He creates investing videos for his 34 followers on TikTok.

She makes gluten-free bread in their basement.

Their budget: $3.2 million

Young people and first-time homebuyers aren’t thrilled with the housing market at the moment.

Prices are skyrocketing in many places. There are bidding wars galore. Houses are going for way more than asking prices all over the place. It’s certainly not a buyer’s market at the exact time many young people find themselves becoming a buyer.

It’s not all bad for young people. Interest rates remain at generationally low levels. And houses are now bigger and nicer than they’ve ever been.

But what if young people are unhappy with the housing market because their expectations are too high? What if our tastes have simply become too expensive?

A podcast listener recently sent the following email:

It seems like a lot of my millennial peers are striving to live TODAY like their boomer parents live now at the end of their careers. Now that I’ve noticed it, I feel like I can’t unsee it. Prime example: people are not just skipping starter homes (I know Ben is a fan of this), they’re skipping straight to the ultra-high end forever-homes. I can’t tell you how many 30-somethings homes that I’ve visited who really have no place for improvement. They’re perfect.

When my parent’s built their home (that they still live in) in the 1990s, they had a mortgage interest rate of 8.5%. Prices may have been lower but they got crushed at the bank. They still built. They just installed carpet instead of hardwoods, linoleum countertops instead of granite, and none of the rooms had any crown molding or decorative embellishments. All of these upgrades have since been made over time.

I think they may be onto something here.

When I was growing up in the 1990s I don’t remember anyone having what we would consider a “nice” house today.

No open floor plans. No good spots to entertain. No granite countertops. No tile backsplashes. No crown molding. No wainscoting. No magnificent bathrooms. No stainless steel appliances.

I blame HGTV.

Think about it. HGTV is like Instagram. Just like you can view other people’s wonderful lives on social media all day long you can now look at all of the wonderful homes outfitted by the likes of Chip and Joanna on HGTV.

If you’re in the market for a home you’ve almost certainly been watching House Hunters, Fixer Upper, Flip or Flop and Property Brothers for hours on end. Watch enough of these shows and it begins to feel like a given we should all live in houses with modern barn doors, giant kitchen islands and heated bathroom tiled floors.

In a way this is progress. People expect nicer things these days. This is what happens.

Yuval Noah Harari once wrote:

One of history’s fews iron laws is that luxuries tend to become necessities and to spawn new obligations. Once people get used to a certain luxury, they take it for granted. Then they begin to count on it. Finally they reach a point where they can’t live without it.

Luxuries become necessities once you get used to them. Smartphones were once a luxury for most people but now they feel like a necessity. College was once a luxury for many and it’s increasingly becoming a necessity for many career paths.

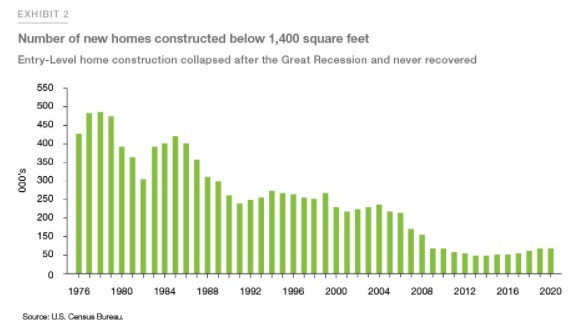

Of course, you can’t blame this all on Jonathan and Drew or Chip and Joanna. It’s also true that starter homes are becoming a relic of the past. Freddie Mac shows the number of new homes with 1,400 square feet or less since the mid-1970s have fallen off a cliff:

Either homebuilders don’t make enough money on these projects or there simply isn’t enough demand from new homeowners.

In 2020, there were just 65,000 entry-level homes constructed, less than one-fifth as many as the late-1970s and early-1980s. Only 10% of new homes built today are considered starter homes.

So you’ve got this surge of new, young homeowners at the same time starter homes are at their lowest levels in decades.

Yet another reason we need the government to make it a priority to incentivize the construction of new homes.

I’m not holding my breath.

Michael and I discussed the impact HGTV is having on homeowner preferences and more on this week’s Animal Spirits video:

Subscribe to The Compound for more of these videos.

Further Reading:

What If Housing Prices Aren’t As High As They Appear?

*******

Now here’s what I’ve been reading lately:

- Myspace Tom got it right (The Verge)

- Why Hank Aaron’s father didn’t want a better house (Waiter’s Pad)

- The problem with always wanting more (Letters From Home & Away)

- Why you shouldn’t freak out about inflation (MarketWatch)

- Play your own game (Collaborative Fund)

- Are you childish about money? (Monevator)

- 4 things you should know before you buy your first house (Peter Lazaroff)

- Houses have gotten bigger and nicer (Irrelevant Investor)