A reader asks:

We are used to seeing financial planning advice based on a constant savings rate over long periods of time, but I am trying to reconcile this with the realities of life. For context, we are a married couple in our mid-30s who strive for a savings rate of 30% of gross income. Prior to becoming parents and purchasing a home (age 30-35), we were living significantly below our means and had a savings rate of 40-45%, far above our 30% goal. However, after purchasing a home and paying for childcare, our savings rate has dropped to 20-25%, and we are feeling guilty about this, because it feels like we have succumbed to lifestyle creep. On the contrary, is this just a natural shift where the savings rate drops until children attend public school, and then bounces back up? We are curious to hear how a savings rate evolves over time with life events and make sure we stay on the right path.

I love this question because it shows how unrealistic the standard retirement calculator is.

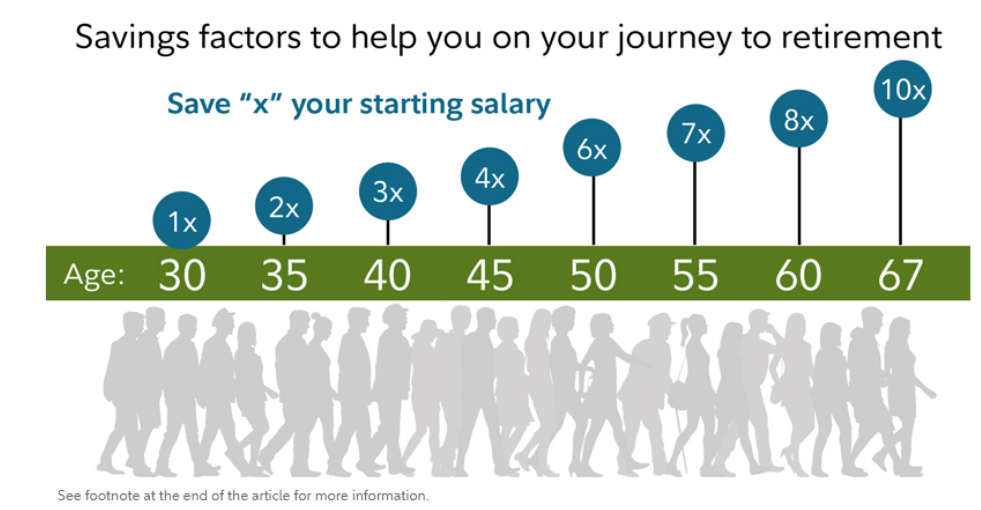

A few years ago, there was a study that calculated how much you should have saved by certain ages:

People on the Internet got very angry about this one, even though the study itself offered numerous caveats.

The problem is that life is not linear.

No one actually saves a set percentage of their income starting at age 25 and keeps that same savings rate right up until retirement age. That’s only in personal finance books and FIRE blogs.

Reality is a lot messier than spreadsheets.

People change jobs, they move, they make more money, they make less money, they get laid off, they have kids, they have unexpected expenses, they endure health scares, they spend frivolously and all of the other things life throws at you.

Everyone is going to have good years and bad years depending on their job, geographic location, circumstances and luck.

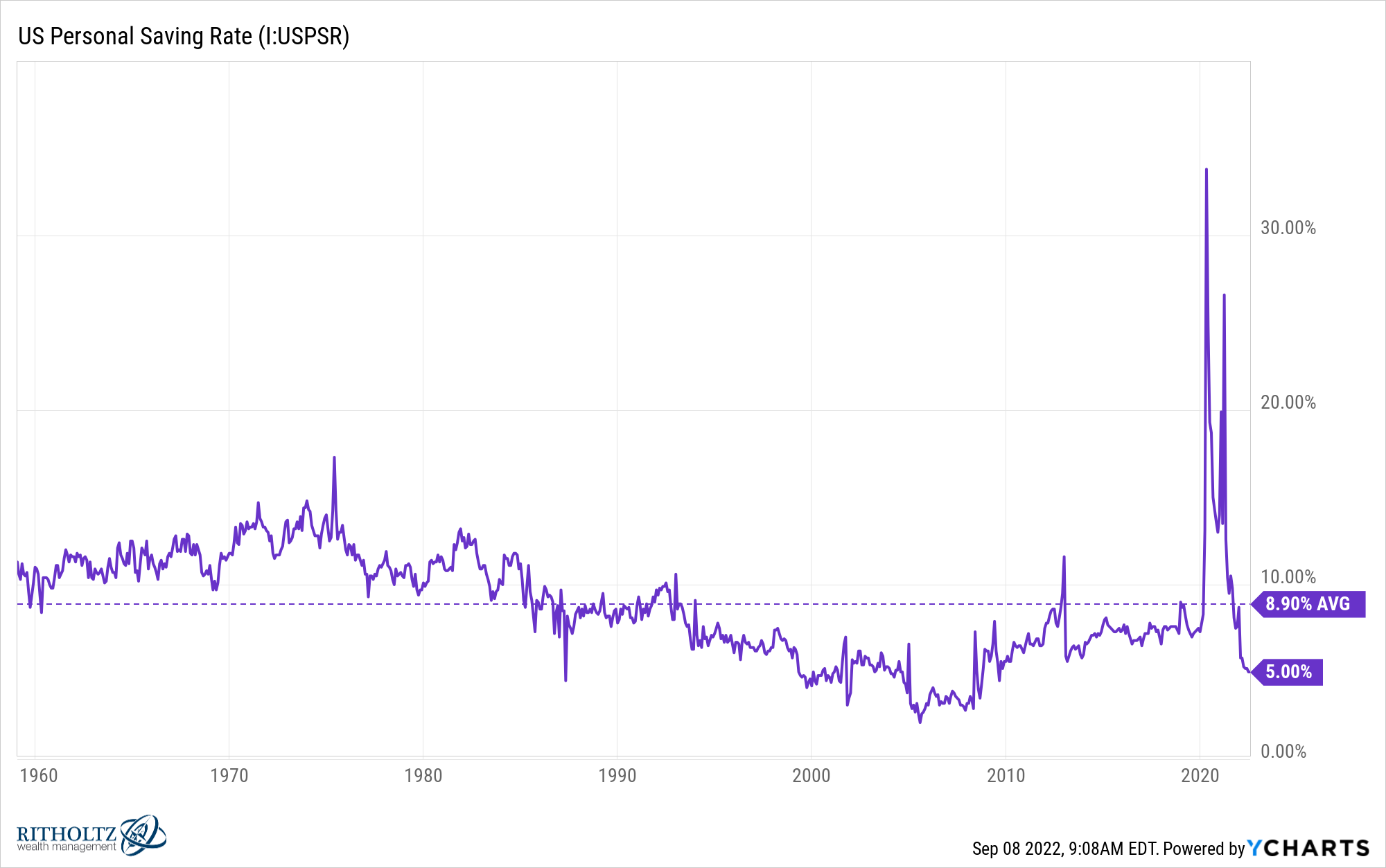

Just look at how volatile the personal savings rate is in this country:

It’s all over the place.

While it would be nice for financial planning purposes if your life moved in a straight line, that’s not how any of this works.

In fact, I would venture to guess that for most people, personal finances are just as volatile as the stock market, maybe more so.

So no, I wouldn’t feel guilty about seeing your savings rate drop just because you purchased a house and had a child.

My personal savings rate has certainly changed over the years in concert with specific life events.

Our first house came with an unfinished basement. The year we finished it put a dent in our savings rate because home renovations are costly.

When my twins were born we had 3 kids in daycare for 2 years. Our savings rate suffered in those years for sure.

But you don’t feel guilty when that happens. That’s the whole reason you have a high savings rate to begin with. A high savings rate gives you a margin of safety when life invariably intervenes.

A 30% savings rate is a worthy goal but 20-25% is probably better than 98% of households. If anything, a savings rate of 40-45% in your 30s is too high. You should be enjoying yourself in those years.

Plus, now that you have the house and the kid you can plan better for the future to increase your savings (assuming that’s what you want to do).

Owning a home is not cheap but you now have a fixed monthly payment. Taxes don’t go up all that much from year to year. I can’t guarantee anything but being in your late-30s means your prime earnings years are still ahead of you.

And while daycare is expensive, public school is a light at the end of the tunnel. When your kid goes off to preschool or kindergarten and those daycare payments come off the books. That’s going to feel like a raise to you.

I have personal knowledge about how expensive daycare is so that’s going to feel like a healthy raise when it happens.

And while your savings rate has taken a hit because life got in the way of your personal finances, there are bound to be life events that go the other way for you — a new job, a bonus, a new source of income, refinancing your mortgage, etc.

Listen, if I rented, lived the life of a monk and never had any kids my savings rate would be appreciably higher. But that’s not the life I’ve chosen to live.

Your personal finances can and will be volatile over time.

Going from a savings rate of 40-45% down to 20-25% is not lifestyle creep — it’s life.

We discussed this question on the latest edition of Portfolio Rescue:

Joey Fishman joined me on the show this week to talk RSUs at start-ups and public companies, online savings accounts vs. short-term bonds and geographic arbitrage.

Further Reading:

Young Retirement Investors Scorned

Here’s the podcast version of this week’s show: