On this week’s Animal Spirits with Michael & Ben we discuss:

- Elon Musk and the prospects for Tesla actually going private.

- Was “funding secured” one of the best days ever on Twitter?

- Why are stock buybacks now the scapegoat for wealth inequality?

- How could we actually fix wealth inequality?

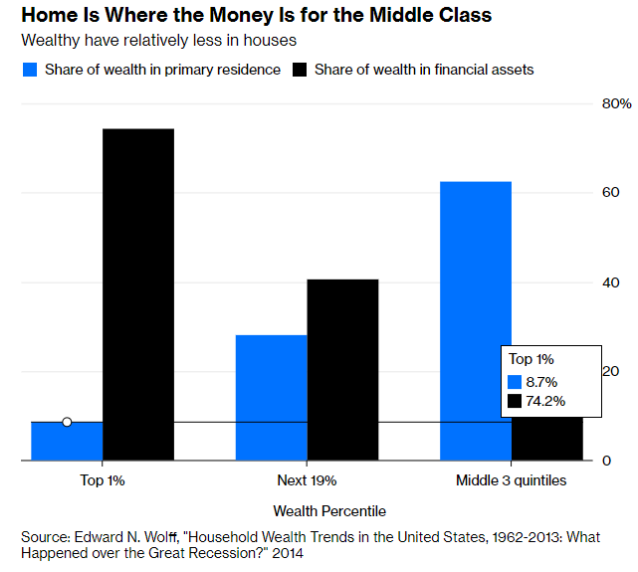

- Why housing plays such a large role in the wealth of the middle class.

- Could technology make gold obsolete?

- Why it’s so difficult to invest after a market crash.

- Amazon’s clothes are pretty nice.

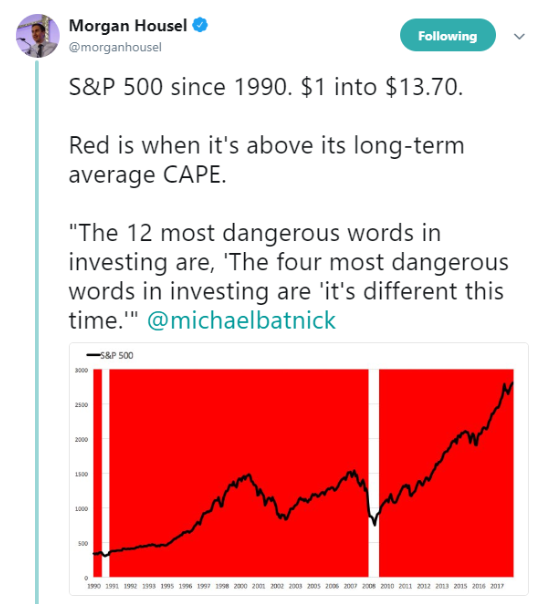

- Is the CAPE ratio useful as a timing indicator?

- What can help if your asset allocation is a mess?

- The best books to read when developing an investment philosophy.

Listen here:

Stories mentioned:

- Update on taking Tesla private

- The privatization of Tesla: Stray tweet or game-changing news

- The scapegoat

- Are stock buybacks starving the economy?

- Buybacks redux

- Many Americans still feel the sting of lost wealth

- 8 questions I’ve been pondering

- You would have missed 780% gains using the CAPE ratio, and that’s a good thing

Books mentioned:

- Those Guys Have All the Fun: Inside the World of ESPN by James Andrew Miller

- Mountains Beyond Mountains by Tracy Kidder

- The Four Pillars by William Bernstein

- The Investor’s Manifesto by William Bernstein

- All About Asset Allocation by Rick Ferri

Charts mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: