December 15, 2022

Should I step down as head of Twitter? I will abide by the results of this poll.

— Elon Musk (@elonmusk) December 18, 2022

Elon Musk says Twitter Blue subscribers will be the only ones allowed to vote in policy related polls

This come after users voted for him to step down as Head of Twitter pic.twitter.com/1qcAKvGq5K

— ScreenTime (@screentime) December 20, 2022

Wedbush lambastes Musk over Tesla stock sale @DivesTech #NotableCall $TSLA $TWTR pic.twitter.com/P0h2eaYmez

— Amber Kanwar (@baystreetamber) December 15, 2022

Twitter has a bug where suspended accounts could still use Twitter Spaces. Since everyone who knows that codebase has been fired, Twitter has shut down the entire Twitter Spaces feature.

Truly a master class in how to run a social media service. https://t.co/c607zR2iKQ

— Dare Obasanjo🐀 (@Carnage4Life) December 16, 2022

Elon Musk's team is seeking new investors for Twitter, offering the same $54.20-a-share deal and trying to close by the end of the year. Scoop w/ @ReedAlbergotti https://t.co/ujZOYxlfQG

— Liz Hoffman (@lizrhoffman) December 16, 2022

https://twitter.com/GergelyOrosz/status/1604601829626892289?s=20&t=2mY9gdcBDZgHX2SdIQUIJw

$MSFT: "Going into the pandemic, we're ~20 million MAUs. Our most recent public statement on Teams has been over 270 million MAUs of Teams..About 6 months ago, we finally saw the number of minutes spent in chat in Teams surpass the number of minutes that people spend in Outlook" https://t.co/48i9QVNwLj

— The Transcript (@TheTranscript_) December 10, 2022

The rising power of Teams at Microsoft:

"Going into the pandemic…Office 365. That was the main source of value for us. During the pandemic, that changed in a pretty significant way…[Teams is] becoming a major force in commercial software"$MSFT pic.twitter.com/jCwVyP4Rri

— The Transcript (@TheTranscript_) December 10, 2022

LinkedIn CEO @ryros: "Pre-pandemic, ~1% of all jobs posted on LinkedIn were remote. As of today, that number is ~14%…but that's not the fascinating part. What's fascinating is north of 50% of all job applications on a daily basis on LinkedIn go to that 14% of remote jobs" $MSFT pic.twitter.com/5TQ19UcfIp

— The Transcript (@TheTranscript_) December 10, 2022

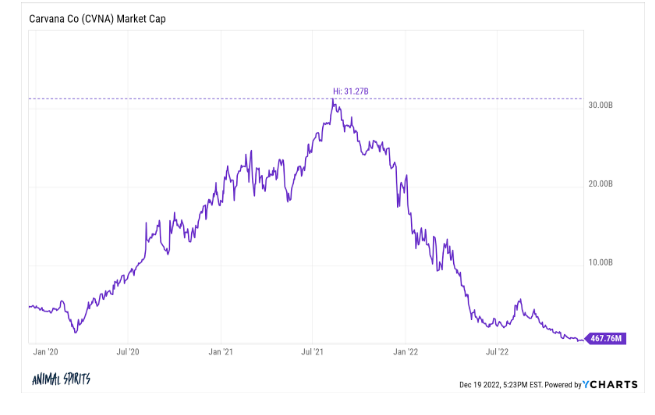

Carvana may have just quietly started liquidating:

The company is now advertising its *retail* inventory to *wholesale* dealers.

Look at the $5,000 price difference. Wild times. pic.twitter.com/fp7PXODEhF

— Car Dealership Guy (@GuyDealership) December 17, 2022

Thanks for the mention! Always appreciated. One quick clarification: The reason those success odds seem high is bc it only accounts for funds that lived at least 5 years (as this is needed to conduct a 5-yr persistence study). It excludes those that died before hitting 5-yr mark.

— Jeffrey Ptak (@syouth1) December 14, 2022

If we focus on US stock funds that existed at the time of ARK Innovation's 2014 inception…what you find is that, even after all of this, ARKK's lifetime return still beats ~2/3 of those funds. Of those 2,984 funds, 714 no longer exist and another 927 lag ARKK's return. Anyway. pic.twitter.com/gFjjaPT2wU

— Jeffrey Ptak (@syouth1) December 16, 2022

So excited to share what we’ve been working on. #MissionImpossible pic.twitter.com/rIyiLzQdMG

— Tom Cruise (@TomCruise) December 19, 2022

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees.