This week’s Animal Spirits with Michael & Ben is supported by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service.

We discuss:

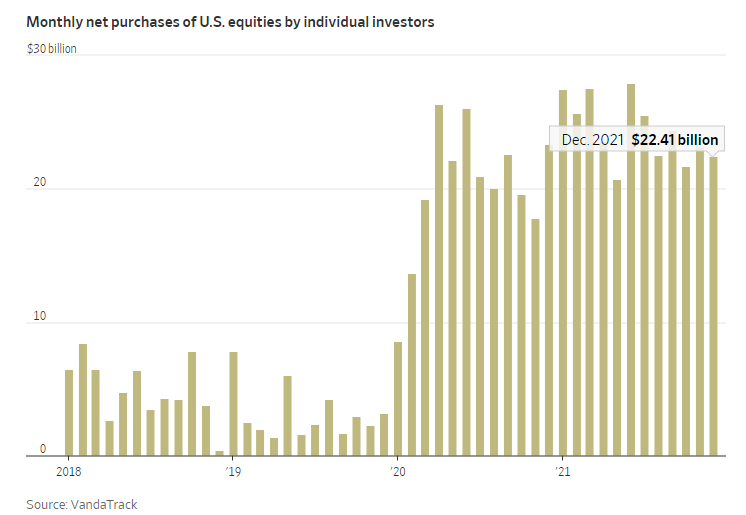

- Why retail investors didn’t go away after 2020

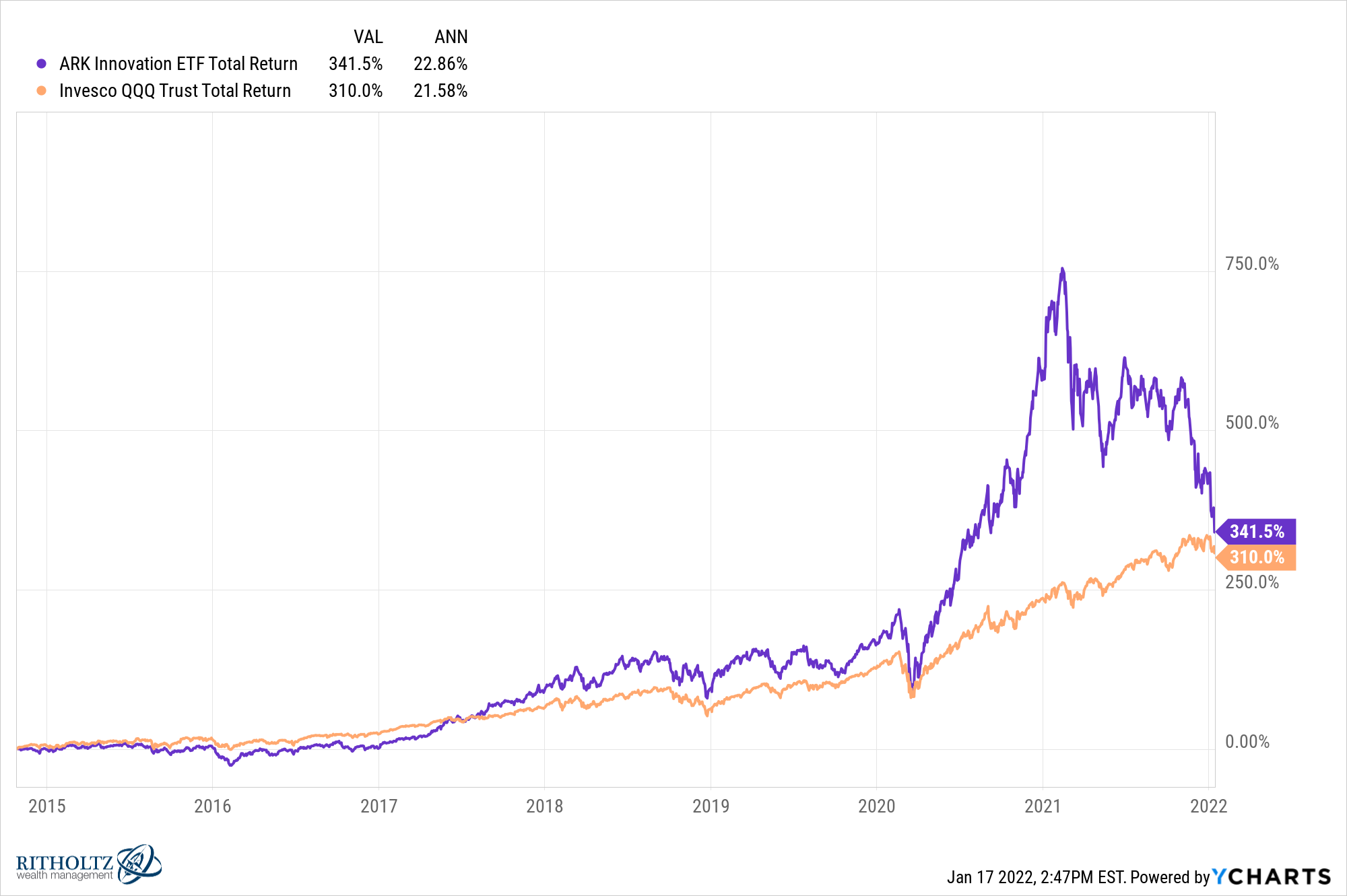

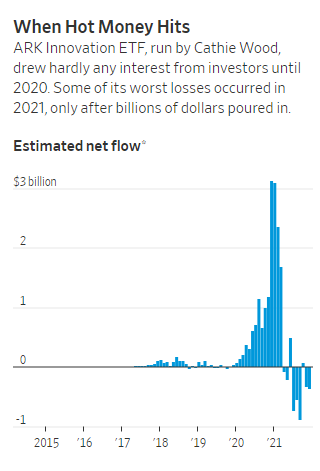

- What happened to ARKK?

- Why size is the enemy of outperformance

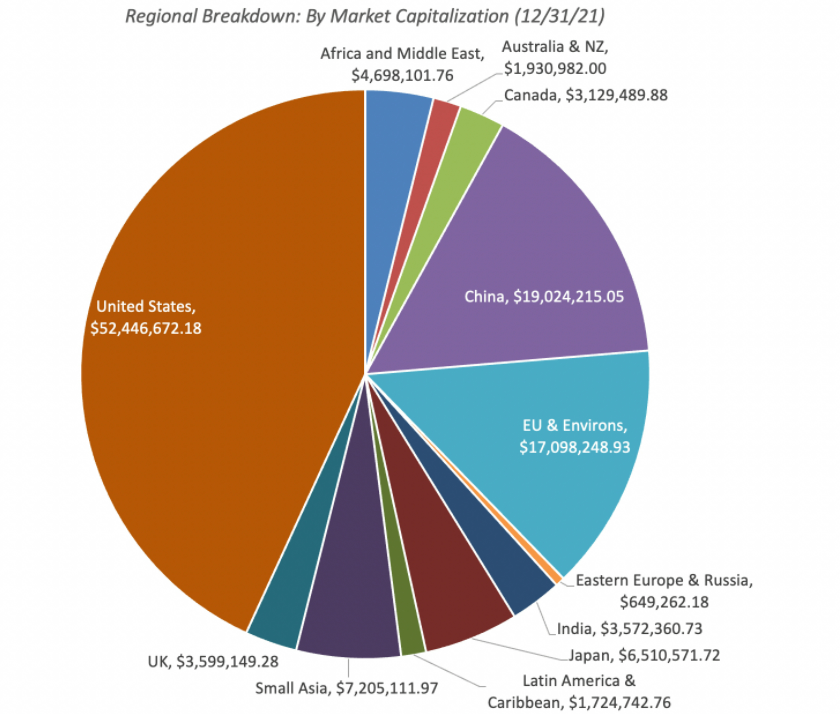

- How big is the United States in terms of the global stock market?

- Why mean reversion is not as simple as you think when investing

- Why has John Hussman been so wrong for so long about the stock market?

- Why business cycle analysis is useless for the economy right now

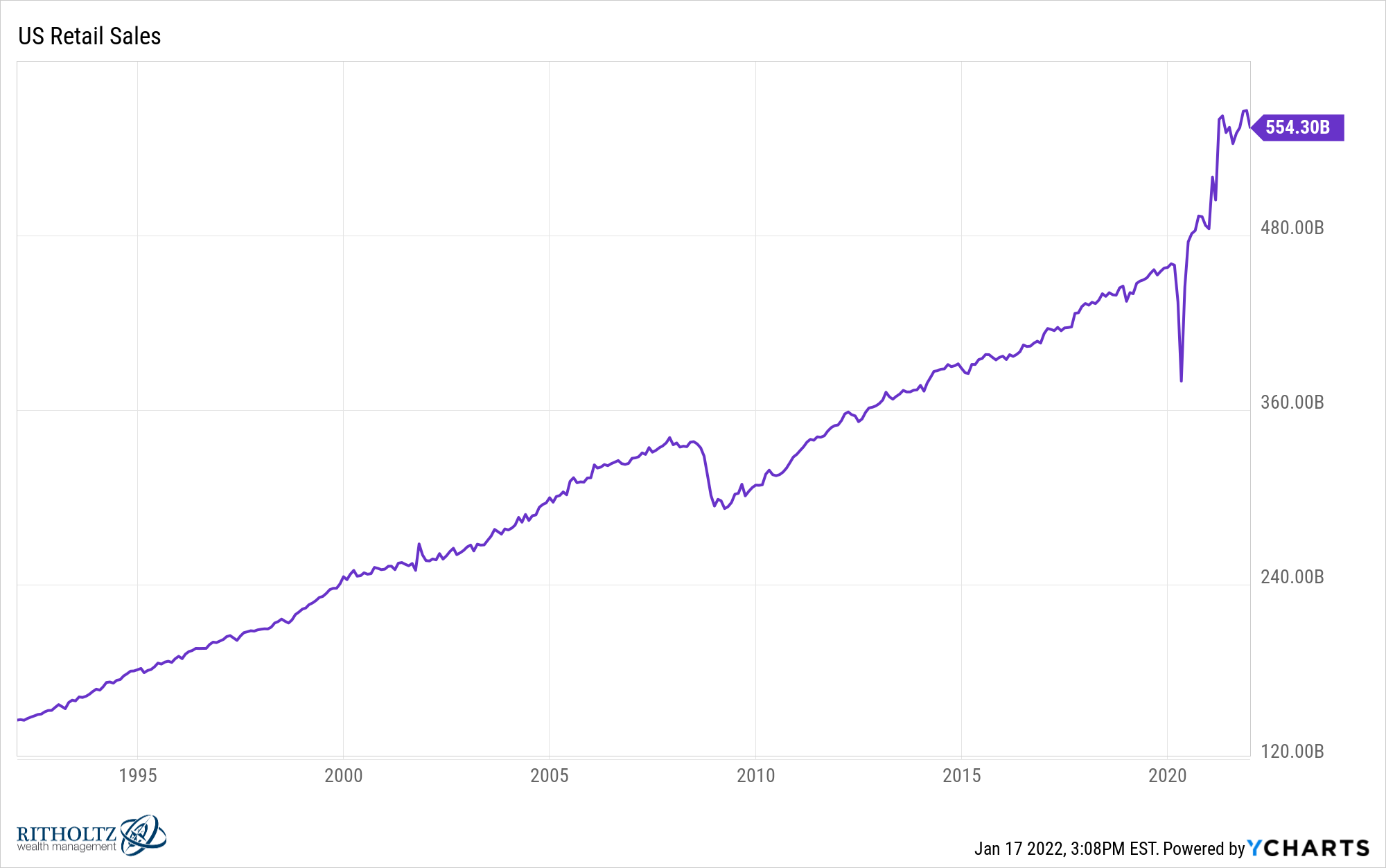

- Why it makes sense for retail sales to fall from here

- Why isn’t the stock market included in the inflation numbers?

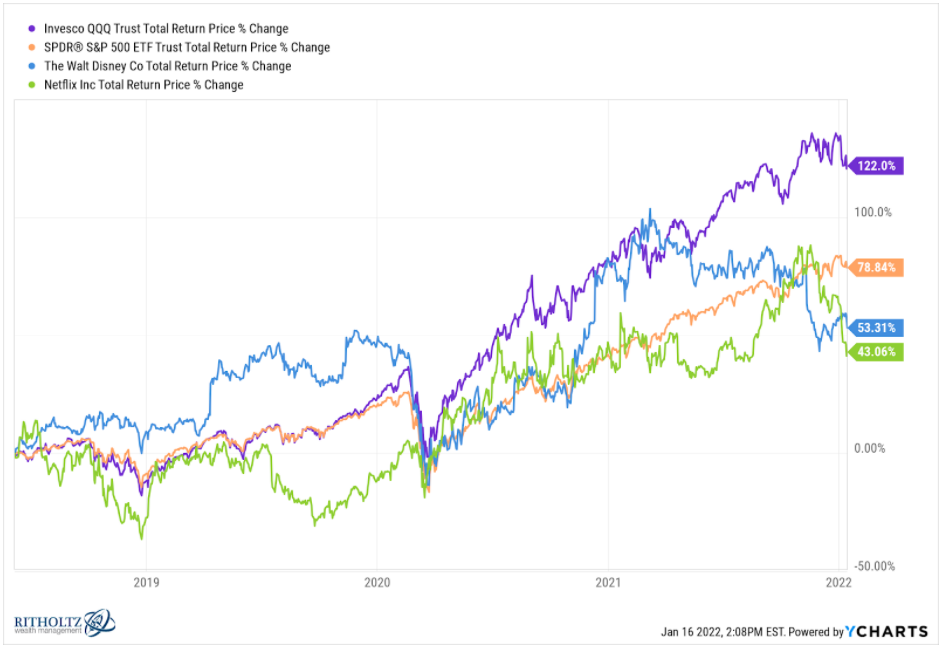

- How much would you pay for Netflix?

- Which would you give up first: Netflix or Prime?

- Why crypto needs gatekeepers to go mainstream

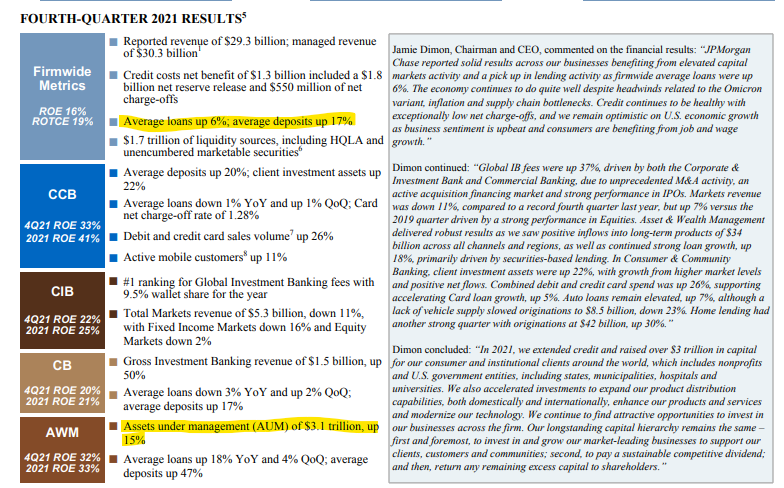

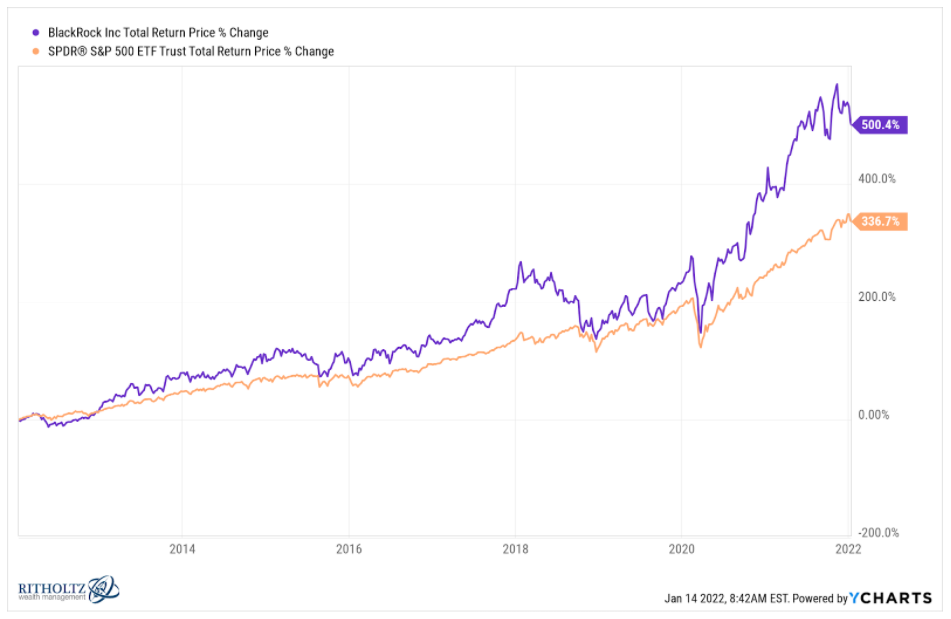

- BlackRock and JP Morgan manage A LOT of money

- What happens to Robinhood during a bear market?

- Was 2019 the apex of Silicon Valley?

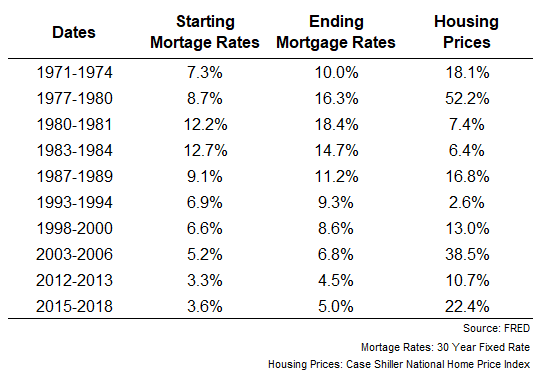

- Is Toronto the craziest housing market in the world?

- An appreciation for prestige TV and more

Listen here:

Transcript here:

Stories mentioned:

- The pros are now paying attention to retail investors

- How a flood of money swamped Cathie Wood’s ARK

- A short history of chasing the best performing funds

- Data update: It’s Moneyball time!

- Damodaran data resources

- This is not the way

- Goldman Sachs destroys one of the most persistent myths about the stock market

- Don’t extrapolate from this fake business cycle

- Retail sales fall

- Netflix raises prices on all US plans

- Amazon Prime is loved at almost any price

- Extreme leverage at extreme depths

- Web3

Books mentioned:

Podcasts mentioned:

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here and here.

Subscribe here: