In 2011, GMO’s Jeremy Grantham made a pretty bold call to buy commodities:

The world is using up its natural resources at an alarming rate, and this has caused a permanent shift in their value. We all need to adjust our behavior to this new environment. It would help if we did it quickly.

The rise in population, the ten-fold increase in wealth in developed countries, and the current explosive growth in developing countries have eaten rapidly into our finite resources of hydrocarbons and metals, fertilizer, available land, and water.

Statistically, most commodities are now so far away from their former downward trend that it makes it very probable that the old trend has changed – that there is in fact a Paradigm Shift – perhaps the most important economic event since the Industrial Revolution.

Maybe Grantham will still be right from a resources perspective, but from an investment perspective this one won’t go down in history as one of his better calls. See the price of oil since August of 2011, just after Grantham’s research note came out:

Here’s natural gas:

Gold:

Copper:

And corn:

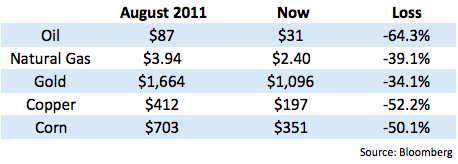

Now here are the returns on each of these commodities since Grantham’s dire proclamations:

If you look at individual stock names the results get even worse. Freeport-McMoRan (FCX) is down -91%. Potash of Saskatchewan (POT) is down -71%.

This is not an indictment on Grantham or an investor’s ability to forecast the future. The guy has been investing at a high level since the early 1970s and has an amazing long-term track record. His firm manages over $100 billion. He’s legit. But even the legends get these big calls wrong on occasion.

I remember reading this piece at the time and thinking much of what he was saying seemed to make for a compelling narrative. He was much more pessimistic about the future than I am, but many investors echoed his sentiments following the release of that outlook. There are plenty of commodities investors who have been burned in this cycle looking for a bottom. People were extremely worried about inflation because of the Fed’s “money printing” in 2011. You can probably count on one hand the number of people on this planet who were predicting $30/barrel oil in early 2016.

Getting these types of bold macro calls correct is insanely difficult, especially when you’re looking for a genuine regime change. Grantham has something like 40 years in this business. He’s lived through a number of different cycles and economic environments. I’m sure he himself and his firm have access to some of the top minds in the field. And he still couldn’t have been more wrong about this call.

It’s not only supply and demand that you have to worry about, but technological advances are nearly impossible to predict more than a few years out into the future. Preferences change. Demographics and economic growth rates have to be factored in. Plus, we are now dealing with more speculators than ever in the commodities futures markets. Funds are now employing satellites to track crops and livestock. They’re sending people to mines all around the world to check supplies of different precious metals and energy sources. These people still have a hard time making investment decisions based on this analysis.

Fundamental analysis is very difficult in the stock and bond markets. In commodities it’s damn near impossible.

Reminder: Markets are hard, even for the best in the profession.

Further Reading:

Are Commodities For Trading or Investing?

Well said. ” at least I ain’t lost”.

I typically find GMO’s Quarterly Letter (which is free to anyone who signs-up for it) to be of interest, and especially the firm’s “rolling” 7-Year Asset Class Return Forecasts. That said, I have always gotten the feeling (so much for relying upon science and analysis!) that Jeremy Grantham’s forecasts—at least the commentaries that he writes for the firm—tend to be colored by his seemingly ultra-liberal environmental (social and political?) views—–the human species is defiling the natural world…..we’re running our of resources……”we’re all going to die from global warming/climate change,” etc”

Thank you for reinstating the “Comments” section!

Agreed. Mixing ideology and investment recommendations is a slippery slope. I also read their quarterly missives, but lately I’m finding myself more interested in what Ben Inker has to say.

Me too. Inker is much more sensible and practical than is Grantham and what he writes is much more compelling reading to me vs Grantham. Grantham’s successes have emboldened him to predict stuff like the direction of commodity prices. He should know better. What does he say now about his predictions made back in 2011, that he could still be right? Haha.

Back in early 1970s people like Paul Ehrlich and the Club of Rome were making these “end of cheap commodities” and “hundreds of millions dead from starvation” just a decade or two away. Mr Grantham may be smart on a lot of things, I don’t know a great deal about him. But I’m pretty wary about doomsday claims about natural resources because of what happened 40 years ago.

All of the observations in your third graf from the end affect supply and/or demand. So yes, long term, we must concentrate on those ancient concepts. The problem is figuring out how these forces play out in determining supply and demand. Despite the simplified curves that economic textbooks may use to portray supply and demand and their effect on prices, the causes of each are probably too complex to model effectively. Grantham, whose quarterly commentaries are often eye-openers, focuses on the very long term, not next quarter or next year. unlike the shorter period portrayed by the graphs accompanying your column.

It was a Malthusian call on his part. Resonates with the choir but in reality it is poor grasp of history. He should have stopped at Julian Simon.