Last week I had a call with a reporter about long/short mutual funds.

He shared with me the readers of his publication like the idea of a hedged product with the potential for lower volatility in today’s market environment but they can’t wrap their heads around the poor performance in the category.

It’s not just long/short funds that have struggled. Pretty much everything in the liquid alternatives category has had a tough run.

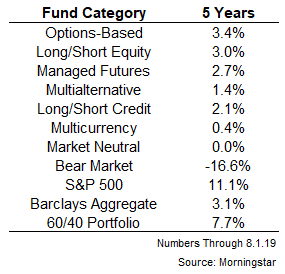

Here are the 5-year returns for various funds in the Morningstar alternative fund universe by category:

It’s no surprise liquid alts have gotten crushed by the S&P 500 over the past 5 years. You can’t expect non-correlated products to keep up during a raging bull market.

But it can’t be reassuring alternative strategies have badly lagged a 60/40 portfolio and all but one category average is behind high-quality U.S. bonds.

The reporter asked why these funds have had such a difficult run, not only over the past 5 years but the previous 5-10 years as well.

I’m not making excuses but here are some reasons alternatives have struggled:

Low interest rates. Alternative strategies are basically cash-plus return streams because they try to hedge out a portion of market risk. When you short securities you borrow shares, pay a fee to a prime broker called a borrow rate, receive cash for the proceeds, and then hope to buy back the shares at a lower price, pocketing the difference.

Funds sit on that cash and invest it in cash equivalents. As recently as the mid-2000s, you could earn 5-6% on that cash. Not anymore. This has hurt returns.

Factors. Not all but many alternative strategies are factor-based in some form, the most prevalent of which is the value factor. Value has gotten destroyed by growth over the past decade or so.

Going long “cheap” stocks and short “expensive” stocks has been a painful strategy since the best play has basically been to be long growth stocks.

Competition. Individual investors can now easily put their money into funds and strategies that would have been impossible to access 10-15 years ago. But this access has increased the competition in the space and nothing hurts successful investing strategies like success.

Fees. Expenses in liquid alts are lower than the 2&20 hedge fund fee structure but they’re still far higher than index funds. That hurdle rate combined with low interest rates has been a severe headwind.

While the performance hasn’t been pretty the reasons many have turned to these strategies — diversification benefits, low interest rates, above-average valuations — haven’t changed.

Alternatives are more complex than the plain vanilla asset classes so they require additional education and understanding before ever even thinking about dipping your portfolio’s toe in the water.

I’ve been tracking alternatives since early in my career working with nonprofit portfolios, many of which are enamored with these strategies. I’ve seen the downsides to alts so I have a love-hate relationship with this space. Liquid alts in an ETF structure are a step in the right direction because they address many of the problems I have with hedge funds (high fees, illiquidity, lack of transparency, hundreds of pages in legal documents, etc.).

So I’m excited to talk with a group of intelligent people who have a deep understanding of alternatives at our Wealth/Stack Conference next month in Scottsdale, AZ.

Here’s the line-up for the panel I will be overseeing:

- Yasmin Dahya, JP Morgan

- Will Rhind, GraniteShares

- Dan Villalon, AQR Capital Management

- Shana Sissel, CLS Investments

Yasmin is one of the smartest people Michael and I have had on Talk Your Book on our podcast. Will is one of the brightest minds in the commodities markets (and also a wonderful Talk Your Book guest). Dan works for what many consider the Vanguard of liquid alts and moonlights as the co-host for one of the best podcasts about these types of investments called The Curious Investor. And Shana is a portfolio expert with over two decades of experience working with alternative investments and educating advisors.

There will also be a live Animal Spirits podcast at the conference in addition to the ridiculously loaded list of speakers we’ve secured.

And beyond the speaker list I know for a fact there are hundreds of intelligent people from the industry and many of my favorite Finance Twitter personalities who will be in attendance. One of my favorite parts about these events is talking to other attendees in the mingling, socializing, eating, and drinking portion of the conference.

There will be plenty of interesting people to interact with at Wealth/Stack.

The conference is filling up but there are still slots available here.