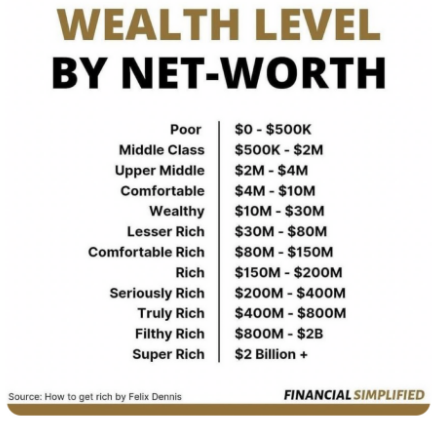

As I explained last week, a certain portion of the internet exists strictly to create outrage. Here’s another one from this week:

I don’t know who created this awful table but it didn’t pass the smell test when I saw the source at the bottom. I recently read the book How to Get Rich by Felix Dennis. This sourced material is not what it said in his book.

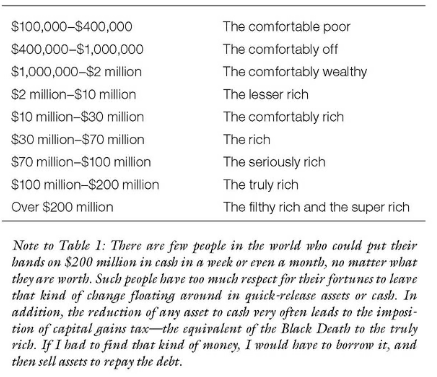

Here is the actual table from the book:

This is not quite as bad as the manufactured outrage post but still not great. Dennis was a gazillionaire so this is coming from someone who was just a tad out of touch with normal people.

The cutoff to be in the top 1% in terms of wealth in this country is estimated to be around $11 million. Being in the top 1% only makes you comfortably rich?

I’m also not a huge fan of the term “comfortably poor.”

First of all, there are a number of different ways to live a rich life that go far beyond wealth. But it’s also because most Americans would fall under that moniker based on the numbers.

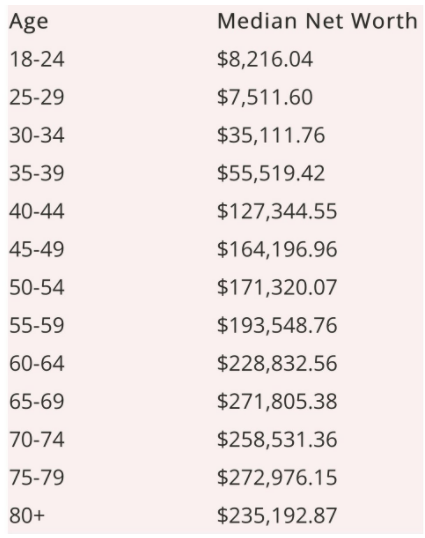

The latest data shows the median household net worth in the United States was a little more than $121,000. Now here is median net worth segmented by age (via Peter Mallouk):

The good news about this data is that it’s likely lower than reality because this comes from the Federal Reserve Survey of Consumer Finances, which was conducted in 2019. Financial asset prices and housing prices are up a healthy amount since then so these numbers should be higher now.

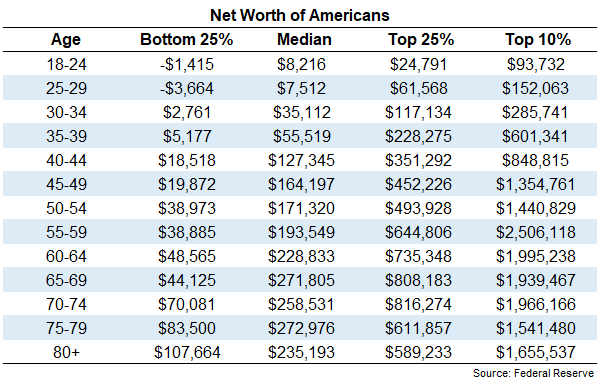

There is, of course, a wide range of values around this median. This is how things look if we break it up by percentiles:

Not only are there different levels of wealth but people are at different stages of their lives. They have different standards of living and costs of living. People also have different expectations about how much wealth is required to live a rich life.

You could have a net worth that makes you comfortably wealthy but if that net worth comes with a commensurate out-of-control spending rate, eventually something has to give.

Or you could have a net worth that makes you comfortably poor in the eyes of wealthy people but have your spending level under control. In this instance, you’re comfortably rich in my mind.

Being wealthy comes down to some combination of your net worth, spending level and expectations.

Net worth can and will change but at any given time it’s pretty well set in stone for most households so the biggest levers you can pull are your spending and your expectations. If either of those goes too far above your net worth, you could be in trouble.

A large net worth certainly makes your life easier. But expectations are the great equalizer in all of this.

If your expectations of a rich life outweigh the amount of money you have, it’s going to be difficult to keep your current lifestyle.

You can have a lot of money and still be uncomfortable in your life. It’s also possible to live a comfortably rich life without a net worth in the top 1%.

Michael and I discussed these numbers and much more on the latest Animal Spirits video:

Subscribe to The Compound for more of these videos.

Further Reading:

How Much Money Do You Need to Make to be Considered Rich?

Now here’s what I’ve been reading lately:

- What to do if you’re worried about inflation (EBI)

- What if the stock market were a bond? (Crossing Wall Street)

- How the pandemic changed me as a parent (Ryan Holiday)

- Why retire at age 65? (Humble Dollar)

- The great resignation is accelerating (The Atlantic)

- 10 truths about the stock market (TKer)