A podcast listener asks:

Location: Seattle, WA

Based on my current savings for a downpayment, $300,000, I am pre-approved for a $1.5 million home purchase, but was hoping to stay closer to $1.2 million. My wife and I looked at houses in our preferred budget, and everything went $200k to $300k over. I have a co-worker who has now put in 5 offers, some escalating $500k over, and has not won a house. It has been demoralizing and I don’t really want to look anymore. We are spending too much of our free time and emotion on this.

My main question is:

My options at this point are to: (1) keep building up a bigger down payment or (2) stretch my budget and buy a forever home now. I favor option 1, to let the housing market settle out and make a more rational decision. However, I am worried about getting priced out of the Seattle housing market forever. I have heard people talk about being priced out of the Bay Area in California. We really love living here. What the heck am I supposed to do? Does it ever make sense to buy a home for the fear of being priced out (is this the same as FOMO, not really)?

I’ve been writing a lot about the housing market lately because the dynamics of residential real estate as so interesting.

Much like the stock market, there are so many emotions that go into the buying and selling of a home but the psychology behind a house is different in many ways.

Stock prices fluctuate more than housing prices because they trade 5 days a week and investors can see the price change in real-time. You can look up an estimated price for your home on Zillow but it’s not like people buy and sell their houses on a daily basis.

In fact, the median duration of homeownership in America is something like 13 years.

Plus, you live in your home, you decorate it, maintain it and make it yours. A home is by far the most emotional of assets and there isn’t a close second.

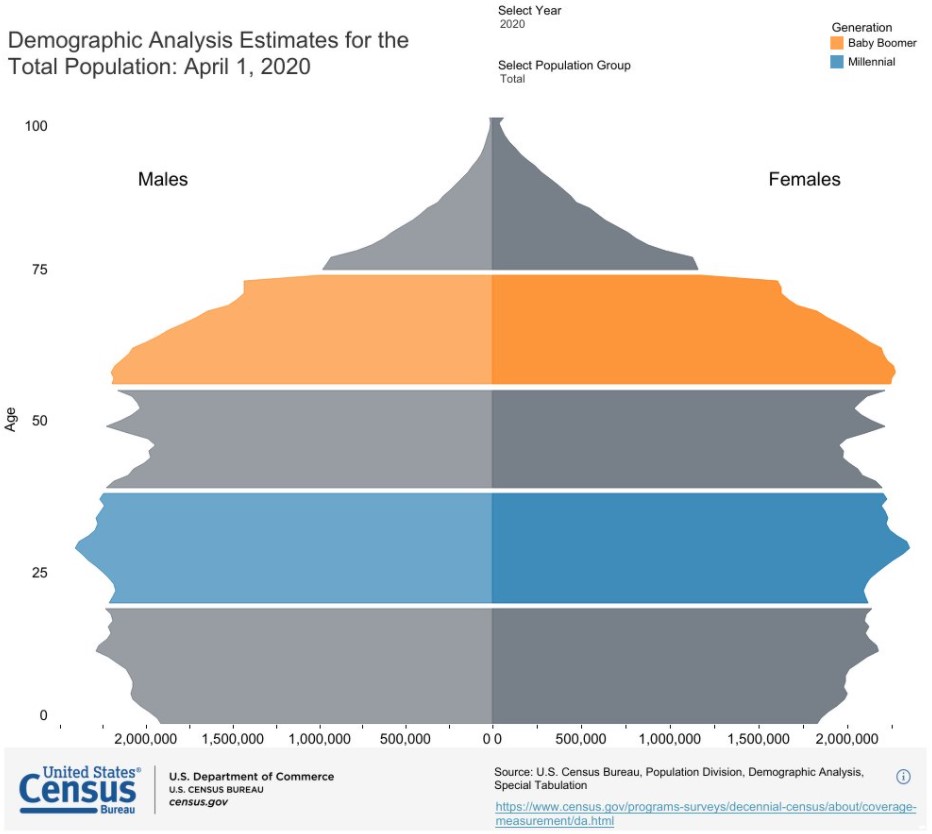

This is what makes the current environment so challenging for first-time homebuyers. Young people badly want to move into a house these days. And this demand is not going away anytime soon. Just look at the wave of millennials slowly growing older:

The homeownership rate in the United States is around 66% or two-thirds of all households. But for millennials that number is more like 48%. That’s up from 40% just 3 years ago.

It’s going to go even higher.

According to Business Insider, nearly one-third of millennials claim the pandemic has pushed them into homebuyer mode even sooner than they planned. These people were going to buy homes anyway but life has forced them to move up that decision.

That’s one of the many reasons houses are flying off the shelves these days as supply remains at record lows.

First-time homebuyers are in a tough situation. Yes interest rates are extremely low, which helps with the monthly payment but prices are out of control and all-cash offers are making it difficult for people to land the home they desire.

Unfortunately, there aren’t many good options right now. Anything is possible but it’s hard to see housing slow dramatically in the coming years without some sort of cataclysmic recession.

Back to our podcast listener from Seattle. Here are your options as I see them:

Keep renting. You don’t have to buy a home. Plenty of people do just fine renting. Owning a home is not for everyone. You could always invest that down payment and do quite well for yourself over the long haul.

Save for a higher down payment. According to Zillow the median home price in Seattle is north of $816k. And many people will scoff at a $1.2 -$1.5 million budget. But in certain big cities, those are table stakes for a decent house these days.

If you’re planning on buying now and moving up to a forever home in the future, you could always save a little more to increase your budget. Of course, the bank may have something to say about that and there’s no guarantee housing prices won’t just keep rising in the meantime.

Suck it up and buy. With people being outbid on the homes they would like this one is easier said than done but you could always increase your bids to the higher end of your range. There is risk involved when buying into a hot housing market. The hedge here would be to live in your home for a minimum of 7-10 years.

Move somewhere else. This is the advice potential homebuyers don’t want to hear right now but a big city budget can take you so much further in a lower cost of living area.

Of course, you have family, friends and career to consider. These things aren’t always easy to leave behind or start anew.

I’m not a huge fan of rules of thumb in most parts of personal finance because it’s so…personal. But I do think they can be helpful in terms of setting baselines and then adjusting to your particular circumstances.

The 50/30/20 rule states that you should allocate roughly 50% of your budget to necessities (housing, transportation, healthcare and other bills), 30% to wants (dining out, travel, entertainment, etc.) and 20% to savings or paying off debt.

If you live in a high cost of living area with ridiculously high housing costs you must be aware that it could eat up a serious part of your budget once you include all of the ancillary costs of homeownership.

There are no right or wrong answers but I do have a lot of sympathy for first-time homebuyers in today’s market.

Michael and I discussed this listener email and more in this week’s Animal Spirits video:

Subscribe here.

Now here’s what I’ve been reading lately:

- Is BlockFi the future of finance? (Not Boring)

- Kati Kariko Helped Shield the World From the Coronavirus (NY Times)

- Where do eels come from? (The New Yorker)

- Attempting the impossible (Neckar’s Notes)

- You ever notice… (Reformed Broker)

- World building (Alex Danco)

- Accessing losses through direct indexing (Big Picture)