Author James Playsted Wood once wrote, “The thing that most affects the stock market is everything.”

The point rings true because there are so many factors that impact the markets.

Just off the top of my head, you have earnings, the economy, interest rates, inflation, the Fed, government spending, investor risk appetite, innovation, demographics, dividend yields, stock buybacks, price trends, Nic Cage movies and a whole host of other variables.

It’s never just one thing that moves the markets.

But there are certain times where a single variable seemingly trumps all others.

Right now some people would say that variable is the Fed or interest rates. That might be true but I have my own unifying theory of what’s driving markets at the moment — money. People have plenty of it and nowhere else to put it.

Let’s not overthink it.

The reason stocks are going up is because people want to own stocks. So they keep buying stocks.

The reason housing prices are soaring is because people want to own homes. So they keep buying houses.

The reason bond yields remain stubbornly low is because people want to own bonds. So they keep buying bonds.

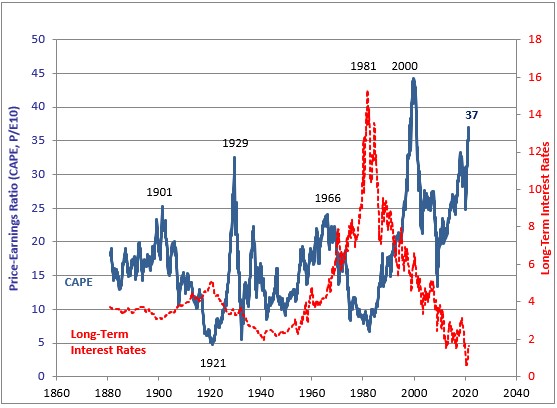

The Shiller PE ratio now stands at 37x, the second highest valuation in history for this measure.

Investors don’t care because people want and/or need to own stocks.

Individuals invest on a set schedule in their 401(k) or 529 or Roth IRA or Robinhood account regardless of valuations because people are living longer, interest rates are low and stocks offer your best chance at returns above the rate of inflation over the long haul.

So they keep buying stocks.

Pension plans have obligations they need to meet. Many of them are behind on those obligations.

So they keep buying stocks.

Young people were bored last year, finally have some disposable income and now have a bug for the stock market.

So they keep buying stocks.

Ten thousand baby boomers are retiring on a daily basis. They have some $70 trillion in wealth and they need to protect some of it. Even though rates are at generationally low levels, high quality bonds still offer protection of your capital in the short-term.

So they keep buying bonds.

Interest rates are even lower around the globe. That makes bonds in the U.S. look attractive on a relative basis to foreign investors and governments.

So they keep buying bonds.

The government probably can’t afford to let interest rates get too high because of all the debt we’ve taken on.

So they keep buying bonds.

The millennials are the largest generation in the United States. Much of this demographic is now reaching their early-to-mid-30s, a time when people begin to settle down.

So they keep buying houses.

The pandemic set in motion a boom in the ability for many people to work from anywhere. People now have the ability to work remotely and not be tied down to the biggest, most expensive cities.

So they keep buying houses.

Interest rates are low in most asset classes. It’s difficult to find steady income that can also protect against inflationary pressures. This has led many institutional investors into the open arms of the residential real estate market.

So they keep buying houses.

Bloomberg’s Tracy Alloway had a great take earlier this year in what she dubbed “flows before pros.” Essentially, the amount of money going into a particular asset class or security can trump fundamentals in terms of driving prices.

Here’s what she wrote at the time:

Flows before Pros is one way to put it. The simple premise here is that in an environment where flows matter more than fundamentals, the people trading stocks in their basements might be better equipped to judge where money is going next. They might have a better sense of the strength of a stock’s particular “story,” for instance, or a better sense of where the forum’s hive mind will go next, than portfolio managers wedded to their valuation models. In a more-than-a-little-ironic turn of events, the professionals may now be chasing retail flows.

Alloway discussed the meme stocks like GameStop and AMC here, but the analogy works for the overall markets.

How many times have you heard a Wall Street professional in the past decade bemoan the fact that stocks, bonds or housing are in a bubble?

Just look at the valuations?!

Why are all of these investors so irrational?!

This is going to end badly…just wait.

Americans have never been wealthier than they are today. Interest rates remain low. People have spent the past 12 years repairing their balance sheets since the Great Financial Crisis. Demographics are a tailwind for a number of asset classes right now.

All of these factors are trumping fundamentals right now.

People don’t care what historical PE ratios were in the past. They just want to be able to retire comfortably someday.

So they keep buying stocks.

People don’t care that housing prices just saw their largest one-year gain ever. They just want a home to live in.

So they keep buying houses.

People don’t care about breakeven inflation expectations. They just want to keep a portion of their portfolio safe from a potential market crash.

So they keep buying bonds.

Of course, this can’t last forever. Markets are always and forever cyclical. Nothing ever goes up and to the right forever. It would be delusional to assume otherwise.

But if you’ve been yelling at people for years and years about fundamentals you’ve missed the fact that a tidal wave of money and demand for assets has trumped every historical metric in the book.

People have a lot of money right now and they want to buy financial assets with that money.

Further Reading:

Why Valuations Probably Won’t Matter For a While