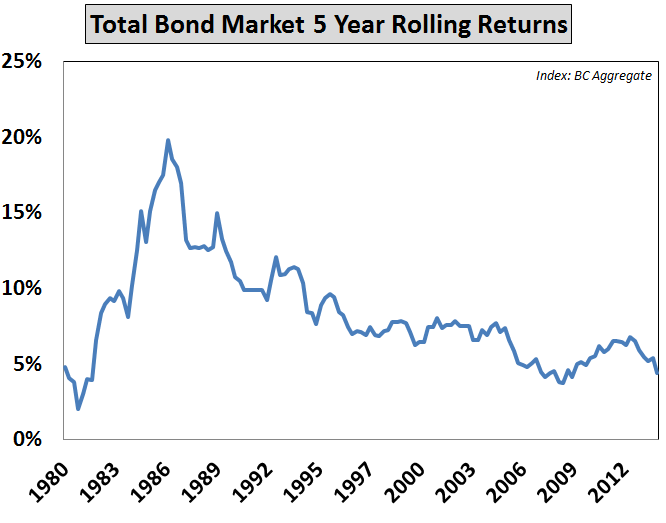

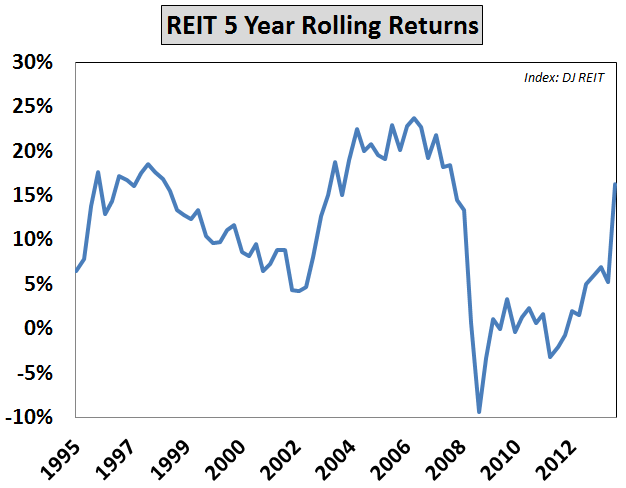

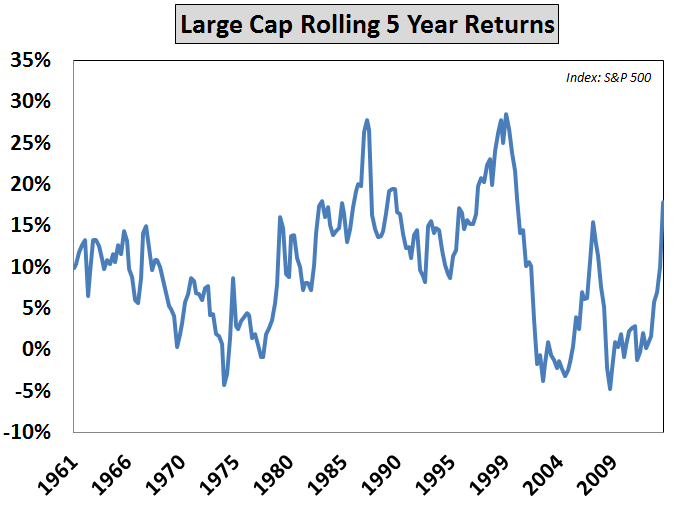

After running a rolling 5 year performance graph of high yield bonds this week I received a request from a reader that was interested in seeing similar charts for a handful of other asset classes.Ask and you shall receive.

But here are a few reminders on these performance numbers:

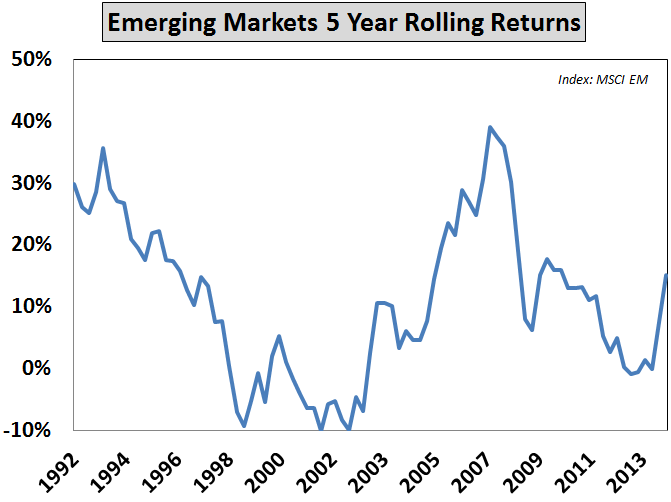

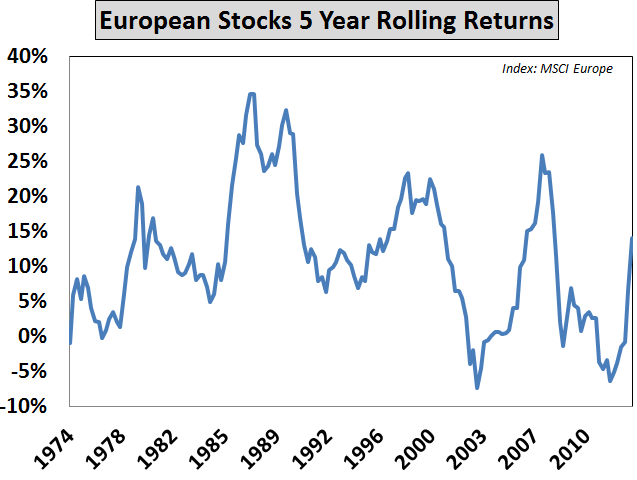

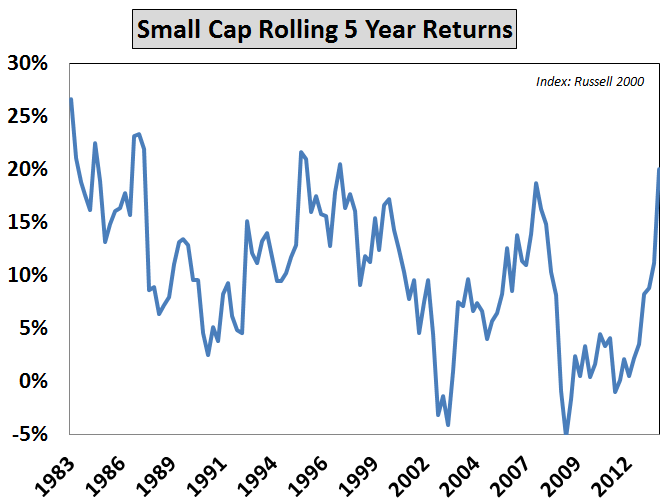

- The latest five year stretch from 2009-2013 was an extraordinary period of returns that just cuts off the huge losses in many markets from 2008.

- Return numbers are rarely “average” even over 5 year periods. Thinking in terms of cycles can help.

- We’re all adults here but every time I take a look back at historical market performance I get at least one comment about the fact that past returns have nothing to do with the future (which is true). Until someone figures out how to predict the future, using the past to understand the present situation to make reasonable decisions about the future is the only choice we have.

- Using a disclaimer on this stuff is basically like using the fake 555-1212 phone number they use in movies. They shouldn’t have to do it, but it’s a precaution against those few people that would call the number if they used a real one. Chris Rock has a great stand-up bit on this phenomenon but I couldn’t find it anywhere.

Here the rolling 5 year performance graphs for bonds, emerging market stocks, European stocks, small caps, REITs and large caps:

[widgets_on_pages]

Follow me on Twitter: @awealthofcs

[…] Rolling 5 Year Graphs […]