On this week’s Animal Spirits with Michael & Ben we discuss:

- The prospects for a melt-up in the stock market over the coming 9-18 months.

- The psychological damage another market crash would have on investors.

- Why not all historical stock market bubbles have ended in a crash.

- The problem with trying to come up with a mathematical formula to define a bubble.

- An under-the-radar idea for your best investment of 2018.

- Michael sets the record straight on a quote of his used by Research Affiliates.

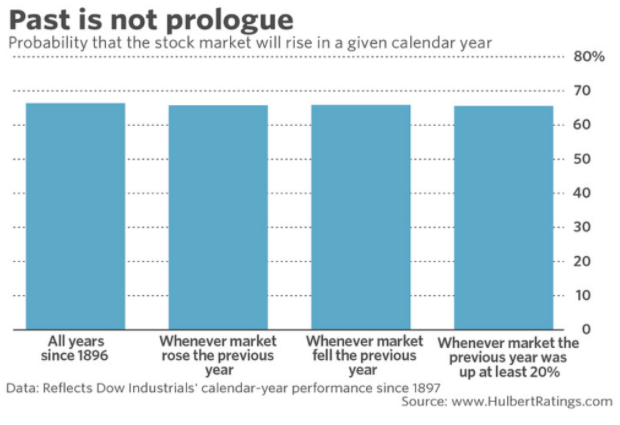

- Why last year’s stock market performance won’t help you guess how things will turn out in 2018.

- The problems with anecdotal market sentiment readings.

- Why mom and pop don’t have as much of an impact on the markets as you might think.

- Is 10% a big enough savings rate to retire?

Listen here:

Stories mentioned:

- Bracing yourself for a possible near-term melt-up

- How to survive a melt-up

- Bubbles for Fama

- Can you predict bubbles?

- The best investment of 2018

- Why CAPE naysayers are wrong

- 10 things investors can expect in 2018

- Is saving 10% for retirement enough?

- Dow 25,000 and individual investors

Charts discussed:

Books mentioned:

Podcasts mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Subscribe here: