Hedge fund manager Bill Ackman is worried about the impact of rising interest rates on his portfolio:

Ackman is so concerned about rising rates impacting his portfolio, so naturally he went to the New York Fed to tell them they should…raise rates. I guess you can’t blame the guy for trying.

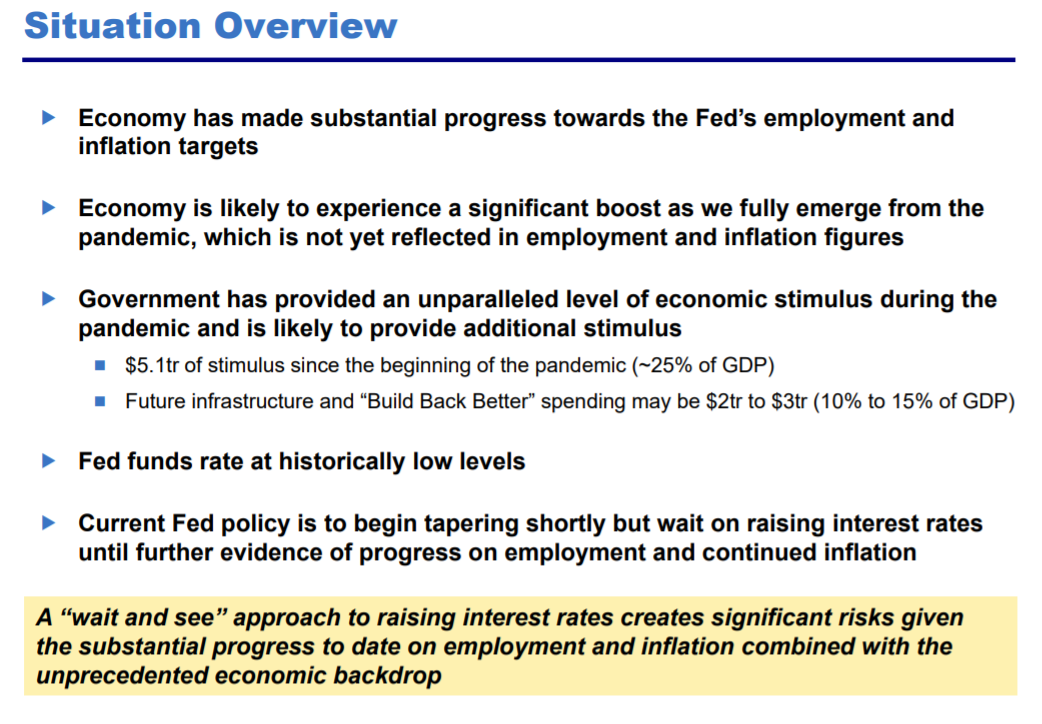

This was the main takeaway from his presentation:

It’s hard to argue with his conclusions here.

The economy has made substantial progress. Fiscal stimulus was rolled out on a massive scale. Interest rates do remain low by historical standards.

While the Fed has said from the beginning they won’t take their foot off the gas pedal too soon this time around, I can see why so many people are starting to worry.

Inflation is rising. Speculation is running amok. House prices are going vertical. Supply chains are constrained.

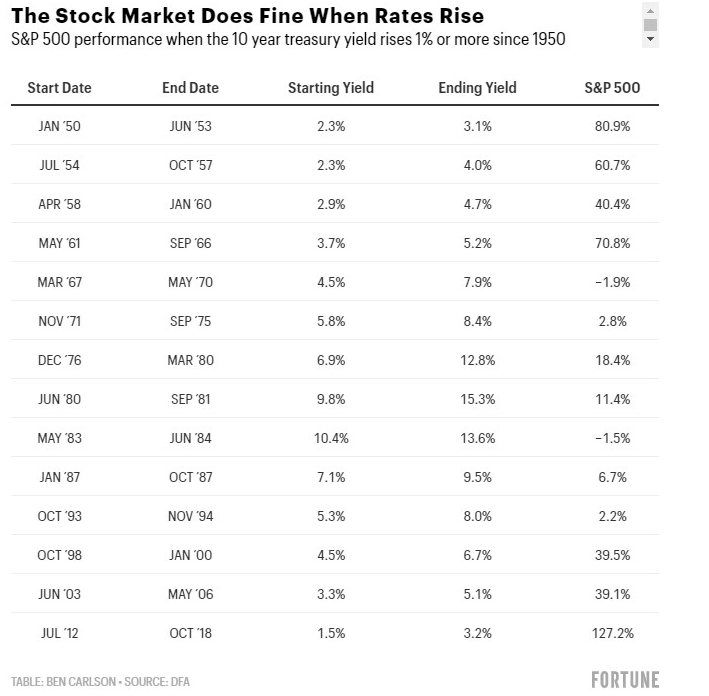

History shows Ackman’s worries about his long-only portfolio could be misplaced though. Earlier this year I looked at the relationship between rising interest rates and stock market performance:

Over the past 70 years or so the stock market has done just fine in a rising rate environment.

Obviously, there is no guarantee this relationship will remain in the future.

It’s possible the current level of rates changes the equation here. Investors could be addicted to low interest rates and become spooked at the first sign of a prolonged increase in yields.

We also could be reaching the point where interest rates now matter more to the markets than the economy.

If the Fed raises interest rates from 0% to 0.5% is that going to help restaurants hire more staff? Will that reduce supply chain bottlenecks? It’s not like the Fed can serve you IPAs and pizza or lift more containers from the backlog of oceanliners.

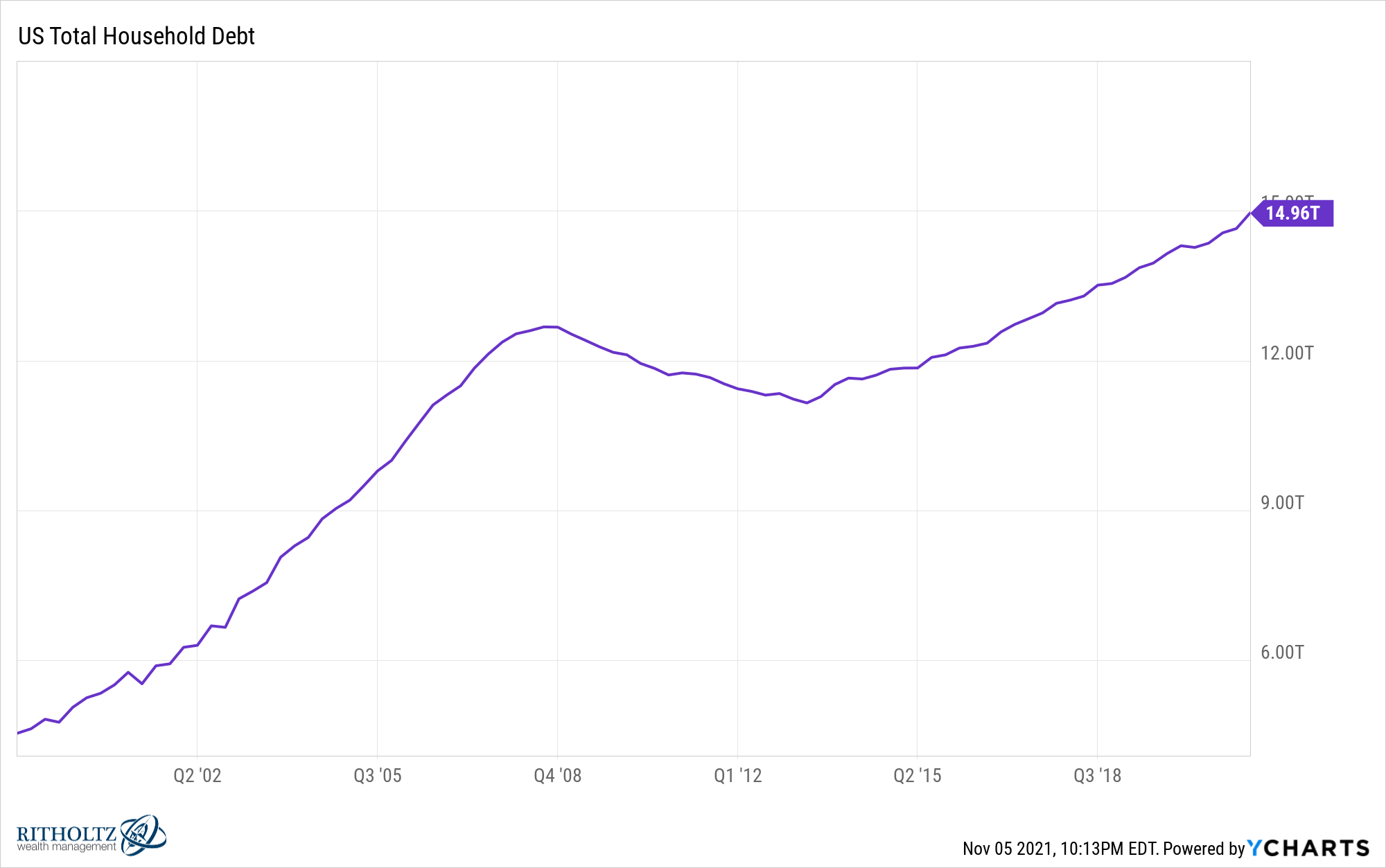

Total U.S. household debt is just shy of $15 trillion:

That’s a lot of money. If rates were to rise that would certainly cause a problem for any borrowers rolling over or taking on new debt.

But that $15 trillion in debt pales in comparison to the roughly $50 trillion U.S. stock market.

The only real argument for raising rates probably comes down to dampening speculation in the markets.

This probably wouldn’t be the worst thing in the world. We’ve had quite a run for the past year-and-a-half in financial assets. Risk assets aren’t supposed to simply go up all the time.

Assuming Bill Ackman is right about the Fed, there are two courses of action here:

(1) The Fed keeps its foot on the gas pedal, inflation stays elevated and markets continue to rise.

(2) The Fed takes away the punch bowl, reins in higher prices and speculation takes a breather.

The markets don’t always work this neatly as there are other potential paths forward but this seems to be the framework he’s working with.

I honestly don’t know what scenario would be worse — letting the economy run hot, thus triggering even more inflation or the Fed taking away the punch bowl early and potentially screwing up the labor and debt markets.

There are trade-offs in each scenario as well as unintended consequences.

Either way, the U.S. consumer has likely never been better positioned to handle whatever direction rates or inflation goes from here:

- The net worth of Americans is at an all-time high.

- Credit card debt has fallen since the start of the pandemic.

- Housing prices are as high as they’ve ever been.

- Home equity is at all-time records.

- Consumers repaired their balance sheets during a pandemic-induced recession.

All of the wealth created over the past 18 months has given us an economic margin of safety that didn’t exist coming out of the 2008 crash.

Further Reading:

Economic Side Effects From the Pandemic