On this week’s Animal Spirits with Michael & Ben we discuss:

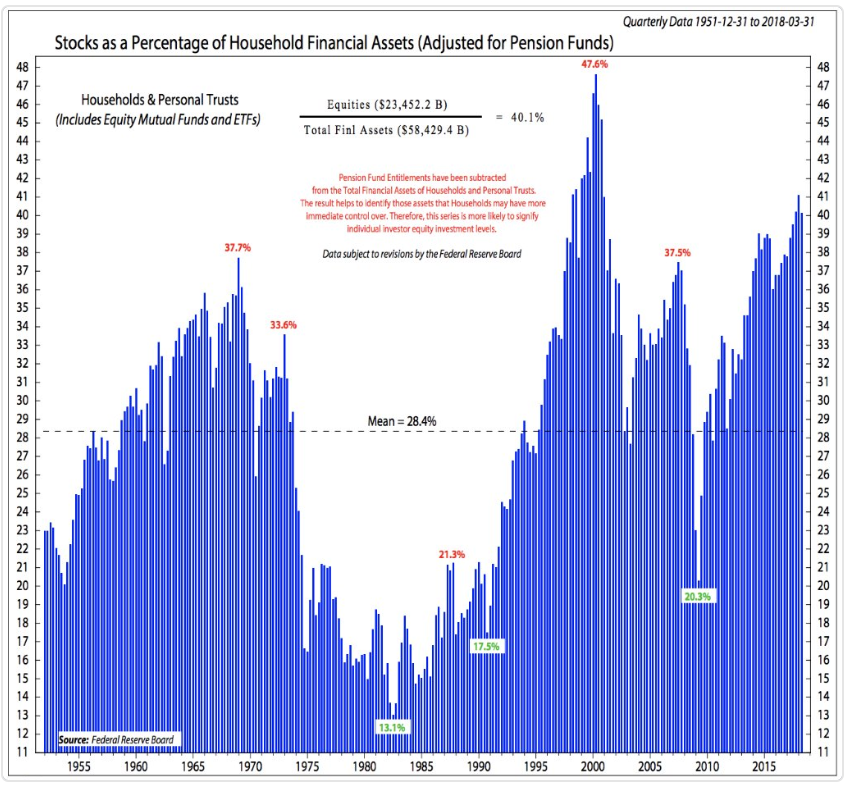

- Are household allocations to stocks too high?

- Is Robinhood positioning to be the bank of the future for Millennials?

- Collective investment trusts are way bigger than we thought.

- How to plan your personal finances with inconsistent income.

- The kind of money that can increase your happiness.

- A new ETF that promises a 7% annual payout.

- What Cliff Asness doesn’t know.

- Why value is more volatile than momentum.

- The problems with CAPE.

- How to make better forecasts.

- Placebo effects and mean reversion.

- The biggest investor worries of the moment.

- Why 1990s tech bubble comparisons don’t hold water.

- How likely is it that you’ll be rich?

- Why Ponzi schemes will always exist.

- Are personalized index funds the next big fund trend?

- Young investors using leverage and much more.

Listen here:

Stories mentioned:

- Robinhood in talks with regulators to offer bank products

- Collective investment trusts: the invisible giant

- Why inconsistent incomes need consistent planning

- Balancing the benefit and burden of wealth

- New ETF aims to provide a steady annual 7% distribution

- It ain’t what you don’t know that gets you in trouble

- Trust the process

- CAPE of good hope

- Wall Street looks to superforecasting to predict financial future

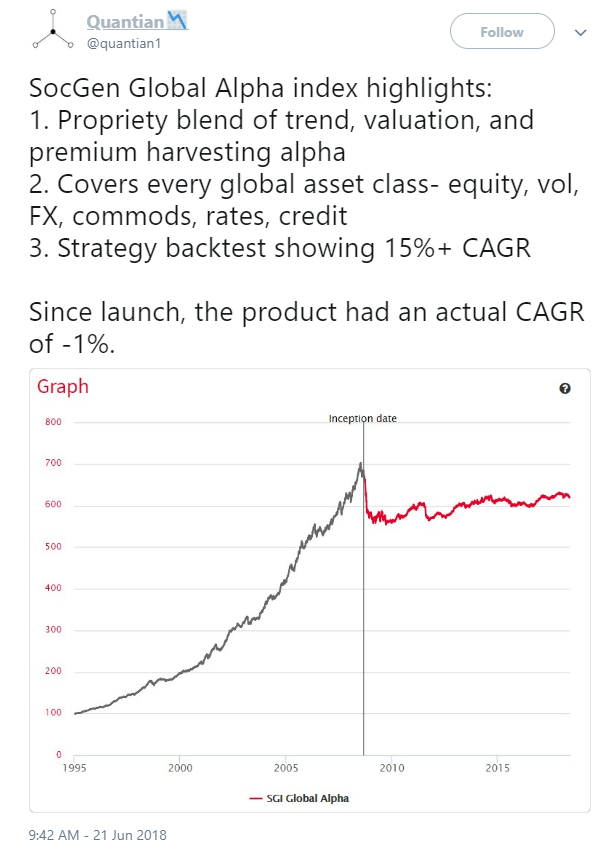

- Hunting for alpha

- Powerless placebos

- Top investor worries

- How likely is it you’ll ever be rich?

- $102 million Ponzi scheme

- The time for personalized index funds may be near

- Mental toughness

Books mentioned:

- Rocket Men: The Daring Odessey of Apollo 8 and the Astronauts Who Made Man’s First Journey to the Moon

- The Little Book That Beats the Market

- The Scarlet Women of Wall Street

Charts mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: