Last week in my 20 Rules of Personal Finance post I talked about the importance of getting the big purchases right:

8. Get the big purchases right. I know I shouldn’t be so judgmental but whenever I see $50-$70k SUVs on the road or enormous McMansions the first thing that pops into my head is, “I wonder how much they have saved for retirement?” Personal finance experts love to debate the minutia of brown bag lunches and lattes but the most important purchases in terms of keeping your finances in order will be the big ones — housing and transportation. Overextending yourself on these can be a killer.

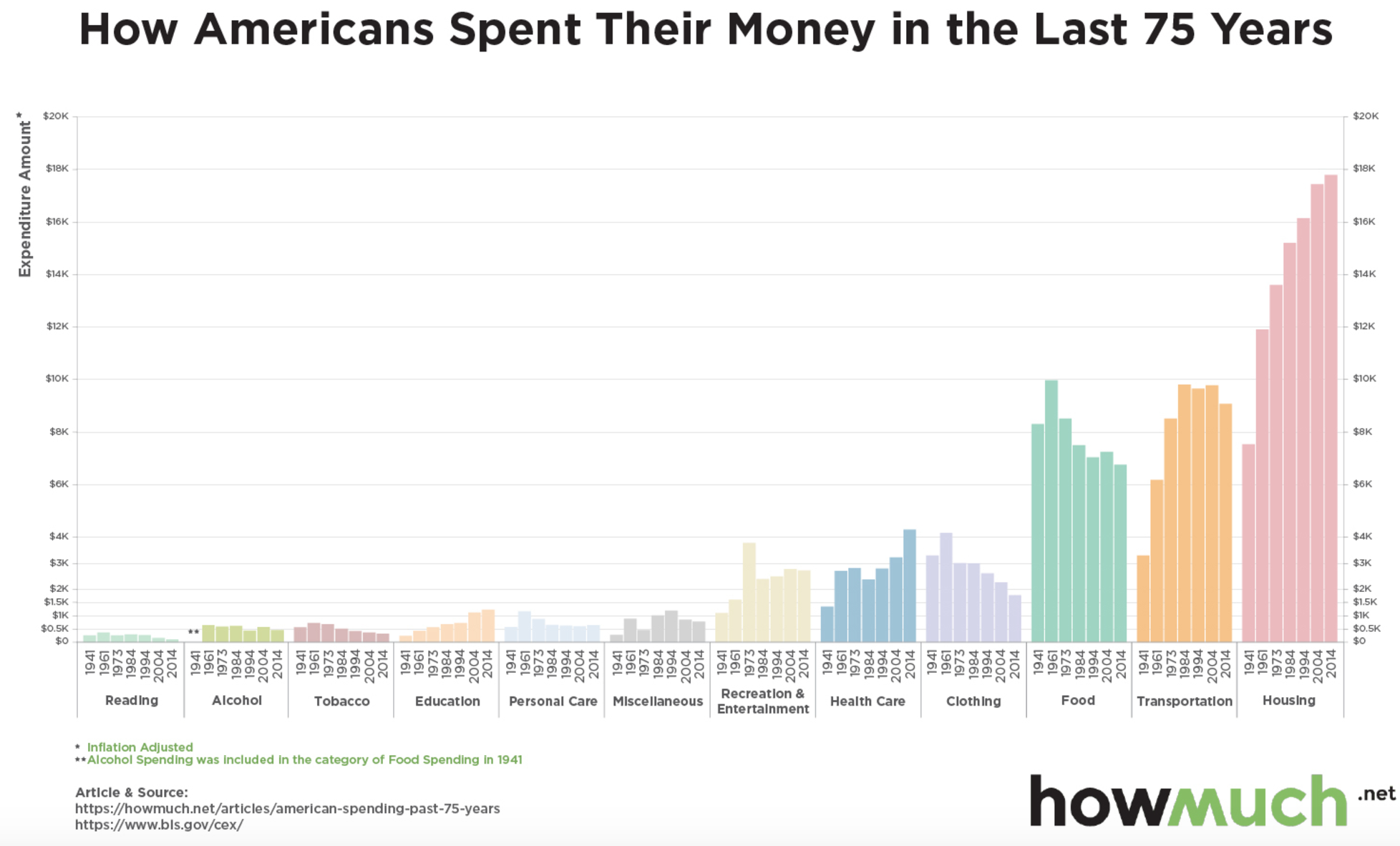

This week I received an email that quantified this idea. Howmuch.net put together this really cool chart that shows the median inflation-adjusted spending levels over the last 75 years in twelve different categories (using data collected from the Bureau of Labor Statistics):

You can see that housing and transportation dominate the average American’s budget today, with housing rising steadily over the years. With the usual caveats that every household is different and averages never tell the whole story, here are a few more observations:

- In 1941, people spent more money on food than housing.

- 1973 must have been a fun year for everyone as recreation and entertainment expenses skyrocketed.

- Healthcare has risen over time but it’s not nearly as high as I would have expected.

- Money spent on reading has slowly declined over time. I’m hopeful that’s because way more information is free these days, but that’s not a great trend in my mind.

- Clothing expenses have fallen by more than half since the 1960s. My guess is globalization has had a huge impact on these numbers.

- Spending on education looks to have seen the biggest percentage increase over time. People love to complain about student loans but these numbers are a sign of progress as more people are investing in themselves.

- Tobacco spending has seen a steady decline since the 1960s but money spent on alcohol is one of the most stable categories. Maybe we should consider booze a consumer staple and not a consumer cyclical sector?

- Cutting costs on minor spending items is not going to have a huge effect on your personal bottom line. The largest categories here are the ones that will make the biggest difference to your finances.

Source:

Unprecedented Spending Trends in America in One Chart (How Much)