I have a confession to make.

I’m never going to make millions of dollars on a single investment.

I’m never going to create a start-up that changes the world and becomes a unicorn.

I’m never going to get rich overnight.

It’s simply not in my DNA.

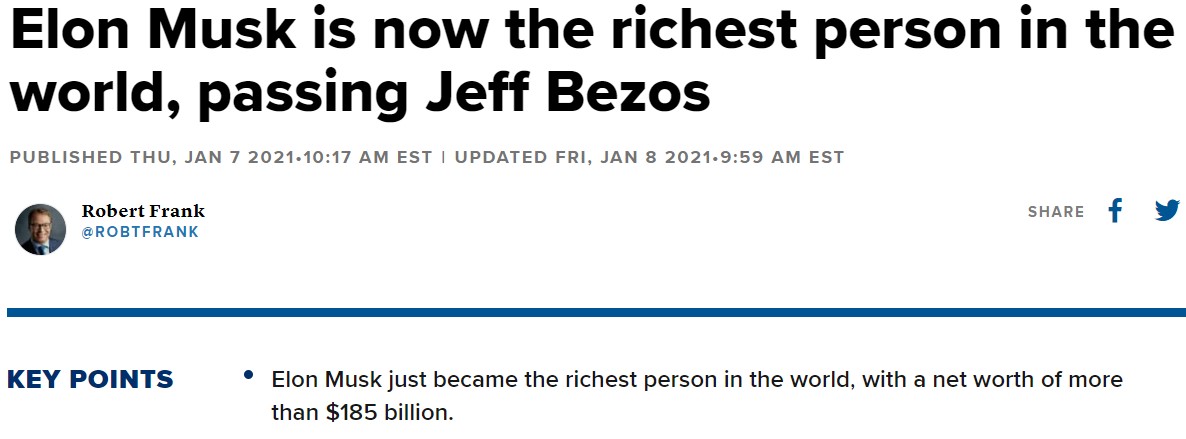

Do I get a touch of jealously when I see stuff like this?

Or this?

Sure. You wouldn’t be human if you didn’t dream about huge or seemingly easy riches.

But I’m OK with the fact that easy riches aren’t in the cards for me. Instead I’ve chosen (let’s be honest — accepted) the slower path to building wealth.

There are some downsides to this path.

I don’t get to brag on social media about how much money I made on a high-flying stock or business venture.

I don’t get to become rich overnight.

I don’t get to become a charlatan guru who preaches the easy steps you can follow to become wealthy.

I don’t get to create a world-changing company.

I don’t get to write a medium post about how transcendental meditation changed my life once I became a billionaire.

And I don’t get to know what it’s like to deal with a life-changing amount of money.

It can be difficult to stick with your own investment plan when you see others hitting the jackpot during a raging bull market.

But there are some upsides to being comfortable in your own skin as an investor.

I’ll never found a company that makes me fabulously wealthy but I’ve also never worked 80 hour weeks in a stressful job that causes other areas of my life to suffer.

In fact, I could probably count on one hand the number of times I’ve gotten home from the office past 5:30 in the evening in my entire career.

So while I’ll never understand what it’s like to be the founder of a hot tech start-up, I will always know what it’s like to have dinner with my kids every night of the week or have my weekends free from the stress of my job.

And while I’ll never know what it’s like to receive life-altering stock options, having enough flexibility to regularly workout, read, watch TV and work only on the projects I truly care about is a decent consolation prize.

Don’t get me wrong, it’s great we have people like Elon Musk or Steve Jobs who push the boundaries of technological innovation on our behalf.

I’m just not a type-A personality like them.

I’ll never put my life savings into a single investment that could go to the moon but being a diversified investor means I’ll never put my family in the position of being completely wiped out by a single position.

Lottery winnings from an investment are likely not in my future but neither is the stress that comes from investing your life savings in a single position.

I simply don’t have the emotional make-up to take extreme positions when it comes to investing. Sometimes I wish I did. But it’s important to remind myself for every Tesla investor who hit the lottery, there are thousands of other tickets that never hit.

And I’m not necessarily saying those people who pursue this type of strategy are wrong. I admire people who have the intestinal fortitude to hold a moonshot investment that swallows the rest of their portfolio whole.

As long as people go into this type of strategy with their eyes wide open to the potential risks, who am I to judge?

Life and risk are both full of trade-offs.

I know clients with tens of millions of dollars who have the ability to take lots of risk but not the desire so they play it safe.

I know other clients with tens of millions of dollars who have the ability to take lots of risk and do so with certain parts of their portfolio because they can.

So much of the success for any investment or wealth-building strategy comes down to your personality.

For me, building wealth slowly over time suits my personality better than the alternatives.

And the best part about building wealth slowly is…it actually works.

At least for me.

I’ve been saving and investing for more than a decade-and-a-half. Although it was hard to see progress at the outset1, I have more money saved as I inch closer to the big 4-0 than I ever would have thought possible when I first started my financial journey.

Had I made some extreme bets with my career or portfolio I could have way more money but those bets also could have crashed and burned, leaving me in a far worse position.

What ifs are useless when it comes to your finances.

And the most important aspect of my deliberate wealth-building strategy is not that it works, but that it works for me.

It may not work for others.

Some people can’t help but take boatloads of risk. Others prefer day-trading or concentrated deep value investing or tech inventing or venture capital or investing in private businesses or real estate or starting their own business or something else entirely.

And that’s fine.

There are plenty of different ways to build wealth.

The important thing to remember is you don’t have to follow someone else’s path just because it looks easy.

There are always trade-offs in life and investing.

Further Reading:

My Strategy For Dealing With FOMO

1I can mostly thank the 2008 crash and a tiny salary early in my career for that.