A reader asks:

I’m 64 and my wife is 53. Due to good fortune and patience, our savings & investments have appreciated quite a bit over the years. As of today we have $2.1M in a rollover IRA which is 75% stocks and 25% cash. And we have $1.65M of shares in pre-tax accounts held more than a year. Plus $500k of post-tax cash.

So in total about $4.25M in financial assets. Plus about $1.4M in home equity, with $175K in mortgage debt @ 2.99%. And neither of us works anymore.

We’ve been very fortunate, to say the least. But the reason I’m writing you is that we don’t have much in the way of income from our investments. Just a lot of capital appreciation from mostly tech stocks. I’d like some advice please on ways to re-apportion these investments, with as little tax implication as possible, into a portfolio that provides more dividends.

The good news here is you’ve won the game. Nicely done. Good fortune and patience are a solid combination for financial success.

The bad news is there aren’t very many safe options when it comes to creating an income portion of your portfolio these days.

Before getting into all of that, there are two considerations for this kind of question:

(1) Am I looking to add more income to my portfolio as a way to diversify away from tech stocks?

(2) Am I looking to add more income to my portfolio because I don’t want to touch my principal balance.

It makes sense if you are trying to diversify away from tech stocks. They have been lights out for well over a decade now and there is no guarantee that will continue.

But I’m not a huge fan of creating an income-based portfolio just because you think income should be your sole goal in retirement.

Let’s look at AT&T as an extreme example here.

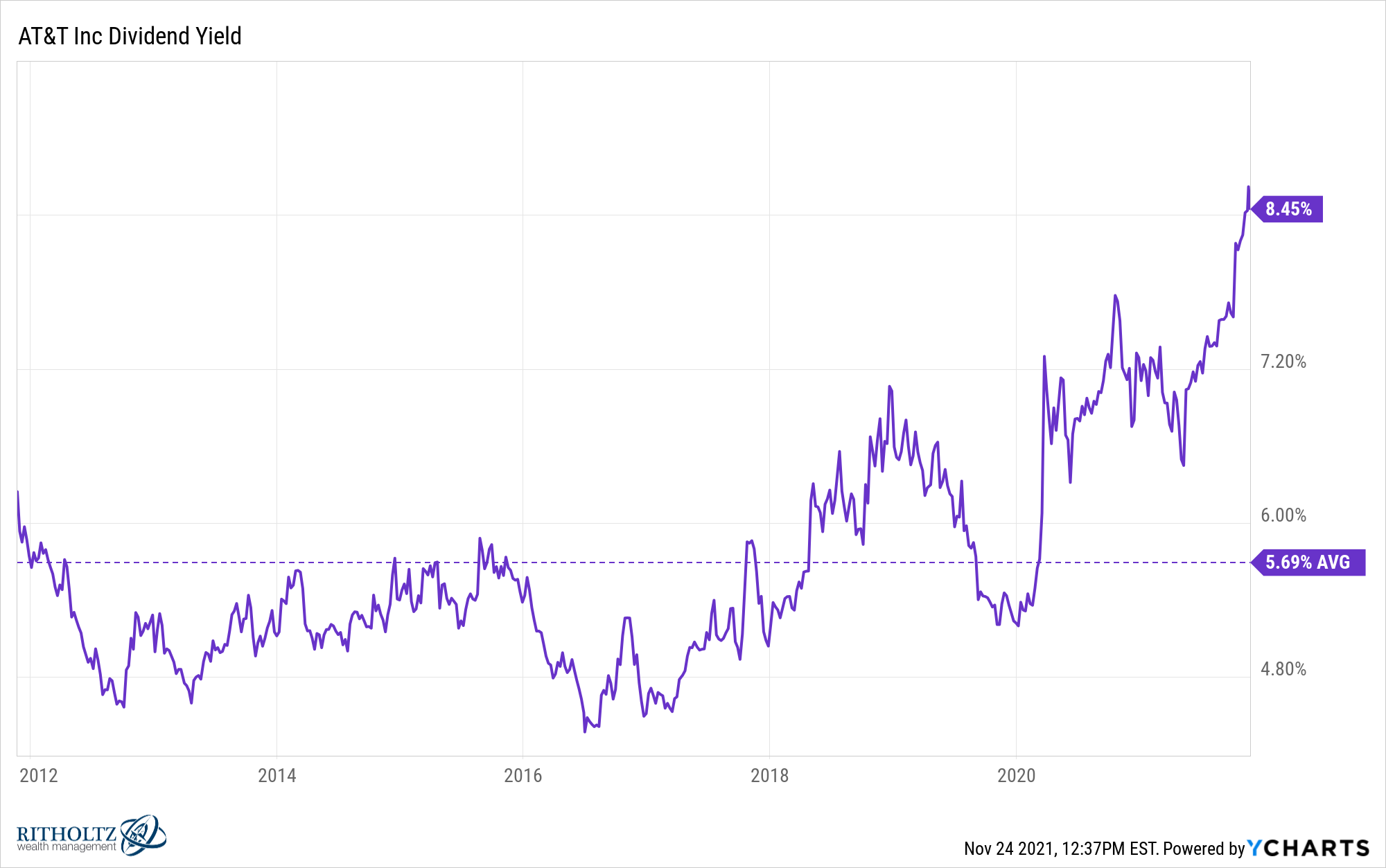

This is AT&T’s dividend yield over the past 10 years:

An average yield of close to 6% when the 10 year treasury has averaged 2% sounds enticing.

Here’s the problem with looking exclusively at yield when it comes to the stock market:

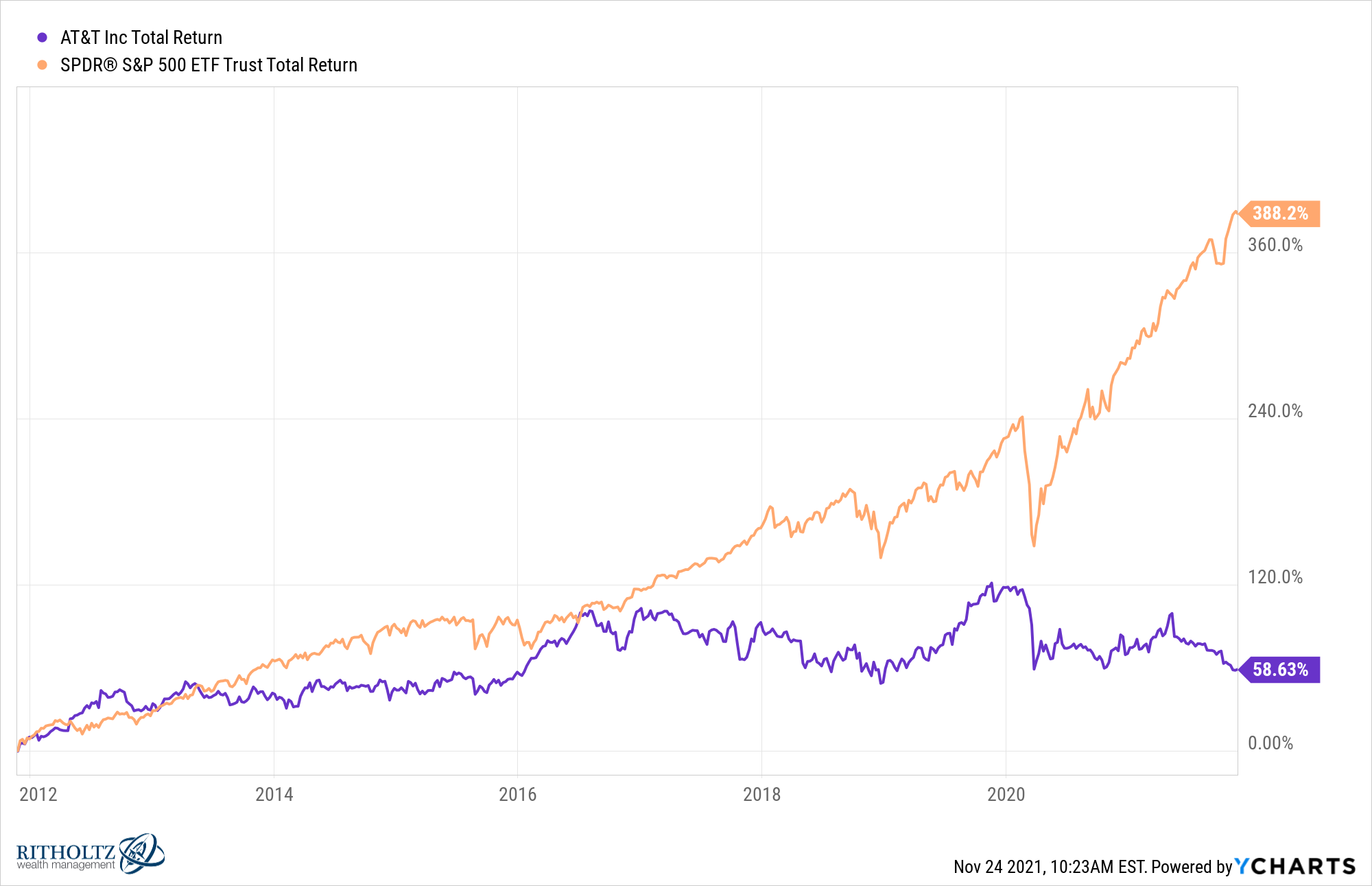

Over the past decade, the stock market has crushed AT&T on a total return basis.1

Maybe that yield makes you feel all warm and fuzzy but total returns, not yield, are the only thing that matter.

I know many investors are averse to spending down their principal in retirement. That principal feels sacred.

But if you’re happy with your current portfolio, you could always create your own dividends by simply selling some shares in the stocks or funds you own. It’s not the end of the world if you take some gains and enjoy your money.

The remained of your portfolio will still compound if the stock market rises over the long-term.

Now if you want to diversify away from tech stocks because you’re worried about being too concentrated in that sector, that’s a completely different equation.

Unfortunately, higher yield invariably comes with higher risk.

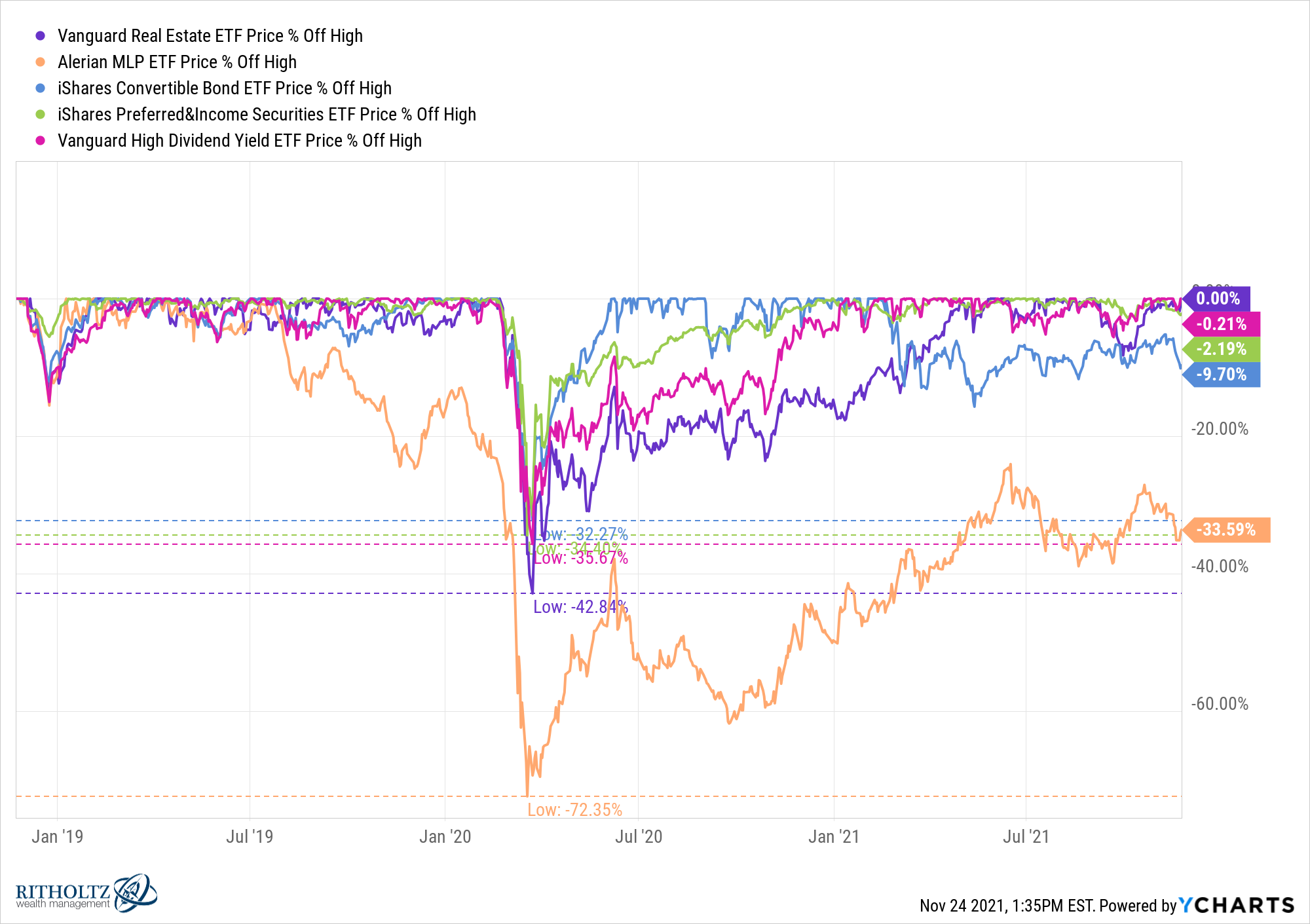

In a low rate environment, investors have turned to dividend-paying stocks, REITs, preferred stocks, convertible bonds and MLPs for higher yield.

Those higher yields come at a price. Look at the drawdown profiles for these assets over the past three years:

They all fell as much or more than the stock market during the Corona crash of March 2020. You can still earn income on these assets when they crash but it’s worth knowing what kind of risk you could be setting yourself up for when the excrement hits the fan.

It’s also worth mentioning my favorite source of income inflation protection comes in the form of the overall U.S. stock market. Dividends have grown at 2% over the rate of inflation for the past 100 years in the stock market.

You don’t get a great yield at the moment investing in a total U.S. stock market fund (just 1.2% right now) but that income does tend to grow and it much less volatile than the stock market itself.

We talked about this question on this week’s Portfolio Rescue:

We also covered some career advice for young people in finance, how to manage your money when you lose your job and how to teach your kids about money.

Happy Thanksgiving!

1It’s worth noting the entire return over these past 10 years for AT&T stock has come from the dividend payments. The price of the stock is actually down 11% in total over this time frame. So if you didn’t reinvest those dividends you would have done even worse.