I’m not afraid to wade into The Compound YouTube comments on occasion.

Sure, sometimes people on the internet can be mean but once you get over a handful of those comments it’s good to hear some feedback, pushback, further research, jokes, questions and thoughts from your audience.

In the comments for last week’s Animal Spirits someone called us out for being too bearish:

This was a new experience for me. I’ve never been labeled bearish before. If anything, I’ve been called a perma-bull in the past.

Does this mean I have to start reading Zero Hedge now?

I don’t know if I should be proud or hurt.

I remain an unapologetic bull on the United States of America, its economy and the stock market.

Maybe sometimes you just need to tell it like it is.

Things don’t seem great at the moment.

The Federal Reserve is actively trying to push the stock market down. Inflation is the highest its been in four decades. Interest rates are rising. Both stocks and bonds are down double-digits from the highs.

There is a good chance the Fed will try to push the U.S. economy off a cliff right into a recession.

“Don’t fight the Fed” has taken on a new meaning when they’re openly rooting against the stock market.

It’s easy to be bearish right now.

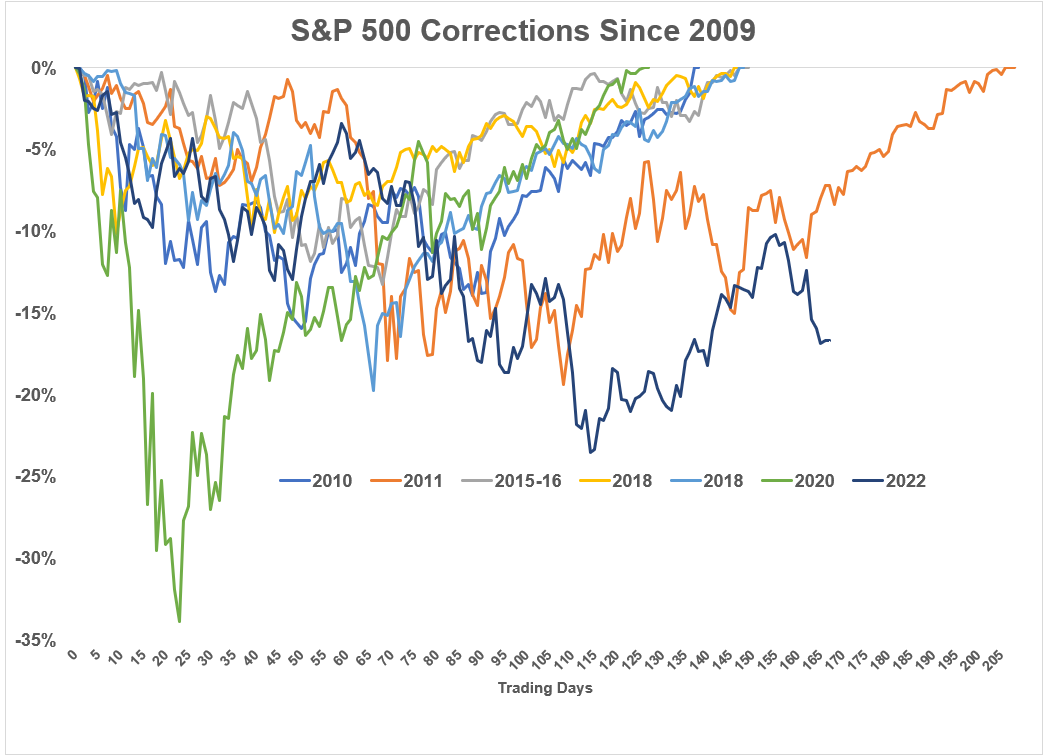

Plus you have the fact that this is the first prolonged bear market since the Great Financial Crisis:

There have been a handful of corrections and bear markets since early 2009 but the only one that came close to matching the length of the current iteration was in 2011.

But the 2011 bear market (-19.4%…close enough) at this point was already in the midst of a recovery. We’re not back at the lows but the stock market has been heading back down yet again. And we’re now heading into month 9 of this drawdown.

It’s easy to be negative right now but it’s always easy to be negative during a bear market.

The stock market wouldn’t be down if there wasn’t bad news.

And I wouldn’t even call myself bearish.

I don’t really see the need to be bullish or bearish as a long-term investor because I expect to see up markets, down markets, sideways markets and everything in-between.

Instead of going back and forth between being bullish or bearish, I prefer to remain calm-ish.

We already know stocks are going to be volatile. Why should you care about market fluctuations if you know they’re not going to last forever?

This bear market could last longer. Stocks could go down more. Or we could see new highs in a matter of months.

I honestly don’t know.

But successful long-term investing comes from letting go of the desire to pretend like you know what’s going to happen all of the time.

If you don’t need the spend the money in the near-term, you’re going to have to become comfortable with seeing the value of your portfolio go down at times.

And if you do need to spend the money in the near-term, why is it invested in the stock market in the first place?

Surviving bear markets requires you to manage both volatility and your emotions.

That means that while it’s okay to feel bearish at times, it’s not okay to stay bearish.

Bear markets don’t last forever.

Michael and I talked about being bearish on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

No One Wants to Follow a Pessimist

Now here’s what I’ve been reading lately:

- Here’s what happens during a market downturn (Reformed Broker)

- Some predictions for 2050 (The Intrinsic Perspective)

- All personal finance books are wrong (The Atlantic)

- Old frugal habits die hard (Darius Foroux)

- Everything you need to know about student loan forgiveness (The White Coat Investor)

- Pros and cons of being wealthy (Monevator)

- Why people collect so much stuff (Humble Dollar)