A podcast listener asks:

I am a 35 year old senior engineer at one of the big three here in Michigan. I am married with three kids and own my home. My 401k savings has swung like a pendulum. I have maxed out my 401k multiple times in the past but have also dropped my savings rate to as low as 4% recently due to austerity measures at my company. My company will match 4% and give me 4% for a total of 8%. I have always tried to stay aggressive. My wife is a nurse but she only works two days a week so she can be home with the kids. Because of her part-time status she has stopped contributing to her 401k.

I have two questions:

1) I have managed to save over 2x’s my base salary but have always wondered should I be including my profit sharing and bonuses in the “salary” number?

2) What’s the best tool to use to benchmark my 401k balance and savings rate to peers in my age group? I always want to know how I am doing compared to others without actually asking people. Maybe it’s just a weird way to convince myself that maybe I will be ok.

This email includes a number of important personal finance topics to hit on:

- It shows why retirement calculators are so unrealistic. It would be nice if everyone saved a set percentage of their income over time but life rarely cooperates with linear spreadsheet assumptions. There are times when a crisis, career or life event will cause you to either increase or decrease your savings. Volatility in savings from year to year is normal for many households.

- It shows how difficult it is to benchmark your savings. How much you have saved for retirement depends on a number of factors — your savings rate, your income, market returns, luck and expectations. Some of these factors are within your control while others have nothing to do with your decisions. The luck component here makes figuring out where you stand difficult because the timing of returns can have such a large impact on your outcomes

- It shows why relative comparisons can be so tempting with your finances. I understand why young people would like to know where they stand in relation to their peers. No one wants to fall behind and knowing you’re ahead of the game would obviously make life easier. And regardless of where you stand, it’s nice to know how you’re doing financially.

The entirety of personal finance can be drilled down to one question: Am I going to be OK?

That’s what the majority of the population is concerned with. Sure, there are people with enough money that finances will never be an issue but even the wealthiest among us compare themselves to those in their peer group.

So how much should you have saved by age 35?

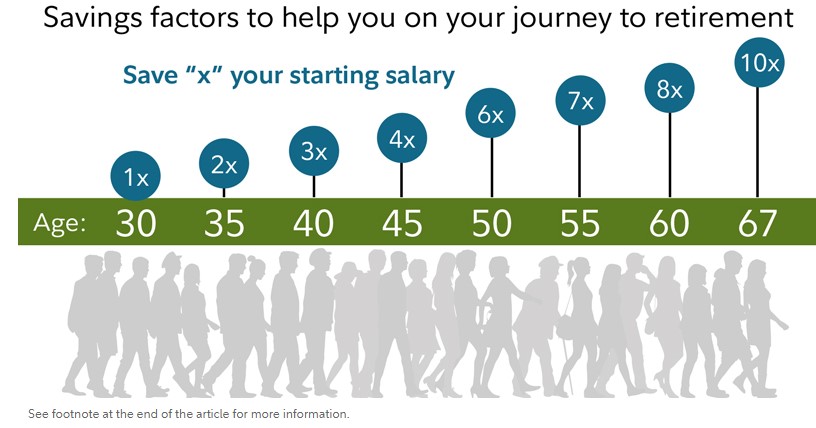

According to Fidelity Investments, our big three engineer is right where they should be:

This type of retirement study bothers a lot of people but at least read Fidelity’s methodology before going to Boston with a pitchfork:

Our savings factors are based on the assumption that a person saves 15% of their income annually beginning at age 25, invests more than 50% on average of their savings in stocks over their lifetime, retires at age 67, and plans to maintain their preretirement lifestyle in retirement.

All retirement planning is based on assumptions. Most of those assumptions will prove to be wrong. But that’s OK. Guessing is part of the retirement process.

Some guesses are in the ballpark while others never make it close to the parking lot of the stadium. Life happens and you adjust your assumptions based on reality.

Those guesses can be updated based on the following questions:

- How much do you spend now?

- How much do you plan on spending in the future?

- How much do you save now?

- How much do you plan on saving in the future?

- What is your savings rate?

- What do you think your savings rate will be in the future?

- What do you want to do with your life?

This is not an exhaustive list but it gets you most of the way there.

As to the question about bonuses and profit-sharing — I wouldn’t get too bogged down in the details here.

I think the most important thing for young people to get right eventually is their savings rate. In my retirement book, I say the target savings rate for everyone should be a double-digit percentage of their income.

Ten percent is a reasonable goal. Fifteen percent would be great. Twenty percent or more would put you in the upper echelon of savers.

This way you don’t have to figure out whether your bonuses or profit-sharing are part of your salary or not. If you’re saving a set percentage of your bonus or additional income you should be fine.

The lack of stability in your savings rate is normal as well. Life is not static like a retirement calculator.

And don’t worry about how your savings match up with your friends or co-workers or peers or some Fidelity retirement study.

Everyone’s circumstances are different. Some people are lucky and things more or less go as planned. Others get dealt a bad hand and have to make do with awful circumstances.

If you started saving at an early age it gives you some leeway later in life in terms of your savings rate and spending decisions because compounding plays such a pivotal role in long-term retirement planning.

But all is not lost if you didn’t follow begin saving from your very first paycheck. Although saving from a young age is ideal, it’s not always realistic.

So do the best you can.

Base your financial decisions on your personal circumstances, risk appetite, time horizon, wants, needs and desires.

Try to have a consistently high savings rate if those circumstances allow for it. Better yet, try to save a little more each year if possible.

And as hard as it can be — avoid comparing your financial situation to that of other people.

The only benchmark that matters when it comes to saving for retirement is comparing reality to your own expectations.

Further Reading:

How a Zoom Meeting Led to My New Book About Saving For Retirement