There are many different ways to make money in the markets. There’s no one-size-fits-all for every investor. But the ways people lose money are fairly common — chasing past performance, groupthink, overconfidence, loss aversion, fear (of missing out and of being in), looking to get rich in a hurry, taking the markets personally and not admitting your limitations.

One of the outcomes from these mistakes is that investors tend to jump around from strategy to strategy and fad investment to fad investment. I think this is because not enough people take the time to first lay out their big picture investment philosophy, which should be used to guide all future decisions. Investors would rather be told where to invest at all times, preferring tactics over process. Most people learn the hard way that tactics are a short-term fix, but not a long-term solution.

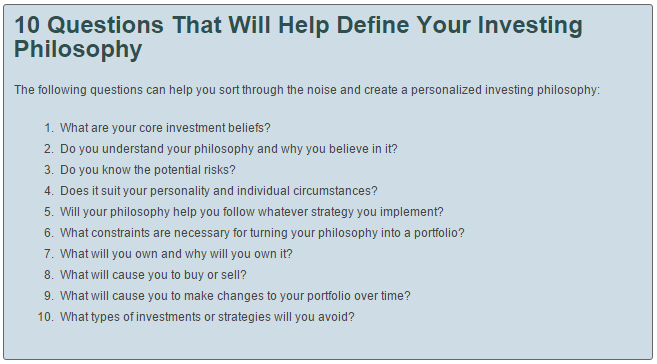

I think the first step in any investment strategy should be to first define your overarching philosophy. Here are ten questions investors can use to help define their philosophy:

This set of questions comes from a long-form piece I wrote for the latest edition of the AAII Journal.

Keep reading here for more:

Defining Your Investment Philosophy (AAII)

In defence of investors who jump around from strategy to strategy.

Is it possible that something worked in the past but won’t in

the future? In bear markets: is it possible that prices will fall much

more than today? We have data about stocks from 1802 (more than 200 years). Is it possible that there will be stock markets in 500 years? If there will be stock markets in 2515 (2015+500 years) than all we know about the past 200 years is just 200/700 of the whole period (until 2515). If You read only 200/700 part of a book can You make any serious conclusion of it? Every important thing we know is just past.

I don’t know better than You. I’m just an investor who try not to jump around from strategy to strategy:).

what we know is that jumping from strategy to strategy rarely pays and is usually the result of chasing returns (recency bias) and not a thought-out plan.

I just highlihgt the basis of uncertainty. Of course I agree with Ben and You and others. “If one does not know to which port one is sailing, no wind is favorable.” Seneca

“

[…] 10 questions to define investing philosophy […]

[…] La idea de este artículo la he sacado del blog “A Wealth of Common Sense” de Ben Carlson, blog que aprovecho para recomendar, en el artículo “10 Questions to Help Define Your Investment Philosophy”. […]

[…] the process for Defining Your Investment Philosophy. Within his piece, Carlson noted 10 Questions to Help Define Your Investment Philosophy. One of the key tenets of his article is that most investors get into trouble by […]