This week’s Animal Spirits with Michael & Ben is supported by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service. If you’re looking for a new job at a fast-growing investment research firm, YCharts is hiring.

We discuss:

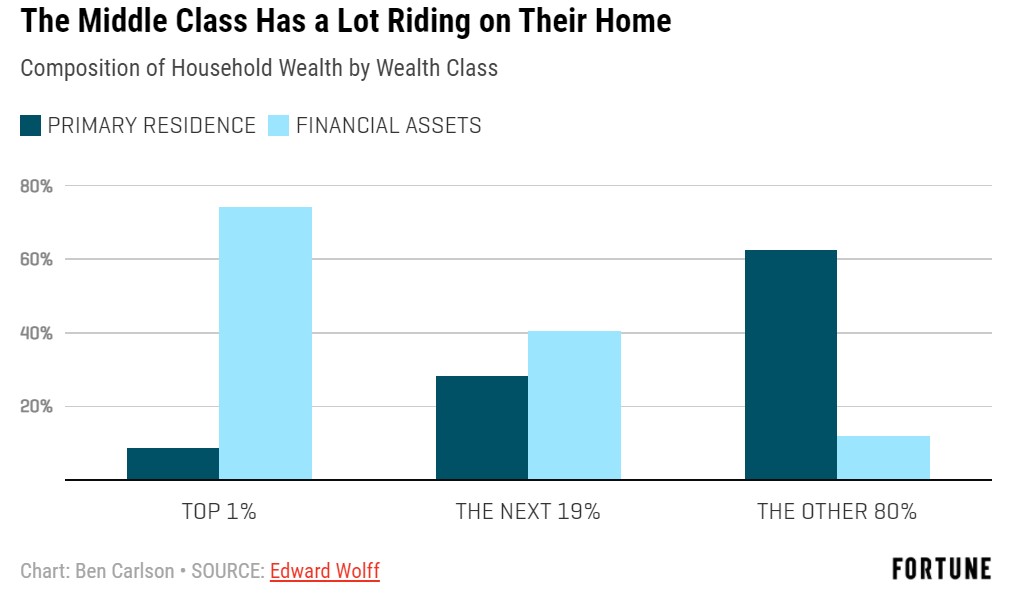

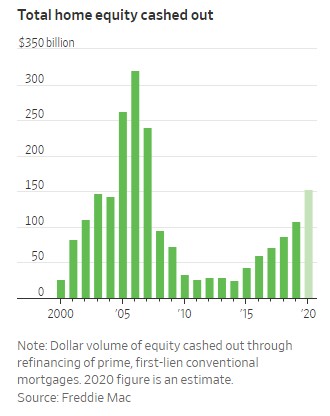

- People are taking cash out of their homes

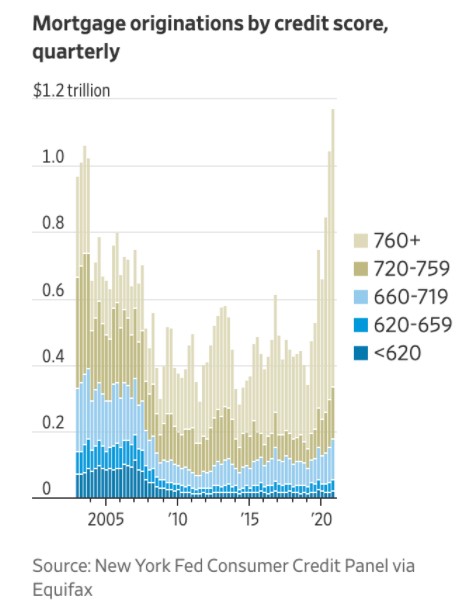

- How millennials got screwed in the real estate market

- Why housing is a good hedge against inflation

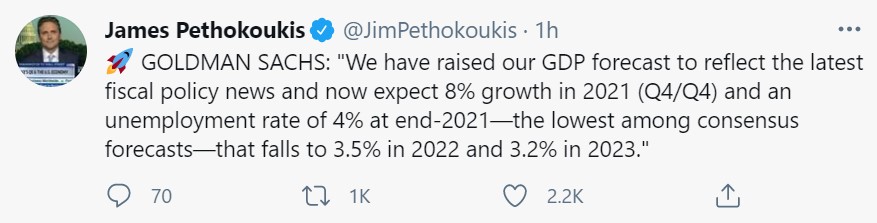

- Can you imagine being bearish about the economy right now?

- Reasons to be optimistic about the economy

- The Fed isn’t printing as much money as you think

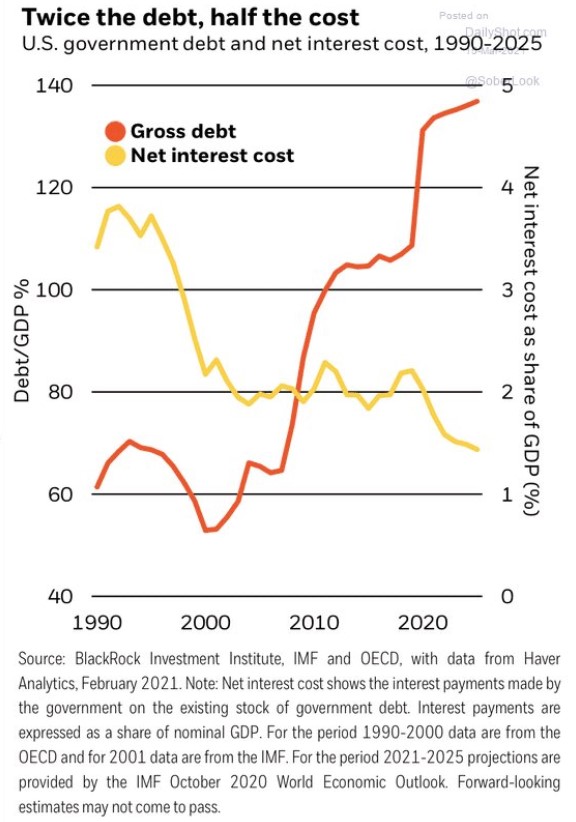

- What if the government wasn’t borrowing enough before?

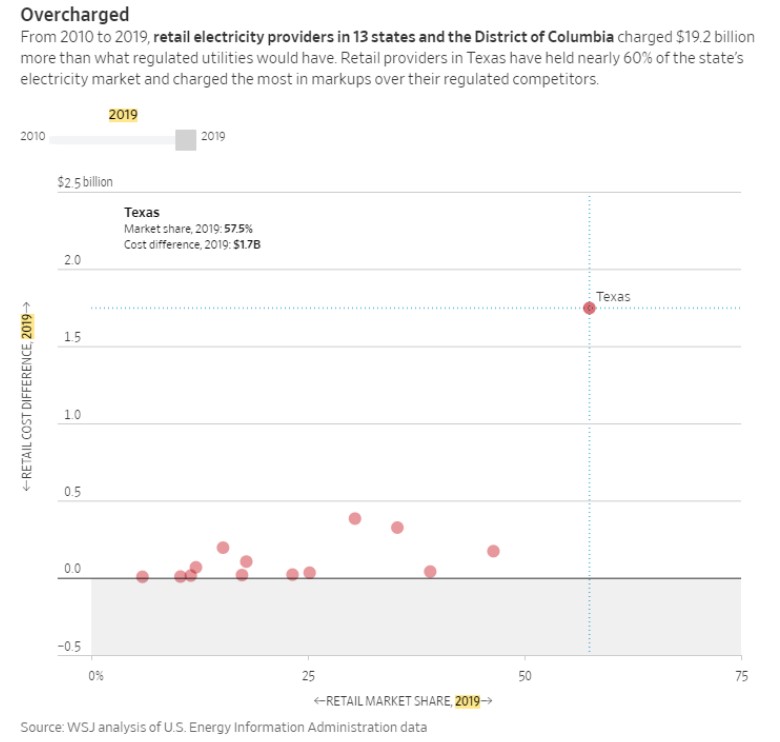

- Deregulation sounds better in theory than in practice

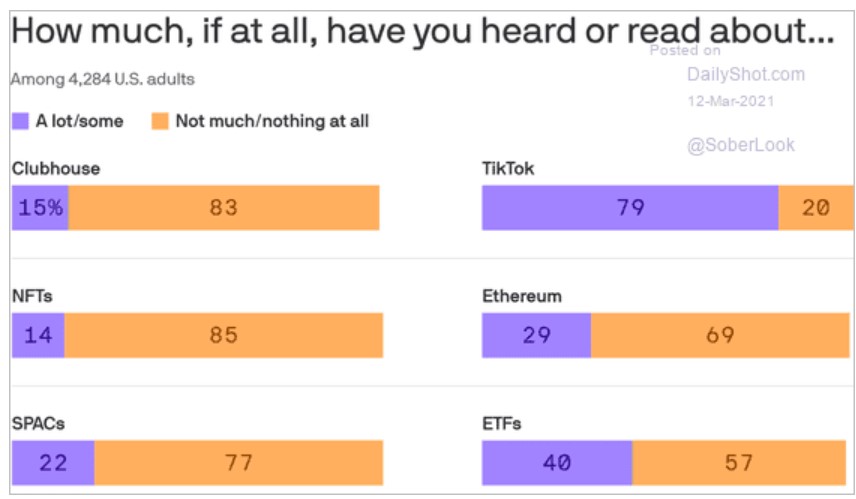

- How young and rich crypto investors are making NFTs happen

- The bull case for Door Dash

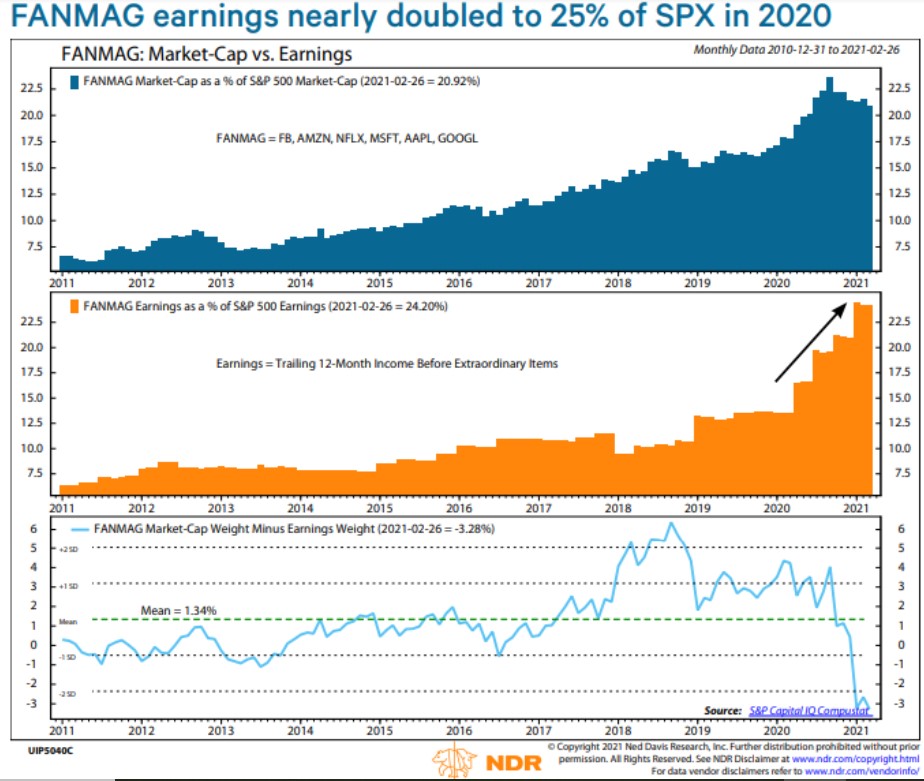

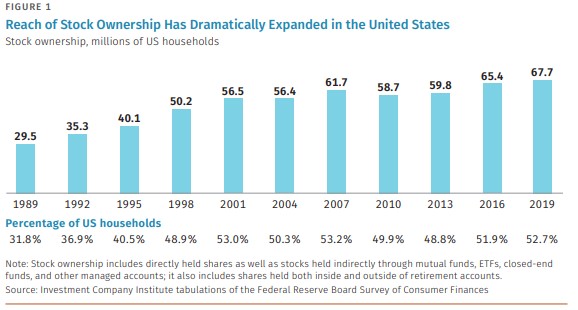

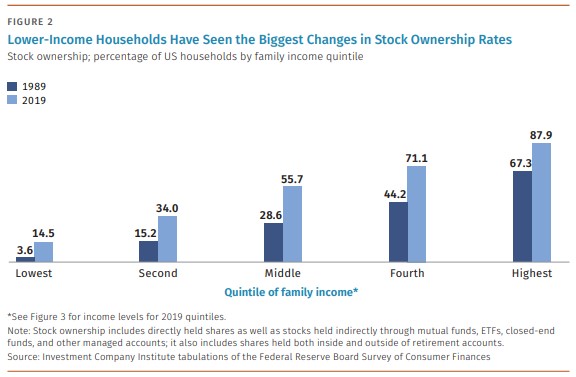

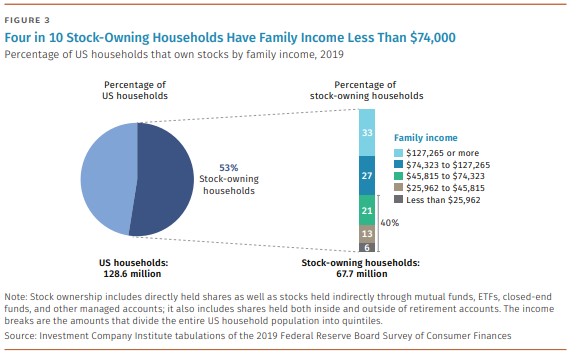

- Good news about stock market ownership

- Why we won’t have another commodities supercycle

- What if you missed out on a huge housing boom?

Listen here:

Stories mentioned:

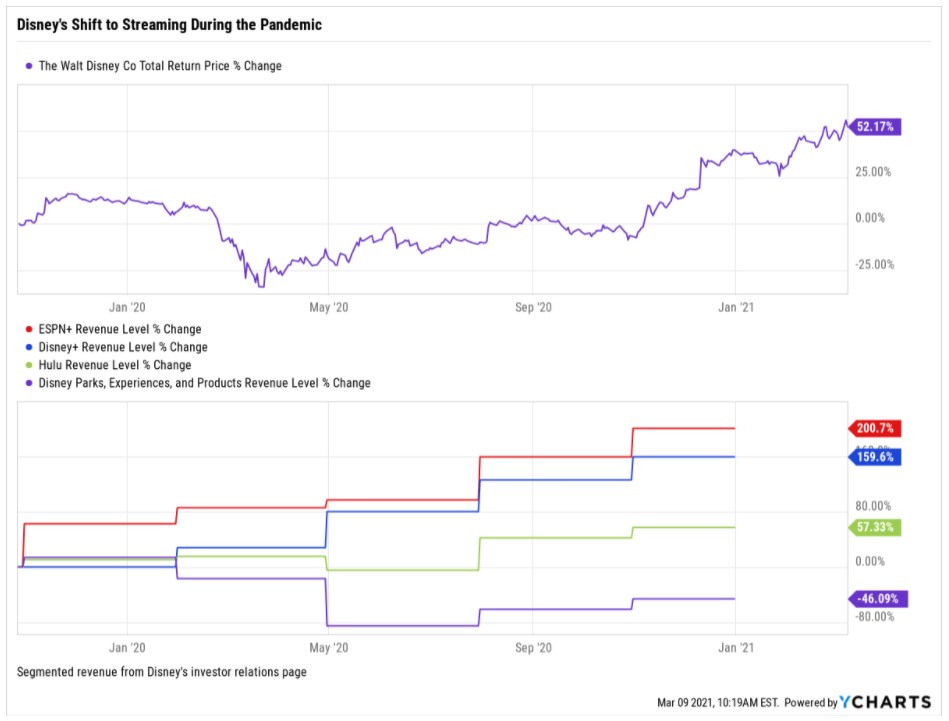

- Disney+ passes 100 million subscribers

- Cash out refinancings hit highest level since financial crisis

- 17 reasons to let the economic optimism begin

- The Fed isn’t printing as much money as you think

- Deregulation aimed for lower home-power bill

- Commodities supercycle looks like a stretch

- Beeple NFT fetches $69.3 million

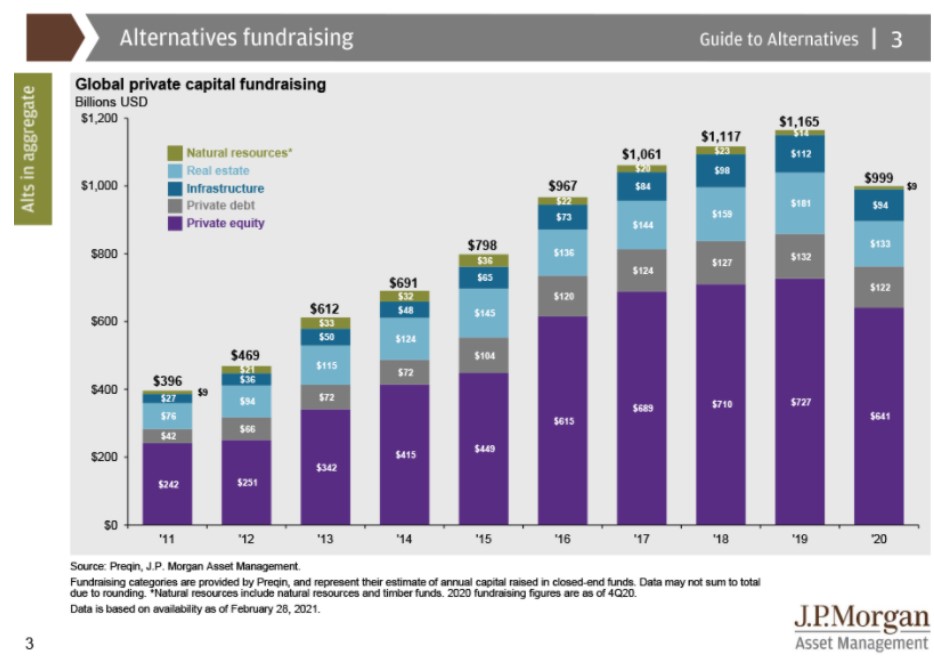

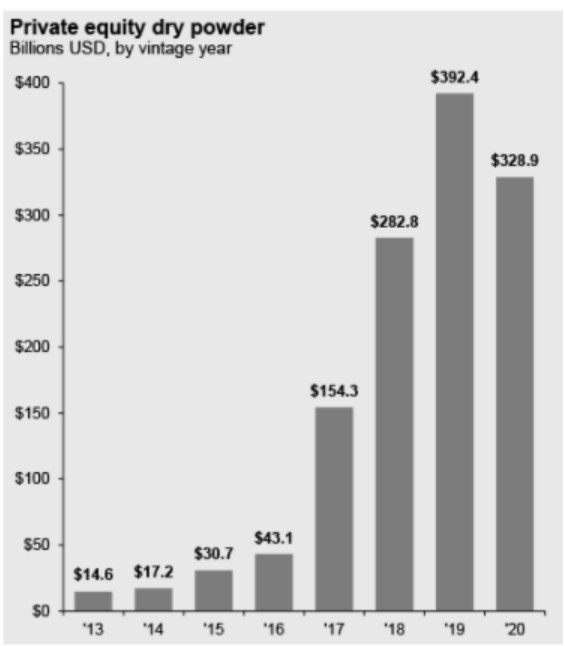

- JP Morgan guide to alternatives

- Door Dash: Reinventing last mile logistics

Books mentioned:

- The Rise and Fall of American Growth by Robert Gordon

- A Short History of Nearly Everything by Bill Bryson (and for the kids A Really Short History of Nearly Everything)

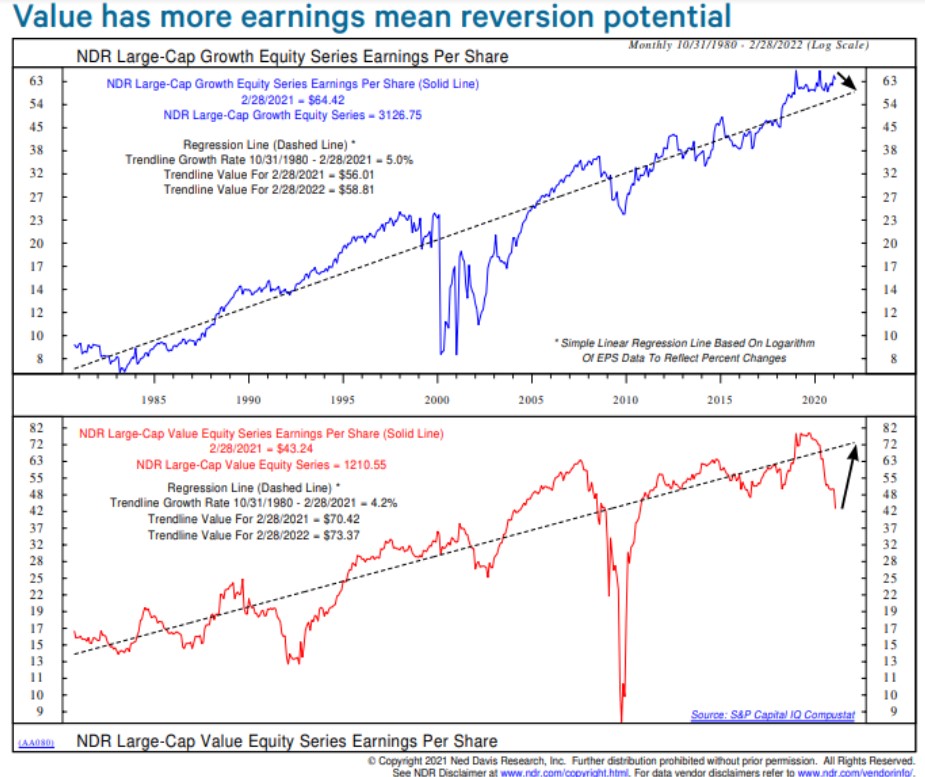

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on the Shuffle app.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: