This week’s Animal Spirits with Michael & Ben is supported by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service.

We discuss:

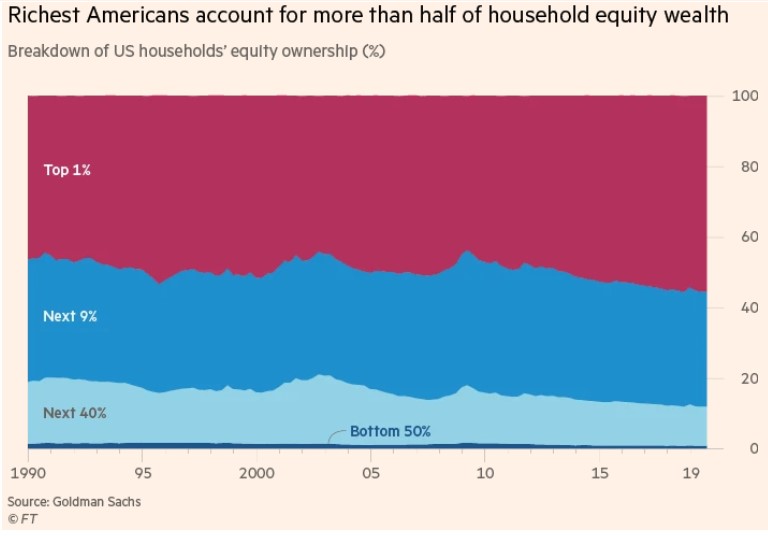

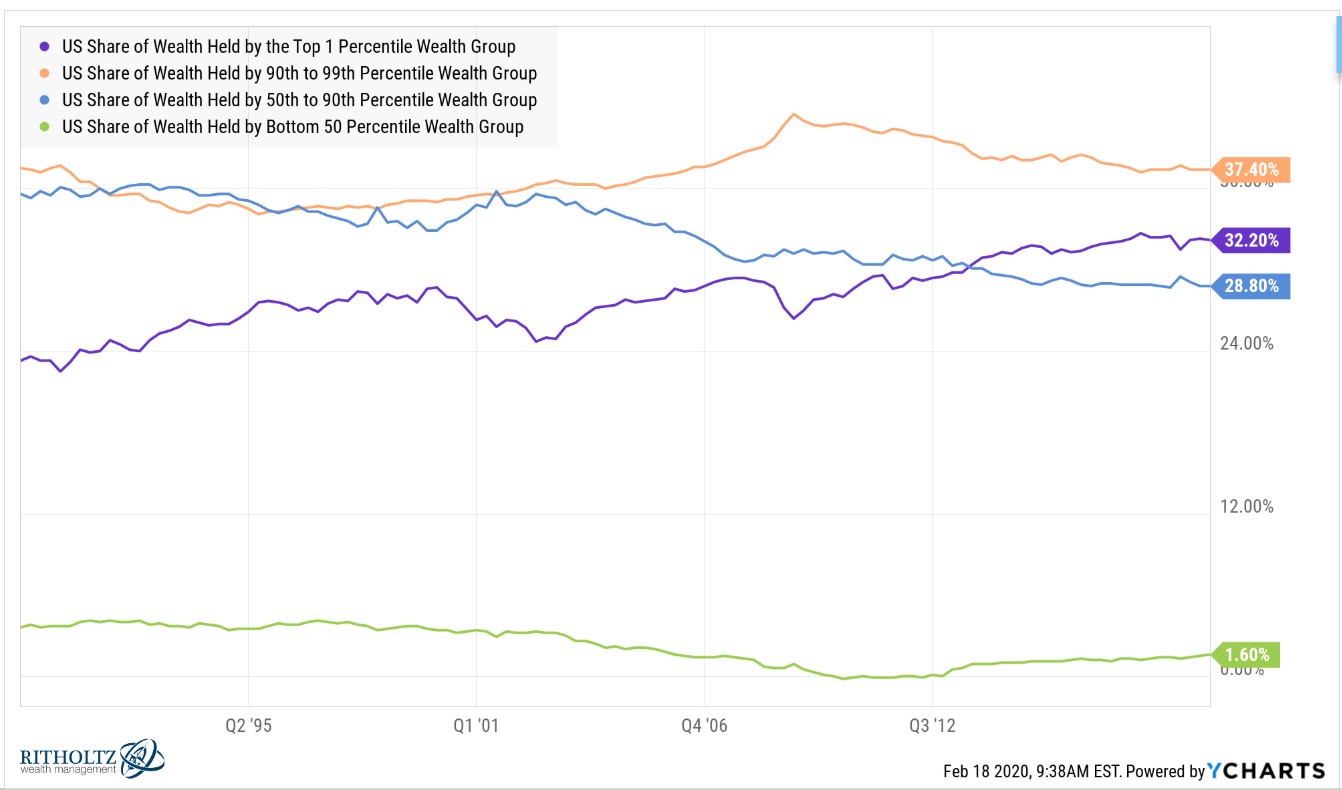

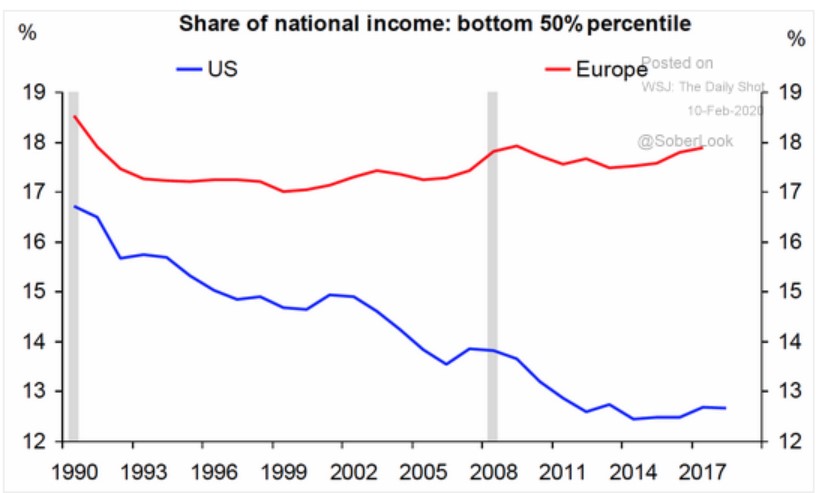

- Why is wealth inequality getting so out of control?

- Will the next stock market crash only hurt the rich?

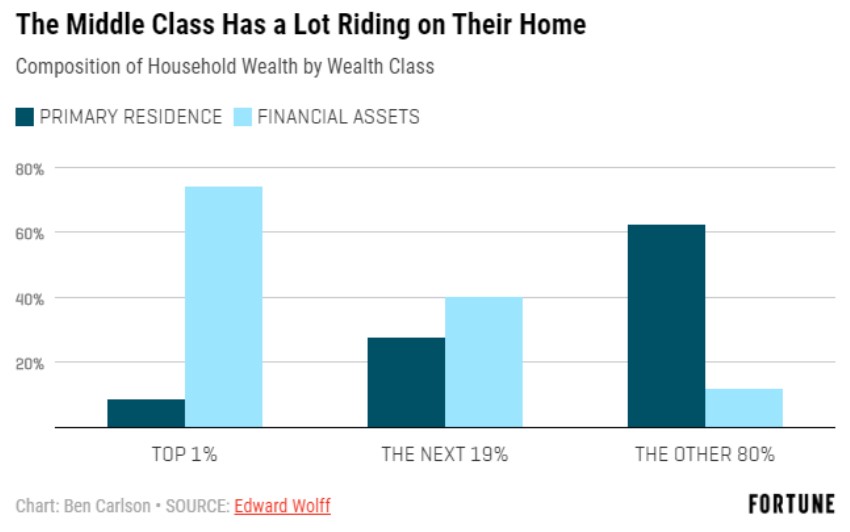

- Why the middle class has so much riding on their home as an asset

- How can we get more people to invest in the stock market?

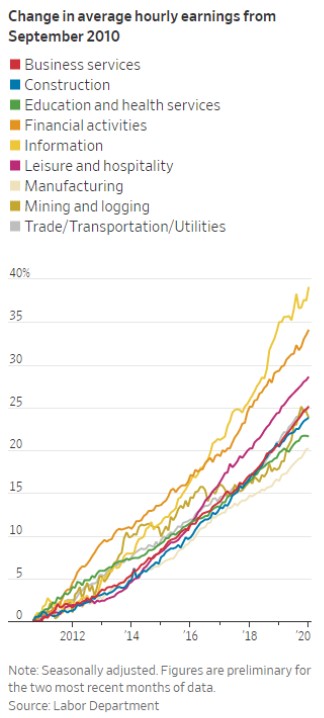

- Is housing becoming too expensive relative to wages?

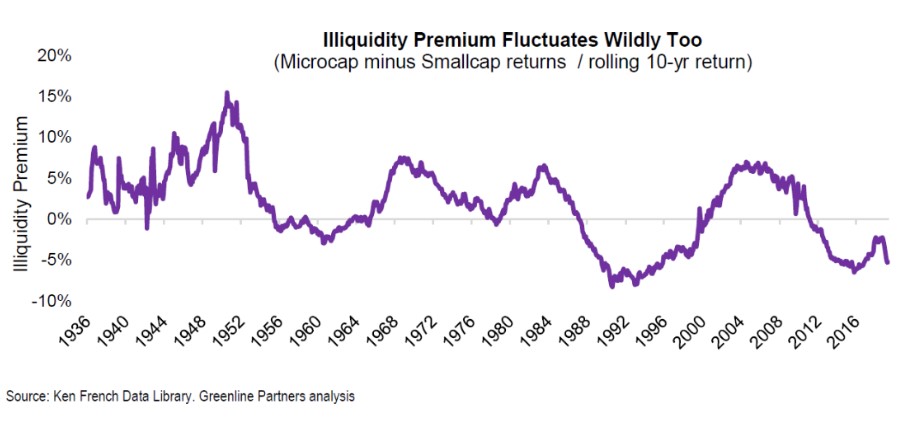

- Is private equity in trouble?

- Will private equity ever make it into target-date funds?

- Why the index fund bubble talk makes no sense

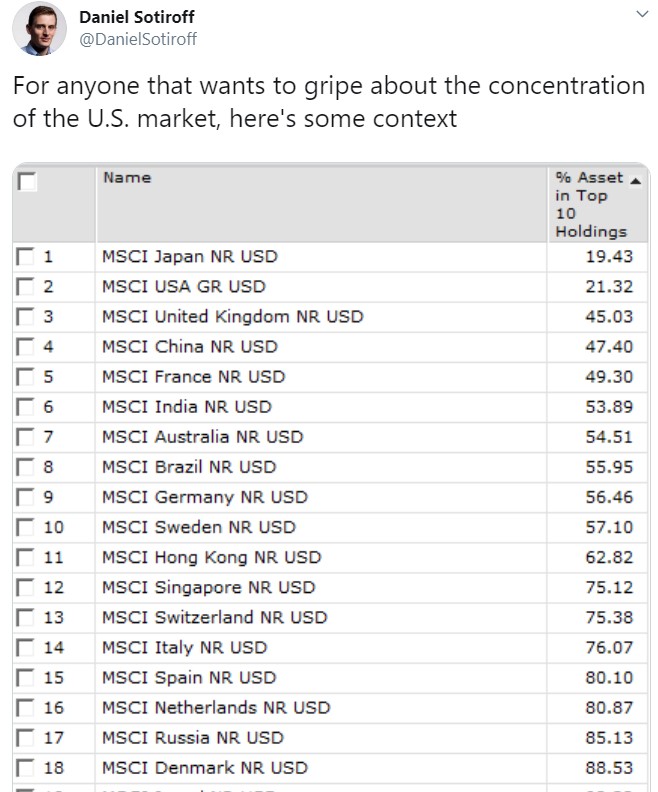

- Does it matter that the S&P 500 is so concentrated at the top?

- Why the U.S. is so unique when it comes to a country’s stock market

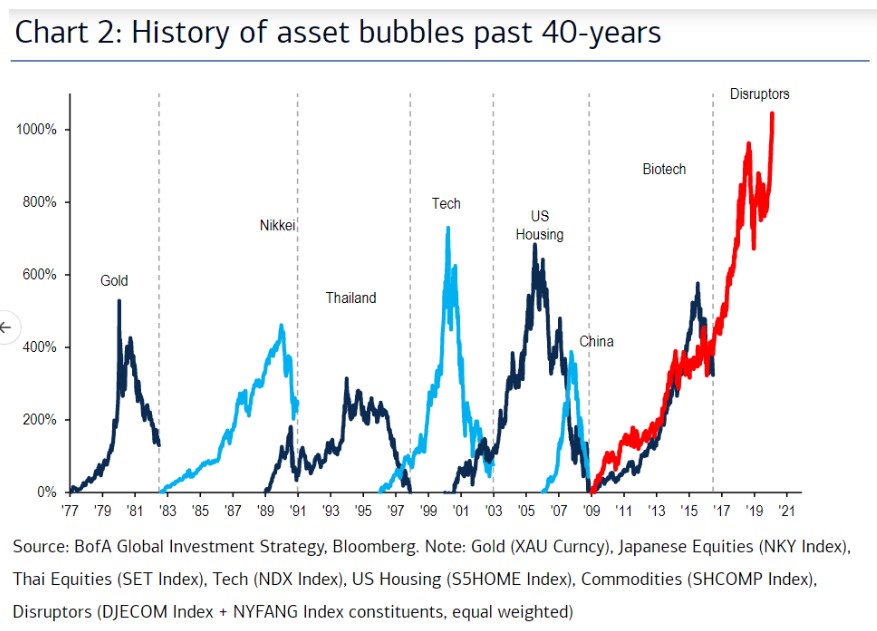

- Has the market ever been tethered to fundamentals?

- The simplest hedge there is

- Why being good at sales is often all you need in business

- Who gets all the alpha from alternative data?

- What makes people happier than money?

Listen here:

Stories mentioned:

- Best FinTechs to work for

- How America’s 1% came to dominate equity ownership

- The rich own stocks, the middle-class own homes

- White House considering tax incentives to get more Americans to own stocks

- The great affordability crisis breaking America

- Is private equity out of capacity?

- Mom and pop millionaires are driving Blackstone’s growth

- 5 companies now make up 18% of the S&P 500

- No longer tethered to fundamentals

- How Suze Orman invests her wealth

- Stockpickers turn to big data to arrest decline

- Credit card debt rises to record $930 billion

Books mentioned:

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: