Things are getting crazy, not only in the markets but society at large with the realization of the massive impact the coronavirus is creating. So Michael and I decided to record an extra podcast this morning to share our thoughts on what’s going on and what it might mean going forward.

We discuss:

- Last night was surreal

- The Jaws-like moment in this

- Why even expectations for the worst can’t prepare you for the actual moment

- Canceling vacations

- Time to overreact

- Will schools and daycares close?

- Is the stock market going to close?

- Is this a 9/11-like moment for society?

- Getting used to working from home

- Using investments as an ATM during a crisis

- How many start-ups are going to go under?

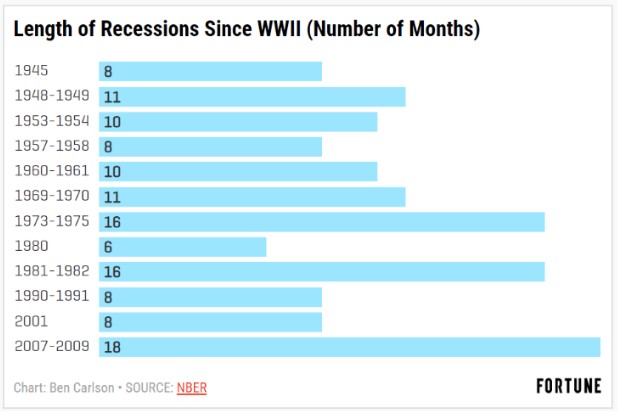

- Is a recession the baseline expectation now?

- How much does the unemployment rate rise during a recession?

- Personal recessions

- How does this end?

- Why expectations matter so much right now

- How long does it take to breakeven from a bear market?

- Don’t look at your account right now

- Why personal finances matter more than your portfolio at a time like this

- How long will life be disrupted?

- Is this going to be a blip like 1987?

- The wild swings coming up in economic data

- Why panicking is never the right reaction

Listen here:

Stories mentioned:

- Creating an overreaction plan for the coronavirus

- Everything you need to know about recessions

- 12 charts you ought to see before the next recession

Books mentioned:

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on Shuffle.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: