Today’s Animal Spirits is brought to you by YCharts:

Submit your email here to claim 20% off YCharts

On today’s show we discuss:

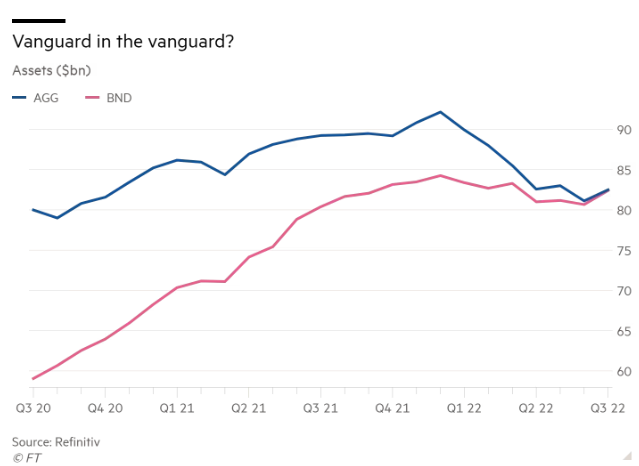

- Vanguard poised to be the largest bond ETF manager

- Wages, prices, and taming US inflation

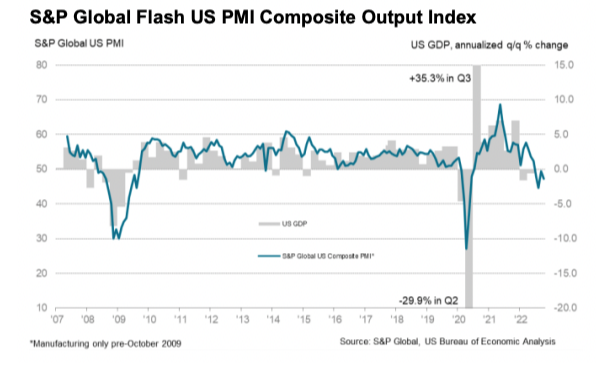

- Higher interest rates can take a long time to bring down inflation

- The Fed Presidents are becoming influencers

- What will peak 30-yr fixed mortgage rates be by December 29, 2022

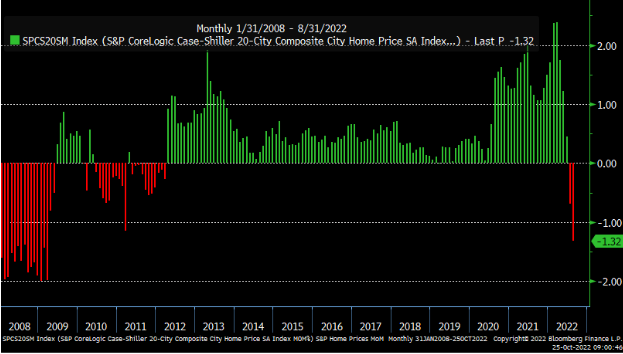

- Builders are ready for the housing slowdown

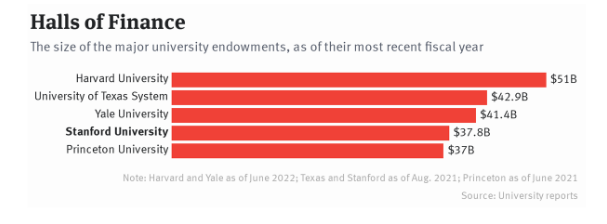

- Stanford wants a bigger piece of Silicon Valley’s top VC funds

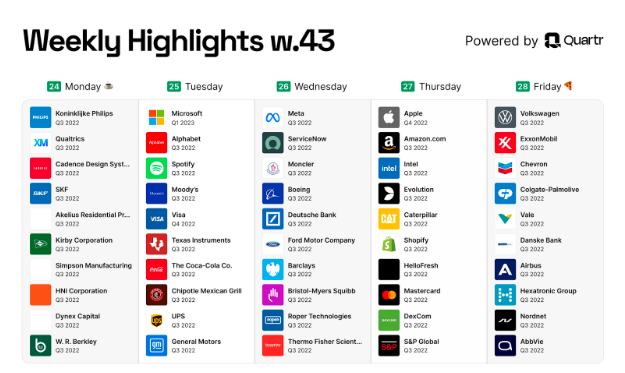

- Sign up here for Quartrs earnings season recap

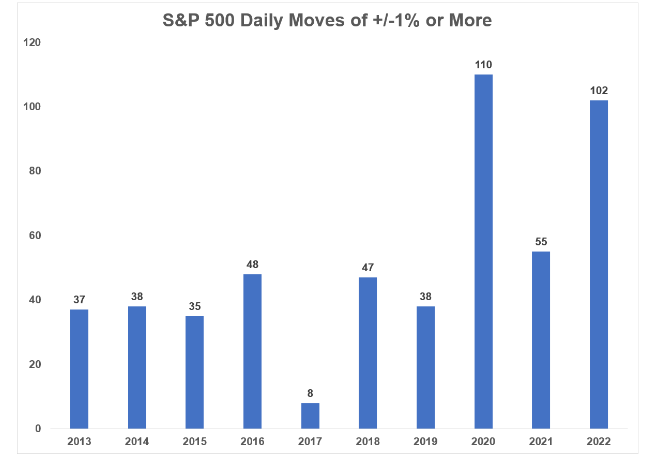

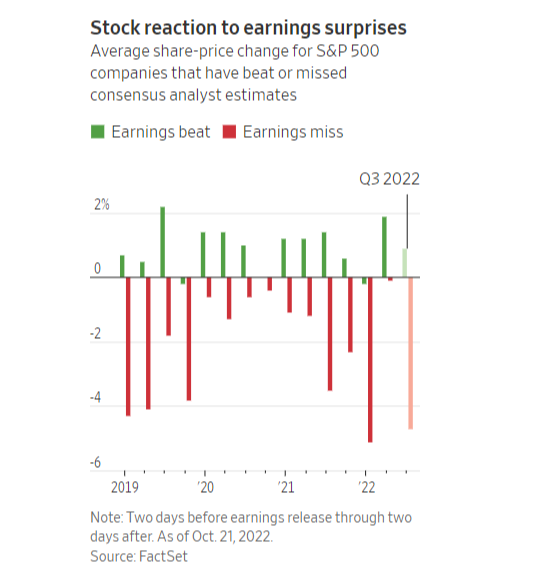

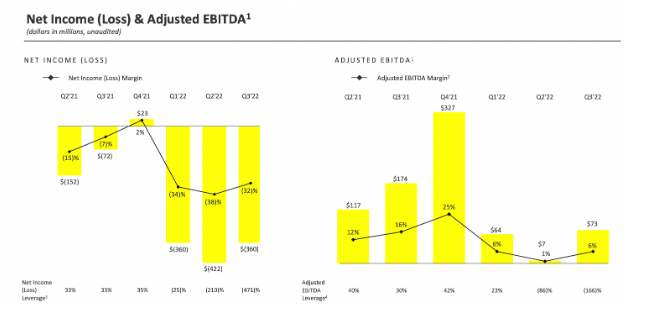

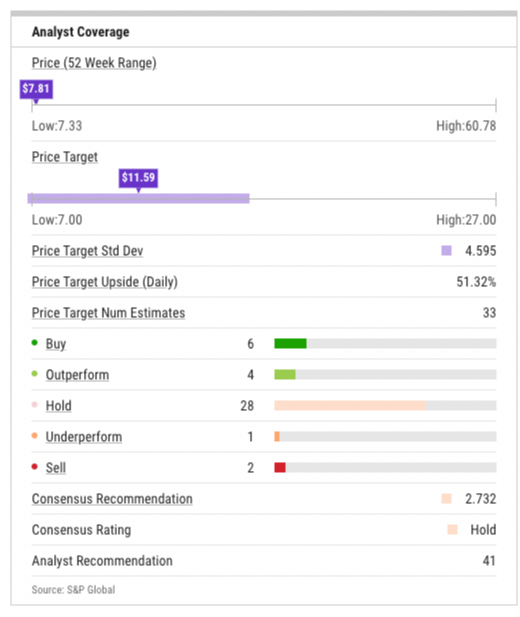

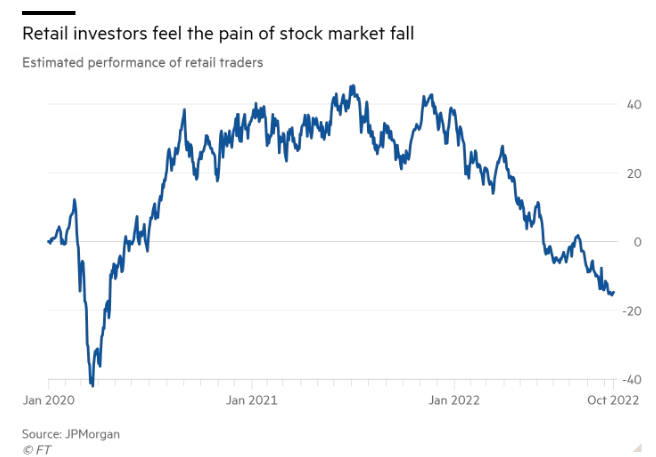

- Early earnings reports are worrying investors

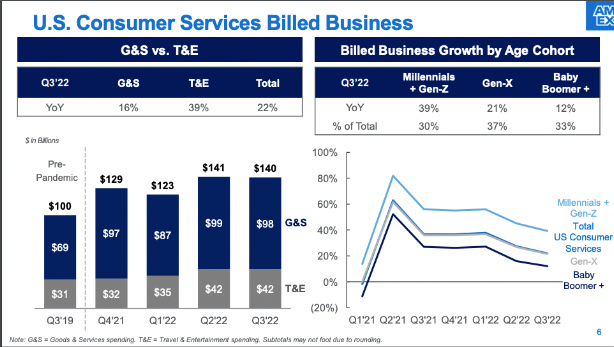

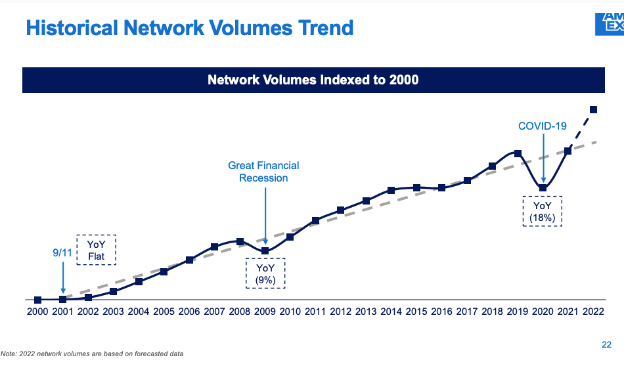

- American Express earnings

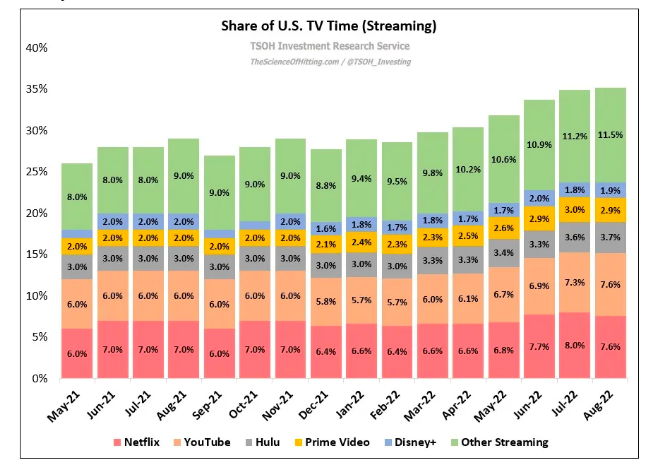

- Netflix earnings

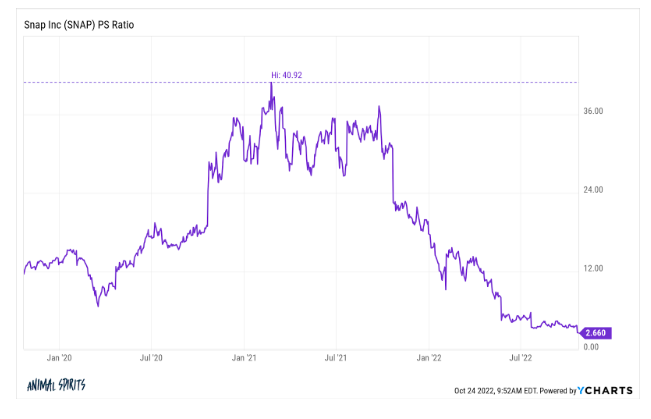

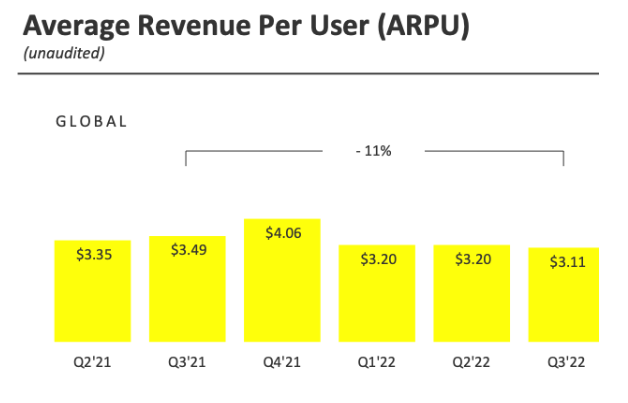

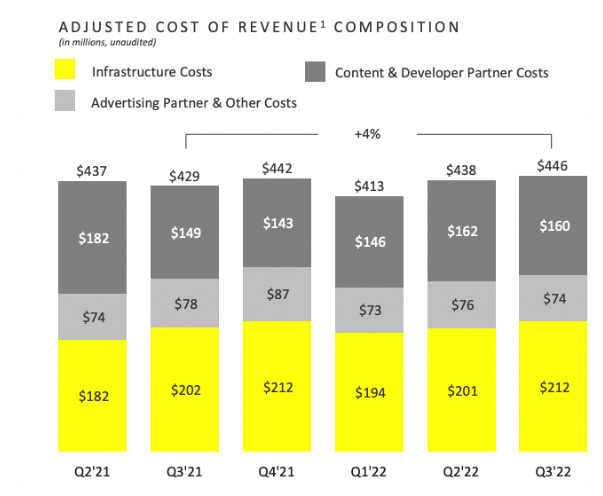

- Snapchat earnings

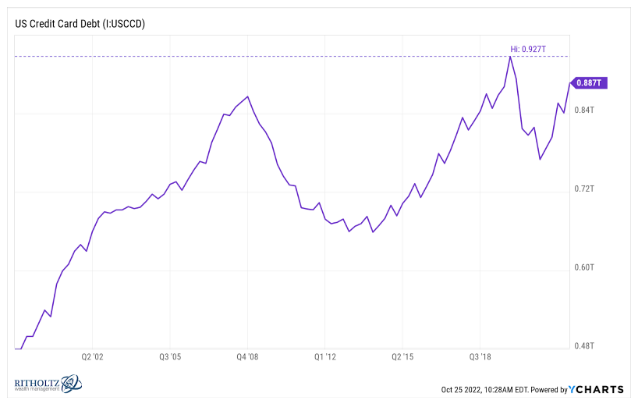

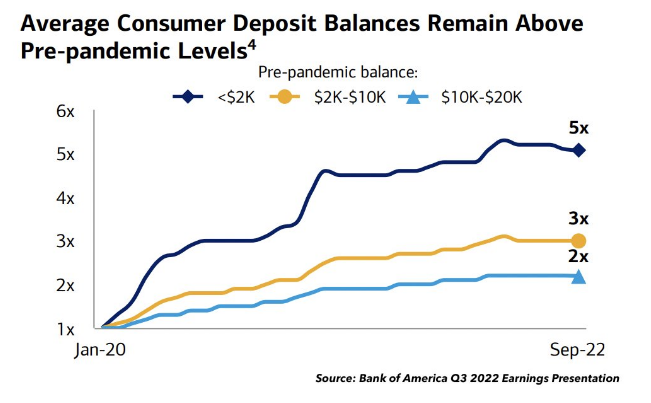

- Bank of America earnings

- IRS increases retirement account limits

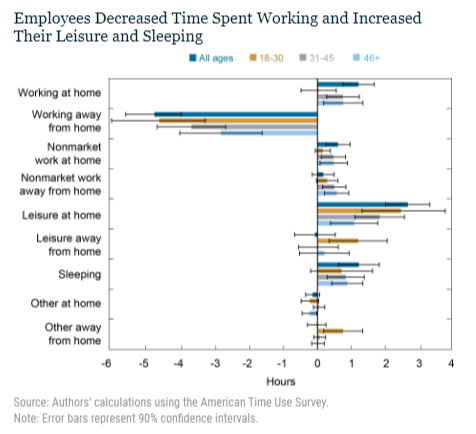

- Americans reclaim 60M commuting hours in remote work-perk

- Abnormal Returns turns 17

Listen Here:

Recommendations:

- House of the Dragon

- Parasite

- Bullet Train

- Nelson DeMille’s John Corey series

- Shut Up & Keep Talking by Bob Pisani

- High Tension

- Rec

- Iron Man

Charts:

Tweets:

$UAL CEO: "There has been a permanent structural change in leisure demand because of the flexibility that hybrid work allows. With hybrid work, every weekend could be a holiday weekend. That’s why September, a normally off-peak month was the third strongest month in our history"

— The Transcript (@TheTranscript_) October 23, 2022

Some household names in the S&P 500 down 50% or more from all-time highs:

Facebook -66%

Tesla -50%

Nvidia -65%

Disney -51%

Nike -52%

Netflix -62%Better performance 5 years out: this basket of stocks or the S&P 500?

— Ben Carlson (@awealthofcs) October 24, 2022

The rate climb has forced S&P 500 prices down to 17 times 12-month trailing earnings from more than 30 in just 18 months, putting stock valuations in line with the last time short-term Treasury yields were in their current range. pic.twitter.com/MK6ZiZNqy6

— Gina Martin Adams (@GinaMartinAdams) October 22, 2022

Natural Gas price in Europe nearly back to pre-war levels. pic.twitter.com/hLUToOA2Fq

— Jeffrey Kleintop (@JeffreyKleintop) October 19, 2022

A collapse in EU natural gas prices — down 43% this month, on pace for the worst month since Feb 2009 #OOTT pic.twitter.com/rduuFONWv7

— Carl Quintanilla (@carlquintanilla) October 24, 2022

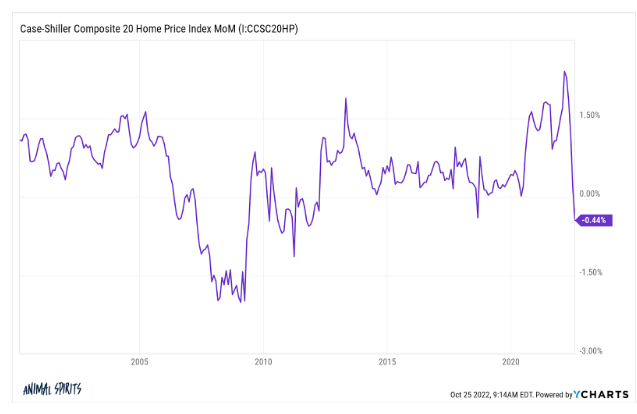

Housing plunging:

Case Shiller -1.32% M/M, Exp. -0.8%, biggest drop since March 2009!

— zerohedge (@zerohedge) October 25, 2022

And some Redfin stats. They currently have twenty properties on the market, and here's a look at acquisition vs current list / pending price. I'm not trying to throw shade here. I will talk about all iBuyers and anything I think is interesting or relevant for conversation. pic.twitter.com/zOF3ErZFzr

— Ryan Lundquist (@SacAppraiser) October 18, 2022

As rates continue to rise, more buyers are applying for ARM loans. The ARM share of applications last week increased to 12.8% by loan count, the highest since 2008. At current rates, an ARM increases consumer house-buying power by ~$47,000 compared with a traditional 30-year FRM. pic.twitter.com/fU0GMcEWXQ

— Odeta Kushi (@odetakushi) October 19, 2022

Pulte Group CFO: "With today’s more challenging market conditions, in Q3 we chose to walk from certain options tied to future land investment where returns no longer met required performance metrics"$PHM is reassessing all pending transactions prior to completing land purchases https://t.co/KuIGupcntp pic.twitter.com/8eQr4fUW0B

— The Transcript (@TheTranscript_) October 25, 2022

We believe in the power and utility of forecasting.

🧵on why we’re giving away $100K to find America’s best forecaster.

— Kalshi (@Kalshi) October 20, 2022

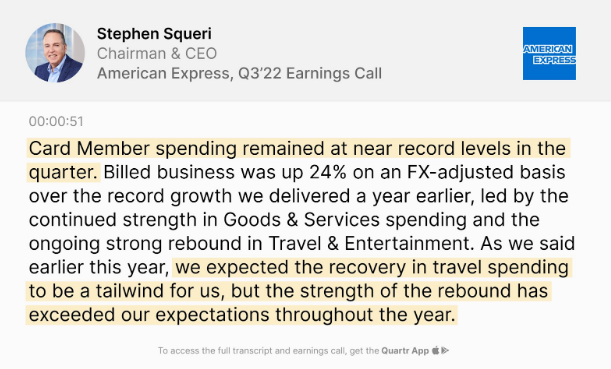

The major credit card network operators can sometimes provide us with interesting insights into broader parts of the economy.

Here’s 8 excerpts and a few slides from Friday’s $AXP Q3 earnings call that stood out to us 👇

1. Spending is at near ATHs: pic.twitter.com/FN1jRcYIGo

— Quartr (@Quartr_App) October 22, 2022

People spend more time watching YouTube on a TV than Amazon, Disney+ and HBO max combined. And that’s just on a TV. pic.twitter.com/3L0OueEr5G

— Lucas Shaw (@Lucas_Shaw) October 20, 2022

a picture that worth a thousand words… pic.twitter.com/s7mTqENTig

— 𝙽𝚒𝚔𝚘𝚕𝚊𝚢 𝙺𝚘𝚣𝚎𝚟 (@NKozev) October 23, 2022

Fidelity to increase its crypto unit by 25% with 100 new hires to a total of 500 people

— Blockworks (@Blockworks_) October 24, 2022

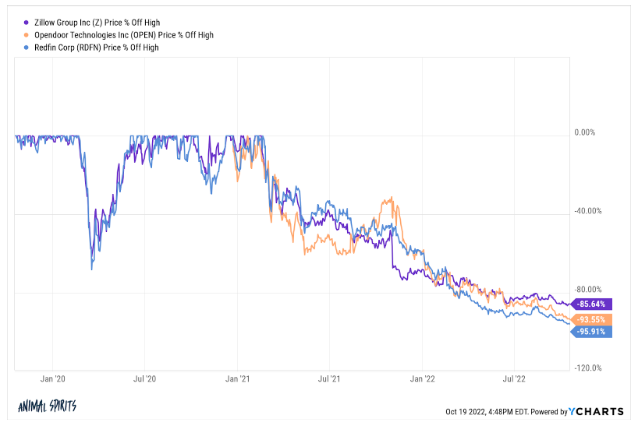

When a stock is already down 92% at $7.32 but then proceeds to drop another 44%, over 5 weeks…

Bear market math is very dangerous.$RDFN $4.10 https://t.co/xvTgORESrn pic.twitter.com/gGacO4Pcjk

— Chris Perruna (@cperruna) October 14, 2022

Have you seen this man?

Age: 30-45

Weight: 150-200lbs

Height: 5’- 6’ 5”

Blonde hair

Blue eyes– Last seen 6 days ago tweeting Bloomberg headlines in all caps.

– Answers to “Walter” or @DeItaone

– Please call 281-330-8004 with any information on his whereabouts. pic.twitter.com/nsi0QyF1DJ

— Ramp Capital (@RampCapitalLLC) October 19, 2022

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: