Gus Sauter, the former investment chief at Vanguard, wrote an article for the Wall Street Journal earlier this week with some important information for retirement savers to consider:

In fact, 56.4% of all 50-year-old women are expected to live longer than their life expectancy of 83 years, and, similarly, 55.4% of all men are expected to outlive their expectancy, according to the Social Security table. That may seem a bit odd, but it’s because the distribution of ages when people are expected to die is not a nice normal distribution. It is a skewed distribution with more people living longer than dying early.

According to the Social Security Administration, 30% of all 50-year-old women are expected to see their 90th birthday and 19% of all men are. In fact, the most likely age for a 50-year-old woman to die is 88 and the most like age for a man is 85. A woman is more likely to die at age 92 than at her life expectancy age of 83, and a man is more likely to die at age 89 than 80.

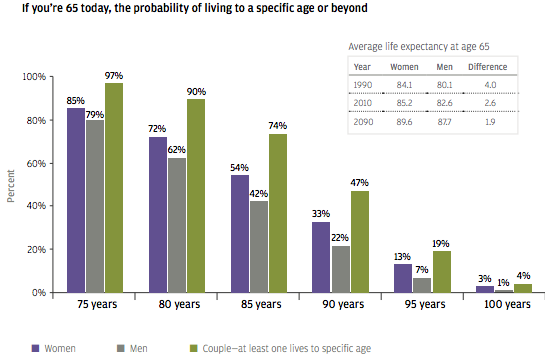

And here’s a chart from JP Morgan that illustrates this nicely from another perspective:

The great news is people are living longer. The double-edged sword version is that people have a much longer time horizon to plan for financially, which could make things tricky for those who aren’t thoughtful about the potential ramifications. Some thoughts on the implications here:

- Many people will have to work longer, save more or both. Charley Ellis performed some calculations on different start and end dates in connection with required savings rates to give people an idea of how much they would have to save to ensure a comfortable retirement. He found that starting at age 25 and working until age 70 — compared to starting at 45 and retiring at 62 — reduces the required annual savings rate by a factor of 10 (from 56% of salary to 5% of salary). For some, there will be no choice but to work longer, but others may choose to work longer for lifestyle reasons because they’re content working. The whole notion of what career entails could change as the concept of retirement evolves with these longer life spans.

- Women are often overlooked in the financial planning world. On average, women tend to live longer than men. This means eventually the majority of the assets are going to be controlled by women who outlive their husbands. The antiquated view many people share is that the men handle the finances in a marriage but that’s certainly not always the case (and few people realize that studies show woman are far better investors than men). The financial services industry needs to spend more time catering to women and their needs. They are the ones who will be controlling the bulk of the money and making financial decisions in the years to come.

- Investors need to define their multiple time horizons. One of the biggest problems investors have is that they confuse their time horizon with someone else’s and lose focus on why they’re investing in the first place. Investing doesn’t end when you retire. As these number show, you could have many decades ahead of you to continue investing your life savings once you drop out of the working world. Many investors assume their portfolios have to drastically change once they retire. While it’s true your human capital (earning power) is very low when you retire, you still have to keep up with inflation in your spending needs and grow your nest egg. Understanding and defining your various time horizons can be tricky because no one knows how long they’ll actually live (obviously). But your investment portfolio has more than one act and it goes beyond your retirement date. Plan and act accordingly as this could affect your risk profile, spending habits and withdrawal rate from your portfolio.

Sources:

How Investors Underestimate How Long They’ll Live in Retirement (WSJ)

Falling Short: The Coming Retirement Crisis and What to Do About It

Further Reading:

Time Horizons & Withdrawal Rates in Retirement