“Investing is intolerably boring and over-exacting to anyone who is entirely exempt from the gambling instinct; whilst he who has it must pay to this propensity the appropriate toll.” – John Maynard Keynes

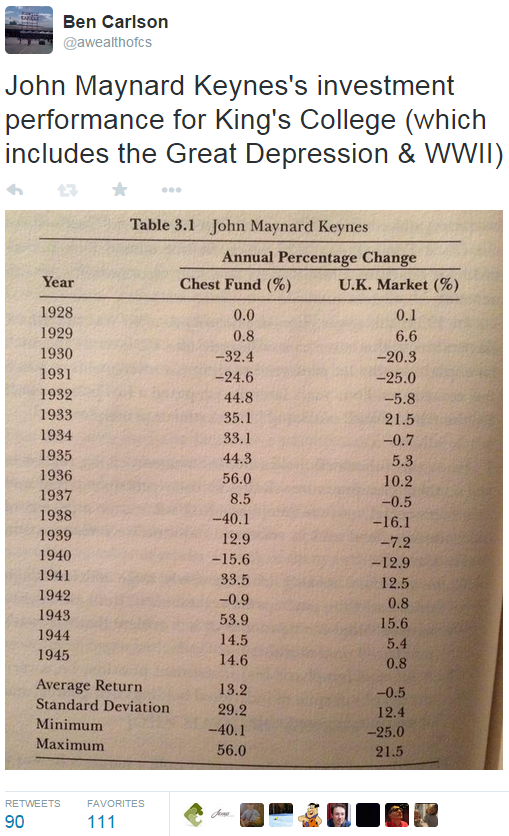

John Maynard Keynes gets plenty of attention in the world of economics based on his macroeconomic theories, but many don’t realize that Keynes was also an extraordinary investor. I tweeted out Keynes’s investment record last night:

These performance figures generated a large number of responses. The thing I found interesting is that the overwhelming majority of the comments were about the fact that Keynes’s returns were far too volatile. Many noted that there is no way investors would put up with this type of volatility or drawdowns in today’s investment world. The conclusion was that Keynes would certainly be fired if he were managing money this way today.

Before I get into some of my thoughts on these reactions, let’s take a look at Keynes’s investment philosophy, courtesy of an old Journal of Finance write-up:

1. A careful selection of a few investments having regard to their cheapness in relation to their probable actual and potential intrinsic value over a period of years ahead and in relation to alternative investments at the time;

2. A steadfast holding of these fairly large units through thick and thin, perhaps for several years, until either they have fulfilled their promise or it is evident that they were purchased on a mistake;

3. A balanced investment position, i.e., a variety of risks in spite of individual holdings being large, and if possible opposed risks.

So basically Keynes was a fundamental, focused investor, similar to Warren Buffett in that he practiced buy and hold in a select group of stock holdings. It’s also interesting to note that even with a small number of holdings he still tried to diversify his risks.

Now back to the question of whether or not Keynes would have been fired by investors today if he showed similar performance, volatility and drawdown numbers. Unfortunately, I agree with the responses from Twitter in this instance, which is a shame. This is a legendary investment record during one of the most difficult periods in history to be an investor.

But short-termism and status quo are so widely practiced in the institutionalized world of investing that it’s highly unlikely that investors would have the requisite patience to stick with someone like Keynes today. Investors would certainly chase performance after the string of good years, but very few would be able to earn the overall outperformance figures.

For most investors the goal shouldn’t necessarily be to beat the market, but to not beat themselves. And then there’s the question of actually discovering the next John Maynard Keynes. But putting all of that aside for the moment — there is an unbelievable amount of time, effort and money spent on the singular goal of beating the market. It’s the entire reason many fund managers exist. Yet the conundrum is that there are very few investors out there with the correct level of patience or discipline to see through the type of strategy that’s required to actually beat the market by a wide margin.

In a recent Think Advisor piece, Yale’s David Swensen summed this up nicely:

Active management strategies demand uninstitutional behavior from institutions, creating a paradox that few can unravel. Establishing and maintaining an unconventional investment profile requires acceptance of uncomfortably idiosyncratic portfolios, which frequently appear downright imprudent in the eyes of conventional wisdom. The most attractive investment opportunities fail to provide returns in a steady, predictable fashion.

This description fits Keynes’s investment principles perfectly. And because he ran an idiosyncratic portfolio, it’s highly likely Keynes would be fired by professional investors in today’s day and age.

Sources:

A Wiser Approach to Alternative Investing (Think Advisor)

The Warren Buffett Portfolio

Further Reading:

The Lollapalooza Effect in Active Management

Do Risk-Adjusted Returns Matter?

Further Viewing:

How Keynes Gave Up on Market Timing (Sensible Investing TV)

As an alum of King’s College, I’m damn happy Keynes’s investment style was as brash as it was. Unlike most US universities, the lack of alumni giving overall increases the need for risk/return in investment philosophy.

Nice. And a very good point you make. The larger endowments have tons of money coming in every single year. Any idea how King’s College currently runs their endowment?

Hasn’t Keynes’ success been described as a triumph of insider trading? Sorry I don’t remember the source, but I do know that insider trading was not a criminal offence in Britain until the 1980s.

Someone else mentioned this to me. I’ve never heard that but anything is possible. Here’s a good paper on Keynes’s methods:

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2498010

Fantastic post. Jeremy Grantham wrote something similar in 2012. I love your work on this subject too. Keep up the great work. http://www.fullertreacymoney.com/system/data/images/archive/2012-04-26/JeremyGranthamGMOApril182012.pdf

Thanks. Good one. I actually heard Grantham give a speech similar to that letter at a conference a few years ago.

[…] of Unconstrained Bondsville (SSRN) • Would Keynes Have Been Fired as a Money Manager Today? (A Wealth of Common Sense) • Investors Rethink Taking a Leap Into Junk Bin (WSJ) • The CEO Who Saved a Life and Lost […]

Would a man who had the ear of the President of the United States and who was well known for his participation in shaping government policy and sitting in many government meetings with lots of insider information be allowed to continue investing, despite a volatile portfolio today? I suspect the answer is yes.

Most will be judged just by performance, but Keynes had a compelling narrative that was likely to distract from actual performance.

That’s a great point. Investors would have been sold on the excitement of that narrative and the ability to brag to others that they were in the exclusive club of investing with him. I didn’t think about that angle. People like a story much more than a process.

I’m reminded of one of my “Sacred Cows” which relates a much overlooked story about the famed economist, John Maynard Keynes.

Years ago, when I was running my own brokerage firm, an opportunity was presented for me to hire a gentleman who possessed a PhD. Shortly after I retained his services, I excitedly told my mentor and best client of what I thought was a hiring coup for my company. His silence let me know he wasn’t impressed.

About two weeks later, I received a plain manila envelope from him containing a photocopy of an essay entitled, “From the Garden.” It was written in the 1930’s about the great economist John Maynard Keynes. In London during this period, a group of very smart and well-connected financiers had convinced Keynes to manage a public fund that they would market. His stellar reputation and credentials would surely bring in many clients, and high fees would flow to these organizers and Keynes. It never occurred to them that Keynes couldn’t manage money. During a short period of time, the value of the assets garnered by these individuals and entrusted to Keynes dwindled away. He was quietly removed from the management of the portfolio and returned to his previous role as an economist.

http://seekingalpha.com/article/12344-concerns-with-the-new-wisdom-tree-etfs?page=2

Very interesting. I wonder what year that was because Keynes was actually a terrible money manager early in his career because he tried to time the market by being a macro investor (see the video link above). But, once he turned into more of a buy & hold, focused investor, his results improved dramatically. See this paper for that evolution:

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2498010

[…] Would Keynes have made it as a money manager today? (awealthofcommonsense.com) […]

[…] Interesting post by Ben Carlson. […]

[…] “Would Keynes have been fired as a Money Manager today?” https://awealthofcommonsense.com/keynes-fired-money-manager-today/ […]

Just last summer I read “Keynes’s Way to Wealth: Timeless Investment Lessons from The Great Economist” (http://amzn.to/1lbvMGJ on Amazon) which detailed his long investing career. As you mentioned in a comment above Keynes started out as a kind of momentum investor but by the end of his career he’d essentially invented value investing.

Hadn’t seen that one. Thanks for the book recommendation. His evolution as an investor is very interesting to me. I give him a ton of credit for changing his style so drastically.

[…] Keynes can be fired at present – A Wealth of Common Sense […]

[…] couple weeks ago I looked at John Maynard Keynes’s investment performance and philosophy when he ran the endowment fund at King’s College. Keynes ran a focused portfolio made up of a […]

[…] couple weeks ago I looked at John Maynard Keynes’s investment performance and philosophy when he ran the endowment fund at King’s College. Keynes ran a focused portfolio made up of a […]

[…] This article first appeared on A Wealth Of Common Sense. […]

[…] This article first appeared on A Wealth Of Common Sense. […]

[…] Further Reading: Would Keynes Have Been Fired as an Investment Manager Today? […]

Another great post. Keynes can teach us a lot about how to invest

My blog features a summary of his investment approach:

http://marketfox.org/2014/10/26/what-can-we-learn-from-keynes-2/

David, Chambers, Elroy Dimson and Justin Foo were given access to the archives covering Keynes’s management of the endowment portfolio at King’s College, Cambridge. They summarized his investment philosophy as:

Active Management

Long Termism

Stocks over Bonds

International Investing

Bottom-Up Stock Selection

Concentrated Portfolios

Value Orientation

Contrarianism

Yeah I read that paper. Very interesting. Plus the fact that he completely changed his investing style after the macro stuff wasn’t working.

Yes that struck me too, how many investor out there do you know that are truly willing to learn from their mistakes?

[…] always going to be parts of your portfolio that you are uncomfortable with at times. To paraphrase Keynes, it is the duty of long-term investors to accept losses and underperformance and act accordingly. […]

[…] “ Short-termism and status quo are so widely practiced in the institutionalized world of investing that it’s highly unlikely that investors would have the requisite patience to stick with someone like Keynes today” (awealthofcommonsense.com) […]