Technology stocks make up nearly 24% of the S&P 500.

And that number is probably understating things since many of the biggest companies aren’t technically in the tech sector.

Amazon and Tesla are two of the biggest holdings in the consumer discretionary sector.

Facebook, Google and Netflix are in the communications sector.

Many of these companies are now such a part of our lives that it’s difficult to classify them in just one sector, but you could make the case that technology stocks actually make up more like one-third of the S&P 500.

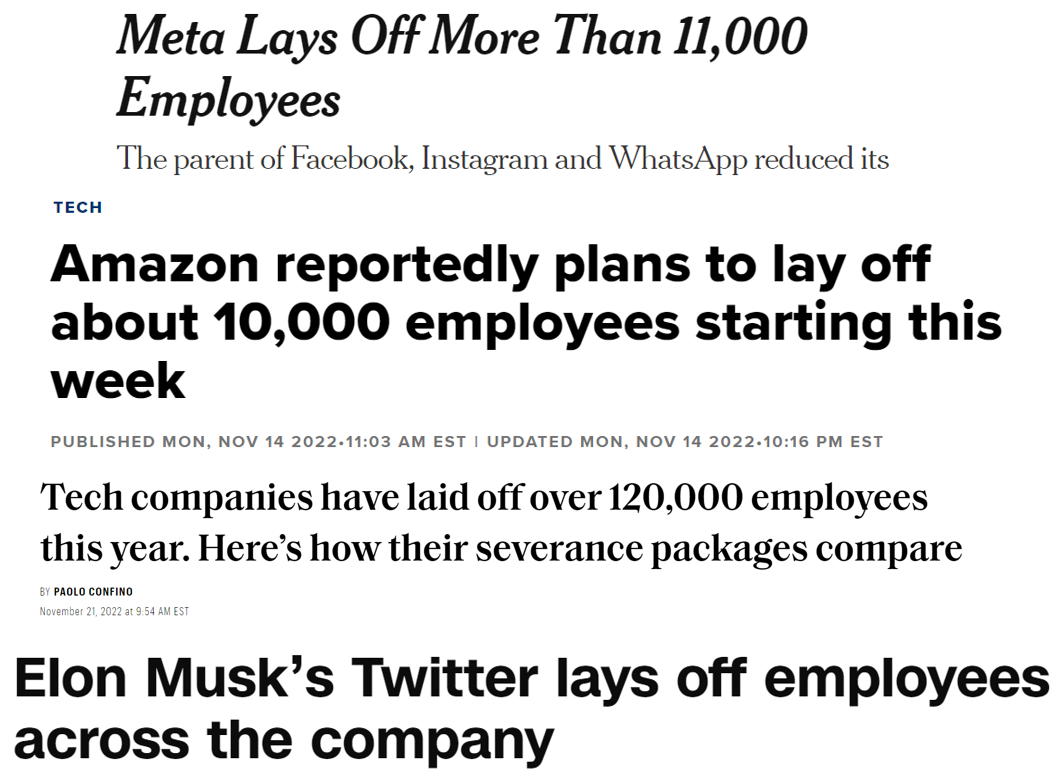

We’re now seeing mass layoffs in these companies that are so embedded in our daily lives and such a big part of the stock market:

This seems like it has to be worrisome for the rest of the economy…right?

I suppose we could be looking at a canary in the coal mine situation where this is the first domino to fall but the tech industry isn’t nearly as important to the overall economy as it is to the stock market.

Carl Quintanilla pointed out a research note from Goldman Sachs this week that put the tech layoffs into perspective.

Goldman notes that even in the unlikely scenario where every single worker in internet publishing, broadcasting and web search were all laid off immediately, the unemployment rate would rise by less than 0.3%.

In fact, technology only makes up 2% or so of the entire U.S. labor force.

Part of this is because technology companies are more efficient. They don’t need as many employees as a steel mill.

But this mismatch also stems from the fact that the stock market is different than the economy in many ways.

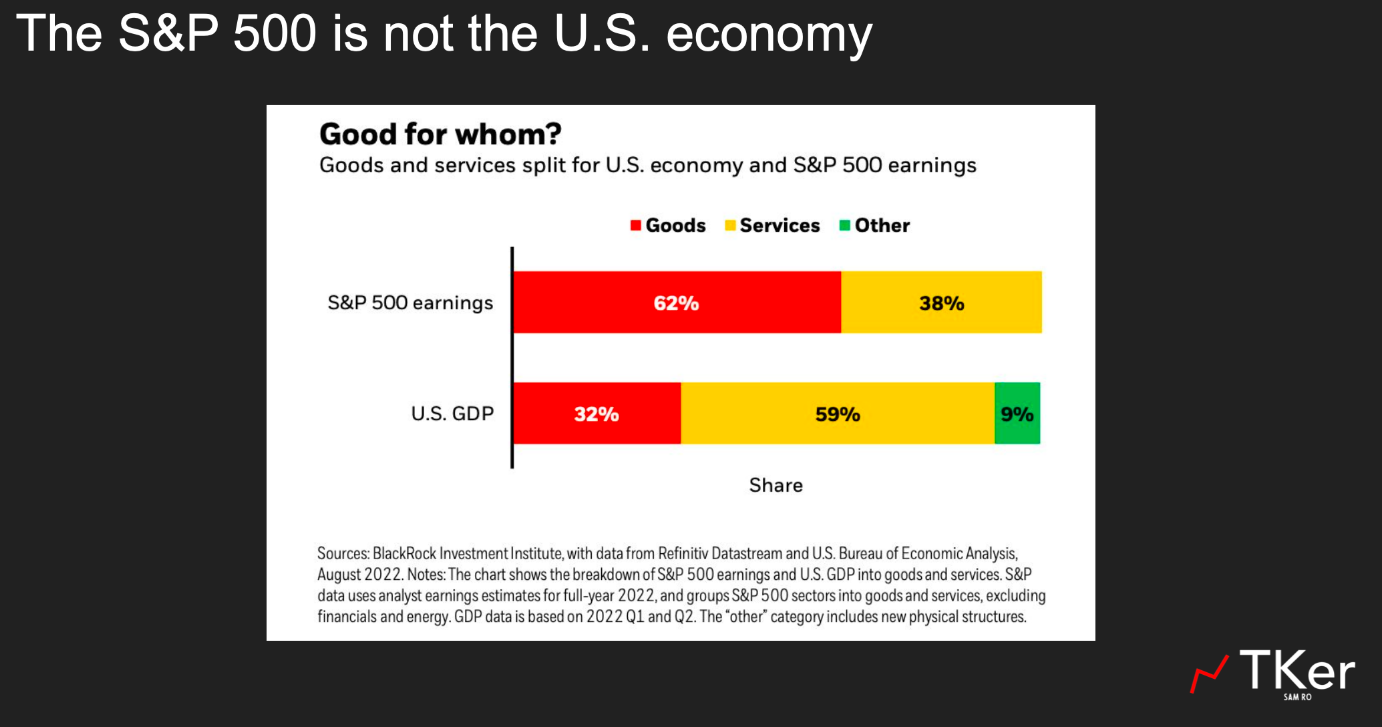

Sam Ro shared a great chart this past week on his Substack that shows the difference in composition between the S&P 500 and the U.S. economy in the form of earnings and economic growth:

Sam notes, “The S&P 500 is more about the manufacture and sale of goods. U.S. GDP is more about providing services.”

The stock market is mostly corporations that make and sell things.

The economy is mostly the stuff we do with those things.

Most of the time the stock market and the economy are moving in the same direction but they also diverge on occasion.

The S&P 500 also receives roughly 40% of revenues from overseas. For technology stocks, that number is closer to 60%.

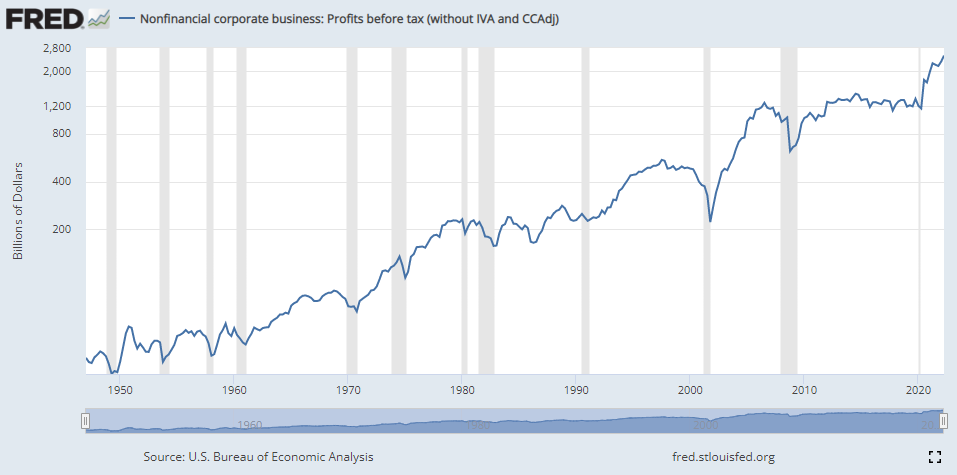

Profits for the broader economy continue to hit all-time highs:

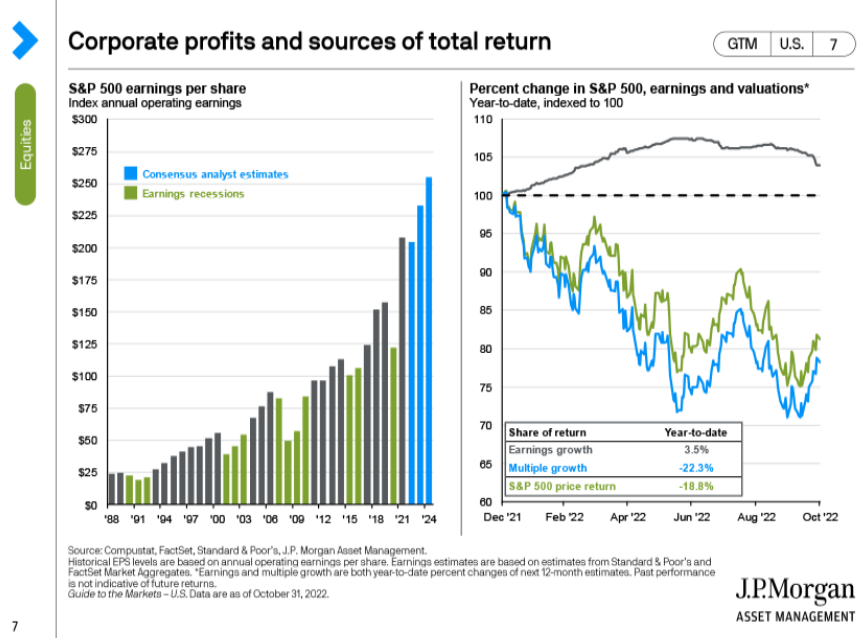

The same is true for the stock market this year:

Unfortunately, investors aren’t willing to pay as much for those profits this year because inflation and interest rates are higher.

Sometimes investors pay a high multiple of corporate profits and sometimes they pay a low multiple.

The same is true of economic growth.

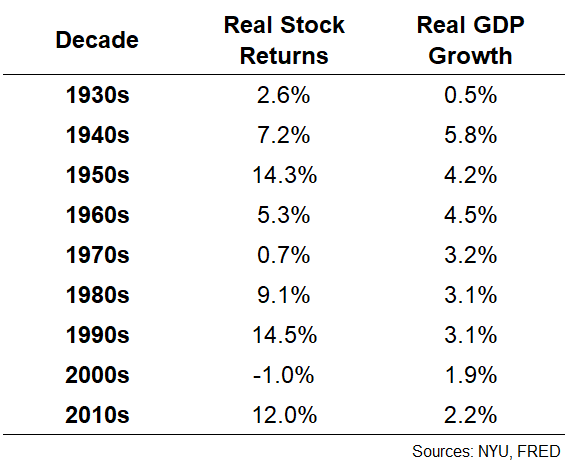

Take a look at the inflation-adjusted annual returns for the U.S. stock market compared to real GDP growth by decade:

Economic growth was higher in the 1940s but stock market returns were higher in the 1950s.

Real GDP growth was basically the same rate in the 1970s, 1980s and 1990s. Yet the stock market was awful in the 1970s and terrific in the 1980s and 1990s.

Growth has been subdued in each of the first two decades of this century. One of those decades experienced phenomenal stock market performance while the other was dreadful.

Sometimes the stock market takes its cues from the economy.

Sometimes the stock market decides to do its own thing.

I don’t know what’s going to happen with the economy in 2023. I wouldn’t be surprised by continued growth or a recession.

But even if you had a crystal ball that foretold which one of those scenarios was coming in the new year, it probably wouldn’t help you predict what’s going to happen to the stock market.

Michael and I talked about the difference between the stock market and the economy and more on this week’s Animal Spirits:

Subscribe to The Compound so you never miss an episode.

Further Reading:

It’s OK to be Confused Right Now

Now here’s what I’ve been reading lately:

- The seasonality of weight gain (Prime Cuts)

- Building inevitable wealth (Darius Fox)

- Life is complicated, working out doesn’t have to be (Abnormal Returns)

- Lessons from 2022 (Bull & Baird)

- Is now a good time to invest? (Monevator)

- Don’t forget to include this asset in your estate plan (A Teachable Moment)

- Lee Child: My wonderful life off the grid (The Times)