On this week’s Animal Spirits with Michael & Ben we discuss:

- Why the next recession won’t look like the last one.

- Why investors are always fighting the last war.

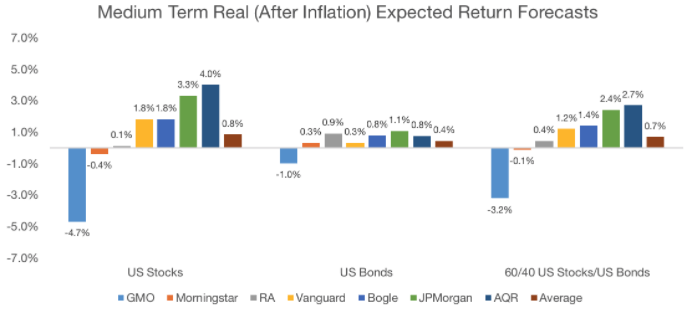

- Is it now contrarian to predict higher expected returns?

- What could cause the future to look better than the past in the markets?

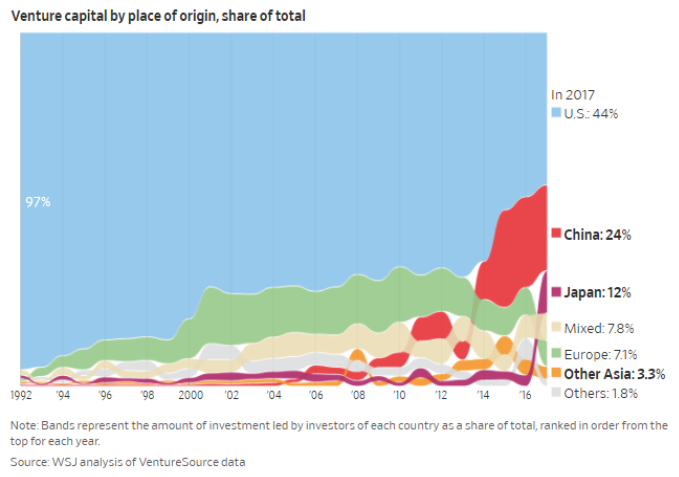

- The staggering growth in venture capital outside the U.S.

- The insane pension payouts to some government workers in Oregon.

- Why Germans save more than Americans.

- What the 200-day moving average tells us.

- Some thoughts on 529 college saving plans and how they can increase your returns.

- Some things Michael learned about the NBA.

- The best TV show I’ve seen in a long time and much more.

Listen here:

Stories mentioned:

- Big banks find a back door to finance subprime loans

- Rising home prices push borrowers deeper into debt

- Predicting the next recession

- Failing slow, failing fast, and failing very fast

- Silicon Valley has a challenger

- What if the future is better than we think?

- A $76k monthly pension

- Why are Germans so obsessed with saving money?

- The 200-day moving average is not always a reliable sell signal

Books mentioned:

- Abundance by Peter Diamondis

- The Fish That Ate the Whale by Rich Cohen

- The Disappeared by CJ Box

- The Book of Basketball by Bill Simmons

Charts mentioned:

Tweets mentioned:

This road charges your car while you drive on it pic.twitter.com/jBphFgenB6

— NowThis Impact (@nowthisimpact) April 13, 2018

https://twitter.com/paulbloomatyale/status/966554128351727617

how to be a billionaire (per the internet):

-sleep 10 hrs/day

-read 6 books/week

-meditate for 2 hrs/day

-post motivational quotes

-wake up before 5am every day

-work 14 hrs/day

-workout 2 hrs/day (before work)

-but also have a good work-life balancevoila that's it

— Ben Carlson (@awealthofcs) April 10, 2018

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: