Bill Gross thinks the end is near for a bubble in both stocks and bonds, according to his interview with Andrew Ross Sorkin in the latest New York Times Magazine:

Is the bubble in stocks or in bonds? I think both. I sort of have a sense of an ending. I think that the 35-year bull market in bonds and in stocks is ending. Now, when you say something like that, it conjures up a crash. It doesn’t have to be that way. It probably ends, like T. S. Eliot said, with a whimper and not a bang.

More than once over the past couple of years I’ve heard financial pundits proclaim that the golden age of financial market returns that began in the 1980s will soon come to an end. Gross himself has said this a number of times. But while many point to the stock market in terms of delivering above average performance in that time, it’s really bonds that have seen the unsustainable gains.

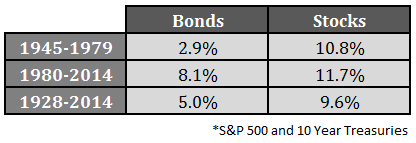

Since Gross says the past 35 years have been a bull market in both stocks and bonds, I decided to compare the past 35 years, from 1980-2014, with the previous 35 years, from 1945-1979. You can see that bonds are the real outlier in these results when you compare these return numbers to the long-term averages:

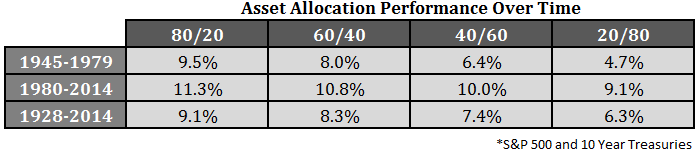

Stock returns have been above average since 1980, but they’re not that much higher than the previous 35 years. It’s bonds that have given investors an uncharacteristically high return over the past three-plus decades. This becomes even more apparent when you look some different asset allocation performance numbers over the different time frames. The bond-heavy portfolios show huge differences across these periods:

The bull market Gross referenced happens to coincide with the turn of the interest rate cycle from a high in the 10 year treasury yield of more than 15%. It’s definitely been a golden age for bonds since this rate peak from a combination of high starting yields and a fall in rates over an extended period of time. But to claim that stocks have been in an unsustainable bull market that started in the 1980s doesn’t seem to hold up. If you want to say that stocks are in a golden age you have to go back much further to find the starting point.

Does this mean stocks will see similar gains in the 10-12% range going forward? Of course not. No one knows what the future returns will be in the stock market. That’s why they’re called risk assets. But it does appear that investors have lived through a golden age in a U.S.-based asset allocation since 1980. The great thing for individual investors today is that it’s so much easier and cheaper to create a globally diversified asset allocation strategy than ever.

Is it possible that huge stock market returns are a thing of the past and we’ll see lower performance going forward? Sure, anything is possible. But it’s hard to say that stocks have been a historical aberration since 1980. If anything, it appears the biggest reason for the out-sized financial market returns over the past 35 years is because of the bond market. Fixed income investors should definitely lower their expectations about future long-term returns.

Mr. Gross is a famous bond fund manager. He’s probably benefited as much as anyone from the bull market in bonds. It’s possible his comments on the markets over the past few years have been his way of tempering expectations for his own investors.

[…] This Bubble – Fiscal Times Why Stocks Will Crash in Two Charts – The Burning Platform The Golden Age of Asset Allocation – Wealth of Common Sense Don’t expect short-term bond funds to keep up with inflation […]

Makes you wonder if Mr. Gross would still be famous if he had been investing in bonds in a different era.

Definitely right place and right time, but he really revolutionized the thinking behind total return-seeking in bond funds and not just yield. Also, in his defense, he has claimed in the past that he was lucky:

http://www.pimco.com/EN/Insights/Pages/A-Man-In-The-Mirror.aspx

Ben,

I am wondering how many investors are actually going to commit to much higher international allocations over the course of more than just a few years or to chase hot markets, such as emerging markets in the past.

That’s true. A broadly diversified approach is very difficult to implement because there’s always temptation and fad investments.

Shiller’s CAPE was at 11.64 as 1945 began, and 8.75 as 1980 kicked off. Both values were below the long-term median, suggesting generous returns ahead.

Today, Shiller’s CAPE is around 27 — about the 94th percentile — pointing to (probably) low single digit returns over the next decade.

If QE finally succeeds in igniting a 1999-style bubble, lifting the CAPE back to its record high of 44.20, the asset to buy will be clear: inverse funds! Until then, remain calm and buy the dips. J-Yel’s got your back.

It seems like people don’t want another bubble but they’re almost getting pushed in that direction begrudgingly. It will be interesting to see if we do get a melt-up or if we see a bear market first.

[…] thinking about the possibility of poor stock and bond performance from these valuation and interest rate levels, it’s worth putting some historical context […]