On this week’s Animal Spirits with Michael & Ben we discuss:

- What to do if you’ve been sitting in cash during the bull market.

- The latest change I made to my personal portfolio.

- What trend-following is and why it’s a difficult concept for investors to grasp.

- The worst bear market no one ever talks about.

- Causes for the low volatility in the markets.

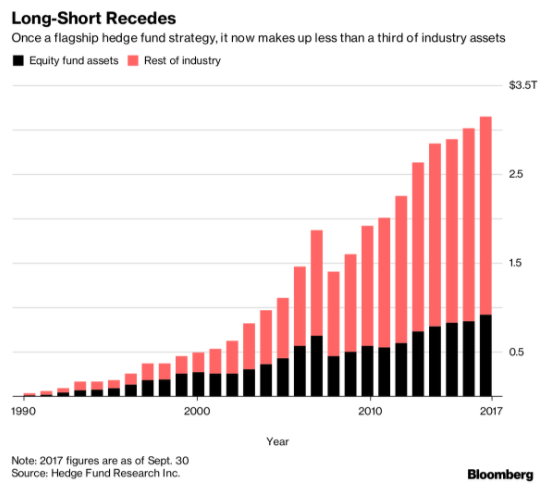

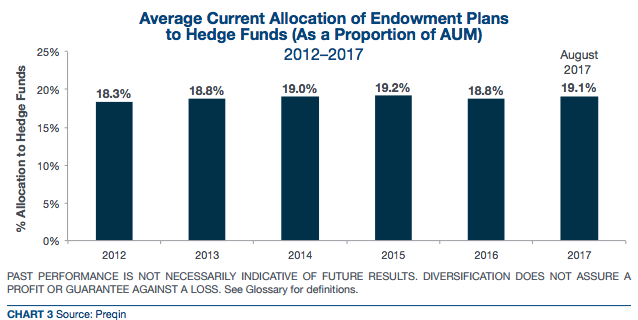

- Myth-busting the “hedge funds are dead” story.

- Why it’s so difficult to benchmark hedge funds.

- Does it matter if you invest in individual bonds vs. a bond fund?

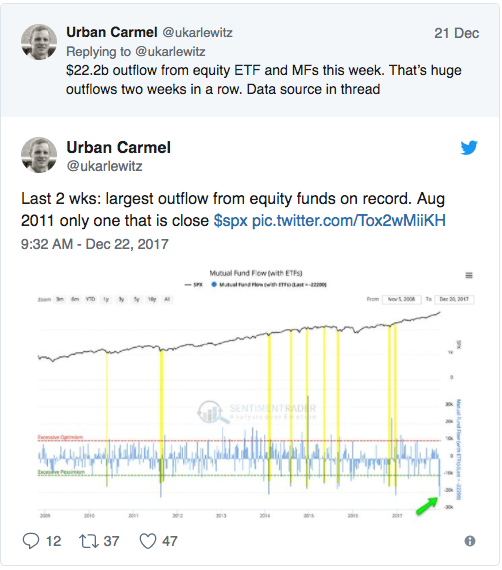

- What’s causing stock fund outflows?

- Will baby boomers destroy the stock market during retirement?

Listen here:

Stories discussed:

- Why young investors should hope for a crash

- My evolution on asset allocation

- 1974 & 1999: history turned upside down

- The worst bear market nobody ever talks about

- Have stock investors become better behaved?

- Myth-busting on hedge funds

- What hedge funds will do after the model dies

- Individual bonds vs. bond funds

- Misconceptions about individual bonds vs. bond funds

- Outflows from stock funds

- Why baby boomers won’t destroy the stock market during retirement

Books mentioned:

Charts mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Subscribe here: