A podcast listener asks:

What do you think the future looks like for people with the CFA designation/skillset? We’re hearing constantly that the investment management function is becoming commoditized.

As a 30-year-old charterholder, it’s disheartening to not know where I fit in our industry. I’m effectively being let go from the small RIA I work at because the owner is looking for a more “pure” client-facing advisor.

I understand the consternation here.

It does feel like there’s been a sea change over the past couple of decades. Investors are moving to low-cost index funds in a big way. Financial advisors have been replacing brokers. Star portfolio managers are a dying breed. Asset allocation, model portfolios, risk questionnaires and financial planning have become ubiquitous. Stock-picking as a hobby is on the wane.

Financial advice is overtaking investment management in many ways. Not only that but there are more CFA charterholders than ever.

The CFA Institute says there are more than 164,000 as of the end of 2018, along with another 226,000 candidates currently enrolled to take the exams.

On the one hand, it’s not a bad thing to have a graduate-level certification in the investment business. On the other hand, there’s more competition for investment jobs than ever in a time when parts of the investment industry are likely going to shrink.

Investment professionals aren’t going away anytime soon but it’s likely becoming harder to find your way on a portfolio management career path.

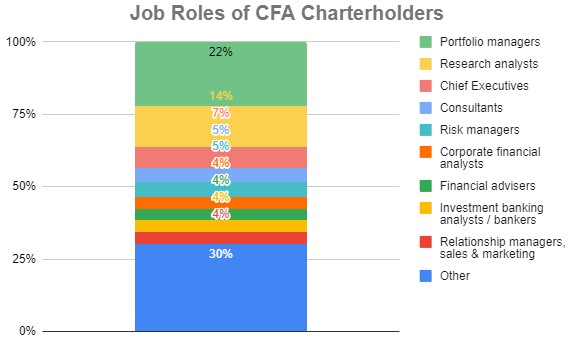

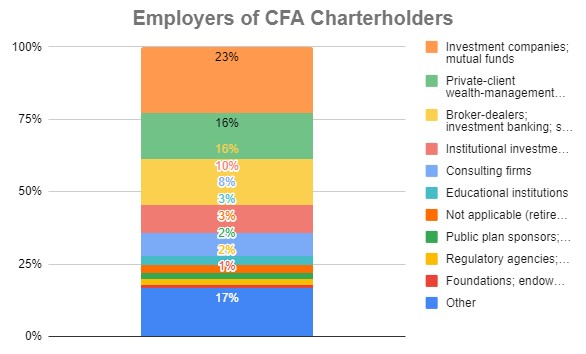

There are, however, plenty of different opportunities available in terms of the range of both jobs and employers. The 300 Hours blog broke out the various roles and employers of CFA charterholders:

The problem is you must have a specific skillset these days to stand out from the crowd. Simply having your CFA designation is not enough. In fact, for many employers, that’s now table stakes. They expect you to have it.

Michael and I discussed this one on the podcast this week and came to different conclusions:

Michael advised a change from investment management to financial advice. The CFP route could work for those who would like to translate their investment skills into more of a financial planning role. I know plenty of people in the industry who have both the CFA and CFP designations (my colleague Blair for instance).

As I explained in the podcast, there is another route if you have no desire to become a financial advisor.

The way I see it, there are two paths you can take in almost any career: (1) you can become a generalist and have a wide range of skills, knowledge or abilities or (2) you can become a specialist and have a specific niche you serve and understand that niche really well.

I typically advocate for the generalist approach when you’re young because you still have so much to learn and very few people really know what they want to do when they’re just starting out in their career.

I had no clue what I wanted to do when I got into the investment industry. Educating myself on alls things markets, investing, and human behavior during my formative years has been invaluable for my career.

But many young people are bound to hit a crossroads in their career either by choice or force. Sometimes people need a new challenge or want to try something new (that was me) and sometimes industry dynamics force your hand (as is the case from the person asking for advice here).

As your career progresses it becomes more and more important to have some sort of specialty you can rely on.

Even if your work doesn’t involve security selection, portfolio management extends beyond asset allocation and fund selection. You could become a specialist in any of the following areas to prove your worth to both clients and wealth management firms:

- Tax planning

- Portfolio withdrawal strategies

- Retirement portfolios for specific client types

- Asset location strategies

- Investment and tax planning for specific industries

- Educating and communicating with clients about the markets and their portfolio

- Social security strategies

- Employee stock ownership plan strategies

- Tax management for small business owners or people with large single stock exposure

I’m sure I missed a few things but you get the idea.

Financial advisors are typically busy dealing with the financial needs of current clients, prospecting for new clients and dealing with all of the business realities involved in the industry. Depending on the size of the firm in question, most advisors don’t have the skillset or background to deal with the majority of the market-related stuff.

Investment professionals can still provide value-add in this space. You just have to prove that value-add extends beyond the standard investment knowledge that becomes more and more widely known and commoditized by the year.

When I first started out in the industry I only wanted to be a behind-the-scenes number cruncher. I wanted nothing to do with clients because I never saw myself as a salesman. I quickly learned that wasn’t going to be possible for most of the positions in the investment industry (I also learned working with clients is one of the most rewarding aspects of this profession).

So being able to marry the investing side of the equation with the advice side of the equation and understanding how to communicate both of those topics is exceedingly important.

The best way to stand out from the crowd is by planting your flag on a specific niche. You need to become an expert in something.

Otherwise, you’re just one of the hundreds of thousands of other people who all studied the same material and took the same exact test as you did to get those 3 letters after your name.

*******

Here are the full highlights from this week’s show:

Subscribe to the Animal Spirits playlist to watch these highlights every week.

Further Reading:

The CFA vs. MBA Decision

Now here’s what I’ve been reading lately:

- Good things happen because bad things are allowed to (Capital Mind)

- The only thing that matters is perceived value (Waiter’s Pad)

- What drives stock market prices? (Klement on Investing)

- Video: Dave Nadig on what free trading means for investors (Big Picture)

- Why don’t rich people just stop working? (New York Times)

- Economic ignorance (Crossing Wall Street)

- Can stamina be taught? (Abnormal Returns)

- An incredible story of survival (ESPN)