The Vanguard Balanced Fund (VBAIX) was down 4.73% in October.

This was the worst monthly return for this 60/40 stock/bond fund since September 2011 when it fell 5.0%.

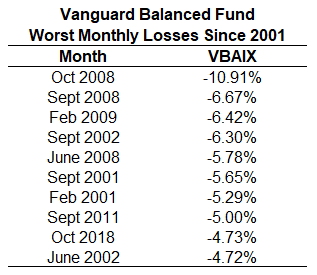

The data for this fund goes back to 2001 so I looked at the worst monthly losses to get a sense of where this past month ranks. These were the 10 worst monthly performance numbers:

October was the ninth worst monthly return since 2001. You can see the other big down months all correspond with a bear market or decent-sized correction.

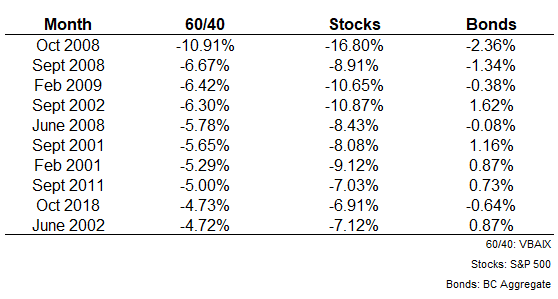

Investors these days are worried about their bonds because interest rates are rising but it’s important to remember where the risk lies in your portfolio in terms of losses. The stock side of the equation will almost always lead the way when it comes to short-term fluctuations and drawdowns.

Here are those same down months along with the corresponding monthly returns for stocks and bonds:

Bonds did lose money in a handful of these months but you can see the big losses for a 60/40 portfolio mainly come when stocks are down big.

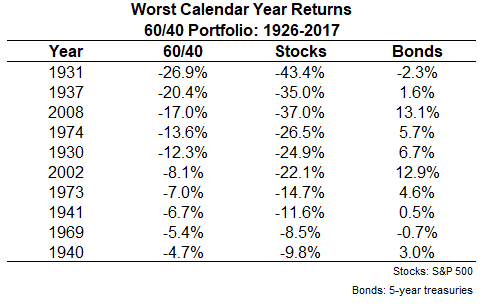

This same relationship holds when we look out a little further. Here are the worst calendar year returns for a 60/40 portfolio back to 1926:

The worst annual returns for the 60/40 portfolio occurred during 8 out of the 10 worst calendar year returns for stocks (and the other two were in the top 15 worst years).

Based on the feedback, I may have scared a few investors away from bonds because of my piece on real drawdowns from a couple weeks ago. The whole point of the data presented there was to show that the different pieces in a balanced portfolio have unique risks.

The biggest short-term risk in a balanced portfolio will almost always come from the stock market. But the long-term risk for any investor is the rate of inflation and the loss of purchasing power. Anyone invested in a diversified portfolio must get used to dealing with these competing forces in their portfolio mix.

Even though yields are lower on bonds than they’ve been over the past four decades or so, they can still earn their keep by dampening volatility and minimizing losses for a chunk of a balanced portfolio. And even though stock market valuations are elevated, owning a piece of corporate profits and innovation is still your best bet for beating inflation over the long run.

The difficult part for investors is that we tend to look at the individual securities, funds, strategies or asset classes when judging performance instead of the overall portfolio. A bucketing mindset can be helpful when thinking about cash flows out of the portfolio (which is another reason to own bonds), but risk management only matters at the portfolio level.

Rising interest rates or falling stock prices tempt investors to be too clever by half by abandoning certain aspects of their portfolio when market values begin to drop. The whole reason for diversifying in the first place is because we don’t know when rates will rise or stocks will fall, and we certainly don’t know the magnitude of those movements in advance once they begin.

Diversification can be loosely translated as “I don’t know what’s going to happen in the future so I am going to seek balance to avoid unnecessary or avoidable risks.”

Further Reading:

Misconceptions About Diversification