A reader asks:

I am in my mid-30s, live in the Seattle Metropolitan area, and have three kids. Back in June 2019, my wife convinced (forced) me to buy our first house, I was very hesitant at that time because house prices were already crazy expensive in this area and I was worried that we were going to buy at the top of the market (Don’t tell my wife she was right about buying the house). Long story short, house price (5 bedroom) was about $750k, I put 20% down and got a 30-year mortgage at a 4%+ rate, One year later I refi’ed for a 3.12% rate.

Fast forward and the housing market is still crazy, my neighbor just sold his house for $1M+, based on what the real estate apps say I could sell this same house less than 3 years after I bought it and, after costs and paying the mortgage, walk away with about $500k. I know it is not a lot of money & I am not planning to sell because this is my primary residence but it made me think: there has to be a point where it makes mathematical sense to sell a house and just start renting. What are your thoughts?

I understand the thinking here.

I had a friend recently tell me they would love to sell their house for a huge gain, pay off their student loans and simply buy a new house in a few years “when prices are more reasonable.”

The problem with this equation is:

(1) Housing prices don’t have to get more reasonable (read: fall).

(2) You have to live somewhere.

Now, housing prices could fall. But what if they don’t fall in your state or city or neighborhood even if they fall elsewhere? And what if you sell now in hopes of buying back in 3-5 years and prices are even higher at that point?

At what point do you get too nervous to buy back in because you’re psychologically scarred from selling?

It’s the same thing as trying to time the stock market except a home has even more emotions involved.

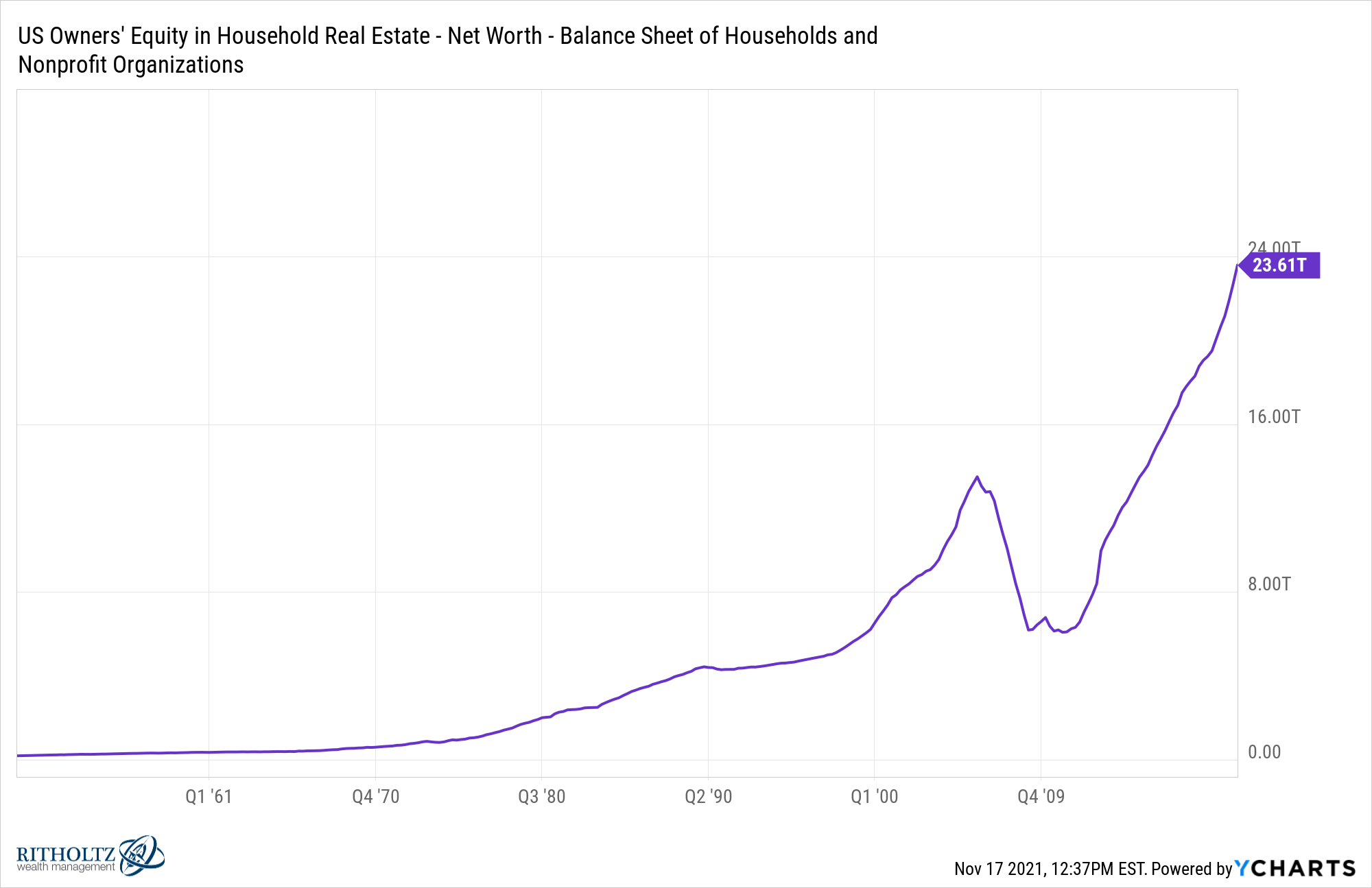

It makes sense people are tempted to take some gains off the table right now. Just look at how much home equity has skyrocketed of late:

In the last three years alone, U.S. homeowners have added more than $5 trillion in home equity.

I’m sure there are some people who could take their gains and arbitrage the housing market by downsizing or moving to a place with a lower cost of living.

Unfortunately, selling your home involves frictions. There are realtor fees and closing costs and all of the pains that come from moving. Plus you need to find a new place. Even if you downsize, you’re still paying a higher price on a new place than you would have a few years ago.

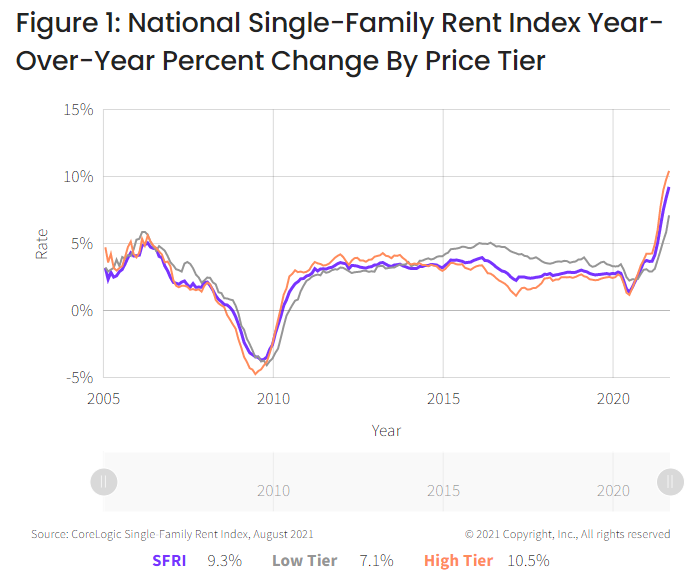

And if you decide to rent, those rates are rising as well. Rents tend to react to housing prices on a lag but you can see from this CoreLogic data that it’s already happening:

The good news is you don’t have to sell your house to take some profits off the table.

You can open up a home equity line of credit to borrow against your house at a low rate. Or you could do a cashout refinance to lock in a low rate and do something else with that money so it’s not just sitting in your house.

I’m sure there is a certain level where it feels like you would be an idiot to not consider selling. But your house is not a stock that you can just flip and buy back if you change your mind.

There are legitimate reasons to sell your home:

- You want to downsize.

- You need more space.

- You want more flexibility.

- You don’t want the responsibility, taxes and maintenance involved in homeownership.

- You need to move for a job or spouse.

- You’re ready to live somewhere else.

This strikes me as the type of decision where finances shouldn’t come into play unless you absolutely cannot afford to live in the home anymore. Life circumstances are far more important.

It typically pays to keep your emotions out of your financial decisions but this is one area where it makes sense to at least consider the psychic benefits involved. Your house is the roof over your head, not some security you can buy and sell in your Robinhood account.

Some people may disagree with me but I would think long and hard about this one.

And if you truly consider selling maybe you should ask your wife first. She seems to have good instincts.

I discussed this question on the latest episode of Portfolio Rescue:

We also talked about where to save money in the stock market for a new born, how to spend money in a more meaningful way and why it doesn’t always make sense to max out your 401k.

Subscribe to The Compound so you never miss an episode.