Today’s Animal Spirits is presented by Masterworks:

Go to Masterworks.io to learn more about investing in contemporary art.

We discuss:

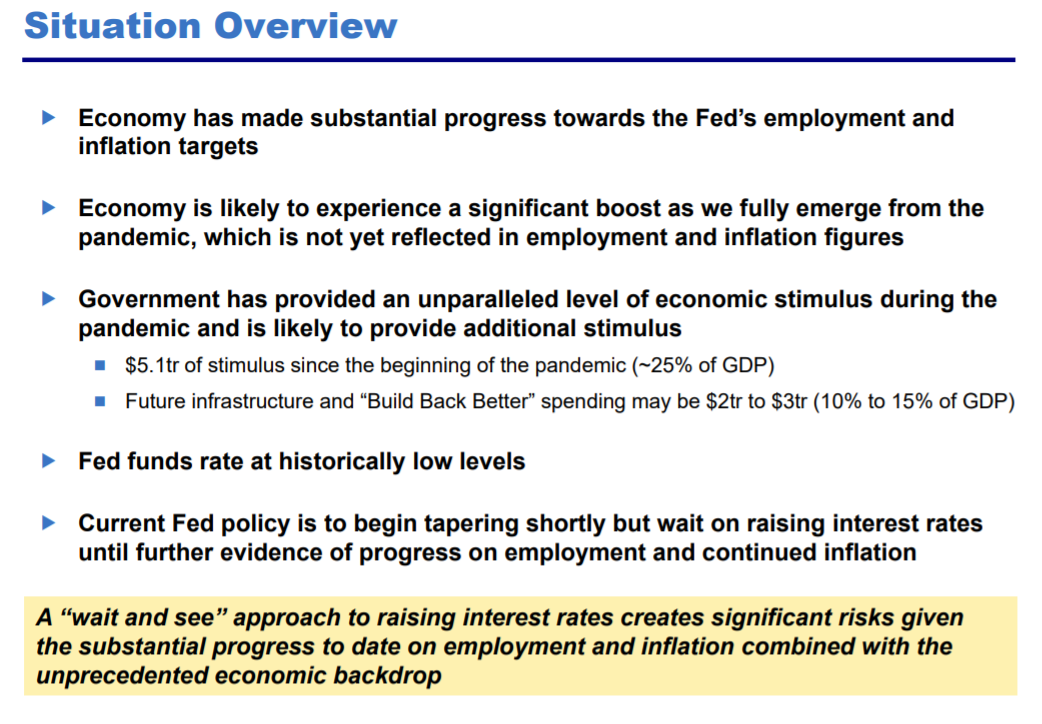

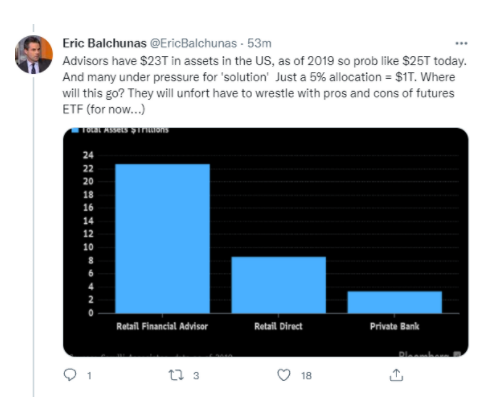

- Is it time for the Fed to raise rates?

- How does the stock market perform when interest rates rise?

- Do rates now matter more to the markets than the economy?

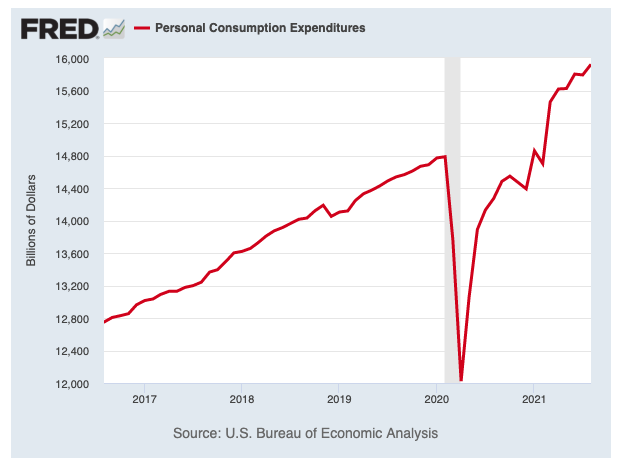

- Has the consumer ever been in a better position to handle inflation or rising rates?

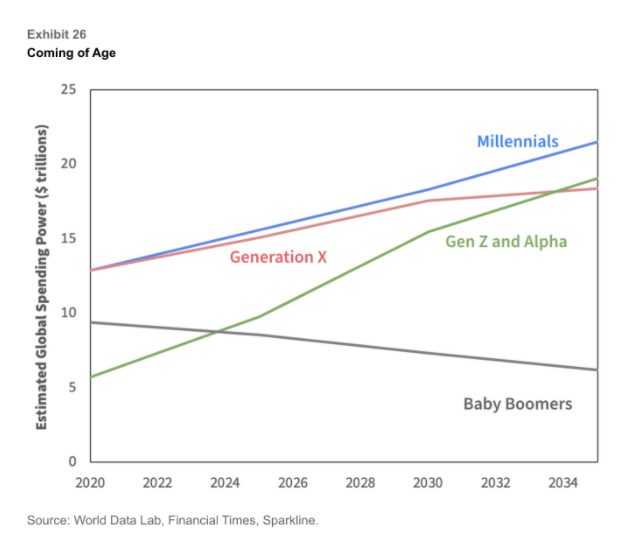

- Millennials are now the biggest spenders

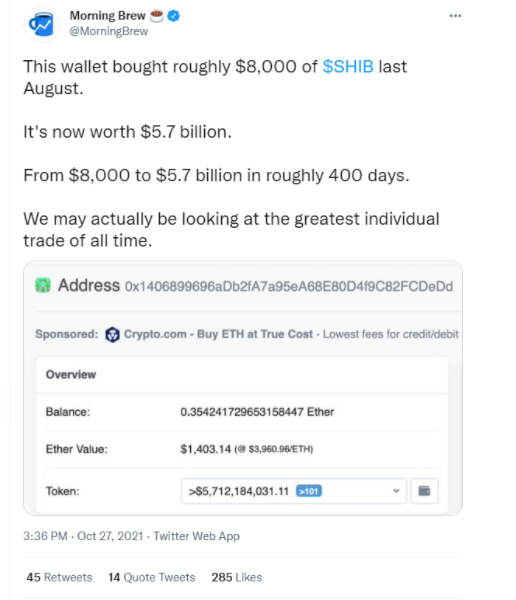

- Overnight wealth in altcoins is insane

- The different levels of FOMO

- Everything we learned in business school is wrong

- What does ‘transitory’ even mean?

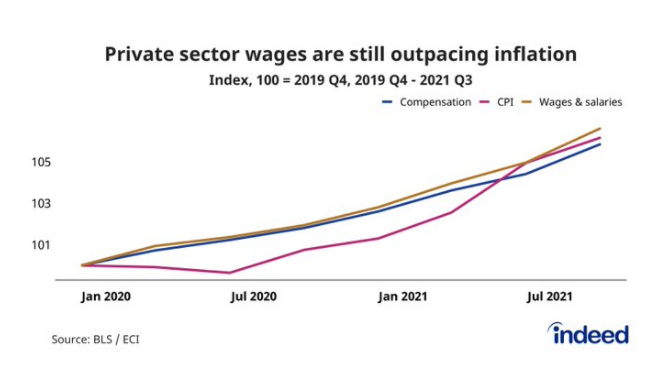

- Is inflation a problem if wages are growing faster than prices?

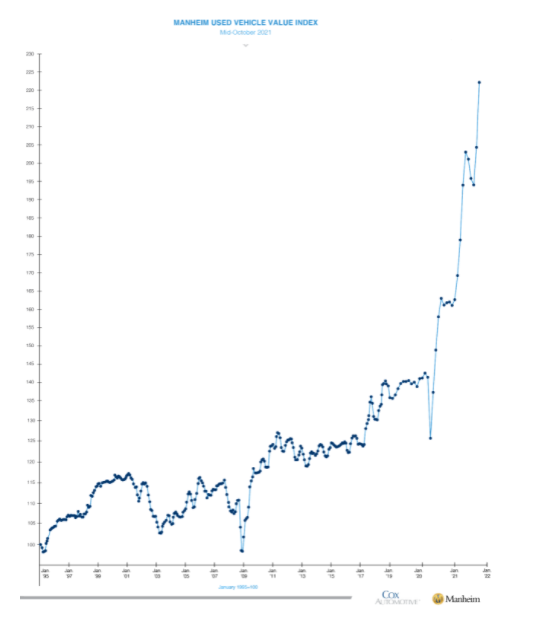

- The many unintended consequences of the pandemic

- Are we setting up for mini-Toronto-like housing markets all around the U.S.?

- Why our kids won’t care about gas prices

- What is Zillow doing?

Sign up for Future Proof:

- Use code “AnimalSpirits” for 50% off your ticket here

Listen here:

Transcript here:

Stories mentioned:

- Bill Ackman presentation to the Fed

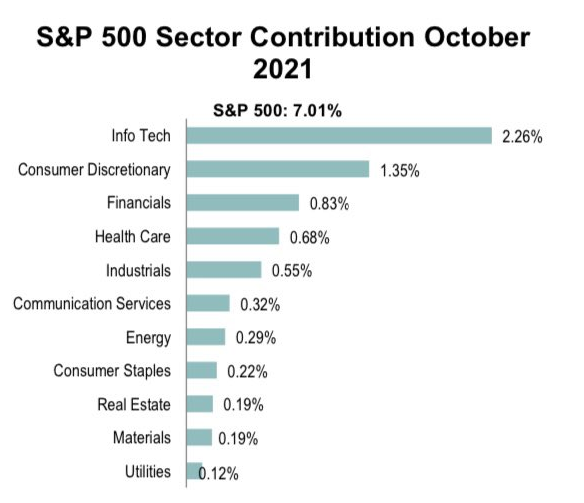

- Inflation matters more to the stock market than interest rates

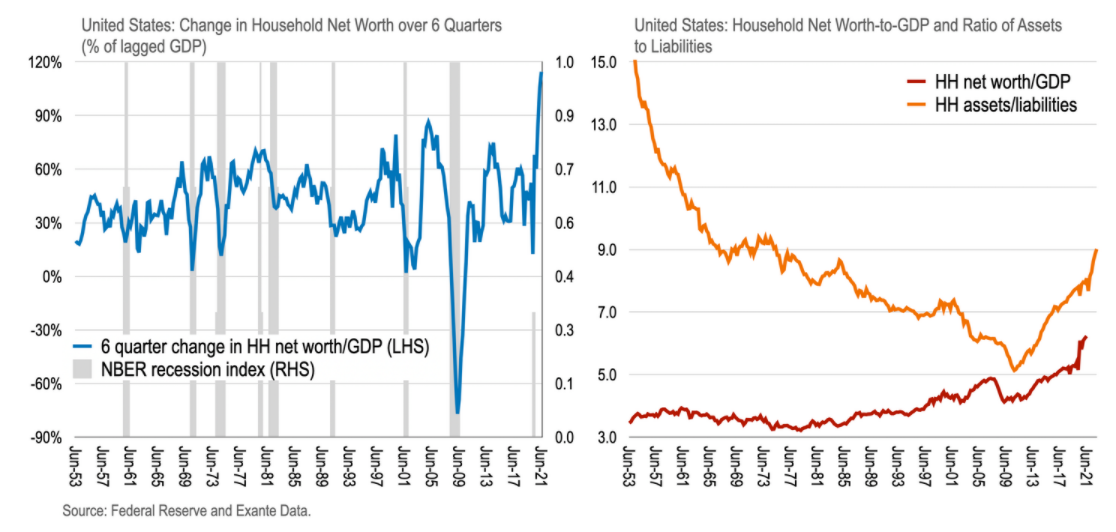

- The greatest surge in household wealth

- Brand in the influencer era

- Squid Game is memecoin warning with wipeout

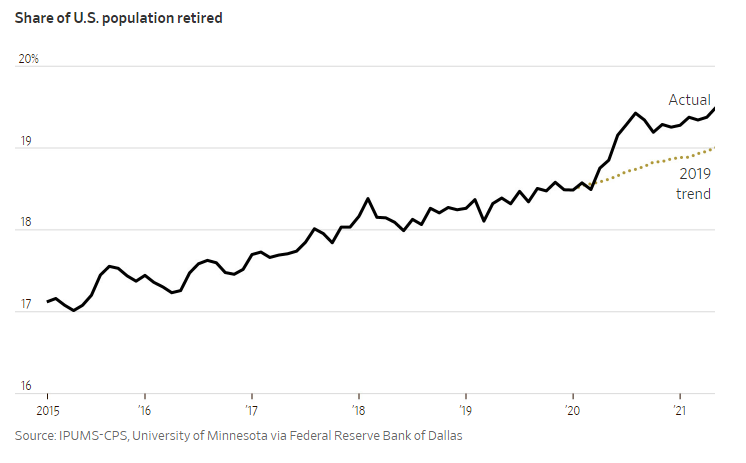

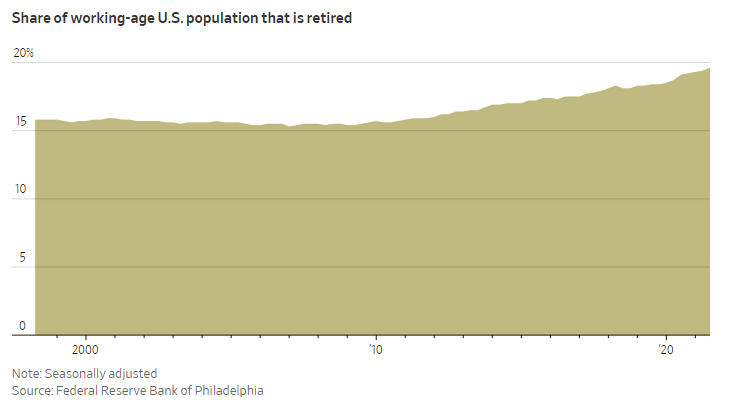

- Covid pushed many Americans to retire

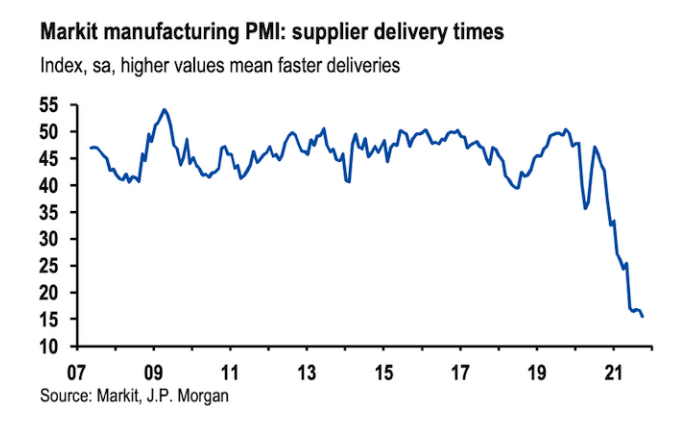

- A 20 year truck driver tells you why the supply chain crisis won’t end

- The good force behind the supply chain nightmare

- Refinance trends

- Luxury house hunters raise a glass to wine country

- Biden sides with Detroit automakers offers EV credits

- Zillow is selling 93% of Phoenix homes at a loss

Books mentioned:

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here and here.

Subscribe here: