“Investors have never liked uncertainty–and yet it is the most fundamental and enduring condition of the investing world.” – Jason Zweig

The U.S. stock market has screamed higher in 2013 but it hasn’t been easy.

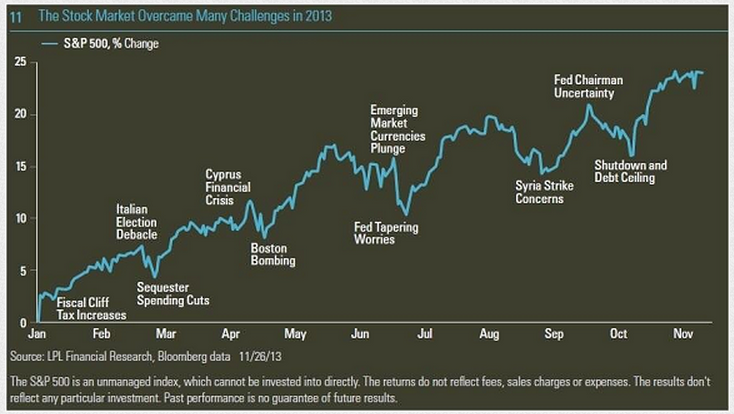

LPL Financial has a great chart in their 2014 outlook piece that lays out what investors have had to deal with this year:

Do you remember all of these issues? At one time or another they were the hot topic du jour. The media latches onto them for a couple of weeks and freaks everyone out until things die down and they move onto the next big thing.

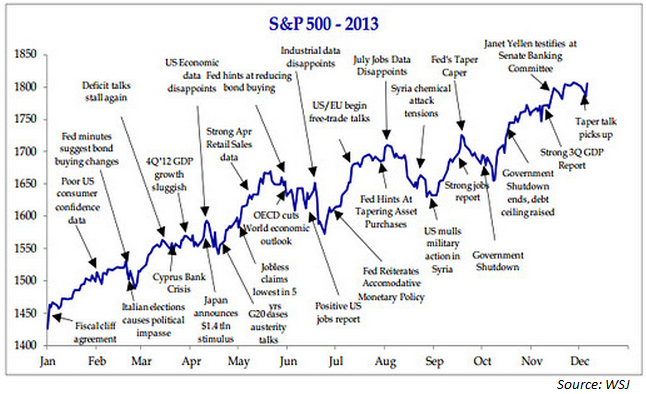

Speaking of noise in the market, take a look at this one that mixes in both the positive and negative factors the market has dealt with this year:

It’s always something. It’s no wonder so many investors get completely overwhelmed when they watch CNBC.

2013 isn’t the only year we’ve dealt with challenges in a rising market. Stocks have doubled and then some since the end of the financial crisis but it hasn’t been a steady rise in prices.

Eddy Elfenbein from Crossing Wall Street noted last week that during the bull market run since 2009 we have endured losses of 5.6%, 5.8%, 6.4%, 7.1%, 7.7%, 8.1%, 9.9%, 16.0% and 19.4%. And every single time we’ve bounced back and raced to new highs.

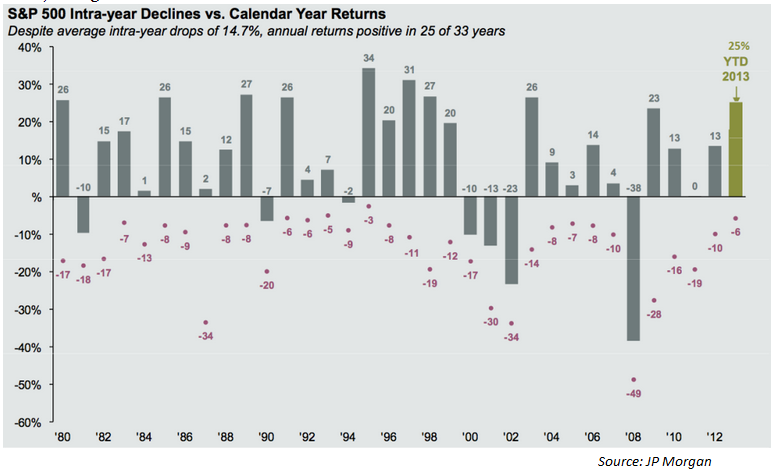

Looking back even further, Barry Ritholtz shared a chart from JP Morgan this week that shows the annual gains in the S&P 500 going back to 1980 along with the biggest loss for each year:

By my calculations, the average annual return since 1980 was between 9-10% while the average intra-year loss was between 14-15%.

It’s amazing to consider that only 7 of the 34 years in the S&P 500 over that time frame ended the calendar year with a loss, yet every single year had a large loss at some point. In 19 out of the 34 years there was a double digit loss incurred at some point during the year.

This is why investing in stocks is hard. It’s also why stocks earn the long term returns that they do. If there wasn’t such a high probability of losing money every once and a while, stocks wouldn’t produce such high returns.

That’s the joy (and pain) of taking risks with your money.

To get the reward you must be able to take on the risk.

Further Reading:

How to ignore the noise

Sources:

Outlook 2014 (LPL Financial)

CWS Market Review – December 6, 2013 (Crossing Wall Street)

S&P 500 intra-year declines vs. calendar year returns (Big Picture)

[widgets_on_pages]

I always look forward to the volatile times as it gives long-term investors opportunities to purchase at much better valuations. In the long term a company’s share price is rewarded through growing their brand/moat/revenue and delivering more EPS and dividends to their owners. Short term, who knows. I find it very hard to believe that a company like KO, PG, JNJ, UL, PEP, GIS and the like would have their “value” change by 15-30% in a given year, yet you’ll see it quite often due to the fickle nature of the markets.

Great points. This is especially true for those still in the accumulation & savings stage. That’s why younger investors should take more risk and welcome the occasional bear market to be able to buy at lower prices.

Great post Ben! 🙂

Watching the business news these days is akin to watching Entertainment Tonight – glossy and hyped up. If you’re basing your decisions on this, your in trouble…

I’ve continued to hold my dividend paying stocks now and never sell them. The longer I hold the greater my returns. I’m actually looking forward to a nice correction so I can even top-up more…

I find by holding the dividend payers it makes it much easier for me to stay the course. The regular dividend payments keep me on track and focussed on my goal. This is why I prefer a dividend strategy over an indexing strategy… I literally get paid to wait. And I don’t have to be concerned with the market. DOW is up 10%, DOW is down 20% who cares?

Keep up the great posts Ben!

Cheers

Avrom

I completely agree. I always tell people it’s OK to watch financial television but for entertainment purposes only. It’s very easy to get lost in the noise.

I think a 10-15% correction would be healthy at this point and I still have years and years to save so I’m with you on being ready for a drop in stock prices.

[…] Here is yet another call to tune out the noise, and switch off the business news! Staff writer Ben Carlson, has a must read post on his blog this week. Be sure to read Investing in Stocks is Never Easy. […]

Nice charts and great illustration of how irrational market can be. Actually not the market, but investors. Many times I really wonder whether people out there are sane at all or not. Why is anybody investing in the market and trading in and out based on all those calls from media. A few days ago Yahoo published an article in the morning that markets were losing because of the budget agreement (which could spark FED tapering) and in the afternoon they published an article explaining that markets were dropping because of fear of lackluster earnings. I watch and read media about the market only as entertainment and usually laugh a lot. But I learned never trade based on their recommendations.

The media is always looking for a reason even though most of the time it’s simple buyers of stocks are willing to pay more or less for shares on any particular day.

These charts show why most investors are probably better off staying completely oblivious to the financial media and keeping their heads down and systematically buying over time. Not the perfect solution, but much better than constantly jumping in and out of the market.