Investors have been warned about overvalued markets basically since the start of this stock market recovery. Some people are scared of above average valuations. Others simply choose to ignore them. And still others use them as scare tactics to sell financial product or newsletters. While you can’t control what the current market valuations are you can control what you will do about them. Here’s a piece I wrote for Bloomberg on your options as an investor in an overvalued market.

*******

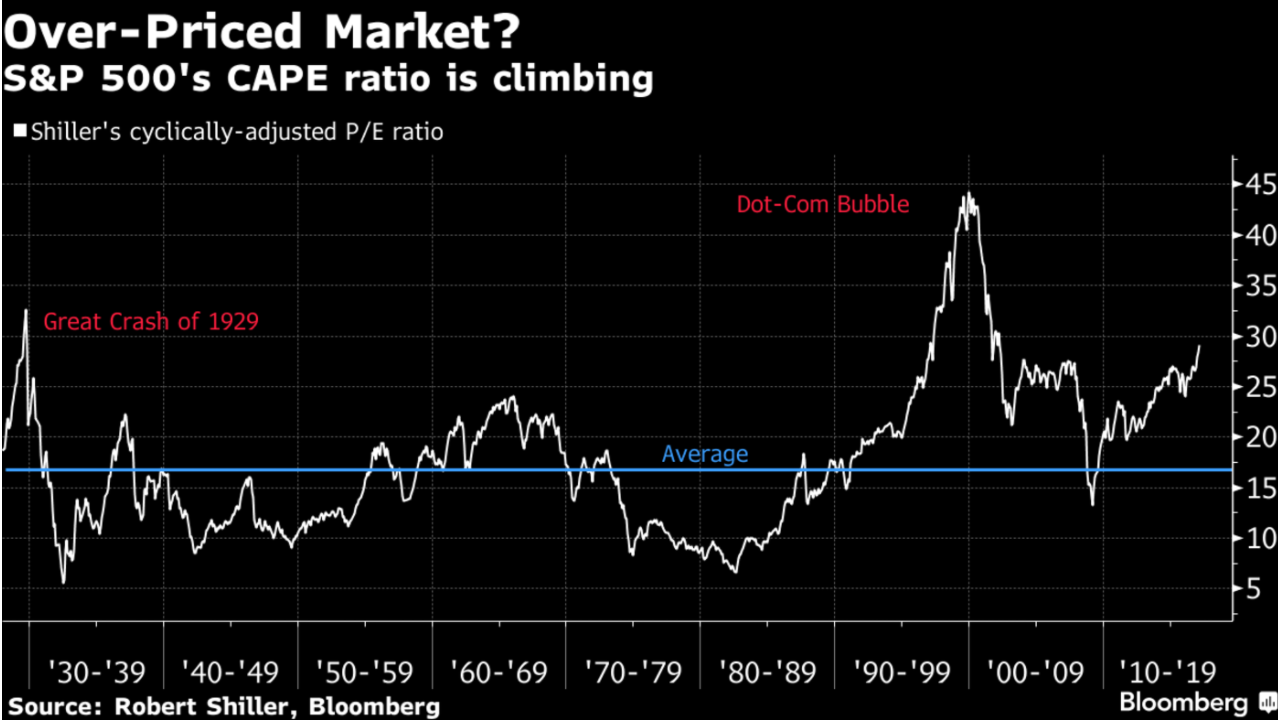

It’s no secret that U.S. stocks are overvalued. After eight consecutive years of gains — we’re now into the ninth — it would make sense that the S&P 500 Index would have above-average valuations based on almost every measure.

Legitimate arguments can be made that U.S. stocks deserve these prices for many reasons, including low interest rates, low inflation, slower growth everywhere, higher profit margins, and a diverse and mature economy.

The problem for investors is that stock market cycles don’t always follow the same pattern. No one really knows if we’re in the seventh-inning stretch, the bottom of the ninth, or heading into extra innings. They don’t ring a bell at the top and these things can go on for much longer than most investors imagine. So it helps to assess the alternatives when investing in this type of environment.

Here are your options:

- Raise cash. Investors who are worried about overvalued markets can always go to cash and pray for a crash. Stocks don’t have to collapse from current levels, but it’s always a possibility. The comfort of cash sounds like an intelligent strategy, but there are two caveats.First, you could miss out on further gains. The S&P 500 has averaged 25 percent gains in the 12 months preceding market peaks since 1937. If you do go to cash in hopes of calling a top, you have to be prepared for the possibility of watching a melt-up from the sidelines. Cash also yields next to nothing, so the relative performance difference under this scenario would be huge.And second, when timing the markets, you have to be right twice — once when you get out, and one when you get back in. No one can consistently call tops and bottoms, so there should be rules in place to guide your actions and tell you when to get back in. Sitting on the sidelines can be psychologically challenging: Once you’re out and stocks begin to fall, there will always be further reasons to stay out. Holding cash can become an addiction when you get out of the markets.

- Overweight bonds. Along these same lines, investors could underweight stocks and overweight bonds in their portfolio. A bad year in the bond market is like a bad week in the stock market, but at lower interest rates bonds will likely see much higher volatility than they have in the past, along with lower future returns.

- Own more overseas stocks. According to a paper by Vanguard, U.S. investors have almost 80 percent of their equity exposure in U.S. stocks. This home-country bias has served investors well over the past few years, but markets outside of the U.S. are much cheaper now because of it. Investors worried about U.S. valuations can find much better value in foreign developed- and emerging-market stocks, but this requires many to invest outside of their comfort zone.

- Get more tactical with your asset allocation. After the financial crisis, investors became much more accepting of tactical asset allocation as a way to reduce drawdowns or volatility. The difficult part about getting tactical is that valuation is typically a terrible signal to use as a timing tool. Mean reversion rarely follows a set schedule. In the short-to-intermediate term, stocks are driven more by sentiment, trends and momentum than valuations, so overvalued markets can always become more overvalued and undervalued markets can always become more undervalued. Take your emotions out of the equation by making it a systematic, consistent process.Since nothing works all the time in the markets, you must accept that you’re bound to be on the wrong side of a trade in any tactical model. This type of investing requires investors to pay insurance premiums occasionally by buying or selling at the wrong time and getting whipsawed by jumping in and out.

- Reset your expectations. Trees don’t grow to the sky, so it would make sense that a period of above-average returns would be followed by a period of below-average returns. Investors banking on high market returns to meet their goals are going to have to save more, work longer, lower their spending, or some combination of the three. A change in expectations doesn’t necessarily mean a change in strategy, but it does require discipline to stick it out during a potentially difficult market environment.

There are no easy solutions when investing in an overvalued market. Every strategy has its flaws. The trick for investors in this situation is to find a strategy they can stick with no matter what happens in the markets. No one can predict the future, but you can plan how you will react under different scenarios.

Originally published on Bloomberg View in 2017. Reprinted with permission. The opinions expressed are those of the author.