Today’s Animal Spirits: Talk Your Book is presented by Direxion.

We spoke with Ed Egilinsky, head of alternative investments at Direxion about the Direxion Auspice Broad Commodity ETF (COM).

We discuss:

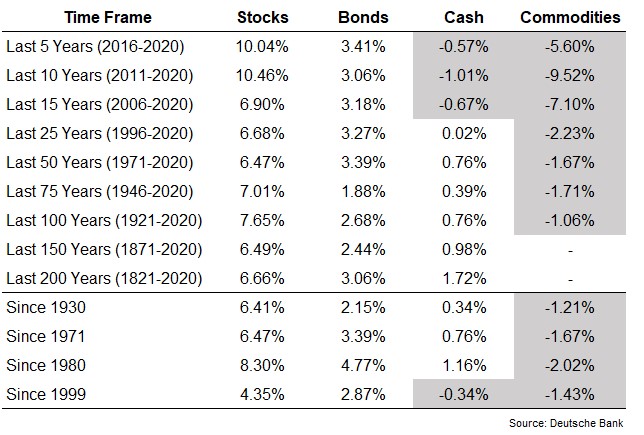

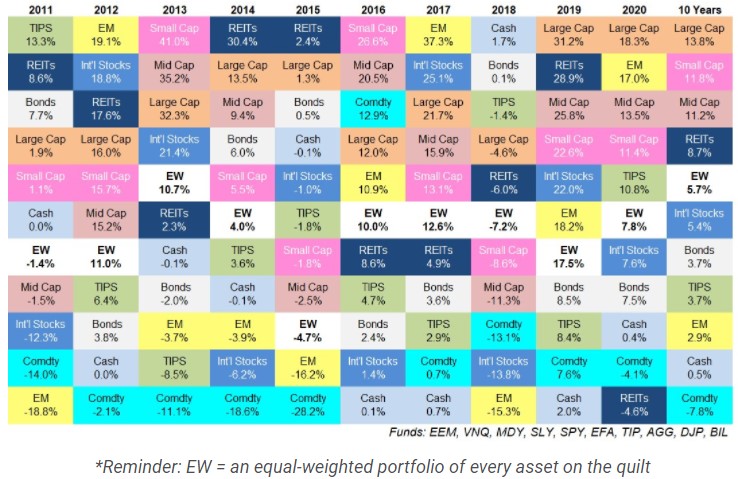

- Why commodities are better for tactical than buy and hold

- Is inflation stickier than the fed expects?

- Are commodities a cause or symptom of inflation?

- Is inflation here just because of shortages?

- Why volatility is a tax on short-term returns

- Are we in the early innings of a commodities supercycle?

- Why contango and backwardation matter for commodities futures

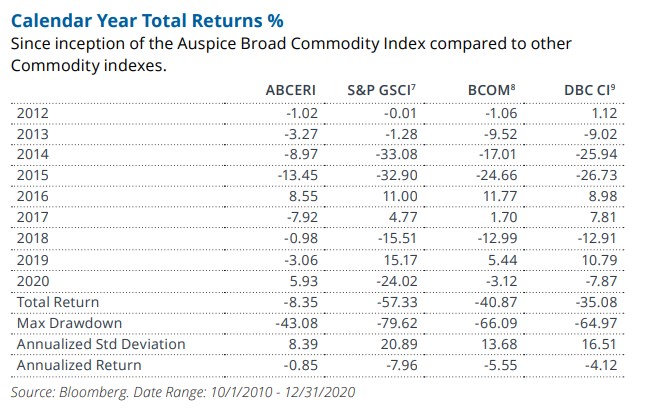

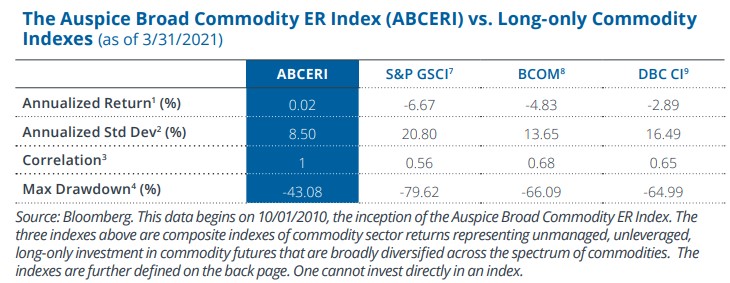

- The differences between commodities indexes

- Has bitcoin taken some of the shine off gold?

- How do commodities fit within a portfolio?

- What could slow the current commodities boom?

Listen here:

Links:

- The Direxion Auspice Broad Commodity ETF (COM)

- Commodities are meant for trading, not investing

- 200+ years of asset class returns

- Updating my favorite performance chart for 2020

Charts:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on the Shuffle app.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: