For the foreseeable future, we’re going to two podcasts a week. Markets are crazy and there’s plenty to talk about.

We discuss:

- The wreckage going on in businesses all across the globe?

- Doesn’t main street deserve to be saved more than Wall Street?

- Searching for some positives in a negative world

- How high could unemployment get?

- How much could GDP fall?

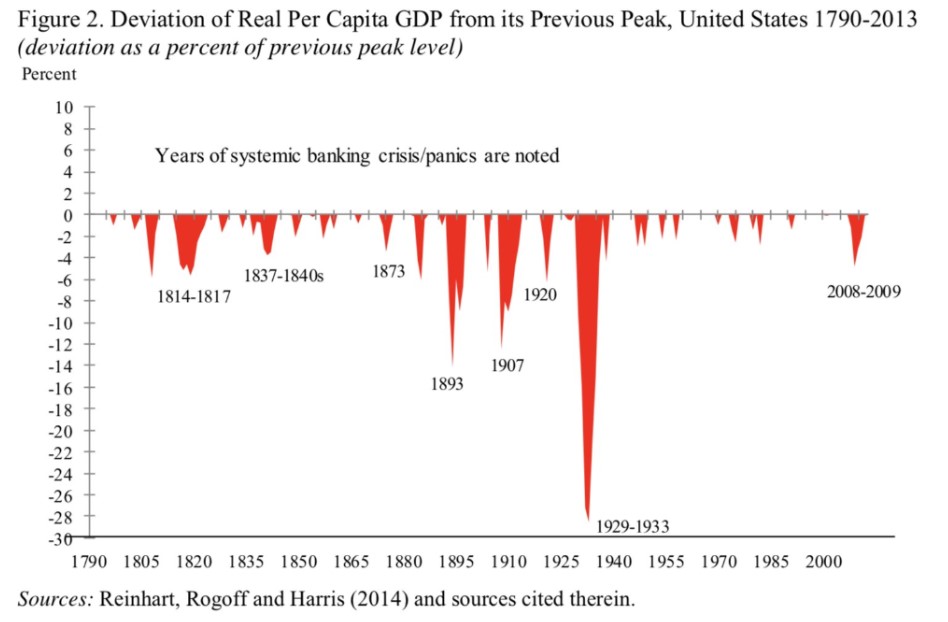

- Why the Great Depression comparisons don’t hold water

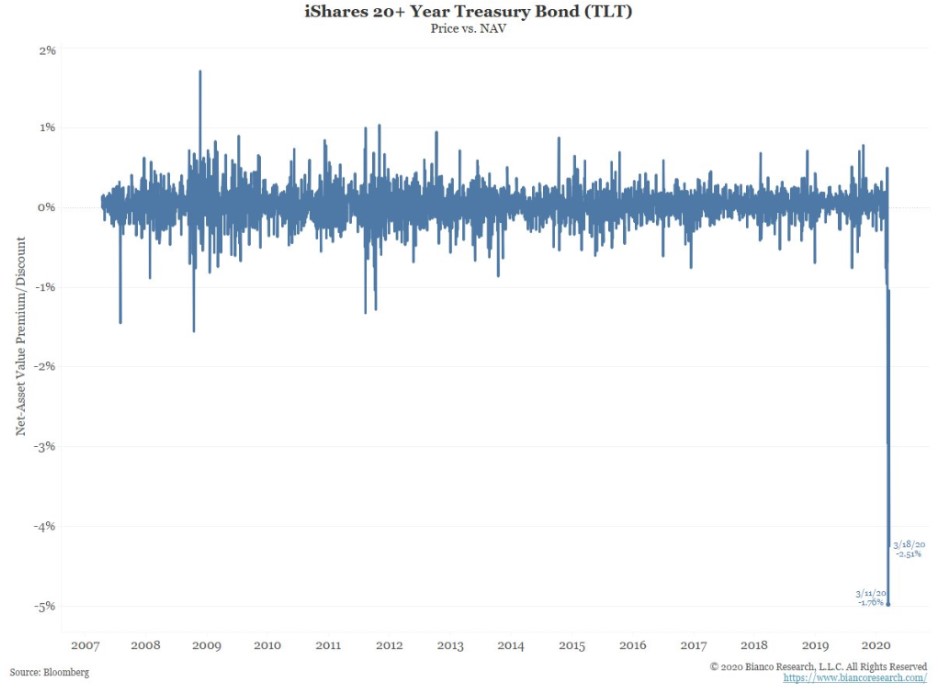

- Why are bonds selling off here?

- Does winner-take-all only get worse from here?

- Will an entire generation of entrepreneurs be lost?

- How are hedge funds holding up?

- What are the lingering effects of this crisis going to be?

- Will the recovery be as vicious as the downturn?

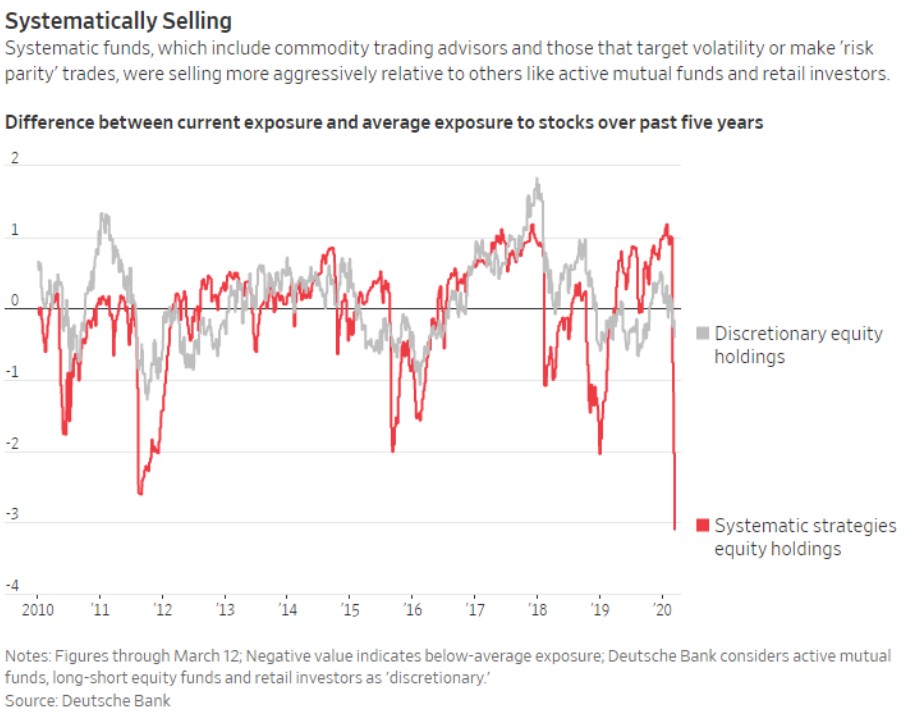

- Are algos making things worse in the market?

- Why they shouldn’t shut down markets

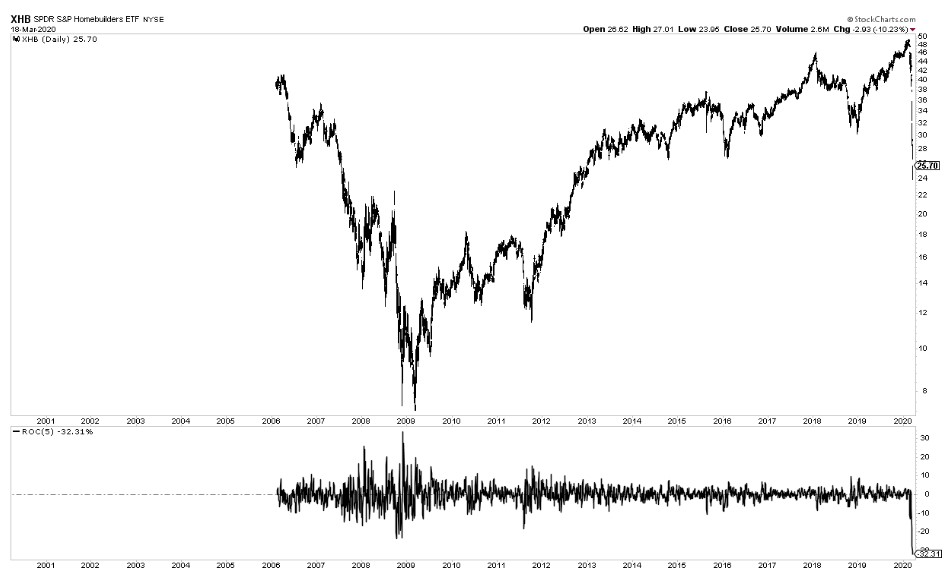

- Is this 2008 or 1929?

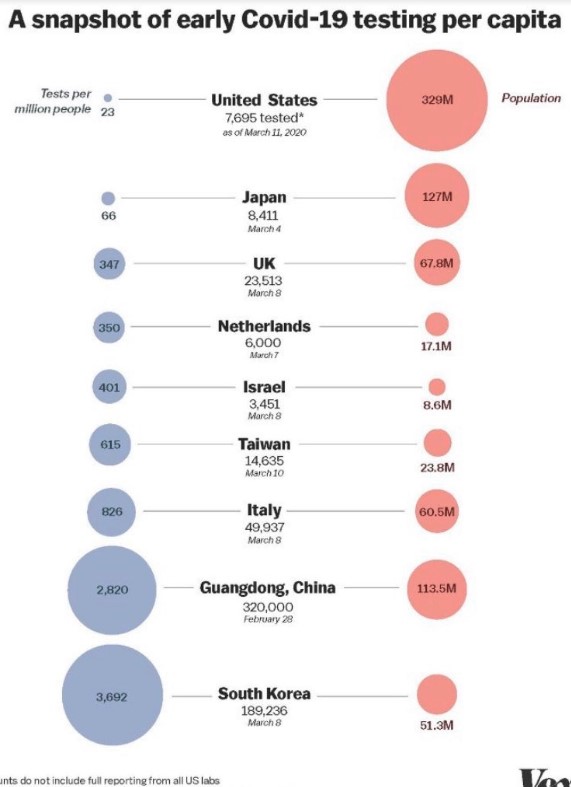

- Is China a light at the end of the tunnel for us?

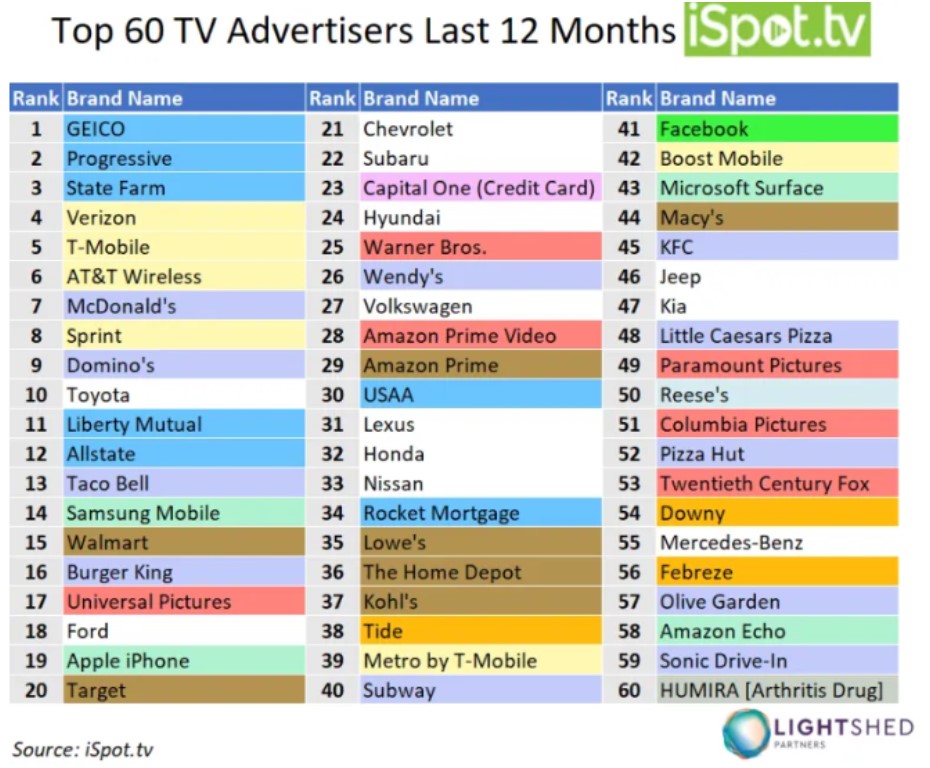

- Is the advertising industry toast as well?

- Rebalancing, dry powder, asset allocation and more

Listen here:

Stories mentioned:

- Union Square lays off 2,000 workers

- Mnuchin warns virus could lead to 20% jobless rate without action

- Cash is all that matters

- Hedge fund performance during the crisis

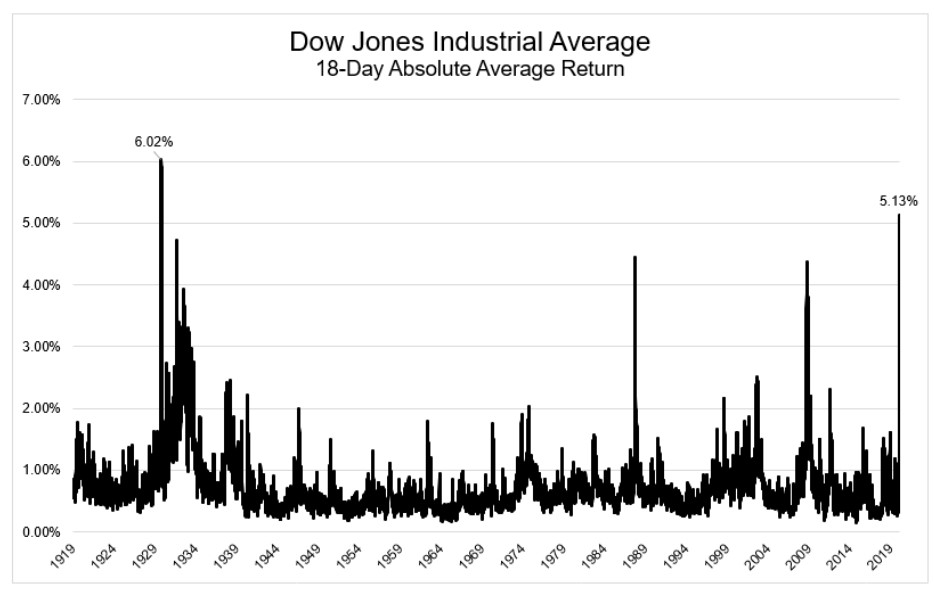

- Why are markets so volatile?

- US postpones tax payments for 90 days

- A hub for money help during the crisis

- GM offers to make ventilators

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on Shuffle.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: