“Never ask a barber if you need a haircut.” – Warren Buffett

The Mutual Fund Observer by David Snowball is fast becoming one of my favorite investing reads. He packs his monthly update with a ton of information and analysis on mutual funds, investment strategies, portfolio managers and the markets at-large.

In the latest edition Snowball shares the unfortunate investing track record for the soon-to-be defunct mutual fund of MSN Money’s Jim Jubak:

Beginning in 1997, the iconically odd-looking Jim Jubak wrote the wildly-popular “Jubak’s Picks” column for MSN Money. In 2010, he apparently decided that investment management looked awfully easy and so launched his own fund.

Which stunk. Over the three years of its existence, it’s trailed 99% of its peers. And so the Board of Trustees of the Trust has approved a Plan of Liquidation which authorizes the termination, liquidation and dissolution of the Jubak Global Equity Fund (JUBAX). The Fund will be T, L, and D’d on or about May 29, 2014. (It’s my birthday!)

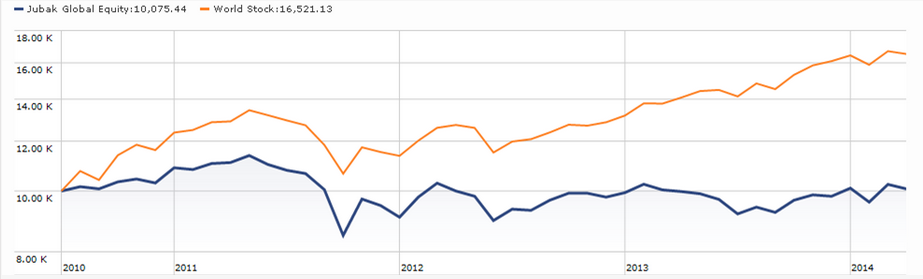

Here’s the picture of futility, with Mr. Jubak on the blue line and mediocrity represented by the orange one:

Yup, $16 million in assets – none of it representing capital gains.

Mr. Jubak joins a long list of pundits, seers, columnists, prognosticators and financial porn journalists who have discovered that a facility for writing about investments is an entirely separate matter from any ability to actually make money.

Snowball then went on to list a handful of other pundits that had trouble finding success managing money after finding success with well-known columns.

I occasionally read Jubak’s pieces at MSN. He seems like a sharp guy with well thought out opinions on the markets. I’ve never seen his message venture into the hysterics you see at times on other large financial websites. But his hypothetical performance numbers he listed were always crazy high. It looked like his ideas were absolutely destroying the market (on paper).

It would appear that running money was easier on paper than it was in the real world.

The point here is not to point a finger at these columnists to show that they can’t run real money. There are plenty of greater writer/investors out there. The point is that you should be skeptical of what investment advice you use and who your sources are. Jubak gives seemingly solid advice in his columns, but it turned out his stock-picking skills didn’t translate so well into the mutual fund industry.

There is a constant barrage of people they throw at you in the financial media, each one a seeming expert in their field. The majority of these people spend their time making endless predictions about stocks, the economy, interest rates, company earnings, etc.

Because these are all intelligent-sounding people, it’s very easy to get sucked into believing every single forecast they put out there. Some will be right some of the time. Most are wrong most of the time.

Not everyone out there making predictions is an evil person. They are only human and no one can predict the future. It boils down to the fact that it’s their job. They are forced to make predictions. Intelligent arguments about the future of the financial markets are wrong all the time.

Part of the problem Is that you have no idea what their actual track record is or the conviction they hold on each recommendation they put out there. The talking heads have no idea what your risk profile and time horizon are. There’s a huge disconnect between financial predictions you read about or see on TV and your personal circumstances.

That’s why it’s so important to focus on a rules-based process instead of short-term outcomes. It moves you away from constantly trying to figure out what’s going to happen next based on expert opinion.

Source:

Mutual Fund Observer April Edition

[…] Media Stocks Picks […]

[…] Beware stock picks from your favorite pundit. (A Wealth of Common Sense) […]

WOW!!!!

First post I’ve ever read on your site, and you got the whole thing wrong..Your takeaway- that investors should be skeptical of any “pundit”- is NOT AT ALL the pertinent conclusion here…What should be noted is that a) Jubak DID have impressive results as a writer on MSN, and that he did so over a period of years, and investors could have tracked his picks for a period to assess his performance, and then could have bought his recommended stocks and done quite well, and b) MORE IMPORTANTLY, running money (whether a mutual fund or hedge fund) presents MANY different challenges than simply being a stock picker.. Fundraising, managing cash in/outflows, preserving liquidity, dealing with investors, tax considerations, organizational challenges (hiring/firing/managing employees, attending meetings) are just a few reasons why one doesn’t equal the other….THAT is the real conclusion to draw from Mr Jubak’s failed tenure here (especially as his track record over 15 years – from his own page I know- +334% vs +125% for SPX)

When I said “running money” and “translated into the mutual fund industry” this is what I was implying. It’s not just paper stock picking. There’s obviously more to it than that. Of course it’s not as easy as simply picking stocks. That’s the point. And YES, you should be skeptical of pundit predictions…always.

[…] Beware stock picks from your favorite media pundit – A Wealth of Common Sense […]

Jubak has perhaps had decent results with his various “Picks” portfolios but there are some murky areas to be investigated.

However that all may be, it’s very easy to check his returns in JubaksPicks — probably his most popular portfolio — since he wrote columns about that. And compare those returns to those of the benchmark S&P 500.

For the year 2010 he wrote:

“For the 12 months that ended on March 31, 2010 Jubak’s Picks was up 26.6%. In that period the Standard & Poor’s 500 Stock Index was up almost 50% at 49.8%.”

2011 — Picks lagged, -2.3% versus benchmark +2.3%

2012 – Picks lagged, +7.3% versus benchmark +16%

2013 – Picks lagged, +19.6% versus benchmark +32%.

But those results apparently will pale in comparison to 2014. I just did a quick calculation and I’m coming up with a Picks return of something like – 240% for the year 2014. I don’t know, maybe something is dreadfully wrong with my method but in any event the returns will not be impressive unless there is a monstrous rally into the end of the year.

One more remark I’d like to make on Jubak’s approach. (Again, like the author above I’m not out for a pound of flesh but having followed Jubak for many years and gotten burned sometimes, I can at least pass on some insights).

Jubak’s picks is organized such that every once in a while the author comes out with a new buy or sell rec. There are therefore at least two issues for the casual reader/investor. Number one, must I buy this stock at the same time as Mr Jubak — do I have a problem if buy it later after it’s already gained 10% (or lost 10%)? The answer is, of course if you wish to duplicate Jubak’s result you must buy it when he buys, and sell it when it tells you to sell! Number two, must I buy ALL the stocks in his portfolio (and that’s a lot of positions in his Jubaks Picks today). The answer again is: Yes, otherwise you’ll have different results than him and not necessarily good results. If you cherry-pick, then you are making yourself the stock picker instead of relying on Mr Jubak. If you own only 5 out of Jubak’s 25-30 positions, then you better not blame him if you have different returns!

Remember, despite his claim on the home page of his web site, his results in Jubak’s Picks for the last 5-6 years have not matched the returns of the indexes, especially of the S&P 500. So don’t expect to get rich, and don’t try to cherry-pick. With those caveats, you can still enjoy his columns.

Yes. From someone who actually lost money in his Jubax Fund, I can speak from personal experience. I was roped in. Of all the well-known internet stock pickers, I do respect Jubak for his relative openness — meaning, he publishes his history — the pick date and the pick price, so you can see for yourself how he is doing. Not every celebrity stock picker is so transparent.

That said, there are some other pitfalls. One is that of picking and choosing — you “cherry-pick” from Jubak’s portfolio(s). You decide his argument about stock XYZ is persuasive so you buy 100 shares. Stock XYZ then craters, while meanwhile, another of his picks stock ABC soars. If you had bought both stocks, WHEN he bought them, maybe you break even. But no you only bought stock XYZ so you get killed. Something to be aware of.

At the end of the day, it is definitely easier to have a method or to just hold index funds and a diversified portfolio. You’ll probably do just as well if not better, particularly in light of the latest studies that demonstrate that low-cost index funds have beaten the pants off active management.

Good points, lessons learned. There’s just another element when you try to add portfolio management to the stock-picking process. Two completely different animals.