“Far too many investors fail to understand that the strategy to get rich (take risks) is entirely different from the strategy to stay rich (minimize risks, diversify the risks you take, and don’t spend too much).” – Larry Swedroe

Ever since the Fed lowered short-term interest rates to essentially 0% during the financial crisis, there has been an argument made by many that ‘The Fed is levying a tax on retired savers that need income from savings accounts or CDs.’

I get the gist of this argument. Investors yearn for the days when they were able to get 4-5% interest rates in bank CDs. A 5 year CD today pays close to 2% annually which is hardly enough to keep up with inflation.

For those investors that have relied exclusively on savings accounts and CDs to fund their retirement, lower interest rates have been a problem.

However, it’s not technically savers that are being targeted. What the Fed has really been punishing is risk aversion.

Those that have invested their savings in the financial markets have done quite well since the Fed lowered its short-term interest rate target in late 2008.

But over the long-term risk aversion has always been punished, if not by the Fed, then by inflation. Real returns on cash going back to the late 1920s are under 0.5% per year.

What many retirees fail to realize is that you have multiple time horizons for your retirement portfolio. You have a very long runway to save before you retire, which could be up to 40 years or more.

Then you have another 20-35 years during retirement where you still need to beat inflation for spending needs (and maybe even longer if you plan on leaving money to your heirs).

Obviously, your risk profile is much different when you have a large portfolio at retirement than it is when you first start out, but it doesn’t mean you need to shun risk altogether. You just have to take it in smaller doses depending on your circumstances.

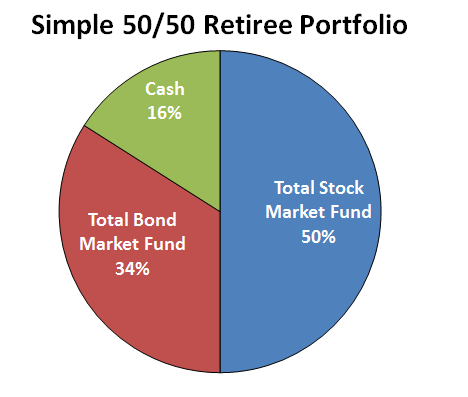

Let’s say you are a risk averse retiree that carries 4 years’ worth of expenses in cash. If you follow the 4% rule of thumb for withdrawals, that would be 16% of your portfolio in a money market account.

Assuming you have a portfolio mix of 50% in stocks and 50% in bonds/cash, a potential simple portfolio could look like this:

The Fed didn’t really cut rates close to 0% until the end of 2008, but I extended a back test of results on this portfolio to the beginning of 2008 to include a huge loss in the markets for the sake of comparison.

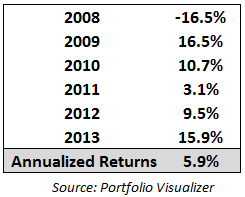

Here are the returns on this hypothetical portfolio:

These results are aided by the bull market in stocks, but you can see that in 2008 there was a fairly large loss.

That’s the type of year your cash and bonds come in handy for spending and rebalancing purposes (total bond funds were up roughly 5% in ’08). In the big stock return years you use those gains for living expenses and risk control.

You can see that our hypothetical retiree was not penalized by the Fed because they were a saver. They were helped out by being an investor.

Even if the Fed hadn’t locked interest rates in the basement and they had been 2% higher over this period, that still would have only added 0.3% to your total annual return. This is only $300 per $100,000 in your portfolio.

Not a huge tax by any means.

Because of our ingrained aversion to loss or a misunderstanding of the dynamics of the financial markets, it seems that many retirees are under the impression that they can never touch their principal balance to use for spending needs.

Many see income as the only way to prosper in retirement. Growth of principal probably won’t be your main goal at that point, but it should continue to play a role.

I’m not an interest rate soothsayer. They can and probably should go up, but they don’t have to. It could take a long time.

Remember that there are never completely risk-free ways to grow your money.

In the financial markets, you are at the risk of losing temporary capital to depressed prices. In cash, you are at risk of losing permanent capital to inflation.

A good balance of these two risks should help you through the inevitable ups and downs in the markets and ensure you have enough money for expenses.

[widgets_on_pages]

Follow me on Twitter: @awealthofcs

[…] Further Reading: Uncharted Territory in the Fed Funds Rate Cycle What if Risk Free Rates Slowly Go Away? […]