Today’s Animal Spirits is sponsored by Masterworks:

Go to Masterworks.io/animal to learn more about investing in contemporary art. And check out our most recent interview with Masterworks CEO Scott Lynn here.

We discuss:

- Looking at the biggest potential risks to the market right now

- How imitation impacts investor actions

- Is the Fed finally in trouble?

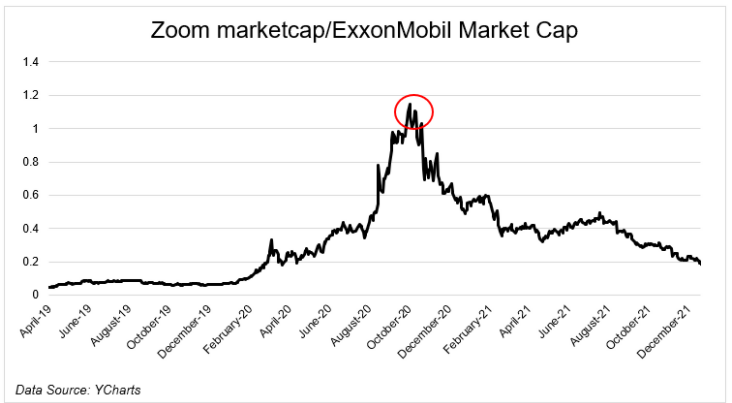

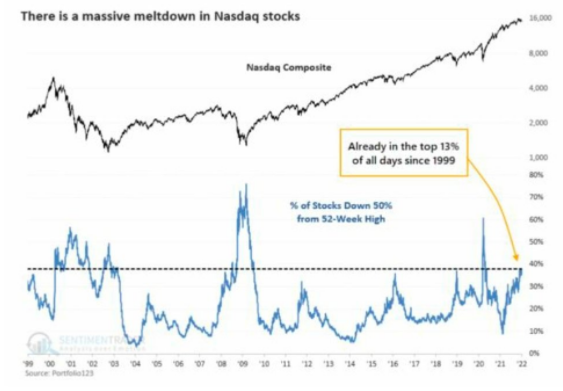

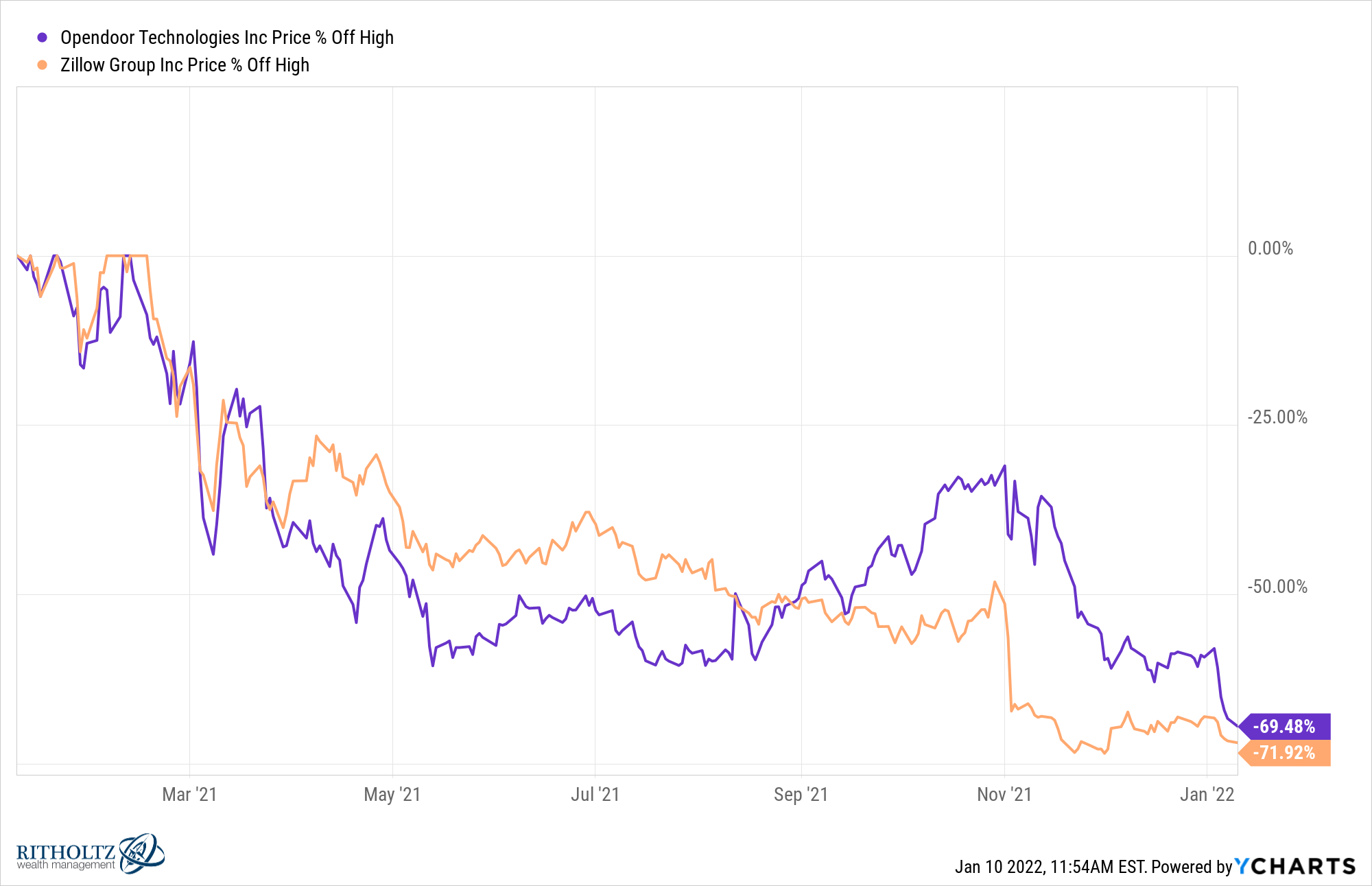

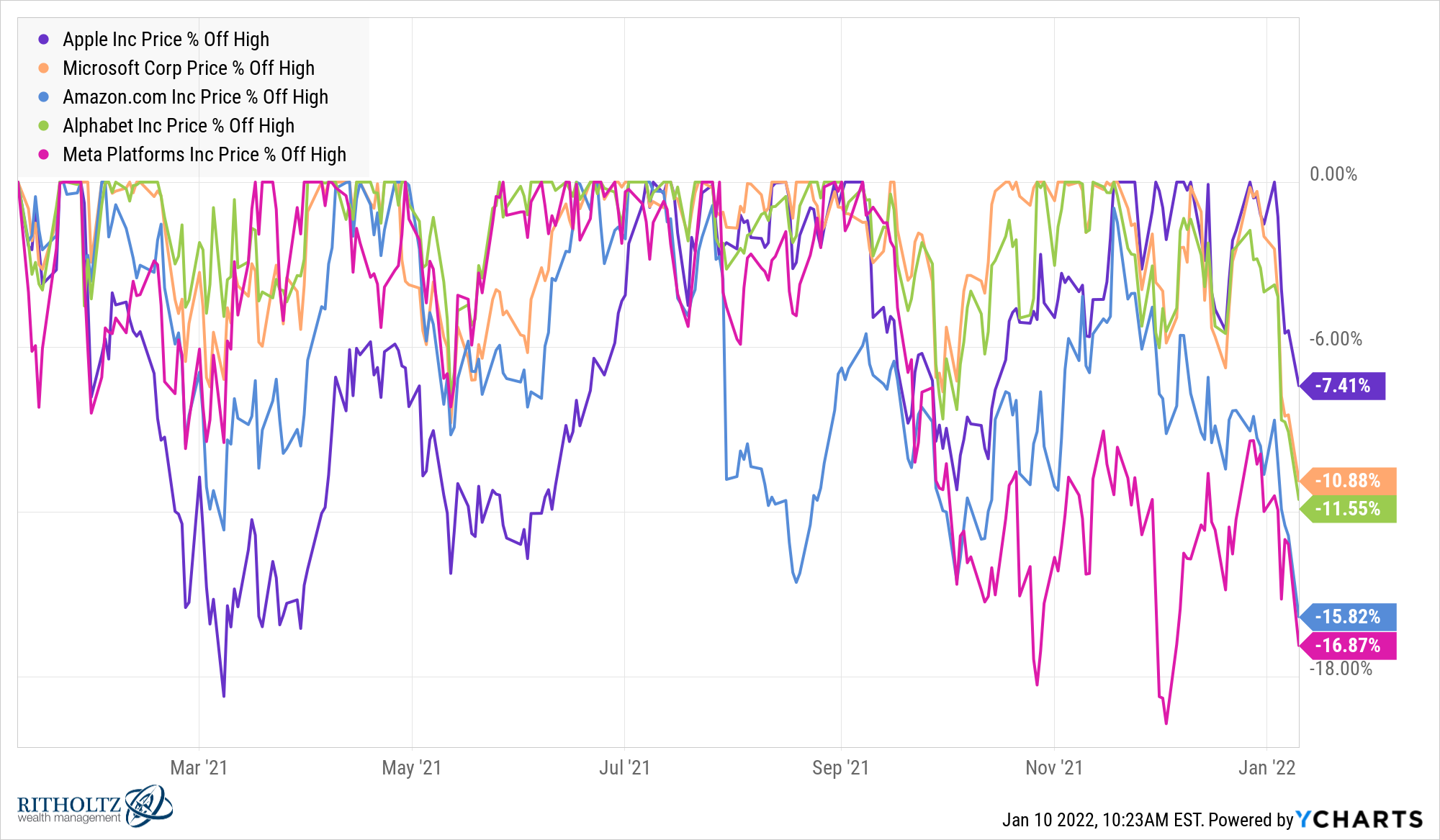

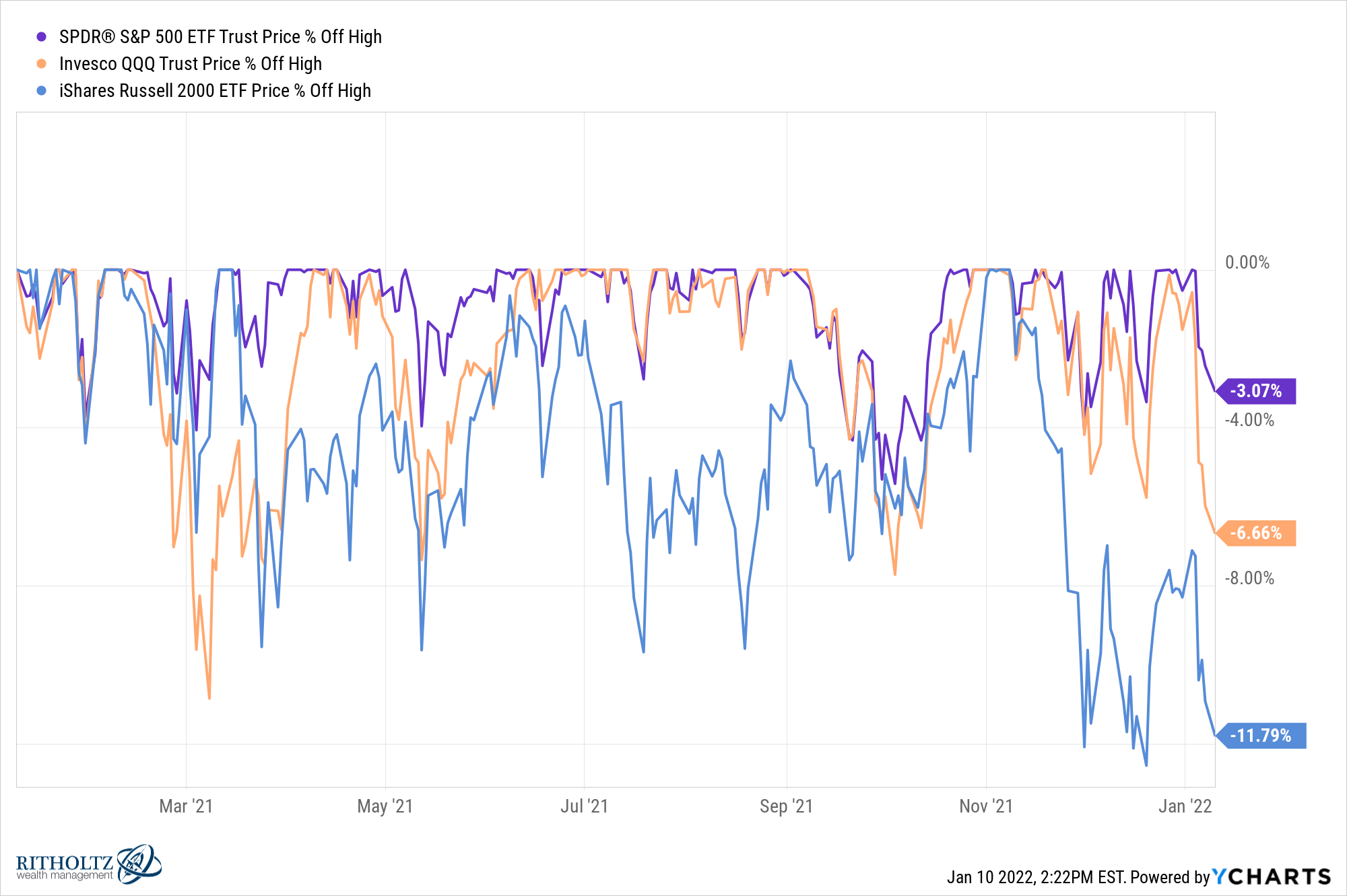

- Growth stocks continue to get wrecked

- If everything is crashing why isn’t the stock market down more?

- One of the biggest reasons the stock market falls

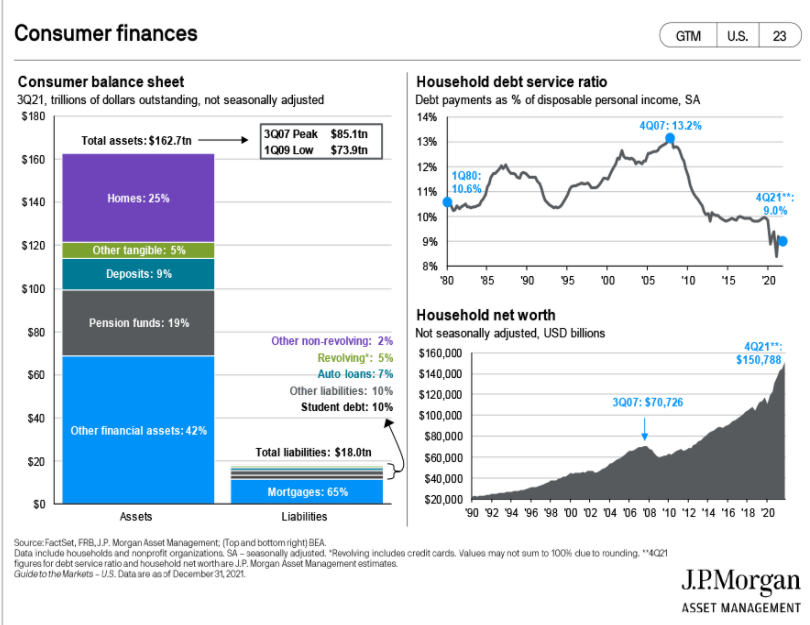

- Why I’m still bullish on the U.S. economy

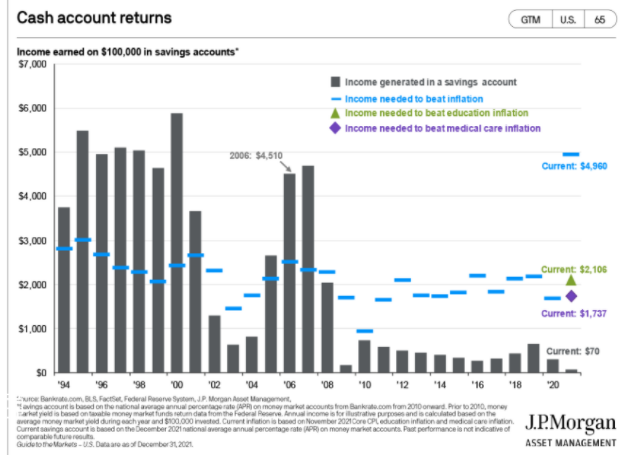

- What does “normal” even mean when it comes to interest rates?

- Why NFTs needs to show some utility

- Maybe we can have web2 and web3

- The pandemic is prolonging the supply chain/inflation issues

- How does refinancing impact inflation?

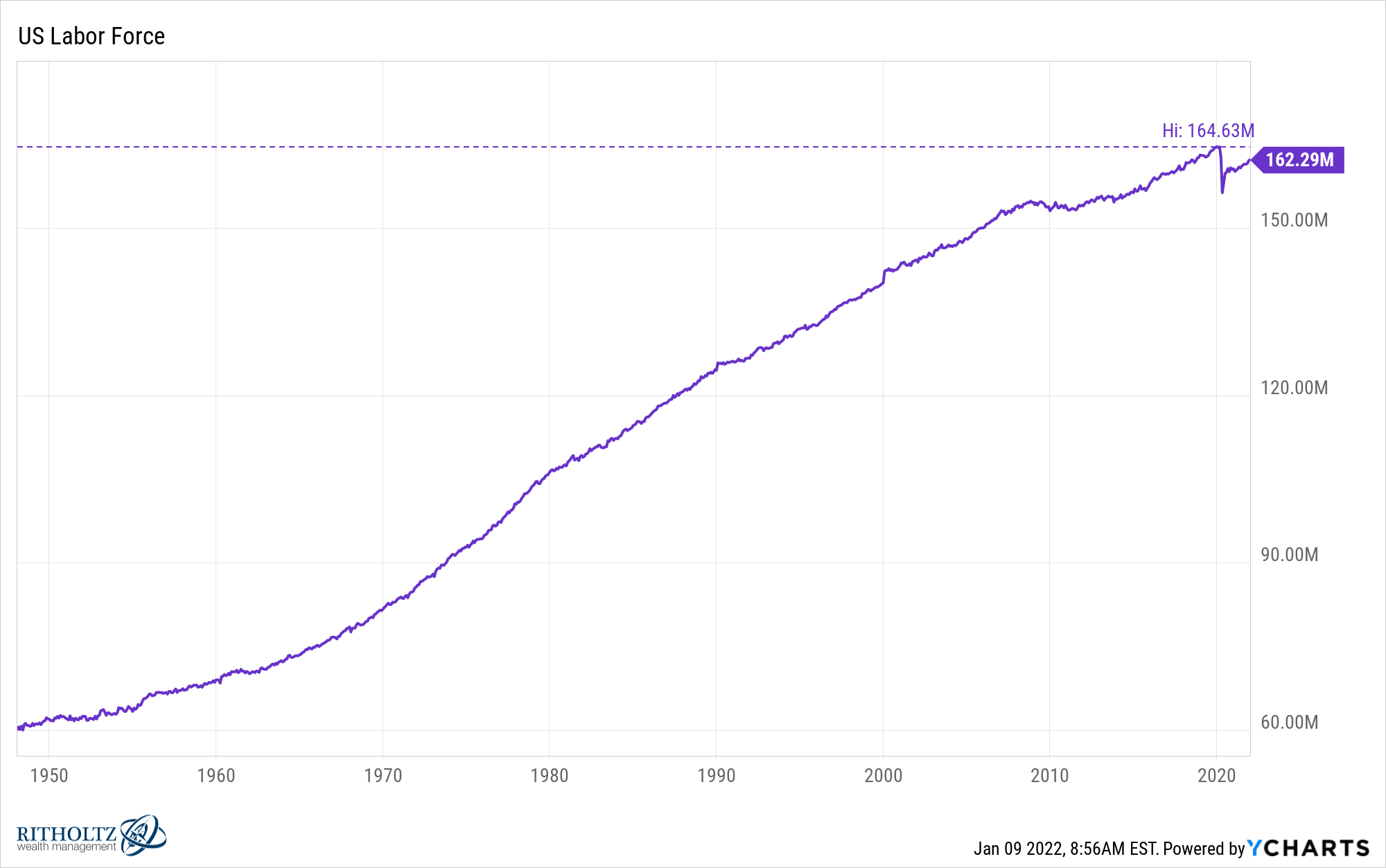

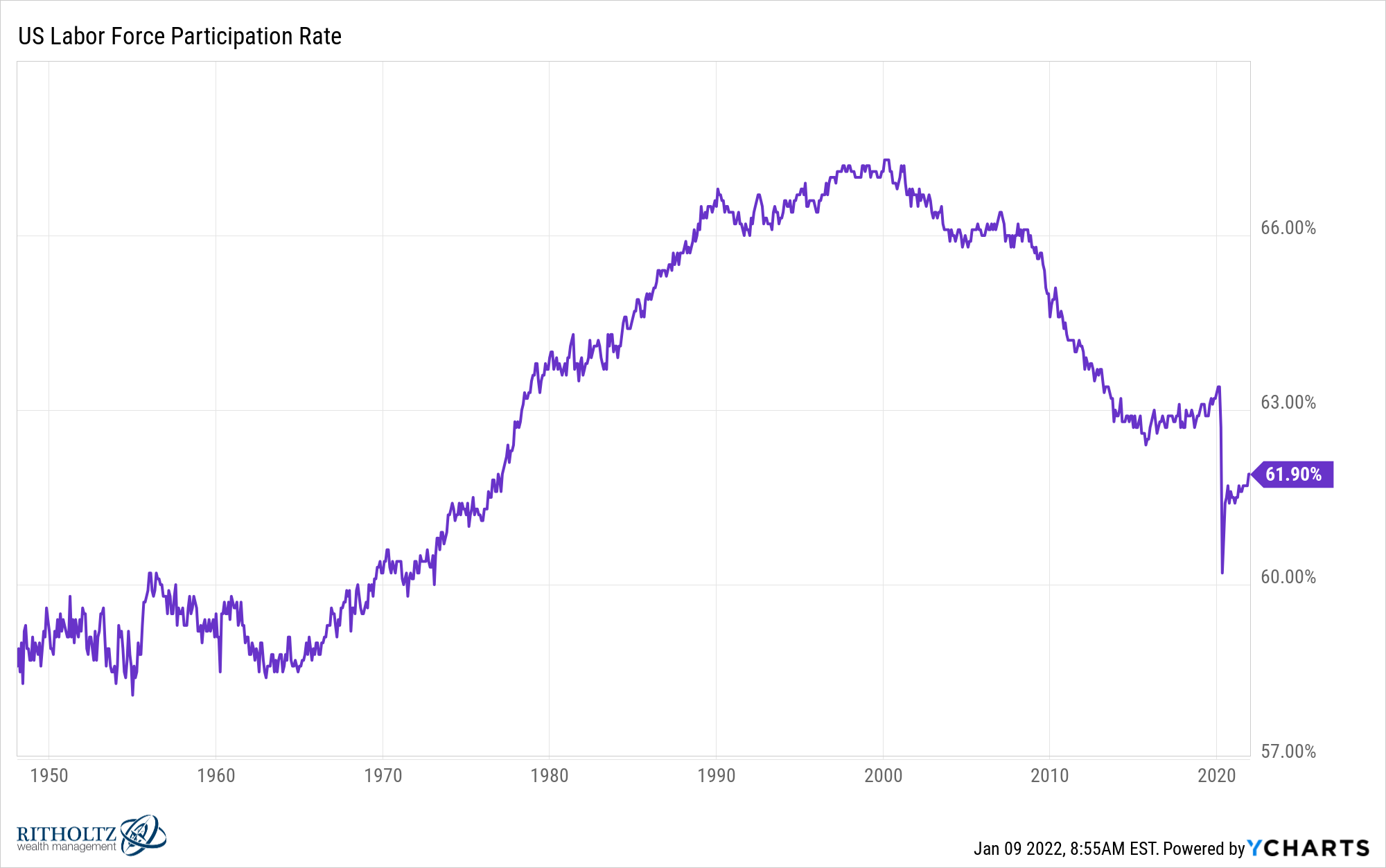

- Why the labor shortage will likely continue

- Critics vs. the audience on Rotten Tomatoes and much more

Listen here:

Transcript here:

Stories mentioned:

- The 3 biggest risks to the market right now

- Rules for buying crashing growth stocks

- Inflation message test

- NFT marketplace Opensea kicks off the year with strong volume

- Celebrity NFTs risk catastrophic failure

- The investment case for ETH

- My first impressions of web3

- Guide to the Markets

- U.S. hospitals struggle to match Walmart’s pay

- Why Tampa will be 2022’s hottest housing market

- More than 1 in 10 first-time homebuyers sold crypto to fund down payment

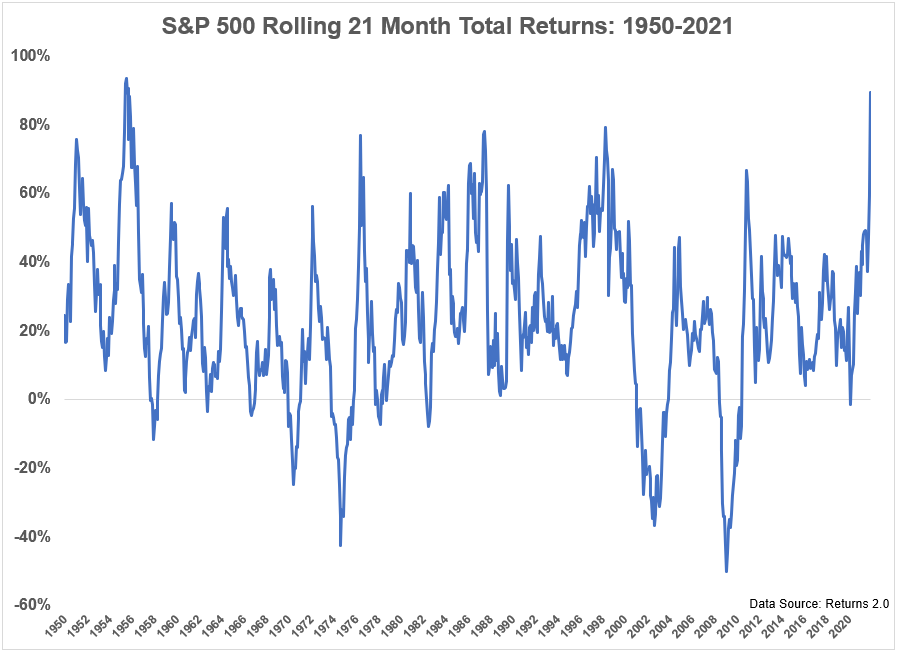

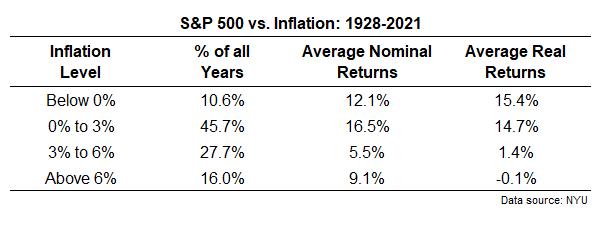

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here and here.

Subscribe here: