“If you’re emotional then you’ll buy at the top when everybody is euphoric and prices are high. Also, you’ll sell at the bottom when everybody is depressed and prices are low.” – Howard Marks

March 9, 2009 marked the bottom for the stock market crash that resulted from the financial crisis.

The S&P 500 hit 666 during trading hours that day but closed at 676. This past week, five years later, the S&P hit 1,881.

Including reinvested dividends, the S&P 500 ETF (SPY) is up just under 25% a year since the bottom or nearly 200% in terms of a total return.

We are closing in on the 6th longest bull market since 1928 (assuming you don’t count the European crisis hiccup that occurred in 2011 that was nearly a 20% loss, but I am picking nits here).

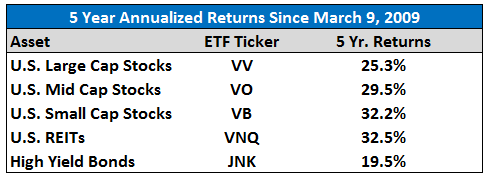

Take a look at some of the other big U.S. market ETFs to see the magnitude of the run-up in prices over the past 5 years:

This is a cherry-picked time frame, but seeing 30% annualized returns in small caps, mid caps and REITs along with nearly 20% a year in high yield is pretty insane.

If you missed any of this rally you could easily blame quantitative easing by the Fed, the bank bailouts, government stimulus or even faulty valuation assumptions.

Just remember that there are no style points for investment returns. We take what the market gives us no matter the reason.

However, it was not easy investing at the market’s nadir.

Howard Marks summed this up it up nicely in a recent interview:

Of course, there were some severe fundamental problems in the years 2008 and 2009: The economy was bad, capital markets were closed, and Lehman Brothers and other financials firms went bankrupt. But most people exaggerated that into a belief that the world was ending. In line with that, asset prices were ridiculously low. Therefore, five years ago the key to making money was to have money to spend and the nerve to spend it. In other words: To do the exact opposite of what most people were doing erroneously at that time.

There are many lessons to be learned from the past five years:

- Markets can rally hard and fast off low levels. According to Ken Fisher, in the first 3 months of a bull market stocks go up by an average of 23.1%. Over 12 months they go up by nearly 50%.

- There is never going to be a perfect time to invest when stocks are down in a big way. There were a few smart investors that called the bottom (Doug Kass and Barry Ritholtz come to mind), but it’s nearly impossible to time it perfectly because emotions run even higher than usual at the extremes.

- Stocks don’t move in a straight line. Expect big gains and big losses.

- Mean reversion has been crazy the past few decades. You had one of the best performance runs ever in the 90s, terrible returns in the early aughts, a nice recovery until the end of ’07, a huge crash from ’08 to early ’09 and now one of the strongest bull markets in history. Long-term average returns are never average in the short-term.

Sources:

Howard Marks: “In the end the devil always wins.” (Zero Hedge)

[widgets_on_pages]

Follow me on Twitter: @awealthofcs

[…] Ode to March […]

I agree! If this market is not overvalued it is close to it. I personally believe we are forming a long term top and will see a crash within the next 18 months.

Higher stock prices don’t always necessarily mean a crash is imminent. It more likely means lower returns going forward. See the difference between a crash and a correction here: https://awealthofcommonsense.com/difference-crash-correction/