According to Bankrate the average interest rate for savings accounts at a bank right now is 0.06%.

That’s 6 basis points.

Using the handy rule of 72 would mean it takes 1,200 years to see your money double at that rate of return.

I’m all for thinking and acting for the long-term but I don’t see the human race turning into vampires any time soon.

Savings account yields are tied to the Fed Funds Rate which is currently set at 0% so it makes sense these yields are so low.

Here’s something that might not make sense:

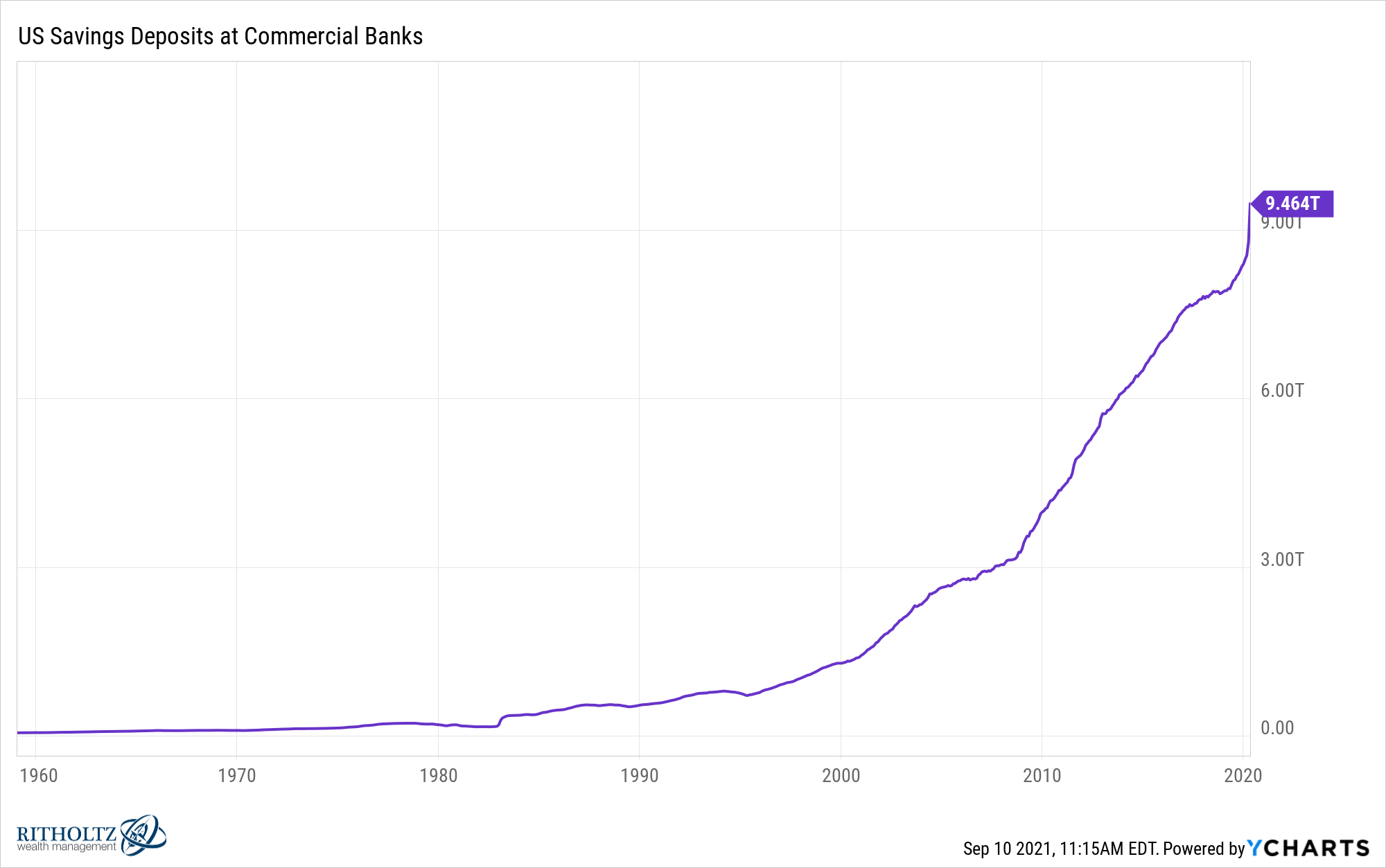

We are now closing in on nearly $10 trillion being held in these savings accounts. There is over $1 trillion more stashed in bank savings accounts than there was before the onset of the pandemic in early-2020.

The U.S. stock market is worth somewhere in the neighborhood of $50 trillion so the amount of money sitting in cash is meaningful.

There are a number of different reasons so much money resides in savings accounts earning nothing. Some are behavioral in nature. Some make sense on the surface. Some are irrational.

Here are the biggest reasons we have nearly $10 trillion earning next-to-nothing in savings accounts at the moment:

Risk appetite. Some people simply don’t have the stomach for the stock market or other risk assets. So their money sits at a bank earning nothing.

There aren’t many good alternatives. Instead of cash sitting in a bank account earning nothing you could invest in bonds. But bonds carry interest rate risk.

You could invest in stocks but the stock market is volatile and can crash without warning.

You could invest in stablecoins or crypto but crypto is still highly unregulated, volatile and relatively new.

You could invest in preferred stocks or convertibles or REITs or dividend-paying stocks or liquid alts or any other number of investment options.

But all of them carry risks, either seen or unseen.

If your money is sitting in a bank account and you don’t like the yields being offered there aren’t any easy alternatives available that offer the same safety and peace of mind.

By far the easiest decision you can make if you have money sitting in a brick & mortar bank savings account is to move it to an online savings account or credit union where they offer higher rates.

My online savings account at Marcus currently pays 0.5%. My credit union offers 3% checking (up to $15k).

The problem is this still isn’t very much money at all in the grand scheme of things.

Safety. Many people keep money in a savings account because they’re more concerned with the return of capital than the return on capital.

And there is nothing wrong with this line of thinking.

If you need your money for a specific purpose in a relatively short period of time the risks tend to outweigh the rewards when it comes to taking chances with that capital.

Regardless of the level of interest rates, there is always going to be a decent chunk of change being held at savings accounts because of this.

Inertia. Changing bank accounts is a pain in the neck. Once you set up all of your account numbers and link your bank account to bill payments, investment accounts and such it’s not very much fun to do that all over again.

So most people simply sit on their hands and do nothing.

It’s like changing your dentist. You may not particularly care for the customer service you receive at your dentist’s office or the constant up-selling that occurs.1 But how many people go through the process of finding a new dentist’s office? It’s just easier to stay put.

The same thing applies to bank accounts.

Inertia remains one of the biggest deterrents to behavioral change so trillions of dollars remains in savings accounts earning nothing.

Further Reading:

The Pros and Cons of Miniscule Savings Account Yields

1It often feels like going to a car dealership these days. No I am not going to pay for a bite guard, stop asking me.