The stock market is in the midst of a 12% correction.

Things look bleak and could certainly get worse. But unless we find ourselves in a Japan scenario (something I don’t believe to be true), the stock market will recover eventually.

I’m far more worried about the bond market right now than the stock market.

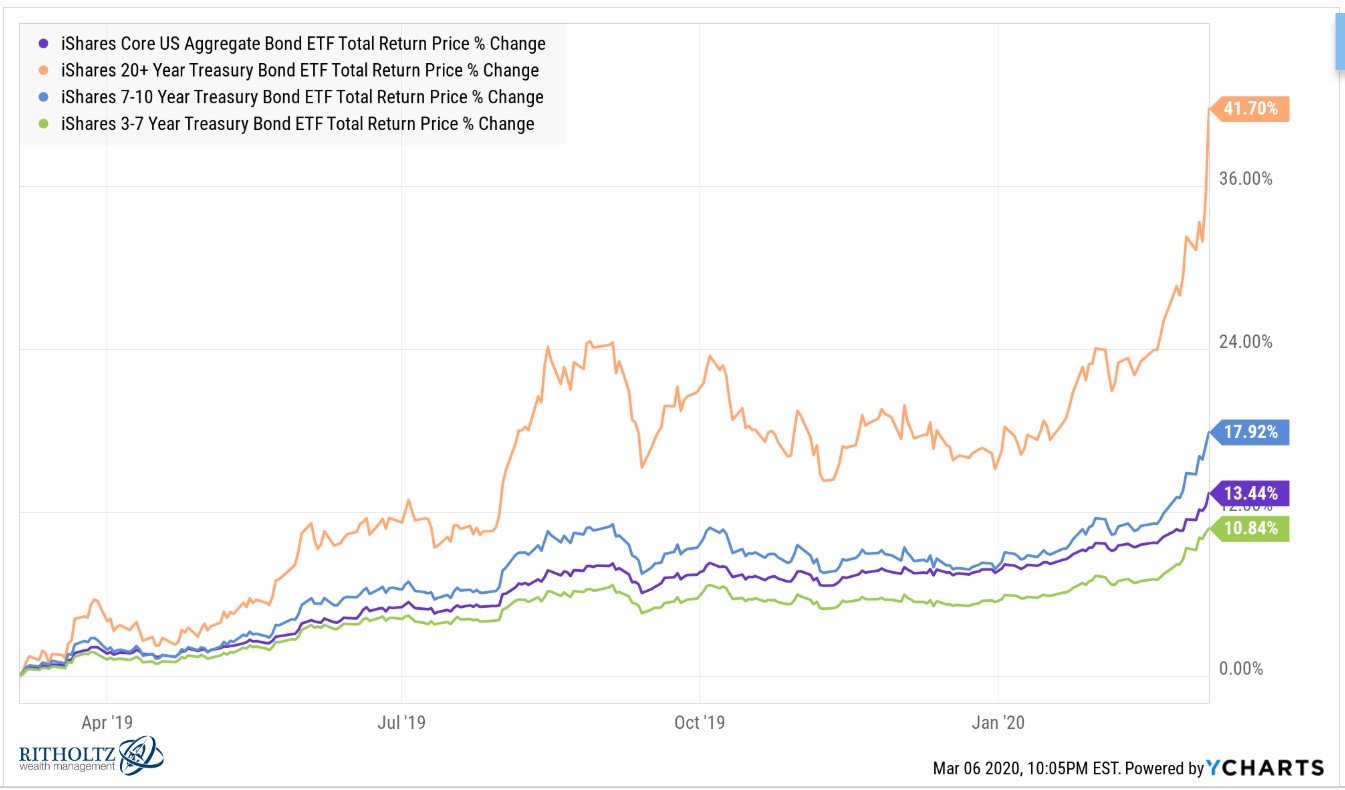

But Ben, how can you be worried about bonds? Just look at these returns over the past year:

Considering the level of interest rates these returns started from, this performance is insane for bonds. And bonds are once again proving to be the most valuable diversifier on the planet during a stock market sell-off. They are doing their job as a portfolio stabilizer and stock market hedge.

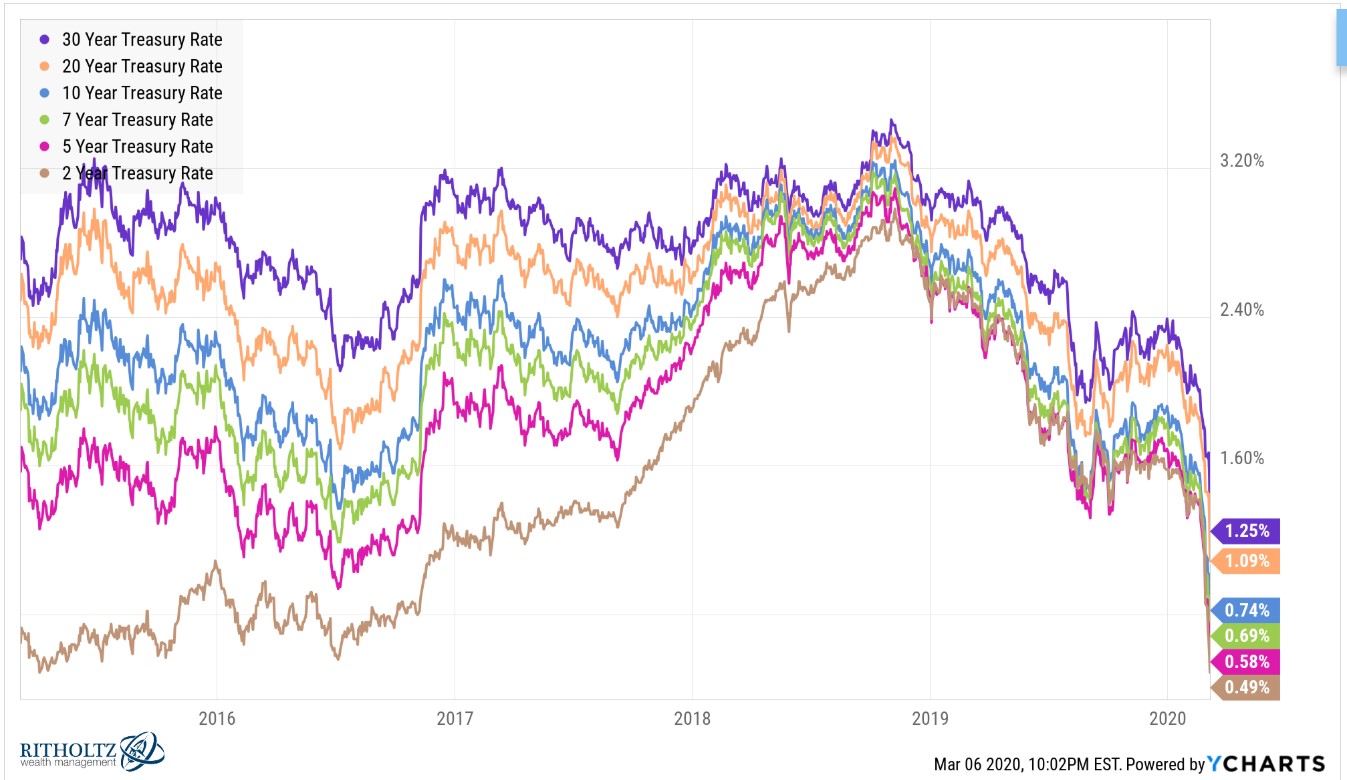

But just look at this waterfall in U.S. treasury rates:

Across the board, rates have fallen off a cliff in recent weeks.

After cutting rates this week, the Fed is now targeting a range of 1% to 1.25% on the Fed Funds Rate.

That means every treasury bond yield is now at or below the short-term interest rate tool the Fed uses to conduct monetary policy. These moves, from such low starting levels, are nuts.

It’s highly likely the Fed will cut again in the coming months if things continue to deteriorate because of the coronavirus. Longer-term rates are all but forcing the Fed to continue cutting but I’m not sure how much help lower interest rates will be for the economy.

I’m not blaming the Fed here because they have no other choice if we’re not going to get a massive fiscal stimulus package from the government.

Sure, everyone can now refinance at ridiculously low rates (I just locked in under 3%) and that should help a lot of people when it comes to their finances. Young people buying their first home and doing so with mortgage rates hovering around 3% should be thrilled right now.

I’m not as worried about the present as I am about the future when it comes to interest rates.

It seems like a foregone conclusion that rates in the U.S. go negative during the next recession, as I predicted on this week’s Animal Spirits:

I never rarely make these types of predictions and could easily be wrong but it seems like we’re heading for a world in which interest rates on high-quality bonds could go below zero.

Even if rates don’t go negative I have many questions for an environment where bonds earn little-to-no interest:

- What does a world with no yield look like for investors?

- How will pension plans, insurance companies and retirees navigate this environment?

- What does this do for portfolio return expectations?

- How many investors will chase yield to their own detriment?

- Or is chasing yield the only option for many yield-starved investors?

- How much more volatility will investors need to accept to reach their goals?

- Will more investors put money into the stock market because of this?

- How will the asset management business react to this new world of low rates?

- Rates can certainly rise just as fast as they’ve fallen but what if they stay low for a prolonged period of time?

My biggest worry at this moment is forward long-term returns for bonds are now guaranteed to be basically nil. Even a whiff of inflation all but means negative real returns on bonds for the foreseeable future.

Even long-term returns in the stock market are hard to predict in advance. That’s not so with high-quality bonds.

Starting yield is by far the biggest predictor of long-term bond market returns. The correlation is somewhere in the 0.90-0.95 range depending on the maturity. This means you can more or less take the starting yield on your bond fund and over the next 5-10 years that will be your return (plus or minor some minor variations from interest rate moves).

That means all high-quality bond investors are now looking at 1% or so nominal returns on their bonds from current levels. Real rates will almost certainly be negative over the next 5-10 years unless we see massive deflation.

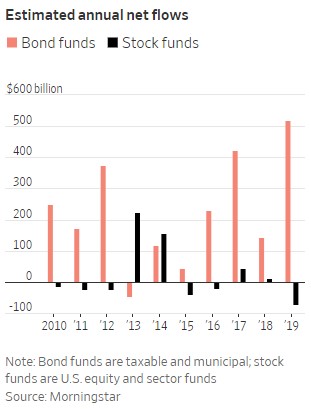

Last month Jason Zwieg reported on the staggering inflows to bond funds over the past decade:

From 1990 through 1999, bond funds and bond ETFs accounted for only 10% of the cumulative $2.37 trillion that flowed into funds, according to the Investment Company Institute. From 2000 through 2009, bond funds made up 26% of the $3.5 trillion in total inflows. Over the 10 years just ended, however, 74% of the total $2.68 trillion that investors added went into bond funds.

Here’s the visual to put these numbers into perspective:

It may seem bizarre that so much money has been flooding into bond funds during an 11-year bull market in stocks but this actually makes sense. Much of this bond buying is likely being done by aging investors who are diversifying their portfolios. It’s a prudent thing to do from a portfolio management perspective as you age.

Here’s the good news — even with interest rates so low, bonds will still:

- dampen volatility in comparison to the stock market.

- provide a hedge when stocks fall.

- give investors a form of dry powder for rebalancing or spending in a down market.

Now for the bad news:

- the margin for safety in bonds is now razor-thin.

- even a small bump up in rates could wipe out years of yield.

- expected returns in bonds are as low as they’ve ever been (nominally).

- it won’t take much inflation to wipe out nominal gains.

- low interest rates likely mean lower returns across the board elsewhere too.

- there are going to be a lot of pension plans in trouble because of this.

No one can predict the future path of rates so it’s possible this all works itself out in the coming years as rates slowly but surely rise back to a more reasonable yield. But that scenario is not guaranteed.

Anyone who tells you they know exactly how this all plays out going forward is either lying to you or themselves. I’m still thinking through what this all means so I have more questions than answers at this point.

We’re all facing an unprecedented situation.

I’ll have some thoughts in the future about how to deal with this situation but investors are going face some tough decisions when it comes to allocating assets over the coming years.

Further Reading:

Something I’m Worried About

My Questions About Negative-Yielding Debt