“I look to the future because that is where I’m going to spend the rest of my life.” – George Burns

Morningstar’s John Rekenthaler had an interesting article recently that discusses what matters most when saving for retirement. He goes over a hypothetical situation where a 42-year old investor is looking at the options for increasing their 401(k) retirement balance in the future and what would have the biggest impact on the ending balance.

There are a number of assumptions including salary, contribution rate, company match, fees, investment returns and the timing of retirement.

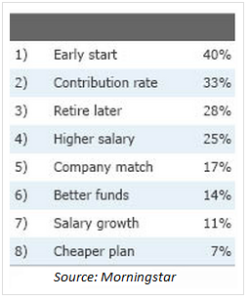

Here are the eight options for what would have helped increase the ending retirement balance the most:

1. Start saving earlier

2. Get a higher salary

3. Increase salary by 4% annually rather than 3%

4. Contribution rate: Save/invest 8% annually instead of 6%

5. Company match: Receive a 75% company match instead of 50%

6. Cheaper plan: Switch to Vanguard and pay 0.22% in fund fees rather than 0.72%

7. Better funds: Own funds that gain 8% per year before expenses (instead of the assumed 7%)

8. Retire later: Wait two more years and retire at age 69, not 67

Rekenthaler then went on to run some tests on the numbers to see which of these eight options had the largest percentage increase on the ending retirement balance. Here’s what he came up with:

Luckily, the top three options are all within your control. You have the ability to start saving early (or right now), increase the amount you save and increase your time horizon if need be. The other options are not really within your control (although you could try to negotiate a higher salary).

This is great news for investors. It’s easy to blame Wall Street, politicians, taxes and the economy for the state of your finances. These are all easy scapegoats. In reality, there is nothing you can do to change any of these things, so why spend your time worrying about them when you have the ability to control what really matters.

Too often investors get bogged down in the minutiae of trying to choose the best investments, figure out the economic environment, time the market, guess the direction of interest rates and focus on the complexities of the financial markets that are completely out of their control.

This is done to the detriment of your retirement portfolio by forgetting that the simple tasks like saving early & often, increasing the amount you save each year and concentrating on your long-term investment time horizon are your best bets to financial independence.

Taking care of these simple, yet often overlooked aspects of your investments actually get you about three quarters of the way there. Once you make it a priority to save, increase your savings and think long-term, you can focus on keeping your costs low, setting the correct asset allocation that fits within your risk profile & time horizon and automating your investment plan as much as possible to avoid costly behavioral mistakes that the majority of investors succumb to on a regular basis.

After you have all of those things in place, and you are 99% of the way there, feel free to focus on the minutiae that will amount to a drop in the bucket of your overall performance. Otherwise, focus on what you can control and spend time on the things that really matter in your life.

Source:

What Matters Most (Morningstar)

Well said..

Thank you. Thanks for stopping by.