Tis the season for gratitude and thankfulness. Here are some of the things this awful pandemic has given me a greater appreciation for this year:

Teachers and schools. My first-grade daughter has always enjoyed going to school but having so many stops and starts since March has created a situation where absence makes the heart grow even fonder.

We lost the end of the last school year, the first month or so this fall and have had 3-4 switchbacks between in-school and virtual classes.

She is now devastated when she can’t go and is forced to go virtual and ecstatic when she goes back. Her teacher told us many of the kids have a similar newfound appreciation for in-class learning.

But this situation has also helped drive home the importance of in-class education for myself as a parent. My wife has admirably handled most of the virtual schooling when my daughter is home but I’ve pitched in as well.

It’s not easy and I can see how much my daughter desires being around her classmates for the social aspects of school.

Luckily, kids are extremely resilient and despite her preference for being in school, my daughter has been a total trooper throughout the entire ordeal.

The outdoors. When the shutdowns came in March so many of our usual activities were taken away. No more organized sports for the kids. Playgrounds were closed. No school or daycare. Those first few weeks were tough.

One of the things we did to keep our sanity and not stare at a screen all day was introduce more outside time.

We went on hikes, rode our bikes everywhere we could, went on more family walks, spent the summer on the water and played outside as much as possible (weather permitting).

Exercise has also provided a welcomed release valve. Even though I bought a Peloton I’ve probably logged more hours running outside more than any other year in 2020 because it feels good to get some fresh air.

Drinking draft beer at a bar. My 3-year-old son has asthma and has been in the hospital on multiple occasions for shortness of breath so our family has been very careful throughout the pandemic. I just don’t see the need to go to a restaurant or bar other than takeout for our situation.

But I do miss having a cold draft beer while sitting on a barstool. I can’t stay up late like I used to so a mid-afternoon beer or 3 straight from the tap is about as good as it gets at my age. I’m ready for bars to get back to normal.

When this is over I have a feeling bars are going to be packed.

Movies. The golden age of television and streaming services has led to a downfall in the quality of movies in the past decade or so. The majority of new releases at the box office are superhero movies, sequels and remakes.

But 2019 saw a resurgence in quality movies and the fact that the pandemic pushed back the release dates of so many anticipated 2020 flicks has given me a greater appreciation for Hollywood.

Especially in the early days of the pandemic, I needed something to get my mind off the real world. Movies helped fill that void.

Since there haven’t been many new releases this year, the never-ending catalog of old movies on the streaming services helped pick up the slack. I’ve been rewatching old favorites all year.1

And the movies that were released on-demand or on a streaming service (Palm Springs or The King of Staten Island) were probably better movie-going experiences at home than at the theater.

Mindless entertainment has been a nice reprieve.

Spontaneity. The older I’ve gotten the more routine-oriented I’ve become. And with three young children, we’ve had to follow a schedule for a number of years now.

But it’s still nice to be able to pick up and go somewhere for the day or weekend without having to worry about the consequences.

It will be nice to be spontaneous again when this is all over.

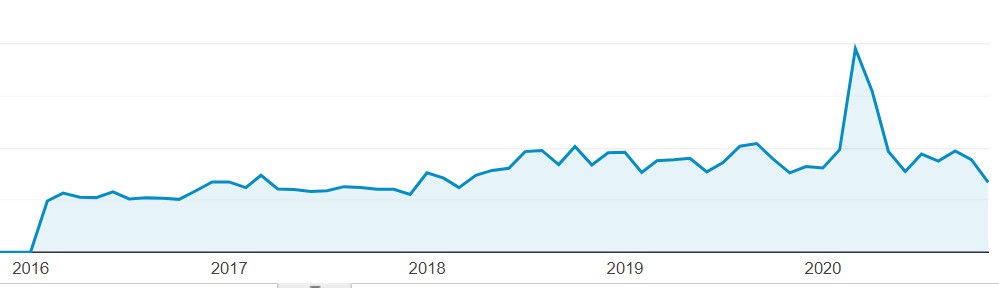

Writing. March 2020 was by far the most traffic this website has ever seen. Check out that spike:

People pay more attention when markets go haywire. There’s always going to be an inverse correlation between the market’s direction and the number of people reading about markets.

When crazy things are happening in the markets you don’t have to look far for inspiration on writing topics but I also felt the process of writing was cathartic.

The outcome seems obvious in hindsight but that 4-week stretch from late-February through late-March was more intense than anything I can remember even in the 2008 crash.

Writing about what was happening and putting it into context was helpful to me personally because it provided an outlet and reminder about my long-held investment beliefs.

Further Reading:

The Only 5 Things You Can Invest In

1The Rewatchables podcast at The Ringer has helped. Here are some movies I’ve rewatched this year: Seven, Knocked Up, The American President, Kicking and Screaming (the 90s one), The 40-Year-Old Virgin, Swingers, Armegeddon, Groundhog Day, Cast Away and Tommy Boy. And of course, my annual Thanksgiving rewatch — Planes, Trains and Automobiles.